Living Trust Redact

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

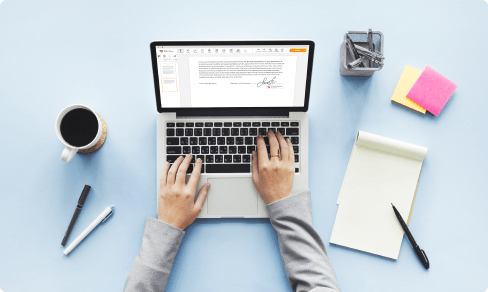

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

How to Redact Living Trust

01

Enter the pdfFiller site. Login or create your account free of charge.

02

With a secured web solution, you can Functionality faster than ever before.

03

Enter the Mybox on the left sidebar to access the list of your files.

04

Choose the template from the list or click Add New to upload the Document Type from your desktop computer or mobile device.

As an alternative, it is possible to quickly transfer the required sample from popular cloud storages: Google Drive, Dropbox, OneDrive or Box.

As an alternative, it is possible to quickly transfer the required sample from popular cloud storages: Google Drive, Dropbox, OneDrive or Box.

05

Your document will open within the feature-rich PDF Editor where you may customize the sample, fill it out and sign online.

06

The powerful toolkit allows you to type text on the document, insert and change images, annotate, and so on.

07

Use superior capabilities to incorporate fillable fields, rearrange pages, date and sign the printable PDF form electronically.

08

Click the DONE button to finish the adjustments.

09

Download the newly produced file, share, print out, notarize and a much more.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Anonymous Customer

2015-12-13

Very useful tool for completing complicated forms.

Darla M

2020-04-16

I don't know how I functioned before I had pdfFiller, love it!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What assets should not be included in a living trust?

Non-Retirement Investment and Brokerage Accounts It includes assets held in an investment or brokerage account in your name, in joint names with others, or as a tenant in common. It doesn't include an account held in a qualified plan including a 401(k), 403(b), IRA, or qualified annuities.

How does a living trust work?

A living trust is funded by your assets such as property, bank accounts, stocks, and bond accounts and certificates that are transferred to the trust during your lifetime; upon your death, these assets are distributed quickly and easily to your designated beneficiaries by your chosen representative, called a "successor ...

How do taxes work in a living trust?

Revocable Trusts: For income tax purposes, the grantor of a Living Trust continues to be treated as the owner of the assets that are now part of the trust no matter who is the trustee. The grantor must pay gift taxes whenever assets are transferred into an irrevocable trust.

Are distributions from a revocable living trust taxable?

In addition, when you've transferred your personal assets into the trust, you'll still be entitled to receive the trust income and principal. As a result, the IRS rules require that you're still taxed on all of the income earned by the trust assets. ... Your revocable living trust will not complicate or change your taxes.

How are trusts taxed for income tax purposes?

In general, the trust must pay income tax on any income its assets generate. But if the terms of the trust require it to pay out its income to a beneficiary, then the trust itself is entitled to get a deduction for any distributable net income. Any remaining income not distributed then gets taxed to the trust directly.

What are the tax benefits of a living trust?

Living trusts typically cost very little to establish and maintain. Additionally, these costs are often offset by investment gains, lower probate expenses and tax savings. Moreover, in some cases fees related to income on taxable securities can be tax-deductible subject to a base of 2% of adjusted gross income.

Do I need a living trust?

A living trust only can control those assets that have been placed into it. ... If your assets have not been transferred or if you die without funding the trust, the trust will be of no benefit as your estate will still be subject to probate and there may be significant state estate tax issues.

Is it better to have a will or a trust?

Both are useful estate planning devices that serve different purposes, and both can work together to create a complete estate plan. One main difference between a will and a trust is that a will goes into effect only after you die, while a trust takes effect as soon as you create it.

Do I need a trust to avoid probate?

A living trust can help you avoid probate. If your assets are placed in a trust, you do not "own" them: the trustee of the trust does. ... When you die, only your property goes through probate. Since you do not "own" the trust property, it will not have to go through probate.

Do you need a lawyer to make a living trust?

As long as your living trust contains these basic elements, you can make your own living trust. Some choose to hire a lawyer, and more specifically, an estate planning attorney to prepare their estate planning documents, but this is not always necessary.

Other ready to use document templates

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.