E-Sign Bridge Loan Agreement For Free

Users trust to manage documents on pdfFiller platform

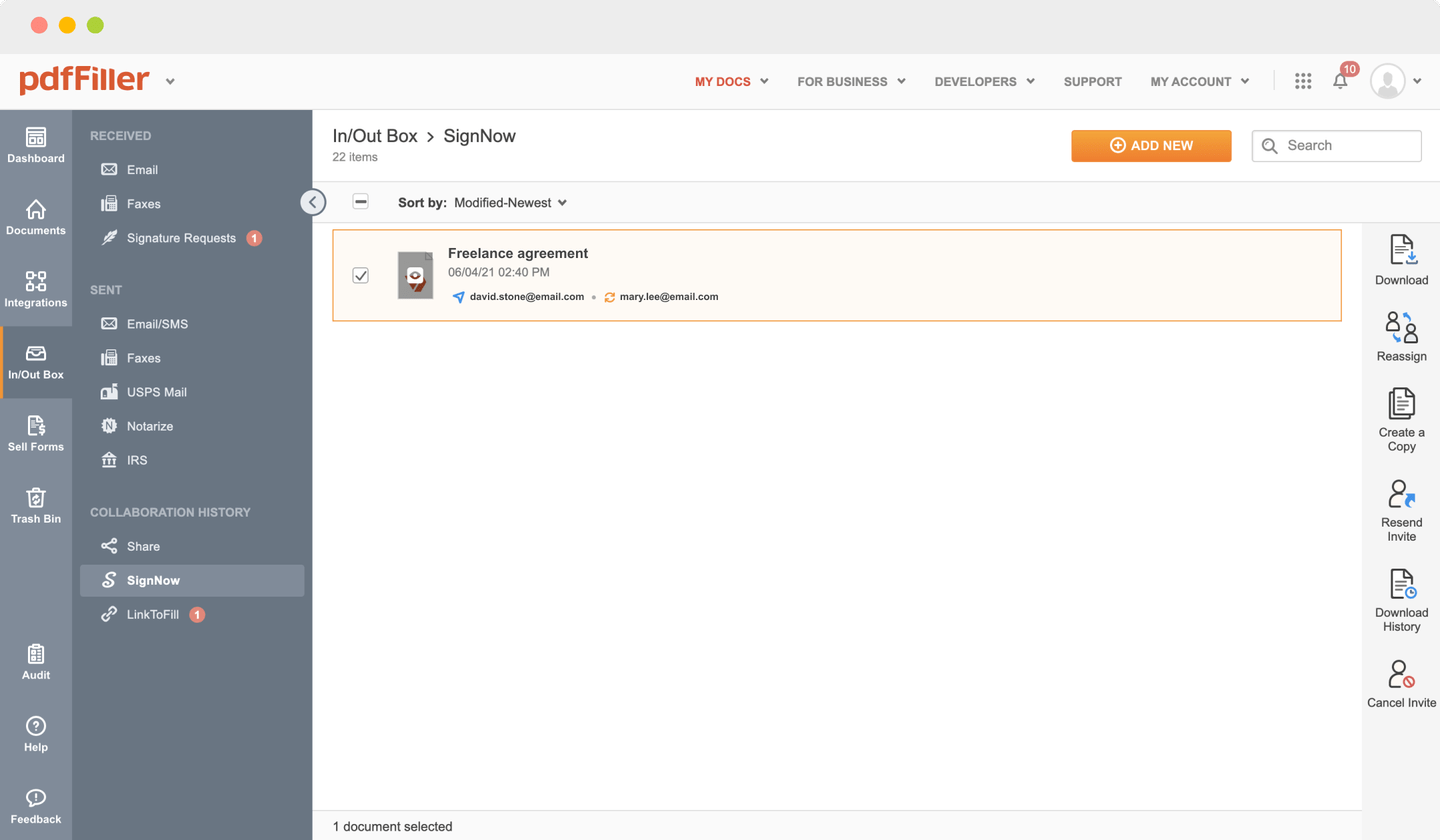

Send documents for eSignature with signNow

Watch a quick video tutorial on how to E-Sign Bridge Loan Agreement

pdfFiller scores top ratings in multiple categories on G2

E-Sign Bridge Loan Agreement with the swift ease

pdfFiller allows you to E-Sign Bridge Loan Agreement in no time. The editor's handy drag and drop interface allows for fast and intuitive document execution on any operaring system.

Signing PDFs electronically is a quick and secure method to verify papers anytime and anywhere, even while on the go.

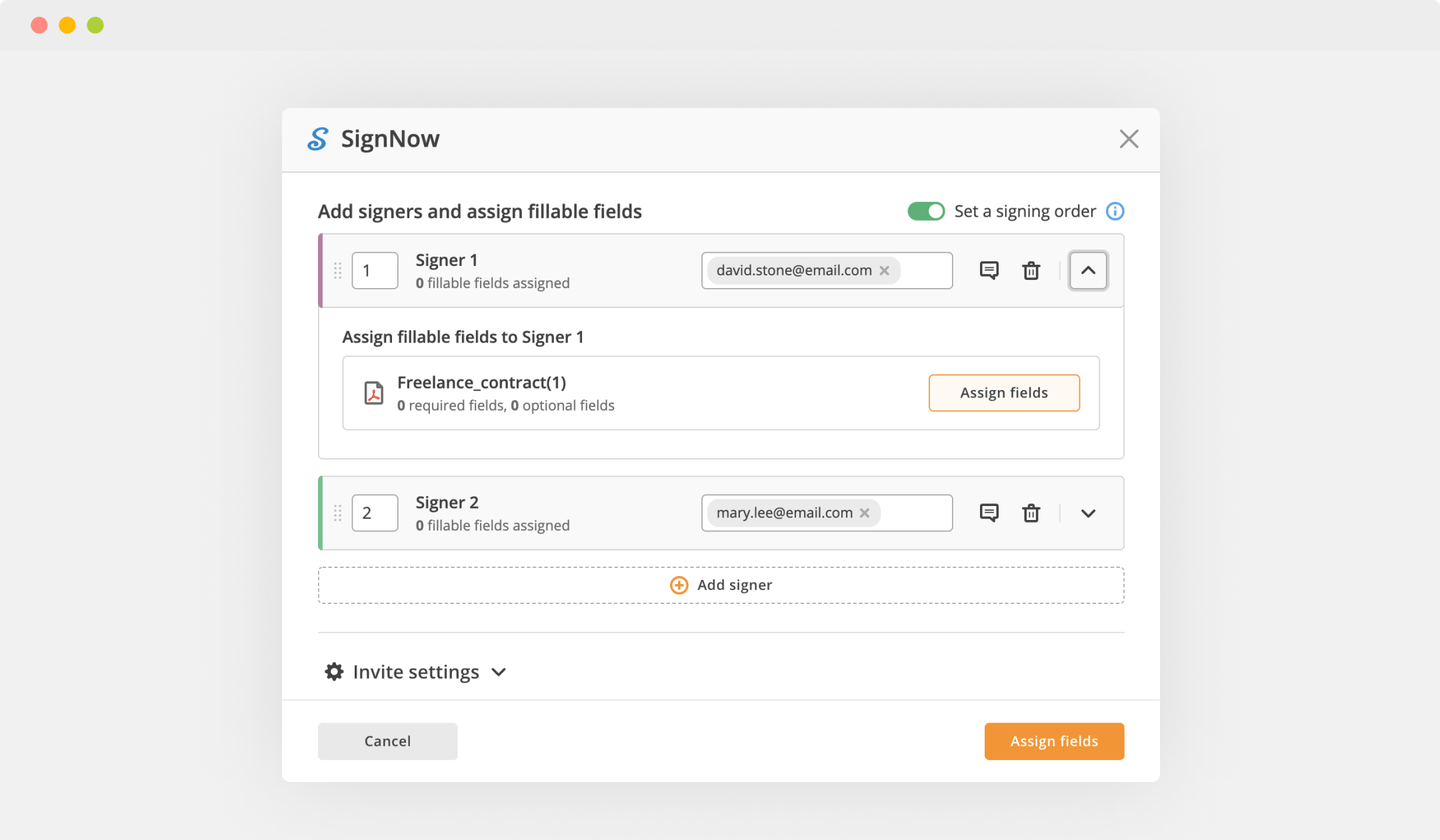

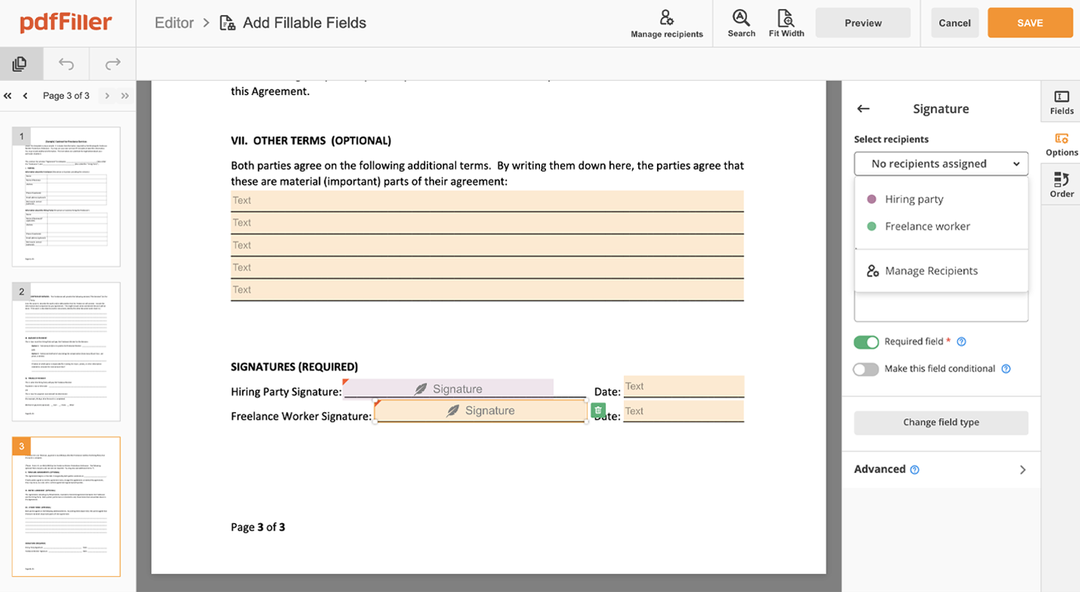

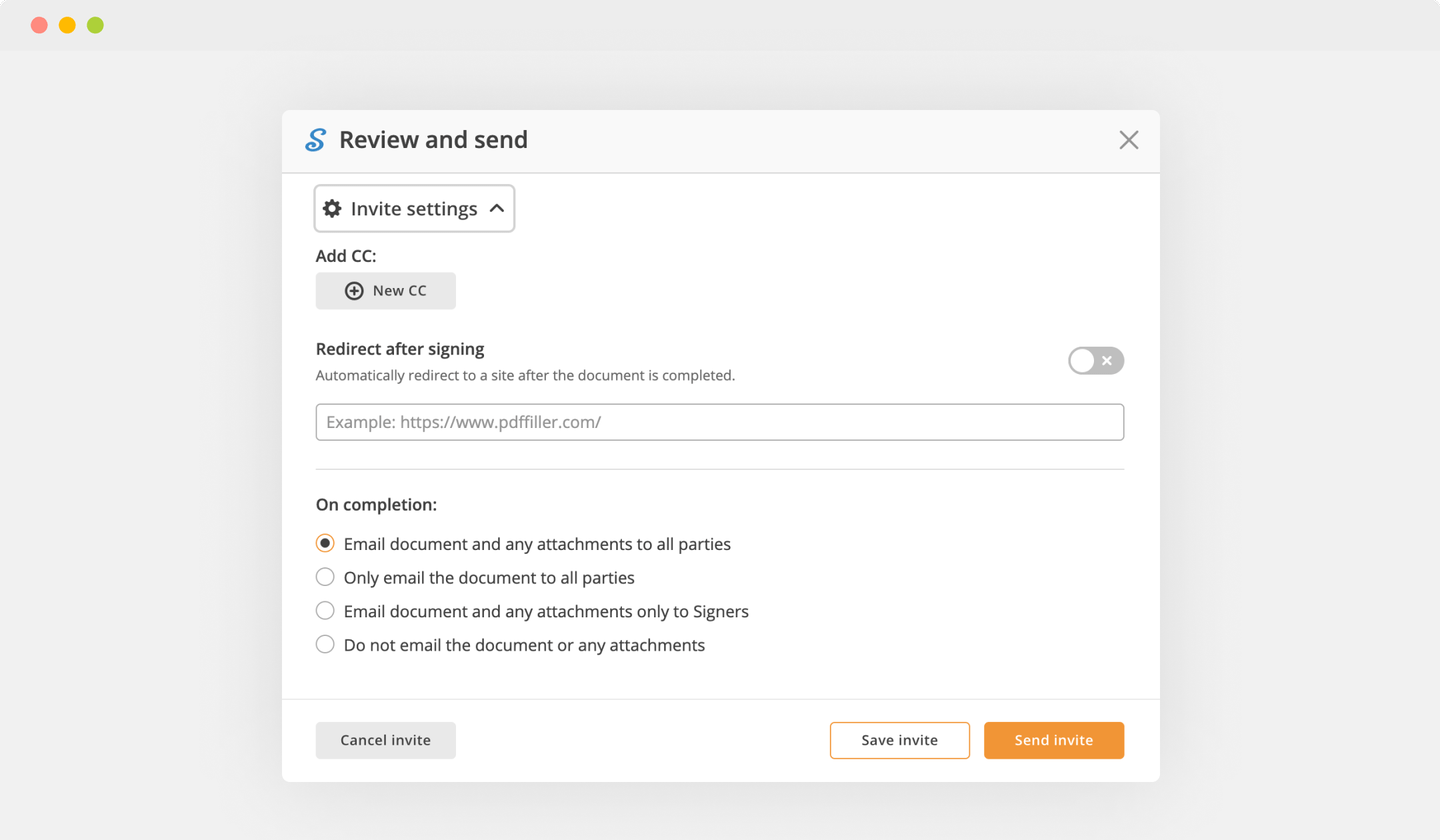

Go through the step-by-step guide on how to E-Sign Bridge Loan Agreement online with pdfFiller:

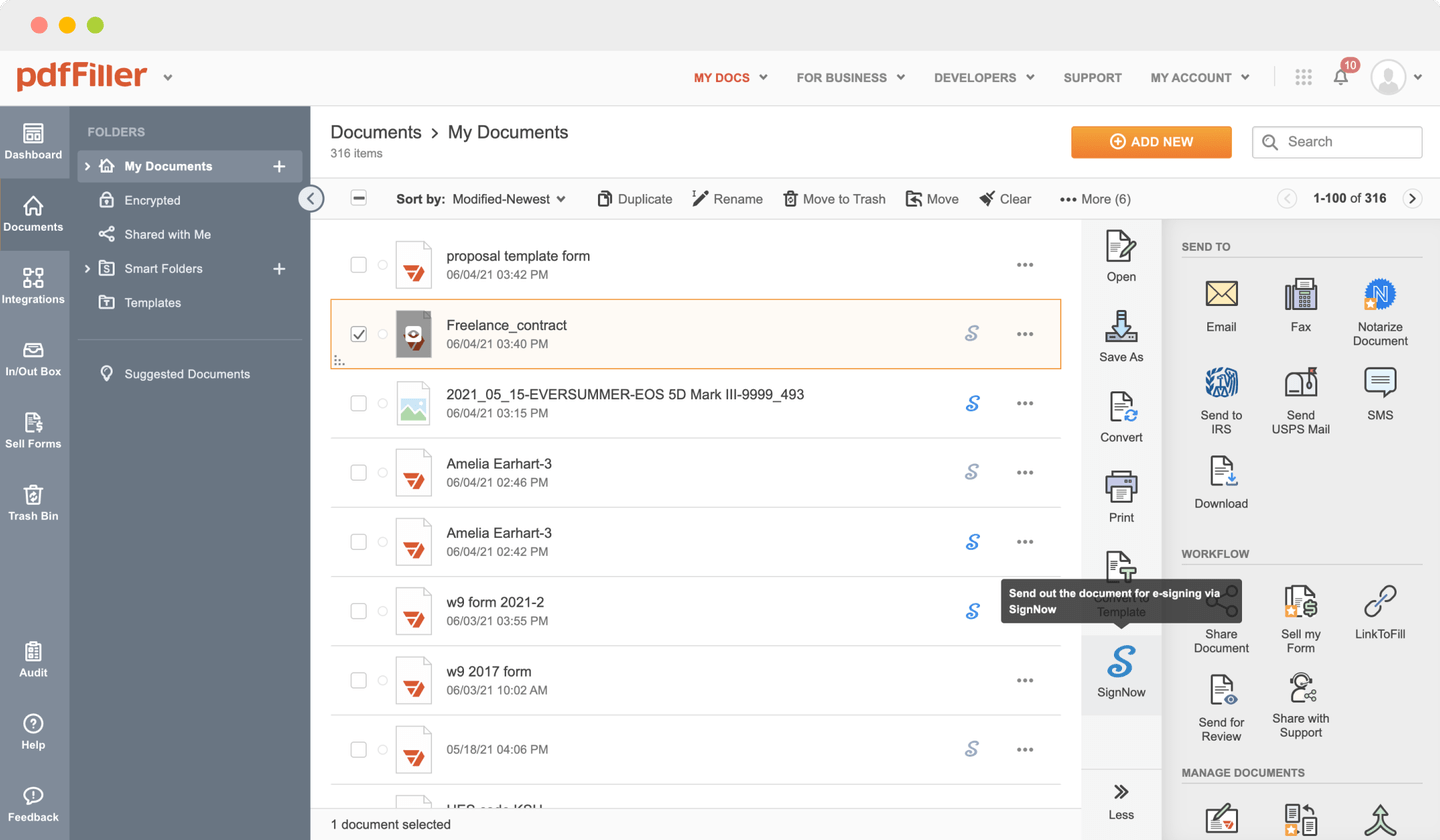

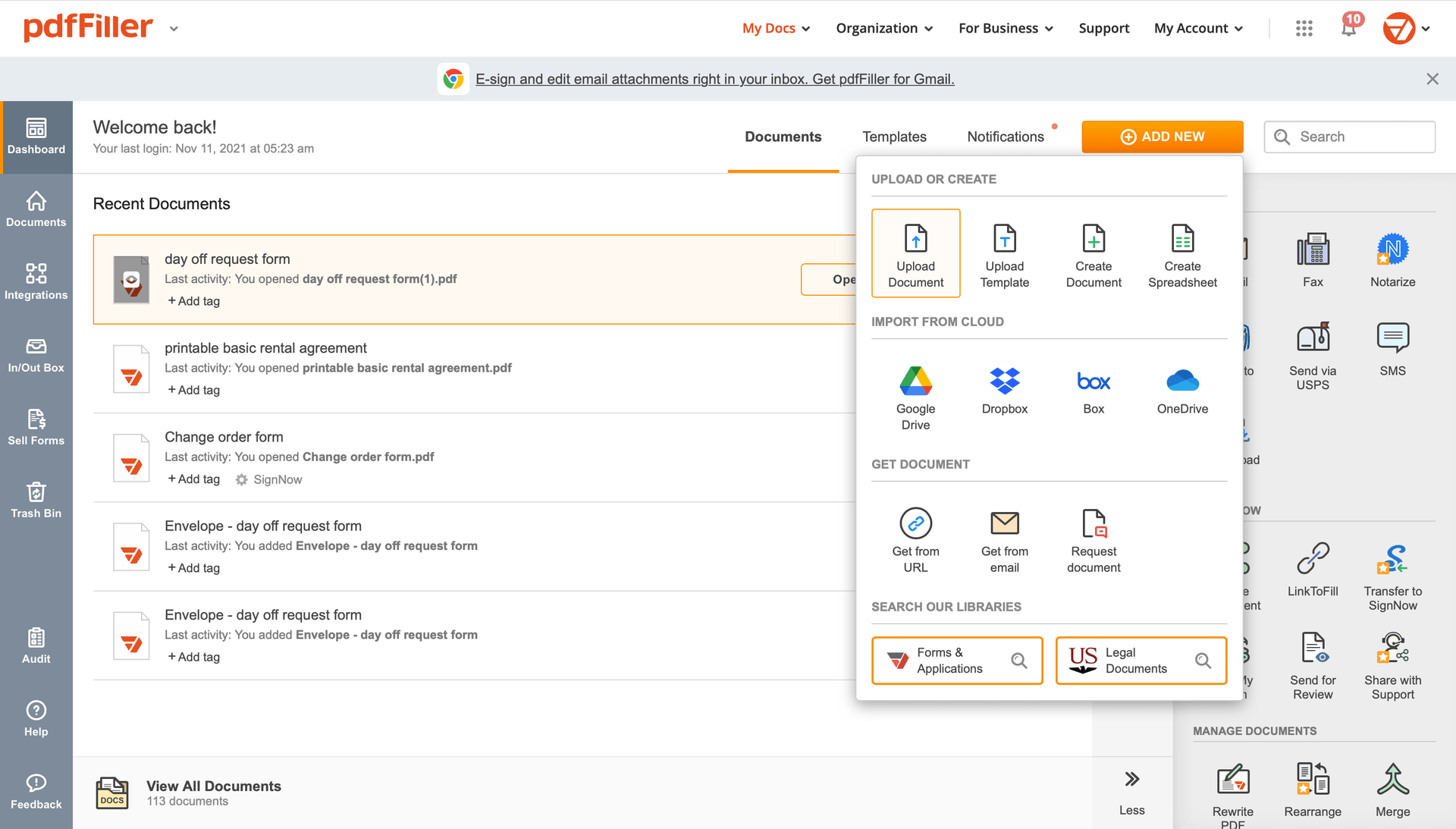

Add the document for eSignature to pdfFiller from your device or cloud storage.

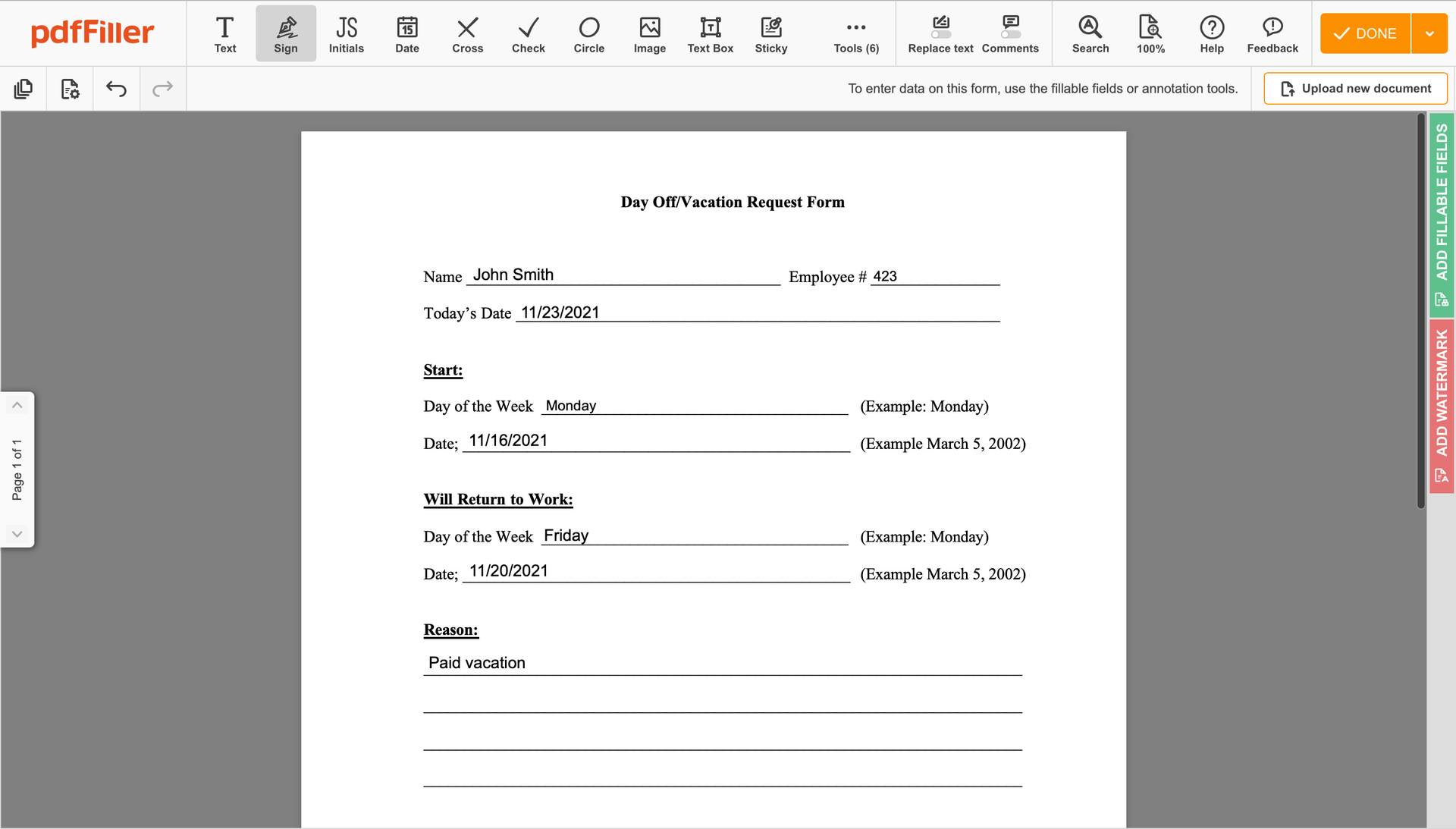

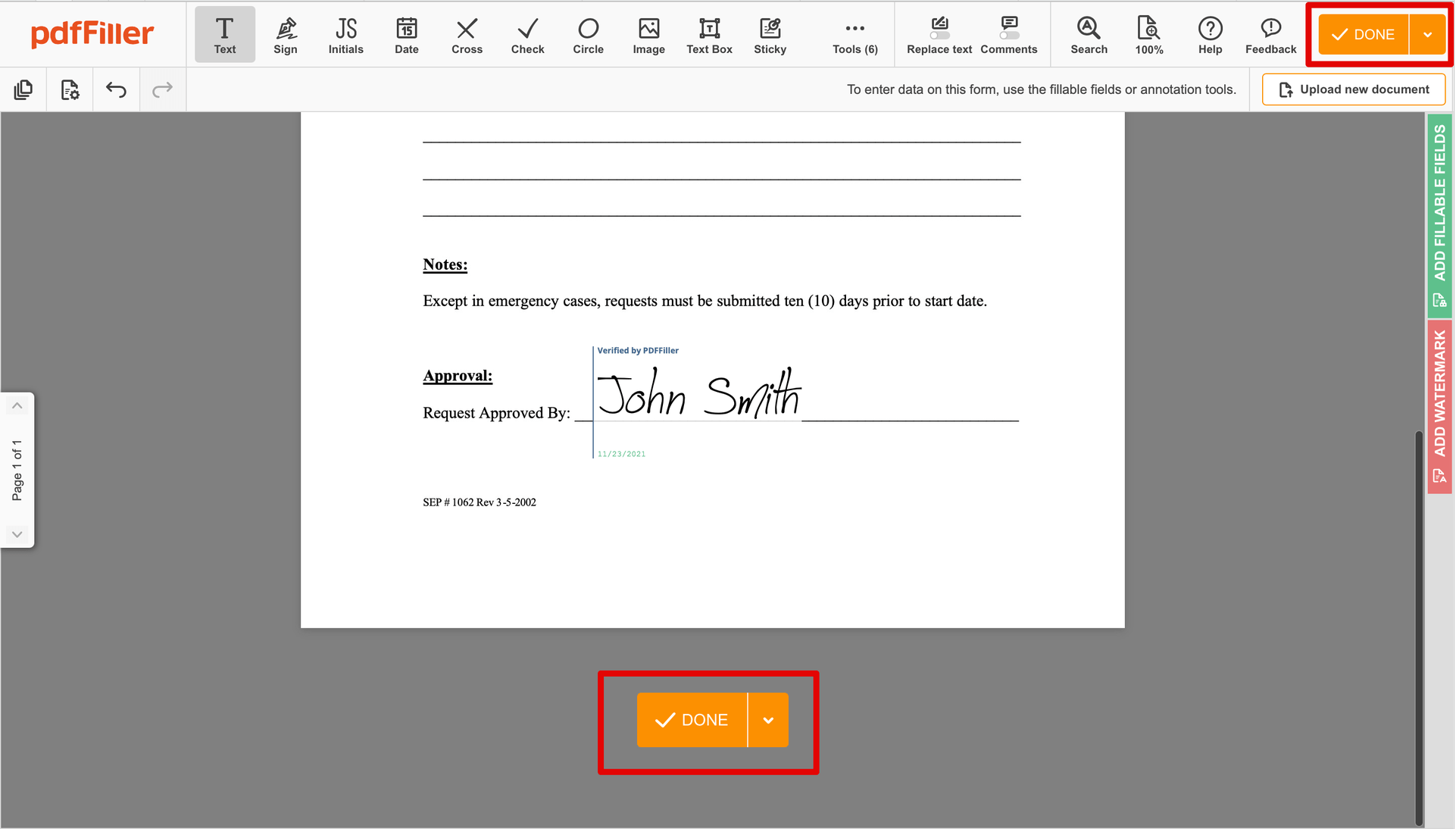

As soon as the file opens in the editor, click Sign in the top toolbar.

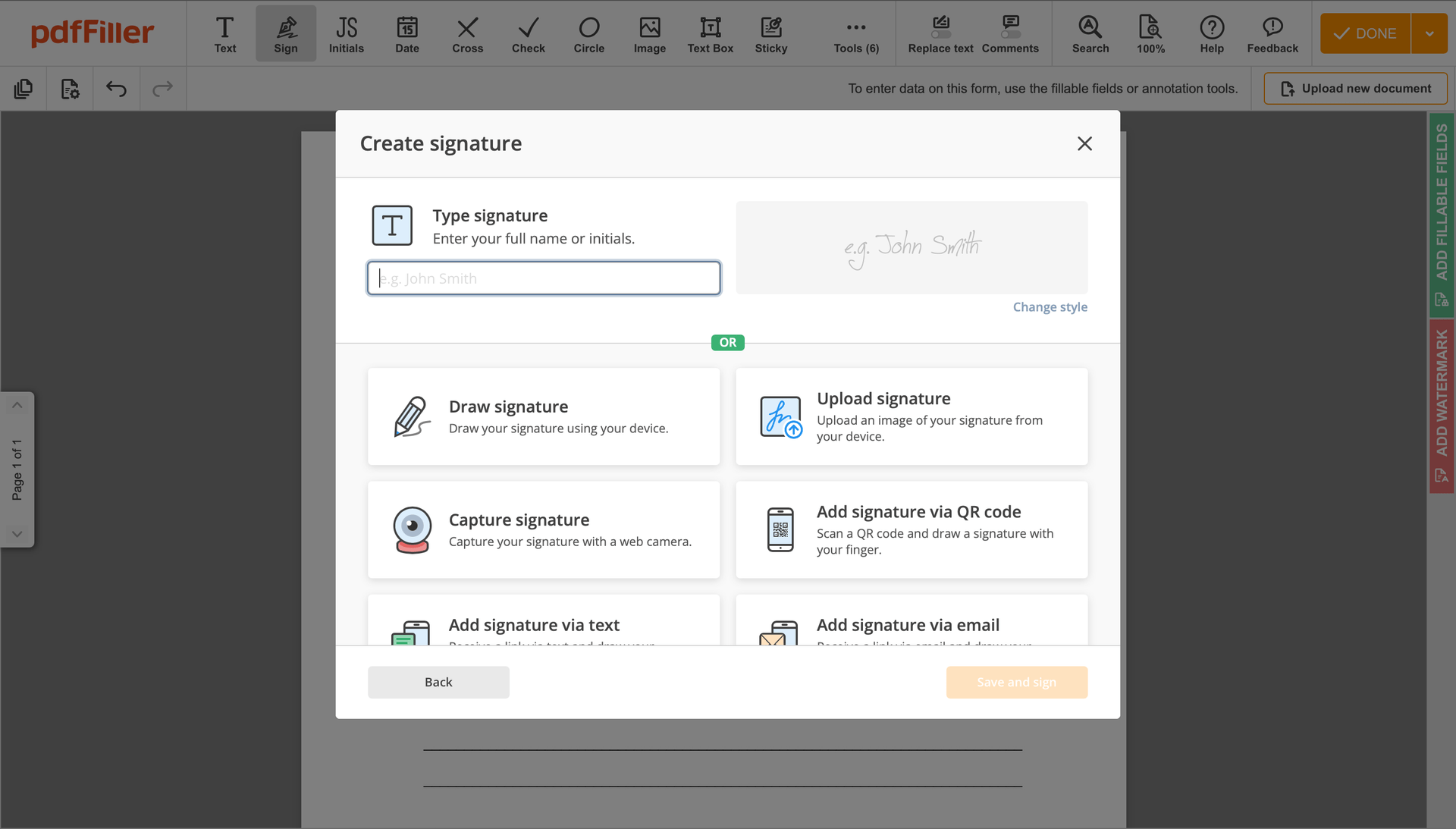

Generate your electronic signature by typing, drawing, or uploading your handwritten signature's photo from your laptop. Then, click Save and sign.

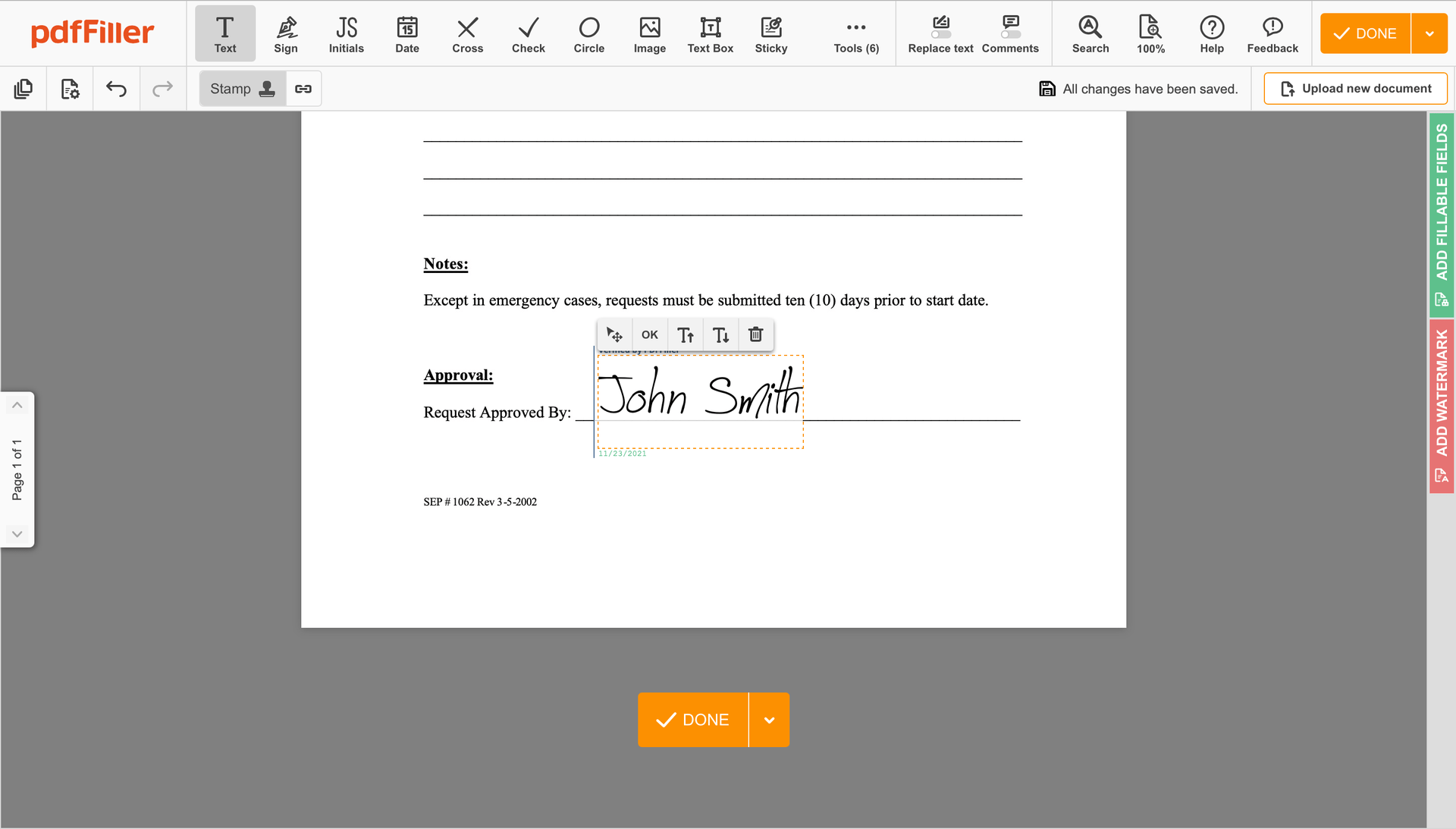

Click anywhere on a document to E-Sign Bridge Loan Agreement. You can move it around or resize it utilizing the controls in the floating panel. To apply your signature, click OK.

Finish up the signing process by hitting DONE below your form or in the top right corner.

After that, you'll go back to the pdfFiller dashboard. From there, you can get a signed copy, print the form, or send it to other people for review or approval.

Still using multiple applications to edit and manage your documents? Try this all-in-one solution instead. Use our tool to make the process efficient. Create document templates from scratch, modify existing form sand many more features, within one browser tab. You can use e-Sign Bridge Loan Agreement with ease; all of our features, like signing orders, reminders, requests, are available to all users. Get the value of full featured platform, for the cost of a lightweight basic app. The key is flexibility, usability and customer satisfaction.

How to edit a PDF document using the pdfFiller editor:

How to Send a PDF for eSignature

What our customers say about pdfFiller