Consolidate Line Log For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

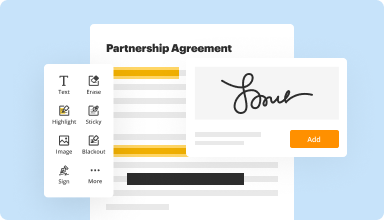

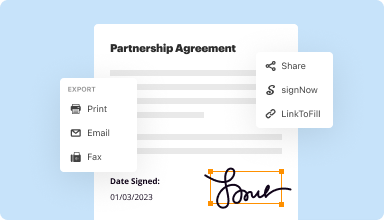

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

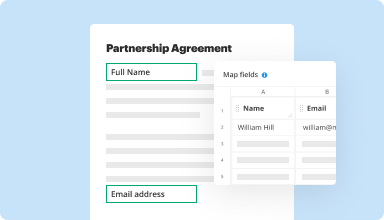

Fill out & sign PDF forms

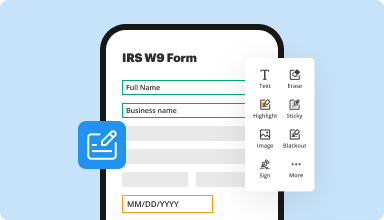

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

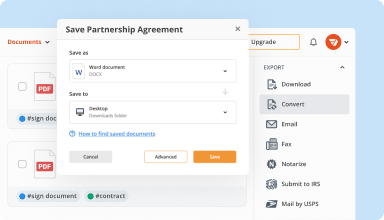

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

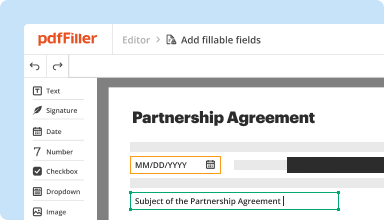

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

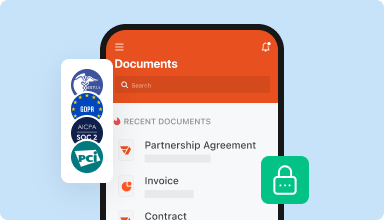

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Very user friendly. I had to contact support and they assisted me very quickly and sent me the correct form to use for an insurance claim I was working on. Looking forward to using this service again.

6/13/16 Makes my life a WHOLE lot easier!

2016-06-13

I just closed escrow on two homes, and the PDF filler allowed me electronically edit/sign/date all the forms necessary to sale and buy our properties. It saved a tremendous amount of time and paper because I saved the forms to my desktop and then returned the completed forms electronically.

2018-06-08

My experience with PDFfiller has been nothing but win after win! At first i was worried i wasn't going to be able to sign without the help of a third party app, but, wouldn't you know? You guys have the option, and many other feats that helped me in the elaboration of mah necessary edit. Many thanks!

2024-07-23

Cool az

Cool az, easy to nagigate, edit and save to your device. For the price, way better than Adobe who try to make you pay pay pay, have outrageously pricey monthly payments n bla bla bla. This is way more affordable

Thanks team

Nga mihi

Sonny

2024-05-21

Great software for the money

Great software for the money. Has helped tremendously with our business needs. The only thing I would change is the LinktoFill. This gets confusing due to saving a file when you make updates to it and then you end up with having the two files. there should be an option to update exsiting file. Besides that, great program.

2022-03-14

The program works amazing wish it was…

The program works amazing wish it was easier to inport templates for medical billing documentation, but we made it work

2021-12-29

This is an excellent service that I would not have subscribed to, had it not been for the special low price. Your initial rate was way too high. Thank you for lowering the price. Keep it low and you'll keep me as a customer.

2021-11-03

I have really enjoyed using the software. I use it on my iPhone, on my windows PC, on my Mac and my iPad so it's a multiplatform Holy Grail. I still use the program. Have it installed on all my computers and IOS devices. there are a lot of features that I've not used so I can't truly say much about them, but overall I'd definitely recommend the program to others.

2020-08-24

It was very easy to navigate the site and fill out...

It was very easy to navigate the site and fill out the form I needed. I like that they have several options available to print, email, fax and even send out a copy USPS.

2020-05-29

Consolidate Line Log Feature

The Consolidate Line Log feature streamlines your workflow by providing a clear, organized view of your line logs. By consolidating data, it helps you manage and monitor your operations more effectively. This feature is designed for users who want to enhance their productivity and maintain accuracy in their records.

Key Features

Centralized log management for easier access

Real-time updates for up-to-date information

Customizable views to meet your specific needs

Automated data entry to reduce errors

Secure storage for peace of mind

Potential Use Cases and Benefits

Ideal for teams that manage extensive line data

Helps in tracking project progress and timelines

Supports compliance with industry standards

Enhances communication between team members

Fosters data-driven decision-making

With the Consolidate Line Log feature, you can solve common issues related to data management. By bringing all your logs into one place, you eliminate confusion and save time. This feature ensures you always have accurate data at your fingertips, allowing you to focus on what truly matters—growing your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Do consolidation loan hurt your credit score?

The way debt consolidation affects your credit depends on the various options you choose. ... If you consolidate by taking a personal loan to pay off your credit cards, your utilization ratio could go down, causing your score to go up.

How does debt consolidation affect my credit score?

Debt consolidation combining multiple debt balances into one new loan is likely to raise your credit scores over the long term if you use it to pay off debt. But it's possible you'll see a decline in your credit scores at first. That can be OK, as long as you make payments on time and don't rack up more debt.]

How does debt consolidation affect your credit score?

The way debt consolidation affects your credit depends on the various options you choose. ... If you consolidate by taking a personal loan to pay off your credit cards, your utilization ratio could go down, causing your score to go up.

Is it a good idea to consolidate debt?

If you don't have a good score, you need to improve your credit behavior to bring your score up. It's also a good idea to use debt consolidation loan if you want to simplify your monthly payments. When you get one loan to pay off your debts, it becomes easier to meet your payments.

How long does debt consolidation stay on your credit report?

A: That you settled a debt instead of paying in full will stay on your credit report for as long as the individual accounts are reported, which is typically seven years from the date that the account was settled.

Does debt consolidation close credit cards?

Yes, although it depends on your situation. If you have good credit and a limited amount of debt, you probably won't need to close your existing accounts. You can use a balance transfer or even a debt consolidation loan without this restriction. Getting a balance transfer credit card never comes with restrictions.

Are Consolidation Loans a Good Idea?

Whether consolidating your debt is a good idea depends on both your personal financial situation and on the type of debt consolidation being considered. Consolidating debt with a loan could reduce your monthly payments and provide near term relief, but a lengthier term could mean paying more in total interest.

Is it bad to consolidate your debt?

When it comes to using a loan to consolidate your debt, an unsecured consolidation loan is almost always the better option if you can qualify for a low interest rate. ... This is why most experts advise against using home equity loans to eliminate credit card debt because it's just not worth the risk.

When should you consider debt consolidation?

You are ready to pay down your debts and put them behind you.

You want to save money on interest in securing a lower monthly payment.

You may qualify for a lower payment that would make managing your debts easier.

Furthermore, you are tired of juggling multiple bills every month.

What is a consolidation line of credit?

Consolidating your debts means rearranging and refinancing your debt by taking out one loan to pay off several smaller loans, credit lines and/or credit cards, preferably at a lower interest rate.

#1 usability according to G2

Try the PDF solution that respects your time.