Free Buying And Selling Homes Word Templates

What are Buying And Selling Homes Templates?

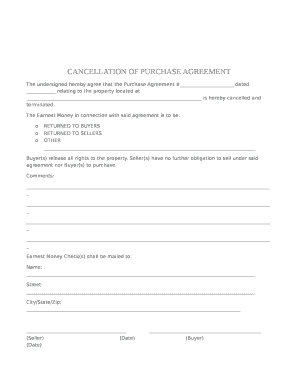

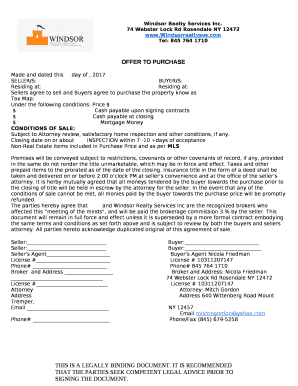

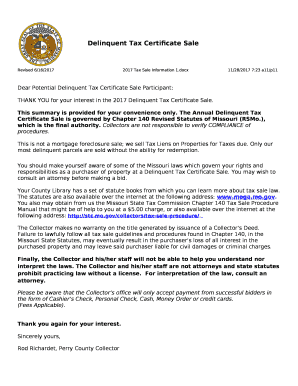

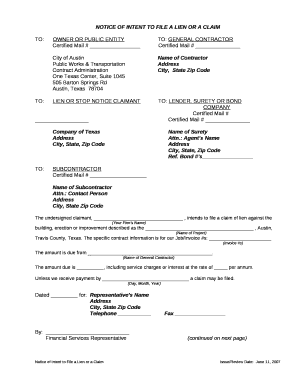

Buying And Selling Homes Templates are pre-designed documents that individuals and real estate professionals use to streamline the process of buying or selling a home. These templates provide a structured format for organizing important information and legal requirements related to real estate transactions.

What are the types of Buying And Selling Homes Templates?

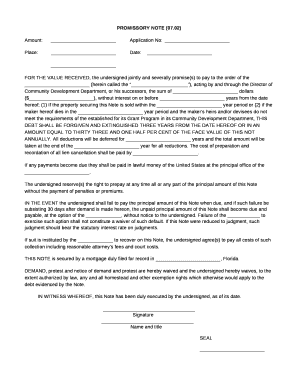

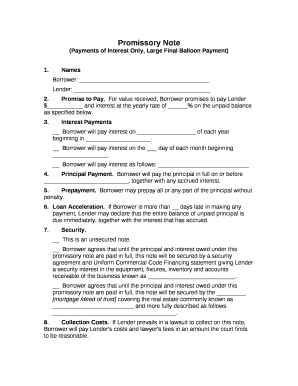

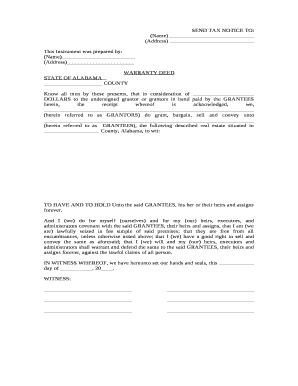

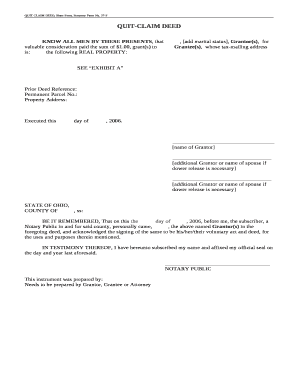

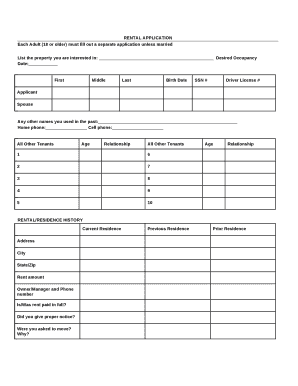

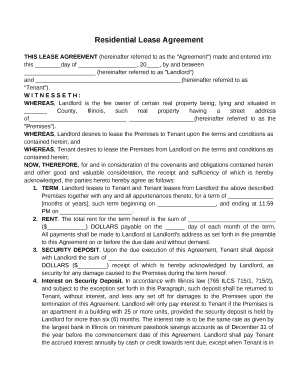

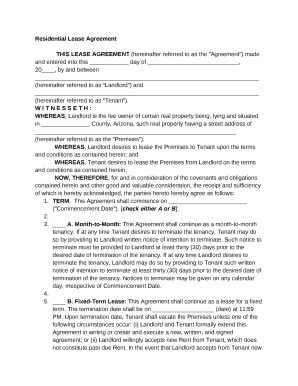

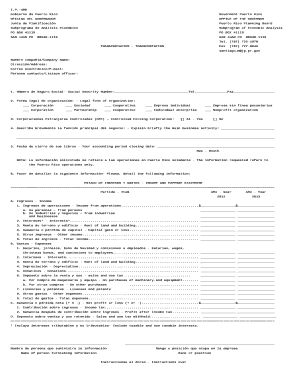

There are several types of Buying And Selling Homes Templates available to suit different needs and situations. Some common types include: 1. Purchase Agreement Templates 2. Home Inspection Checklist Templates 3. Closing Statement Templates 4. Property Disclosure Forms 5. Lease Agreement Templates

How to complete Buying And Selling Homes Templates

Completing Buying And Selling Homes Templates is a simple process that can be done effectively with the right tools and guidance. Follow these steps to successfully fill out a template:

pdfFiller is a trusted online platform that empowers users to effortlessly create, edit, and share real estate documents. With a wide range of fillable templates and robust editing tools, pdfFiller is the ideal solution for all your document needs.