Independent Contractor Agreement Make Notes

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

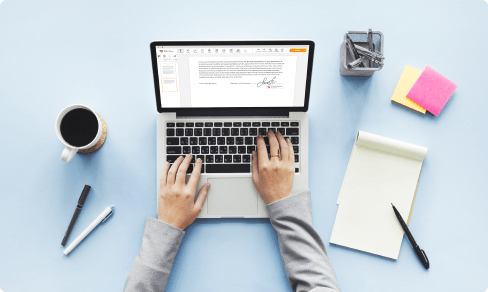

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

How to Make Notes Independent Contractor Agreement

01

Enter the pdfFiller website. Login or create your account for free.

02

Using a protected internet solution, you may Functionality faster than ever before.

03

Go to the Mybox on the left sidebar to get into the list of the files.

04

Select the template from the list or tap Add New to upload the Document Type from your pc or mobile device.

As an alternative, it is possible to quickly transfer the specified template from well-known cloud storages: Google Drive, Dropbox, OneDrive or Box.

As an alternative, it is possible to quickly transfer the specified template from well-known cloud storages: Google Drive, Dropbox, OneDrive or Box.

05

Your form will open in the function-rich PDF Editor where you can customize the sample, fill it up and sign online.

06

The powerful toolkit allows you to type text on the form, insert and edit pictures, annotate, and so on.

07

Use sophisticated functions to add fillable fields, rearrange pages, date and sign the printable PDF document electronically.

08

Click the DONE button to complete the changes.

09

Download the newly produced file, distribute, print out, notarize and a lot more.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Georgia R

2016-02-09

I have used similar applications but not as user friendly as your. Love it.

Sharon M

2018-05-22

I really have needed a tool like this to turn a number of internal business documents into fillable forms. Do not want to have to buy a typewriter to do the tasks PDF filler can do so easily. Without any training I have been able to do the basic functions just fine. I would be interested in furthering my skills be learning how to do more sophisticated editing or creation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is an independent contractor agreement?

An Independent Contractor Agreement is a written contract between two parties for a specific service or project. One person or company is hiring another to help on a short term task. Unlike an employment agreement, this document clearly spells out why the party being hired is not an employee for legal and tax purposes.

What should be included in an independent contractor agreement?

An independent contractor agreement is a legal document between a business and an independent contractor, freelancer or subcontractor. It outlines the details of the work to be performed, terms of the agreement, deliverables, compensation, and any additional clauses.

What should be included in a contractor's contract?

This includes the overall scope of the work as well as individual aspects of the project; from foundation and framing to all finish work required. ... Clearly define the project's start date, and secure from your contractor the approximate length of time it will take to complete the project.

Do independent contractors need a written contract?

Written independent contractor agreements provide legal protection. For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing.

Can you terminate an independent contractor?

The employer need not actually exercise control; it is sufficient that he has the right to do so. Right to fire. An employee can be fired by an employer. An independent contractor cannot be fired so long as he or she produces a result that meets the specifications of the contract.

What is difference between an employee and an independent contractor?

A business may pay an independent contractor and an employee for the same or similar work, but there are important legal differences between the two. For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes.

What classifies a worker as an independent contractor?

An independent contractor is a person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes. The payer must correctly classify each payee as either an independent contractor or employee.

Is it better to be an independent contractor or employee?

An independent contractor must pay the higher self-employment tax. ... An employee may be able to obtain better benefits than an independent contractor. Employer subsidized health, life, disability and retirement benefits represent part of the hidden paycheck for employees that independent contractors don't always enjoy.

Can you tell an independent contractor when to work?

You define the work hours: Generally, independent contractors do the job as they see fit. They set their own hours and work how and when they want. And they should be paid by the project -- never on an hourly basis. ... You don't receive invoices: The contractor should be treated as a vendor under accounts payable.

Can an employee also be an independent contractor?

When you wish to contract with a current employee, it is important to look at the nature of the work the employee will perform as an independent contractor. If the work is similar to that which he or she performs as an employee, it is unlikely that a true independent contractor relationship is formed.

Other ready to use document templates

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.