Countersignature Stock Plan For Free

Users trust to manage documents on pdfFiller platform

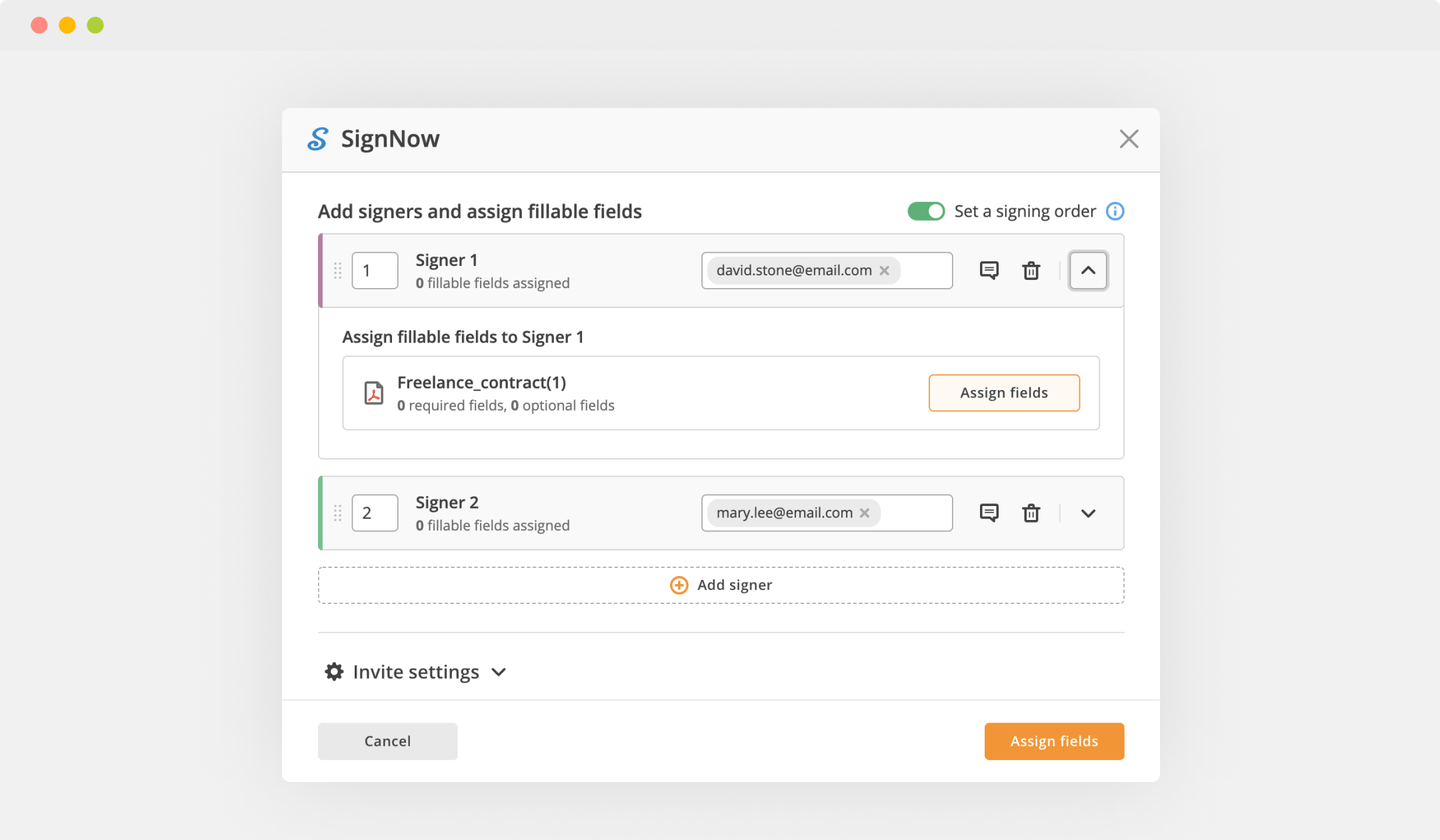

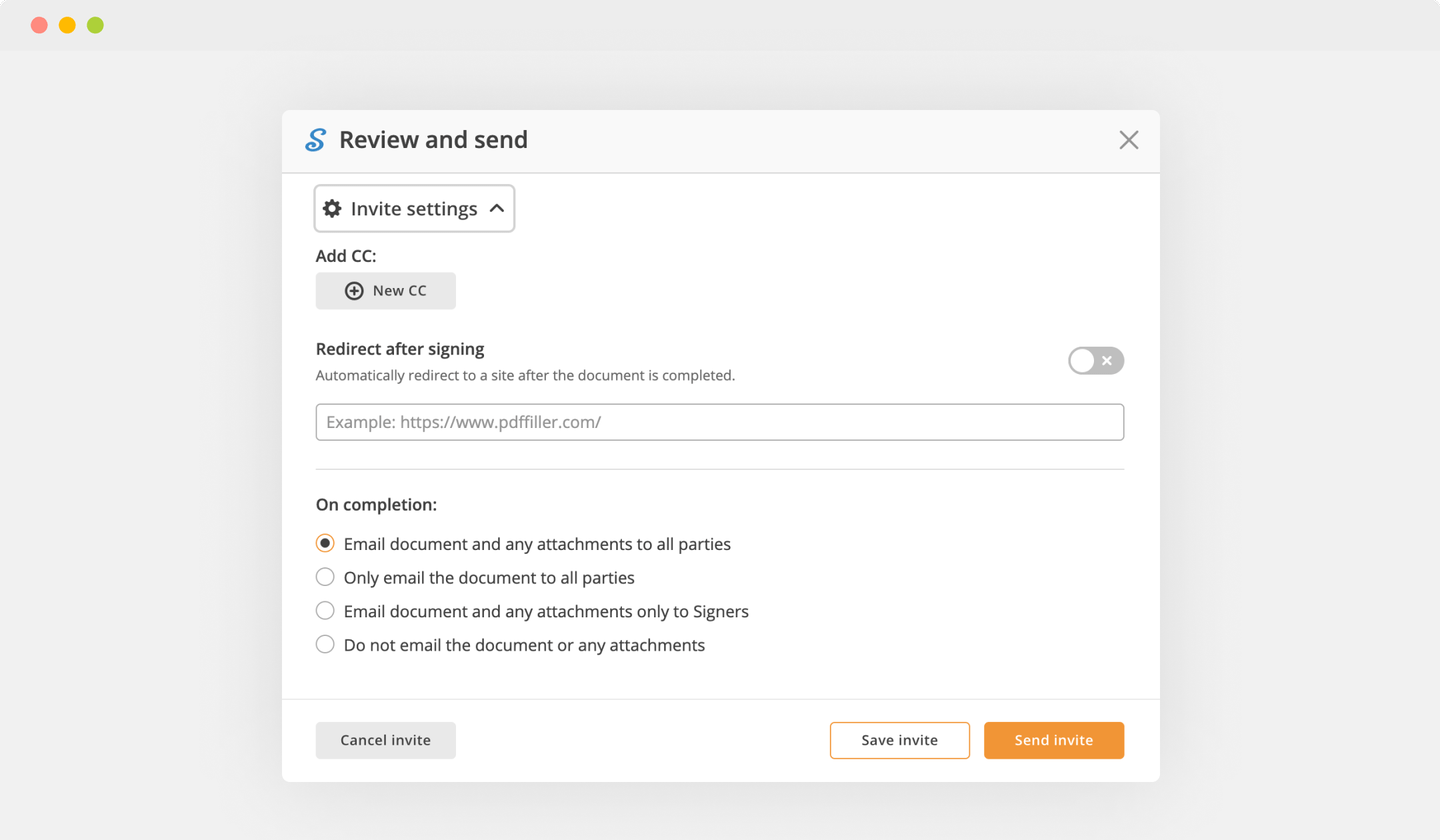

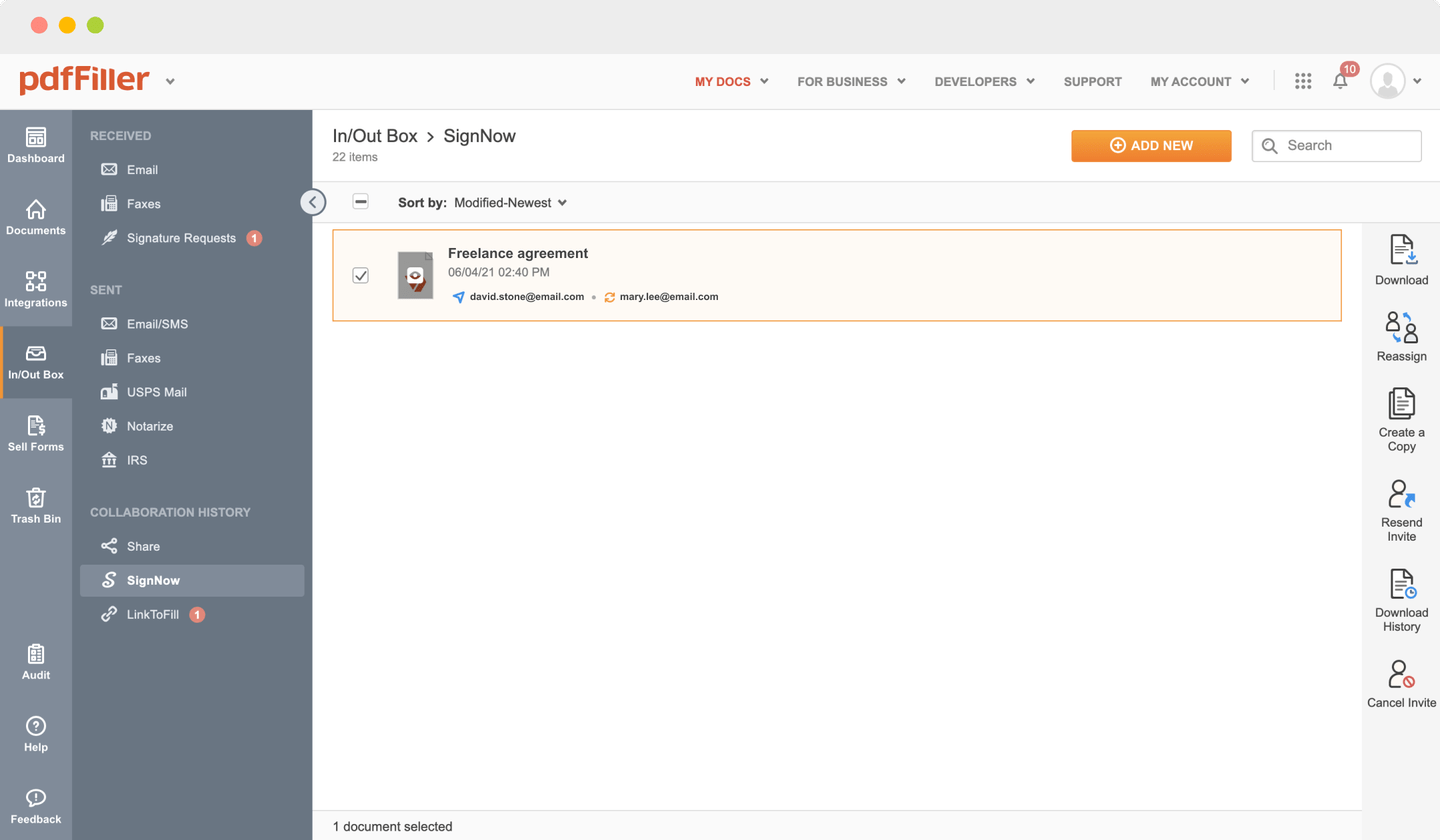

Send documents for eSignature with signNow

Watch a short video walkthrough on how to add an Countersignature Stock Plan

pdfFiller scores top ratings in multiple categories on G2

Create a legally-binding Countersignature Stock Plan in minutes

pdfFiller allows you to handle Countersignature Stock Plan like a pro. No matter what platform or device you run our solution on, you'll enjoy an easy-to-use and stress-free way of executing paperwork.

The entire signing process is carefully safeguarded: from adding a document to storing it.

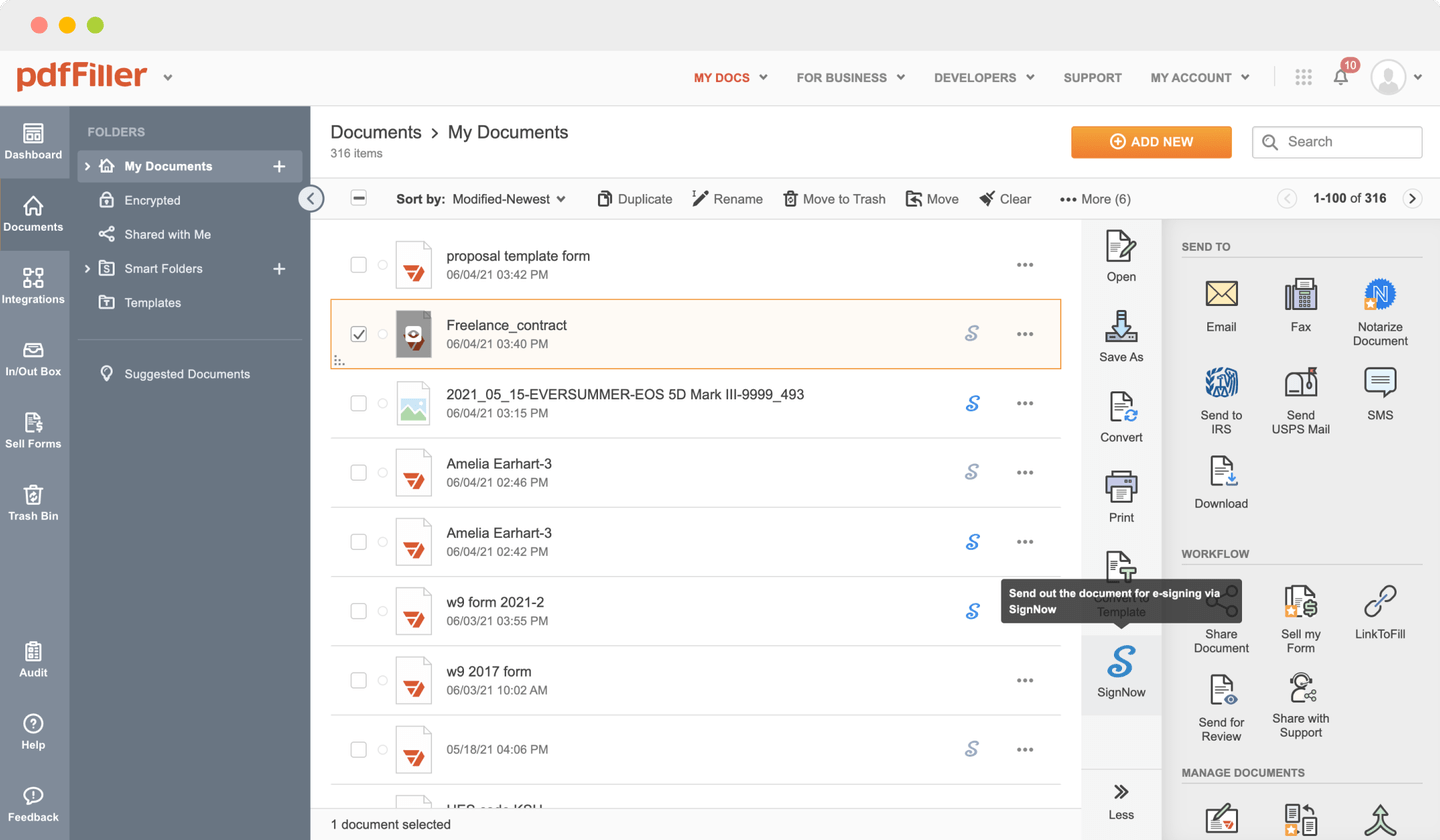

Here's the best way to create Countersignature Stock Plan with pdfFiller:

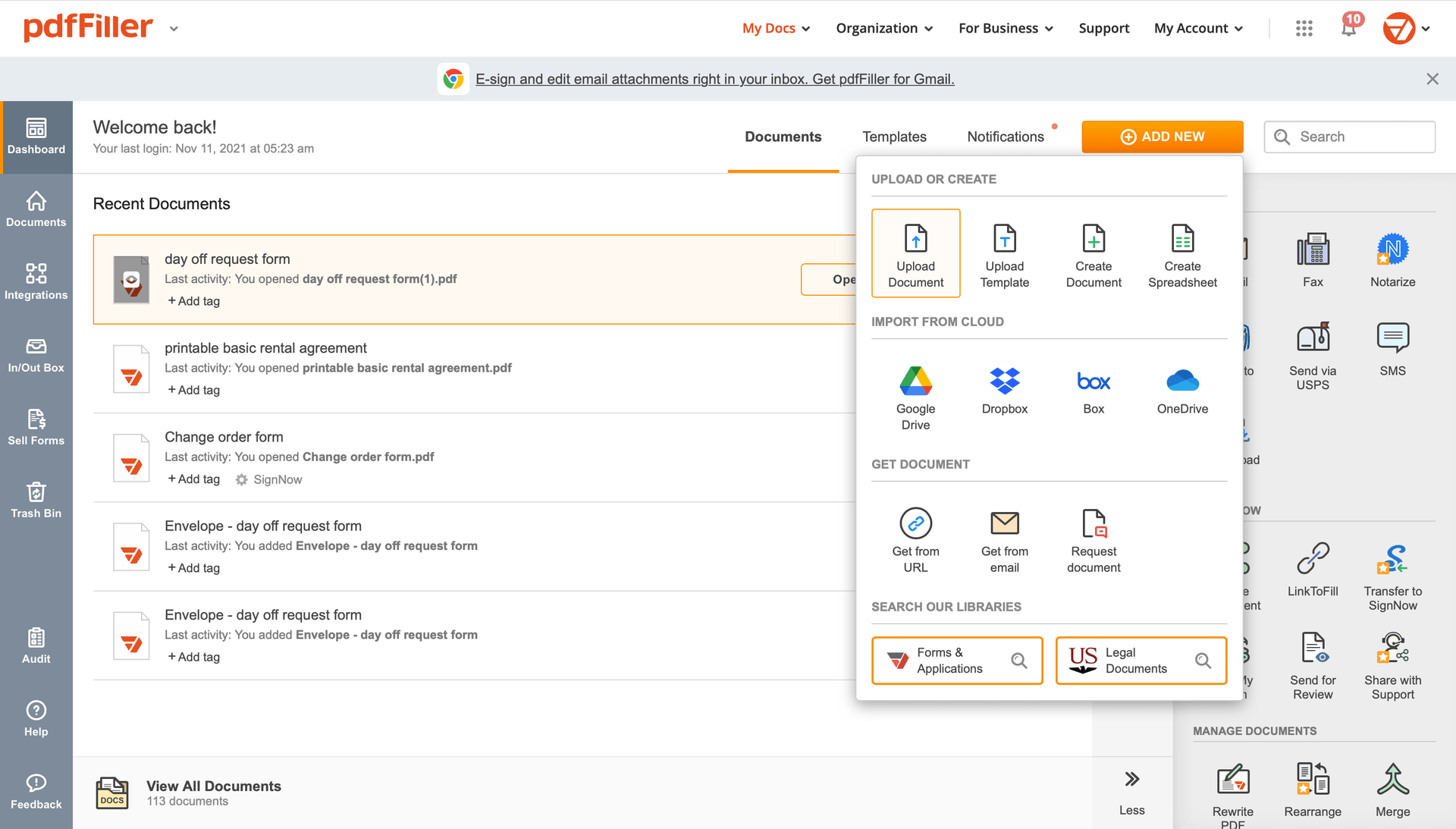

Select any available way to add a PDF file for completion.

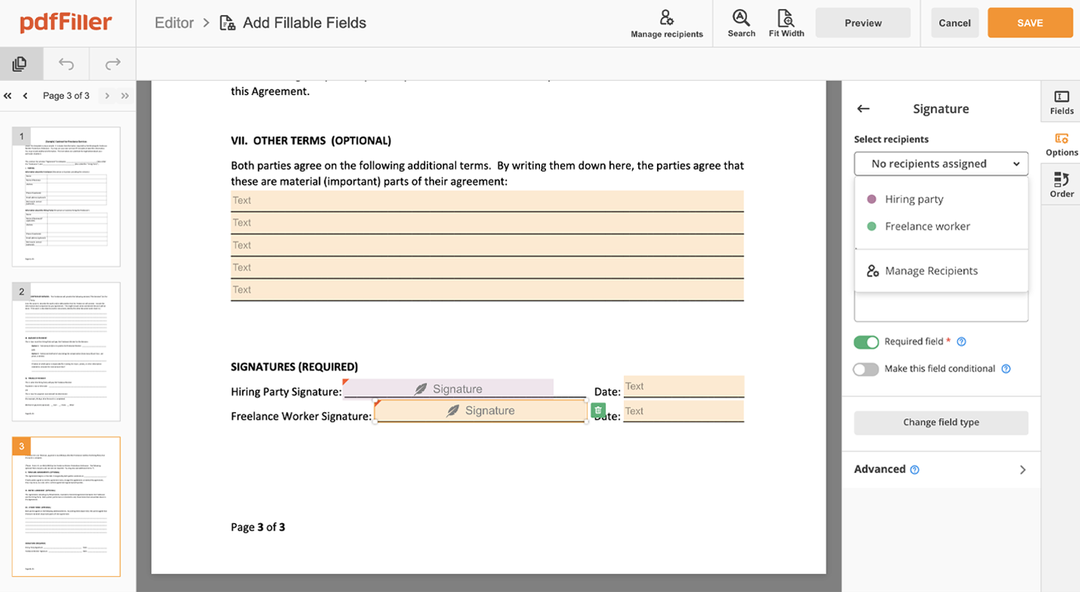

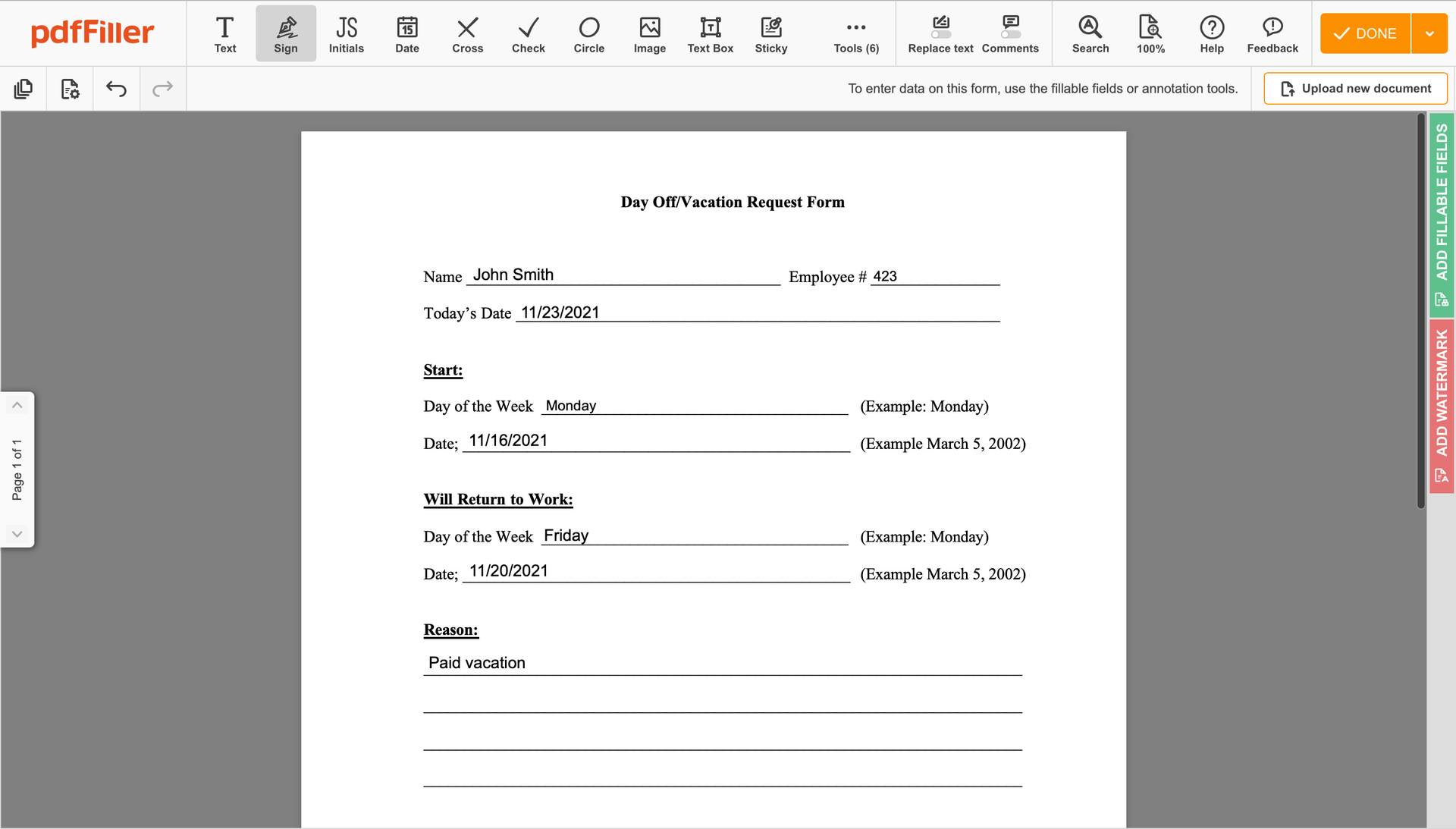

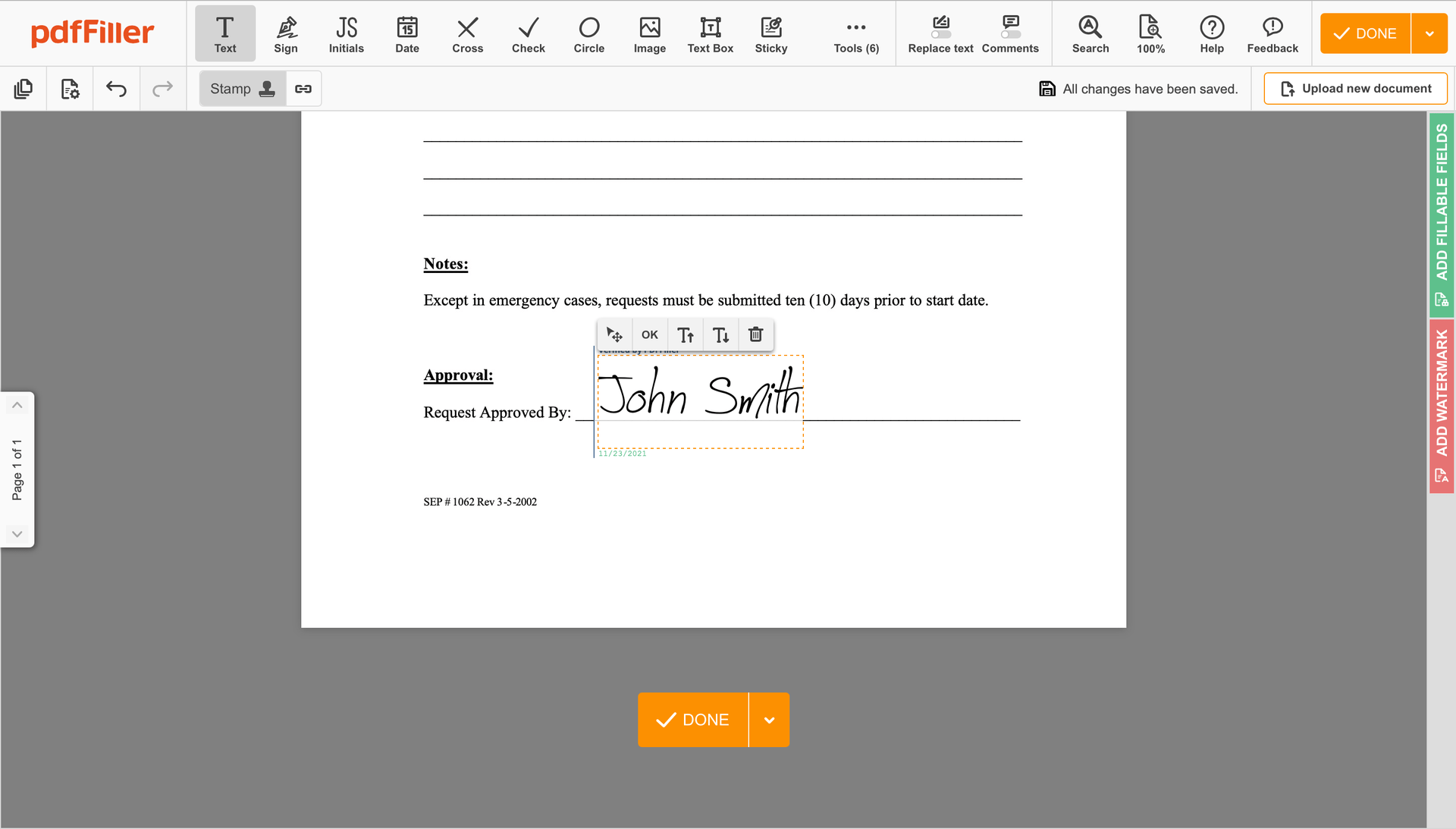

Utilize the toolbar at the top of the interface and choose the Sign option.

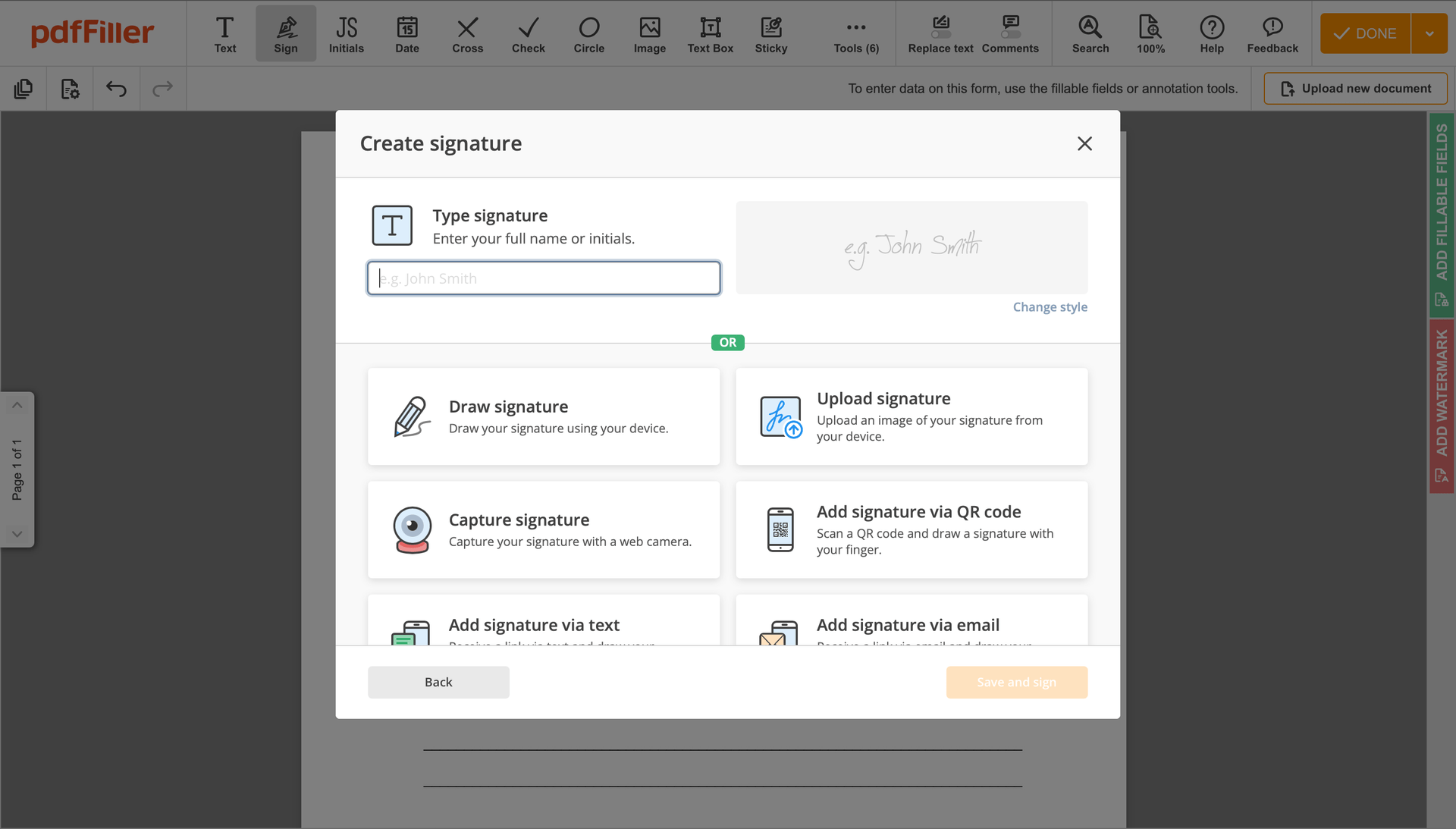

You can mouse-draw your signature, type it or add an image of it - our tool will digitize it in a blink of an eye. Once your signature is created, hit Save and sign.

Click on the form place where you want to put an Countersignature Stock Plan. You can move the newly created signature anywhere on the page you want or change its configurations. Click OK to save the changes.

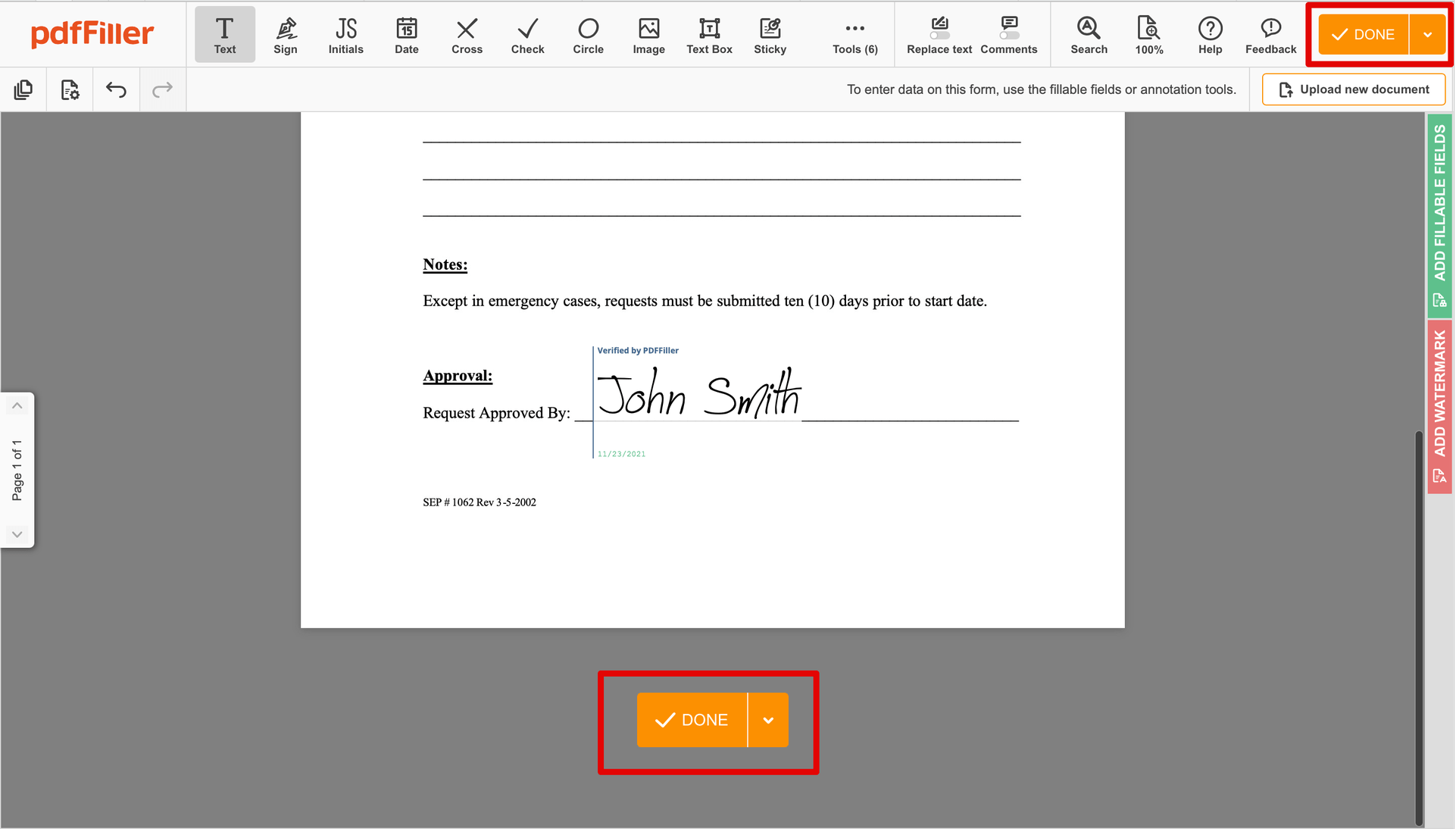

As soon as your document is ready to go, click on the DONE button in the top right area.

As soon as you're through with certifying your paperwork, you will be taken back to the Dashboard.

Utilize the Dashboard settings to download the executed copy, send it for further review, or print it out.

Still using numerous applications to modify and manage your documents? We have the perfect all-in-one solution for you. Use our document editor to make the process efficient. Create document templates completely from scratch, edit existing form sand many more features, without leaving your browser. Plus, it enables you to use Countersignature Stock Plan and add other features like signing orders, reminders, requests, easier than ever. Pay as for a lightweight basic app, get the features as of pro document management tools. The key is flexibility, usability and customer satisfaction. We deliver on all three.

How to edit a PDF document using the pdfFiller editor:

How to Send a PDF for eSignature

What our customers say about pdfFiller

The customer support is phenomenal. They always answer quickly and fix whatever issue i have. The actual software does it's supposed to and increases my productivity x10. There are features included to import government forms easily or you can upload your own. The templates are easy to create and to make new documents using.

What do you dislike?

The amount of options can be overwhelming. It seems like the product can do so much and would take a long time to fully understand or use. The speed of the application is actually pretty fast but its not a literal immediate load time.

Recommendations to others considering the product:

Learn to import your forms directly from their bank of existing forms. Be careful when editing fields so that you don't overwrite existing functionality. If you need help don't hesitate to do a live chat and screen share. Their chat agents will fix any issue you have. I've had them help me multiple times.

What problems are you solving with the product? What benefits have you realized?

We use it to fill out government tax forms, specifically form 1098c for our nonprofit organization. The primary benefit is a secure place to share and store all our documents that we can search and edit when we need. This software saves us an immense amount of time. It provides a method to update and edit documents in minutes with recurring pages that would otherwise take 4x times longer fill out and complete. We generally only use this form an IRS form specifically but i can see the use case for many types of companies and situations.