Cosign Ssn Field For Free

Upload your document

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

Users trust to manage documents on pdfFiller platform

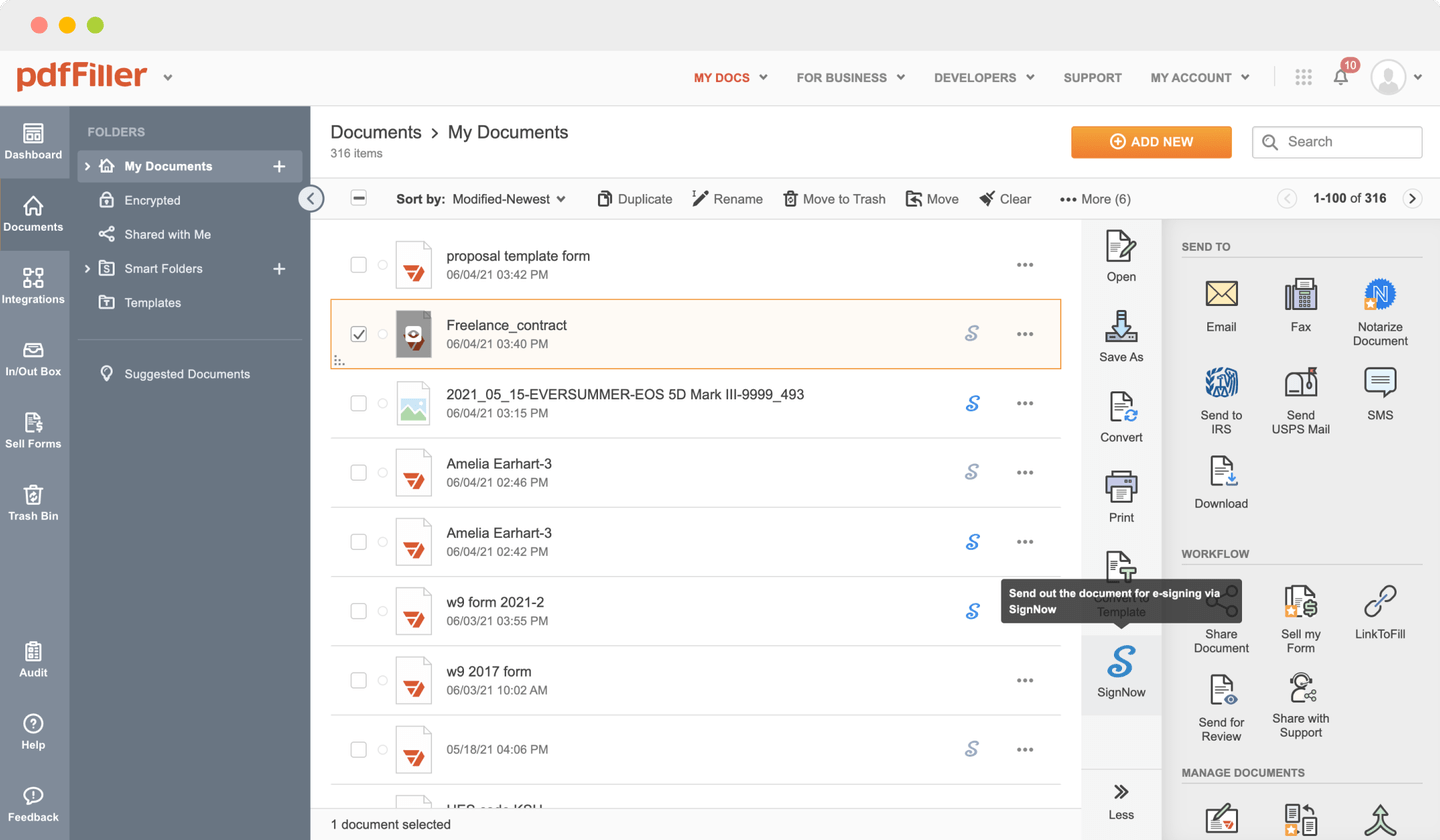

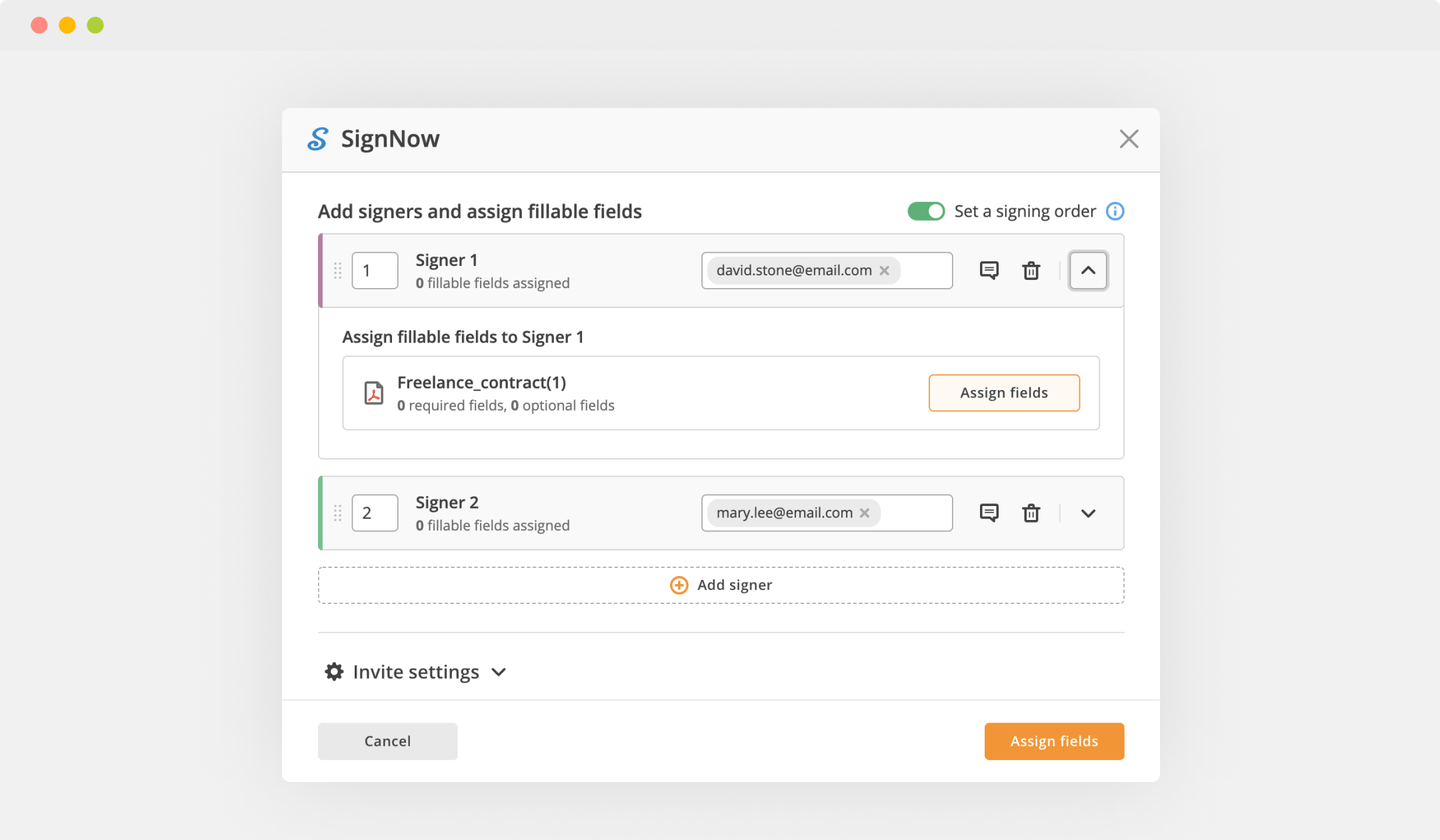

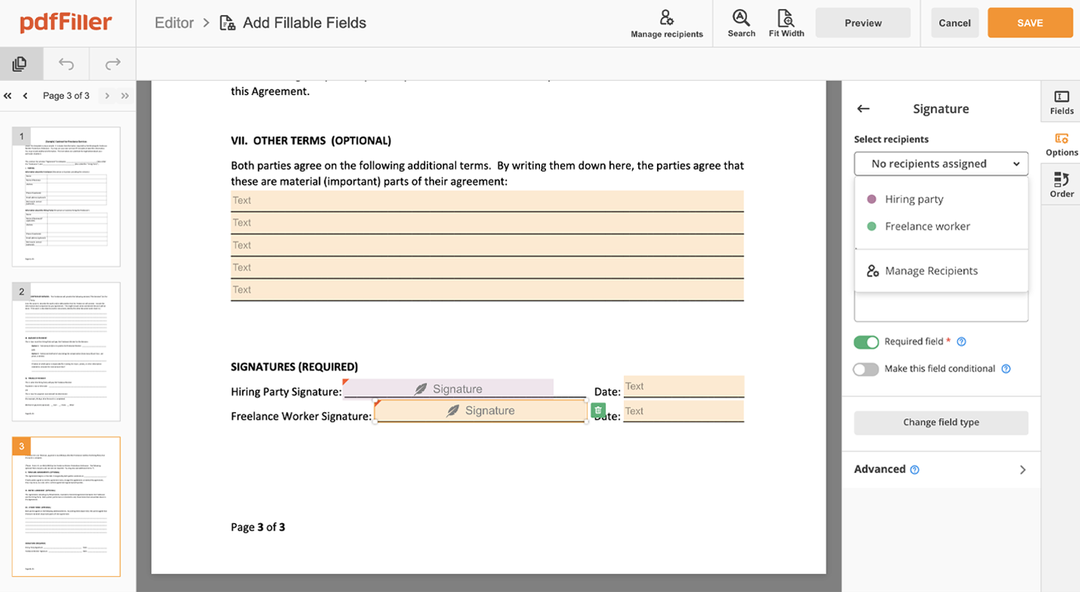

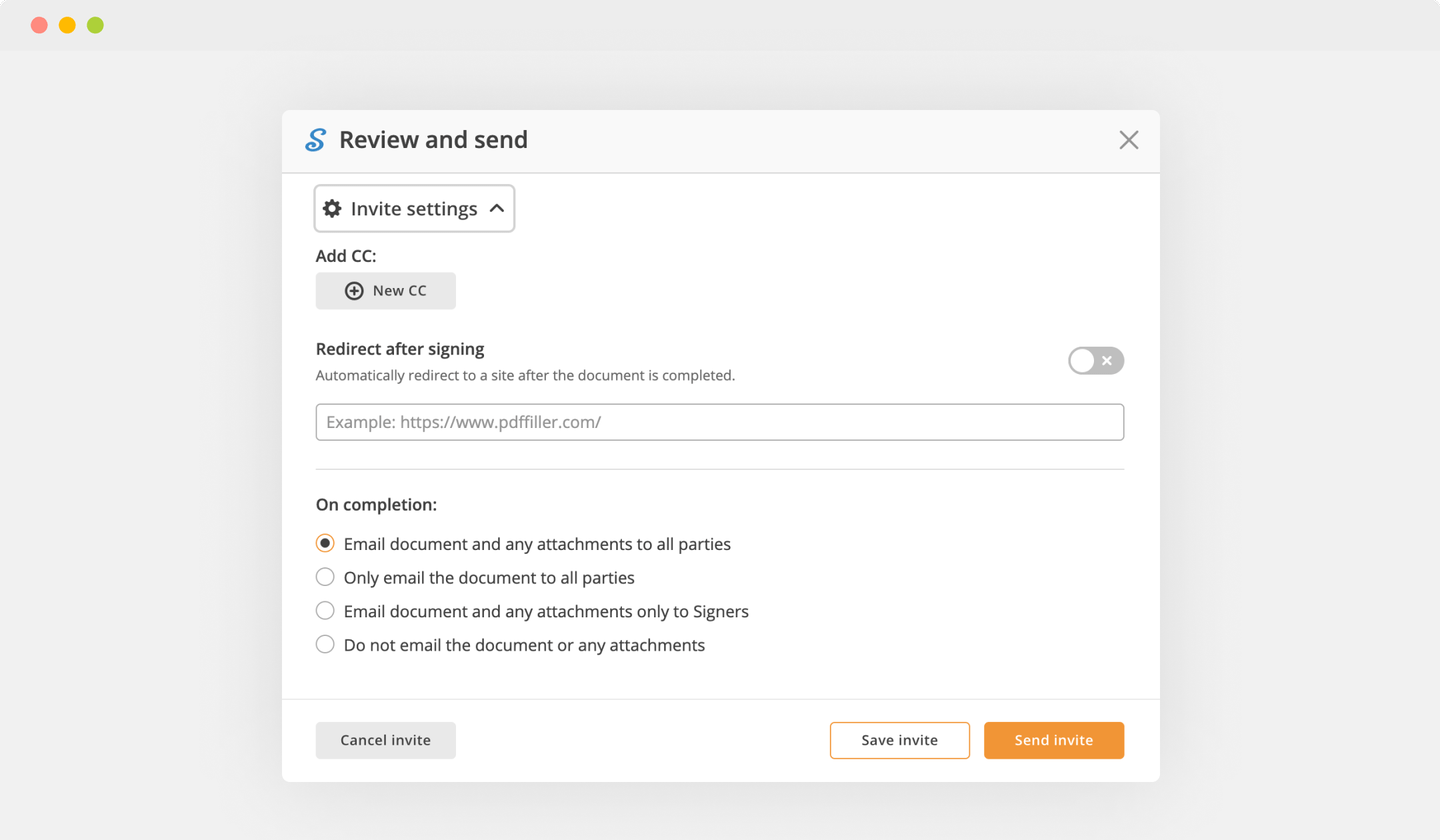

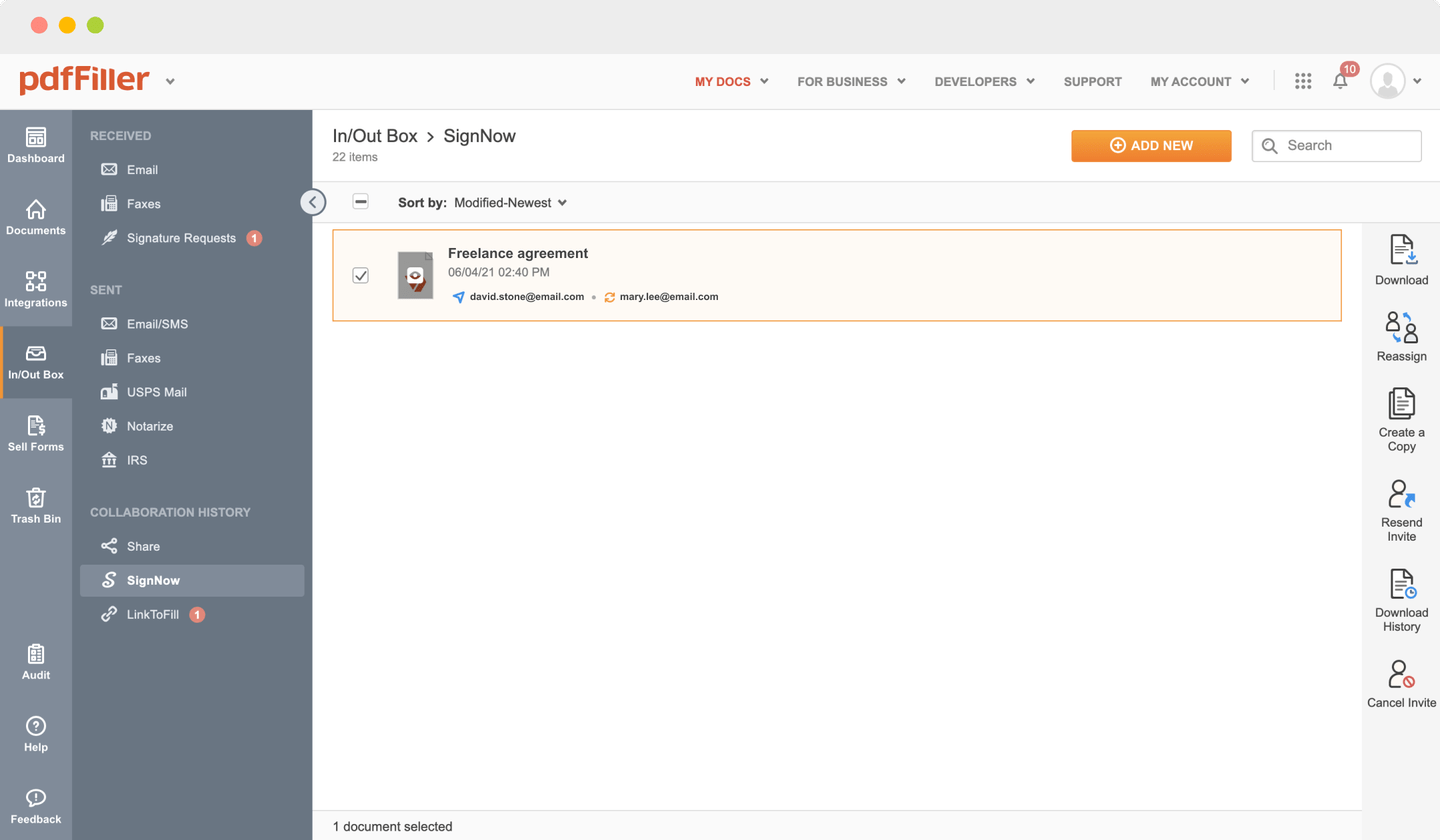

Send documents for eSignature with signNow

Create role-based eSignature workflows without leaving your pdfFiller account — no need to install additional software. Edit your PDF and collect legally-binding signatures anytime and anywhere with signNow’s fully-integrated eSignature solution.

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

pdfFiller scores top ratings in multiple categories on G2

How to Cosign SSN Field

Still using different programs to create and modify your documents? We have a solution for you. Use our document editor to make the process simple. Create fillable forms, contracts, make templates, integrate cloud services and utilize many more useful features without leaving your browser. Plus, it enables you to Cosign Ssn Field and add high-quality features like signing orders, alerts, attachment and payment requests, easier than ever. Pay as for a basic app, get the features as of a pro document management tools.

How-to Guide

How to edit a PDF document using the pdfFiller editor:

01

Upload your document to pdfFiller`s uploader

02

Choose the Cosign SSN Field feature in the editor`s menu

03

Make the needed edits to your document

04

Push the orange “Done" button in the top right corner

05

Rename your template if it's required

06

Print, email or save the form to your computer

Dissuade persons who ask about the ‘SSN Field’, that is, questions on people who were born inside Iran and lived there with Iranian passports for more than two years. Relegate persons, who are working on the ‘SSN Field’, not only in Tehran and other important cities and towns but also in the provinces, not to carry out personal inspections of persons, except with a judicial order, to establish their identity and the identity of persons issued the ‘SSN Field’. Make the persons' appearance and the name of the person who issued the ‘SSN Field’, to be recorded in the State security intelligence and reformatory systems and not in personal checklists. Make information about persons who can not be issued an Iranian passport since the time of the issuance of the ‘SSN Field’, not to be published in public. Once you install the SSN Manager service, we help you to get the most out of your SSN by letting you track every transaction you make, manage your account in-depth with multiple data categories, view your transaction records, manage your account security, view your documents — all within your browser. The SSN Manager provides you complete access to the documents your SSN holds, providing you the ability to:

View and track transactions on your SSN account with a transaction record page using our unique database and transaction log.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Dawn

2019-05-27

so far so good, very easy to use. The only issue is I can not verify my office # as I do not use a CELL phone. CAnnot receive SMS text to verify my tel#

Heather O.

2019-05-16

Great tool

Easy to use and has functionality I need.

Think there is some maximum number of pages you can convert at one time so have to break it up.

Get a powerful PDF editor for your Mac or Windows PC

Install the desktop app to quickly edit PDFs, create fillable forms, and securely store your documents in the cloud.

Edit and manage PDFs from anywhere using your iOS or Android device

Install our mobile app and edit PDFs using an award-winning toolkit wherever you go.

Get a PDF editor in your Google Chrome browser

Install the pdfFiller extension for Google Chrome to fill out and edit PDFs straight from search results.

List of extra features

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I pay someone to cosign for me?

You do have to pay for our services after applying in order for us to help find you a cosigner. You can choose to pay your cosigner out-of-pocket with what you can afford. If you are applying for a loan, you could offer to pay your cosigner with a part of the loan you receive after your application is approved.

How much should a cosigner make?

So, it is important to keep two key things in mind when looking for your cosigner. Their income level would need to be sufficient to cover the loan payments should you be unable to make them. Their credit score needs to be above 650 for your lender to consider them as a reliable cosigner in most cases.

Do co-signers need good credit?

Although there might not be a required credit score, a cosigner typically will need credit in the very good or exceptional range670 or better. A credit score in that range generally qualifies someone to be a cosigner, but each lender will have its own requirement.

Is it a bad idea to cosign for someone?

Even if the borrower is diligent about making the payments, you may still run into credit problems as a result of cosigning. Any loan you cosign will show up on your credit report as one of your own debts. Yes, that's a hassle, but if this person can't get a loan without a cosigner, there's a good reason for it.

What does the Bible say about cosigning for a family member?

Proverbs, He that is surety for a stranger shall smart for it: and he that hate suretiship is sure. Someone who cosigns a loan is given many warnings from the Word of God not to mention the bank as well. It demands great responsibility and must not be entered into lightly.

How do I find a cosigner online?

Short answer: you can't find a co-signer online. If you do, it's a sure bet it's a scammer looking to separate you from your money. A co-signer is someone who is willing to take responsibility for your loan payments should you default.

What if I can't find a cosigner?

How to Find a Cosigner. Most people who cosign for a loan are friends, family members, spouses, or significant others to the primary applicant.

Non-Traditional Lending Options.

Pledge Collateral.

Reduce Your Loan Amount.

Delay Your Application.

Build Your Credit.

How do I find an American cosigner?

Suggested clip

How to Find a US Cosigner - YouTubeYouTubeStart of suggested clipEnd of suggested clip

How to Find a US Cosigner - YouTube

Does a co applicant need good credit?

When applying with a co-applicant, a standard credit application is required for both borrowers. Borrowers with good credit can help low credit quality borrowers to obtain loan financing approval. They can also help to lower the interest rate on a loan for average credit quality borrowers.

Does a cosigner credit get affected?

In a strict sense, the answer is no. The fact that you are a cosigner in and of itself does not necessarily hurt your credit. However, even if the cosigned account is paid on time, the debt may affect your credit scores and revolving utilization, which could affect your ability to get a loan in the future.

Does Cosign affect your credit?

In a strict sense, the answer is no. The fact that you are a cosigner in and of itself does not necessarily hurt your credit. However, even if the cosigned account is paid on time, the debt may affect your credit scores and revolving utilization, which could affect your ability to get a loan in the future.

Is cosigning a bad idea?

Even if the borrower is diligent about making the payments, you may still run into credit problems as a result of cosigning. Any loan you cosign will show up on your credit report as one of your own debts. Yes, that's a hassle, but if this person can't get a loan without a cosigner, there's a good reason for it.

Why Cosigning is a bad idea?

Even if the borrower is diligent about making the payments, you may still run into credit problems as a result of cosigning. Any loan you cosign will show up on your credit report as one of your own debts. Yes, that's a hassle, but if this person can't get a loan without a cosigner, there's a good reason for it.

Does Cosign affect your debt to income ratio?

Cosigning a loan raises your debt-to-income ratio since you're basically promising to pay the loan if the borrower doesn't. It also puts you at risk for damaging your credit score and having your wages garnished for non-payment.

Will Cosigning affect me buying a house?

They are correct that cosigning the loan could affect their ability to qualify for a mortgage, especially if they are planning to purchase a house in the near future. Because they share full responsibility for the debt, the loan will appear on your father or mother's credit report, as well.

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.