Electronically Signing Revocable Living Trust For Free

Users trust to manage documents on pdfFiller platform

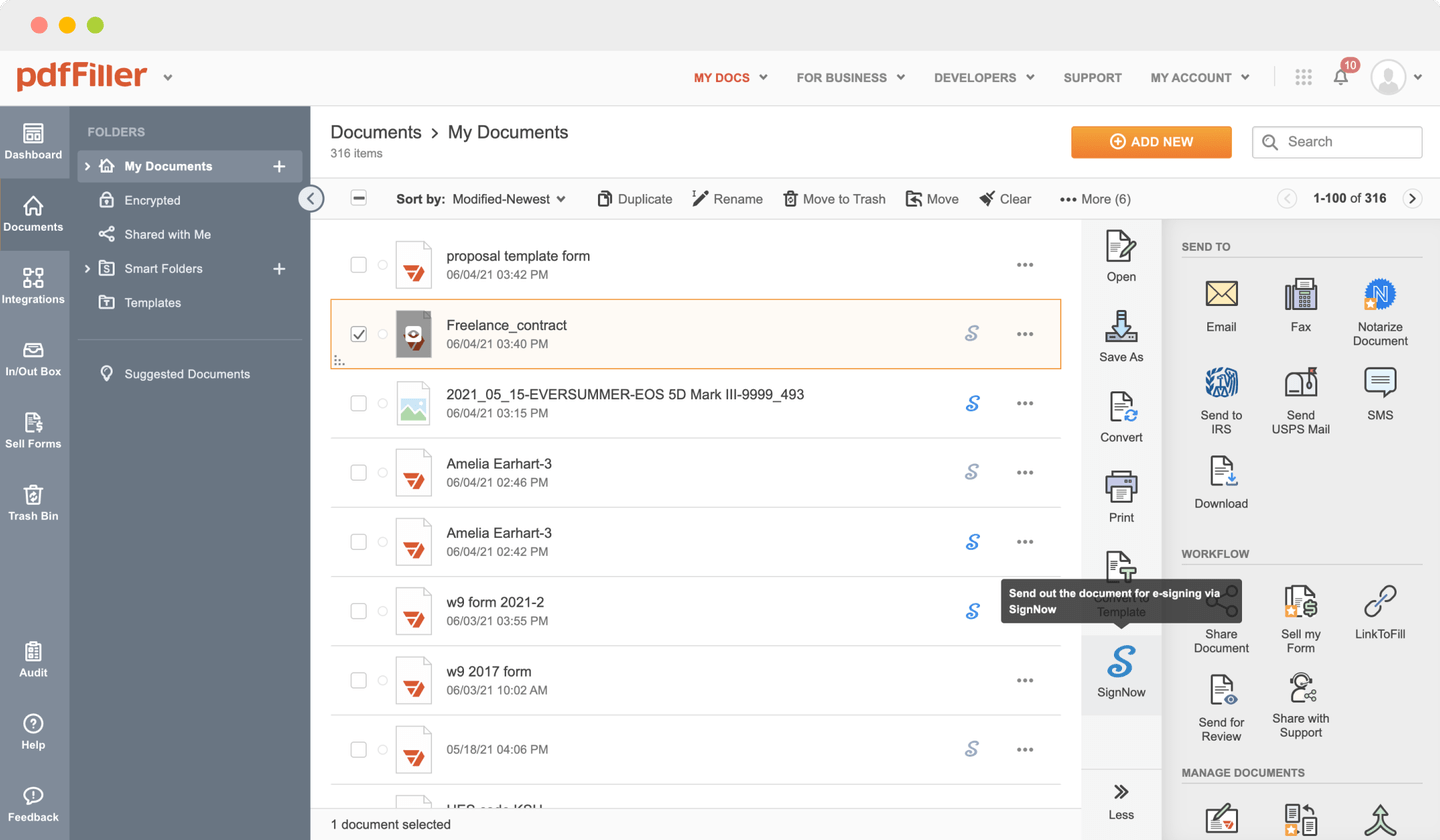

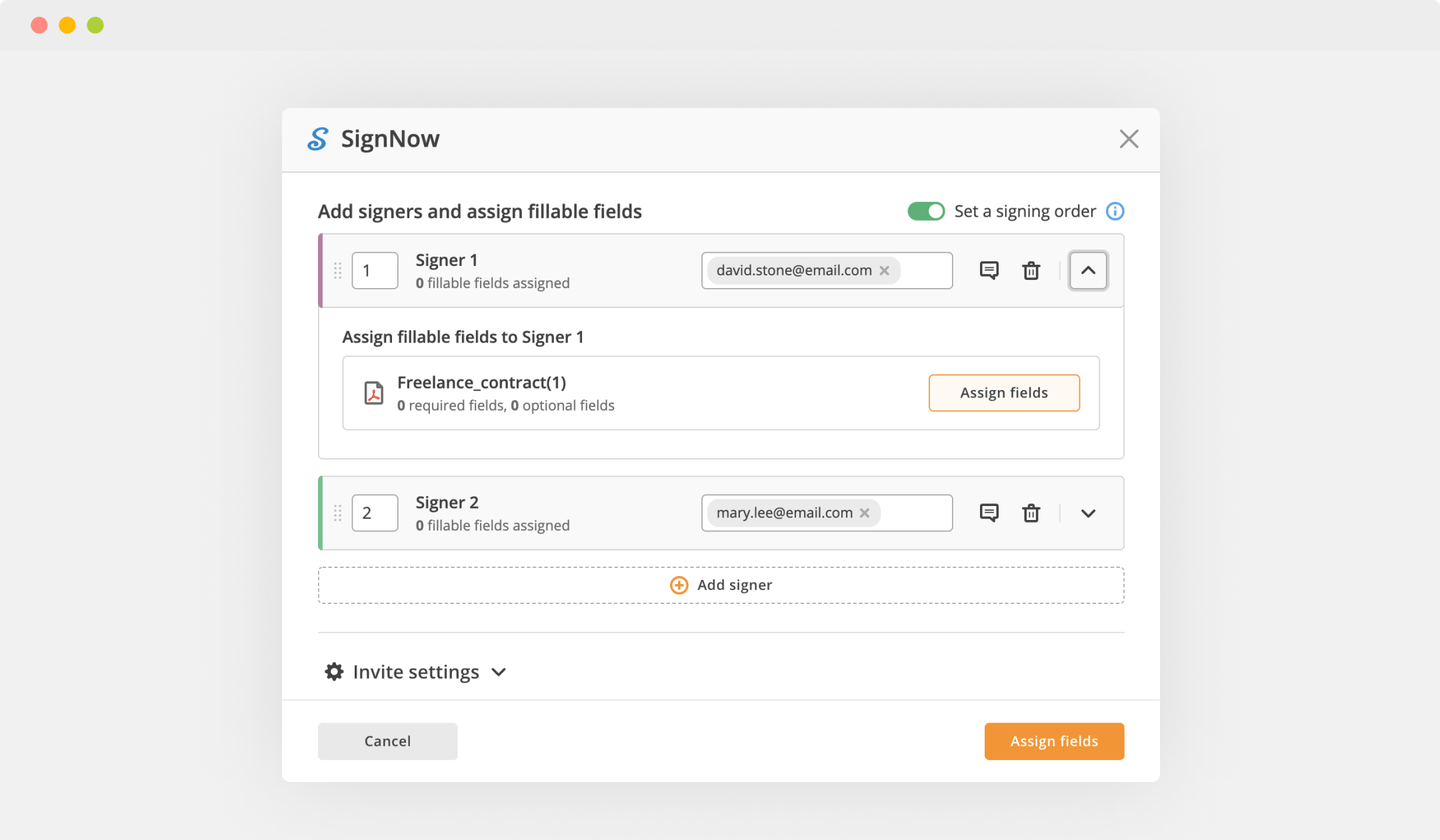

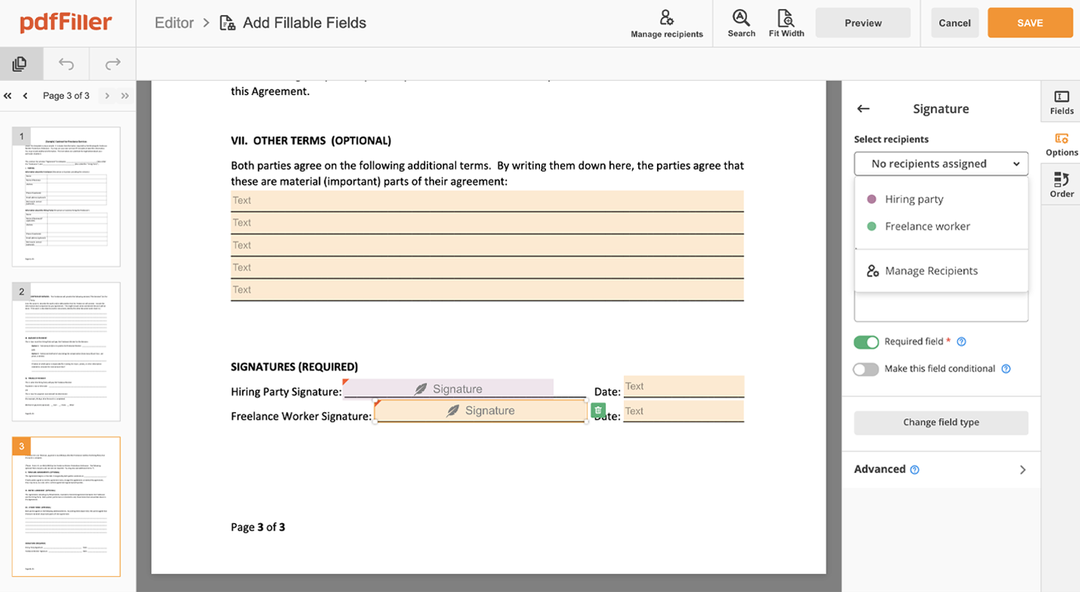

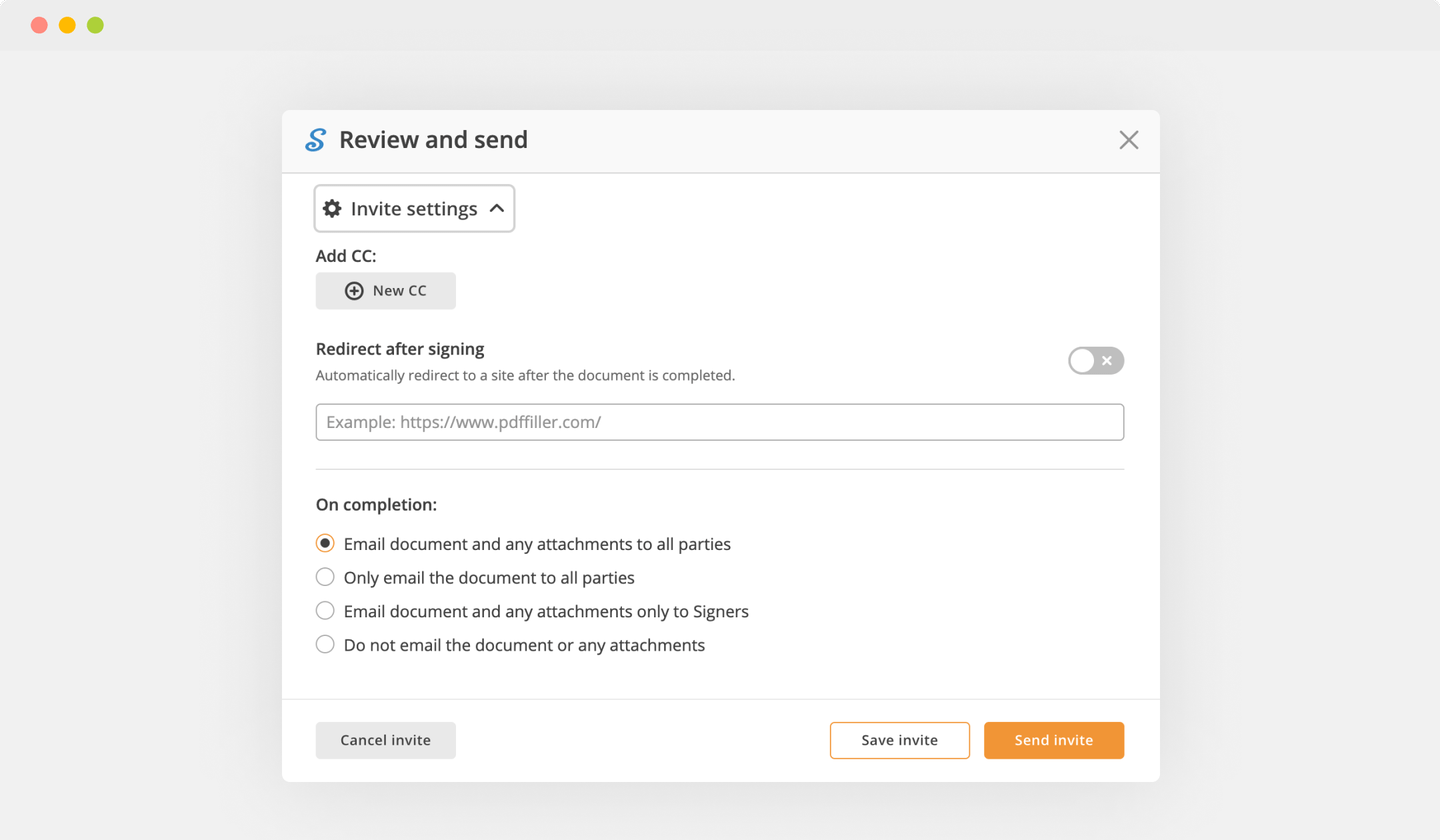

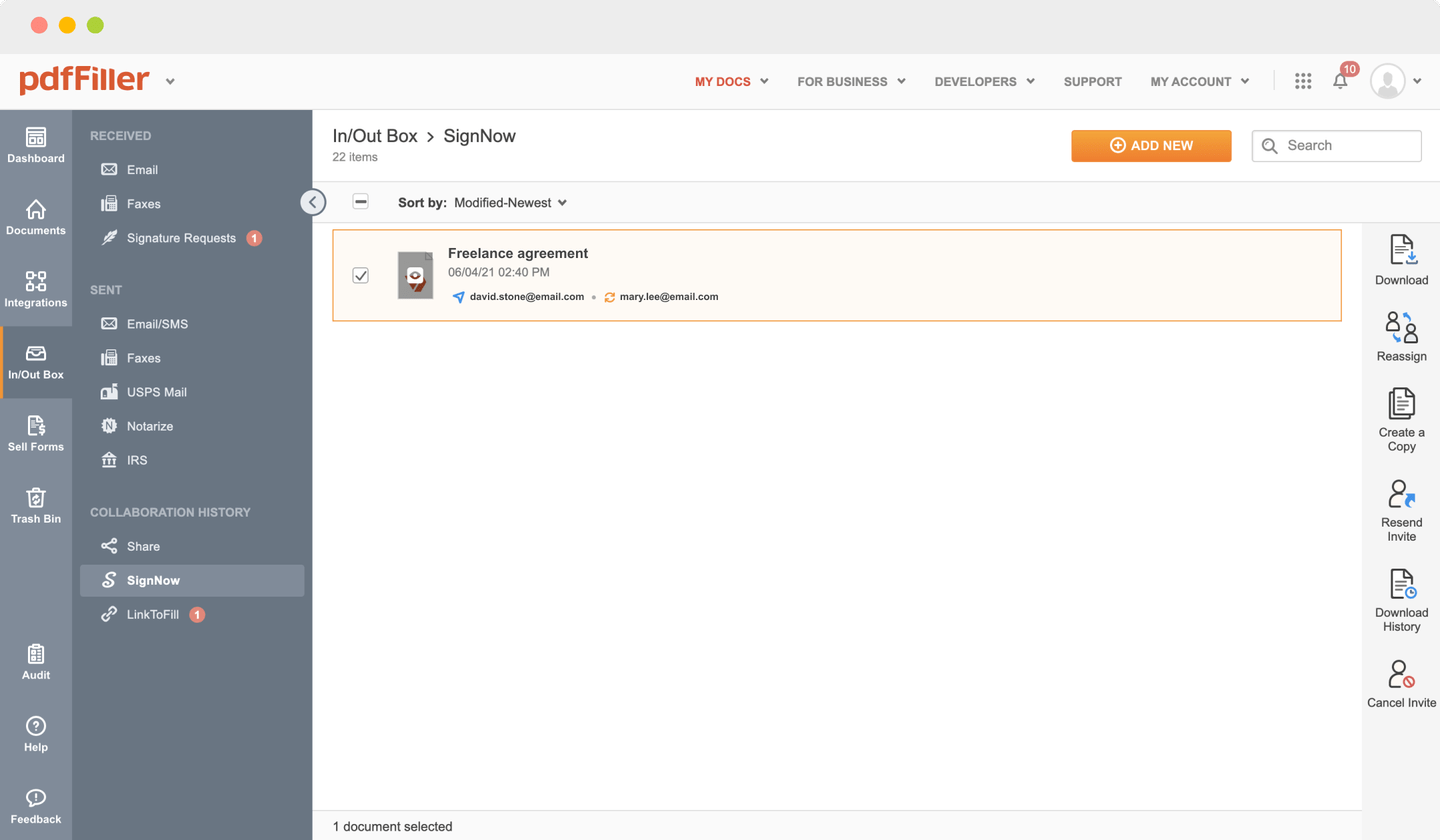

Send documents for eSignature with signNow

Watch a short video walkthrough on how to add an Electronically Signing Revocable Living Trust

pdfFiller scores top ratings in multiple categories on G2

Add a legally-binding Electronically Signing Revocable Living Trust in minutes

pdfFiller enables you to deal with Electronically Signing Revocable Living Trust like a pro. No matter what platform or device you use our solution on, you'll enjoy an intuitive and stress-free way of executing paperwork.

The whole pexecution process is carefully safeguarded: from uploading a document to storing it.

Here's the best way to generate Electronically Signing Revocable Living Trust with pdfFiller:

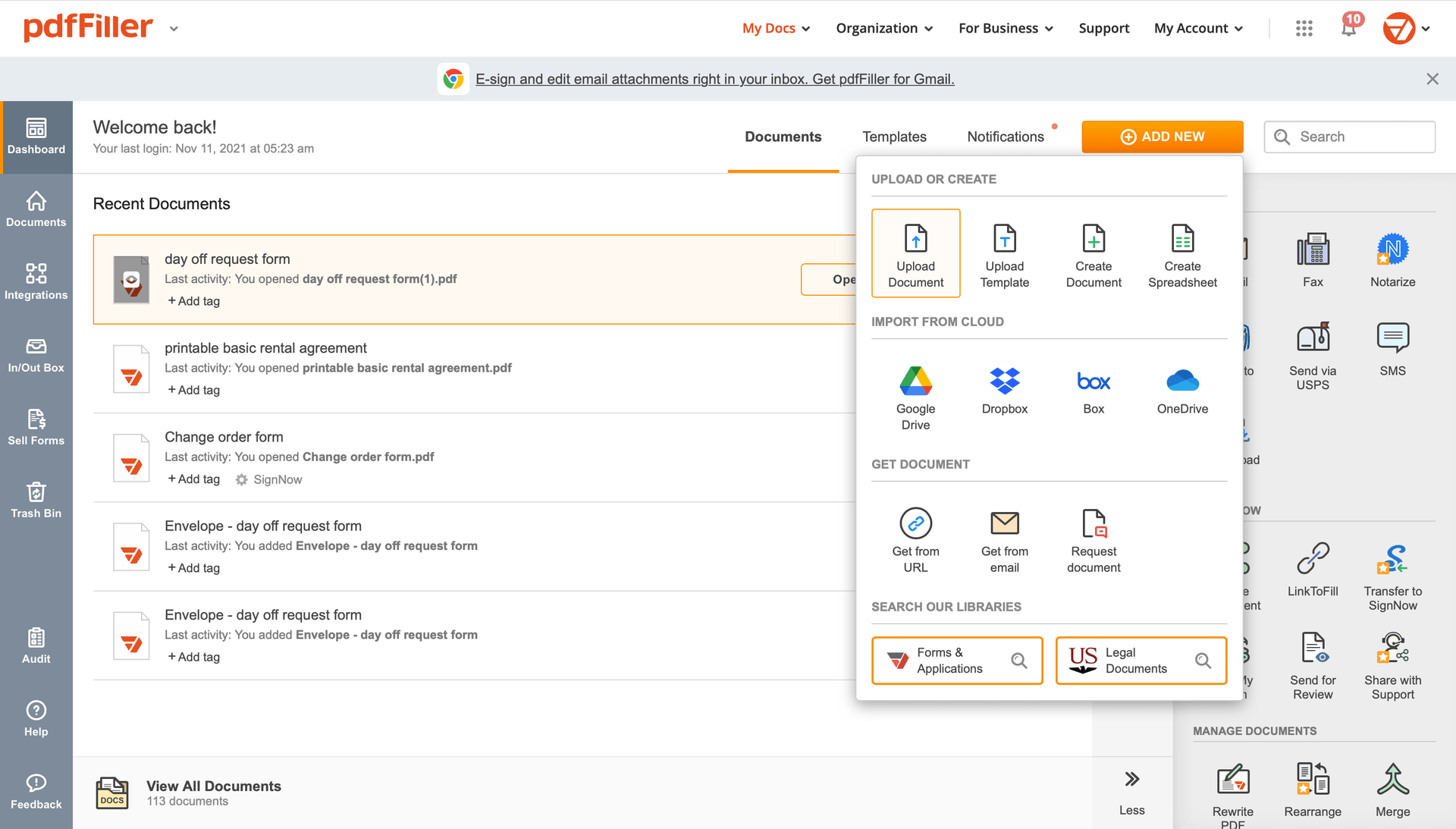

Select any available option to add a PDF file for signing.

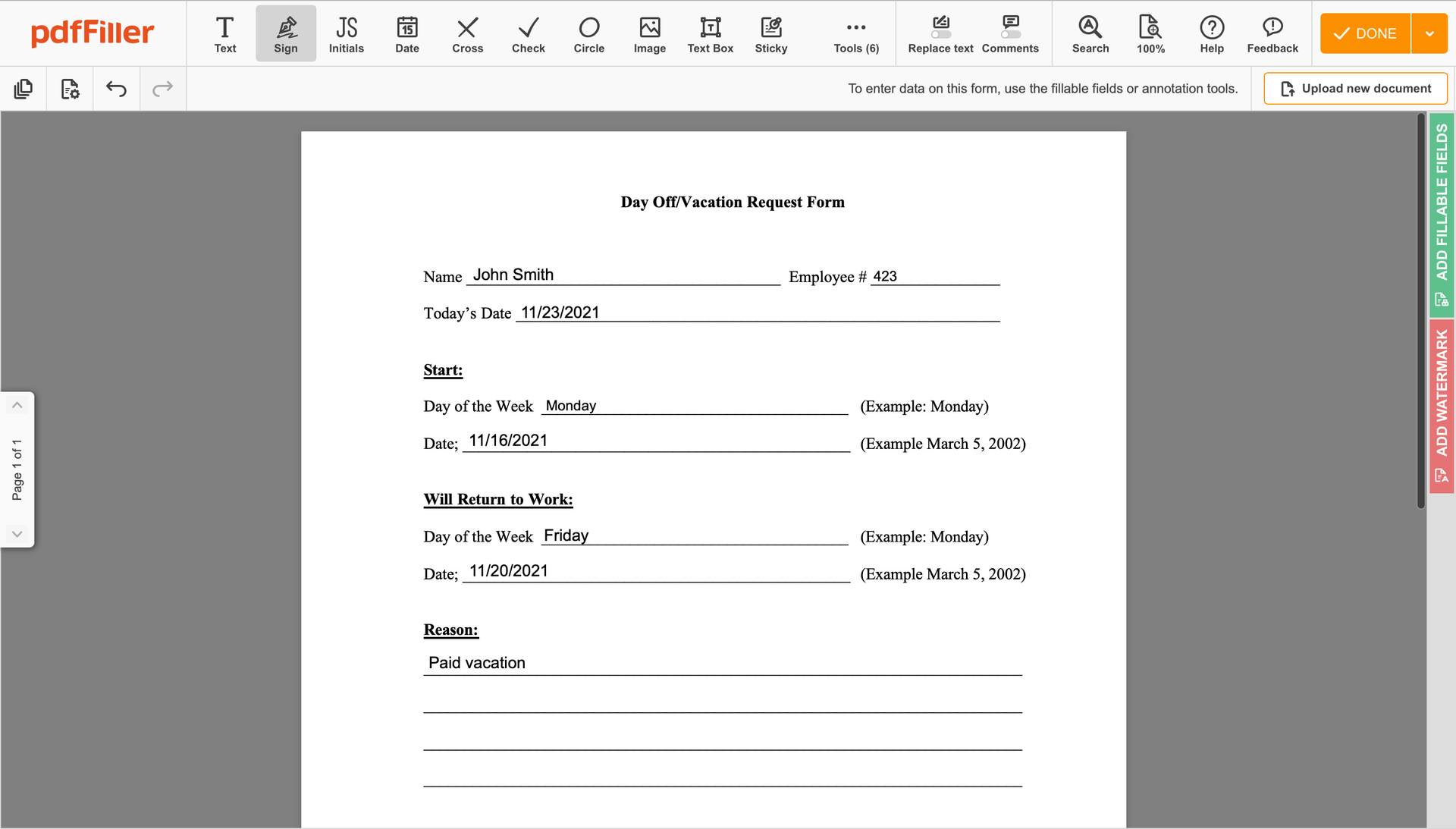

Use the toolbar at the top of the interface and choose the Sign option.

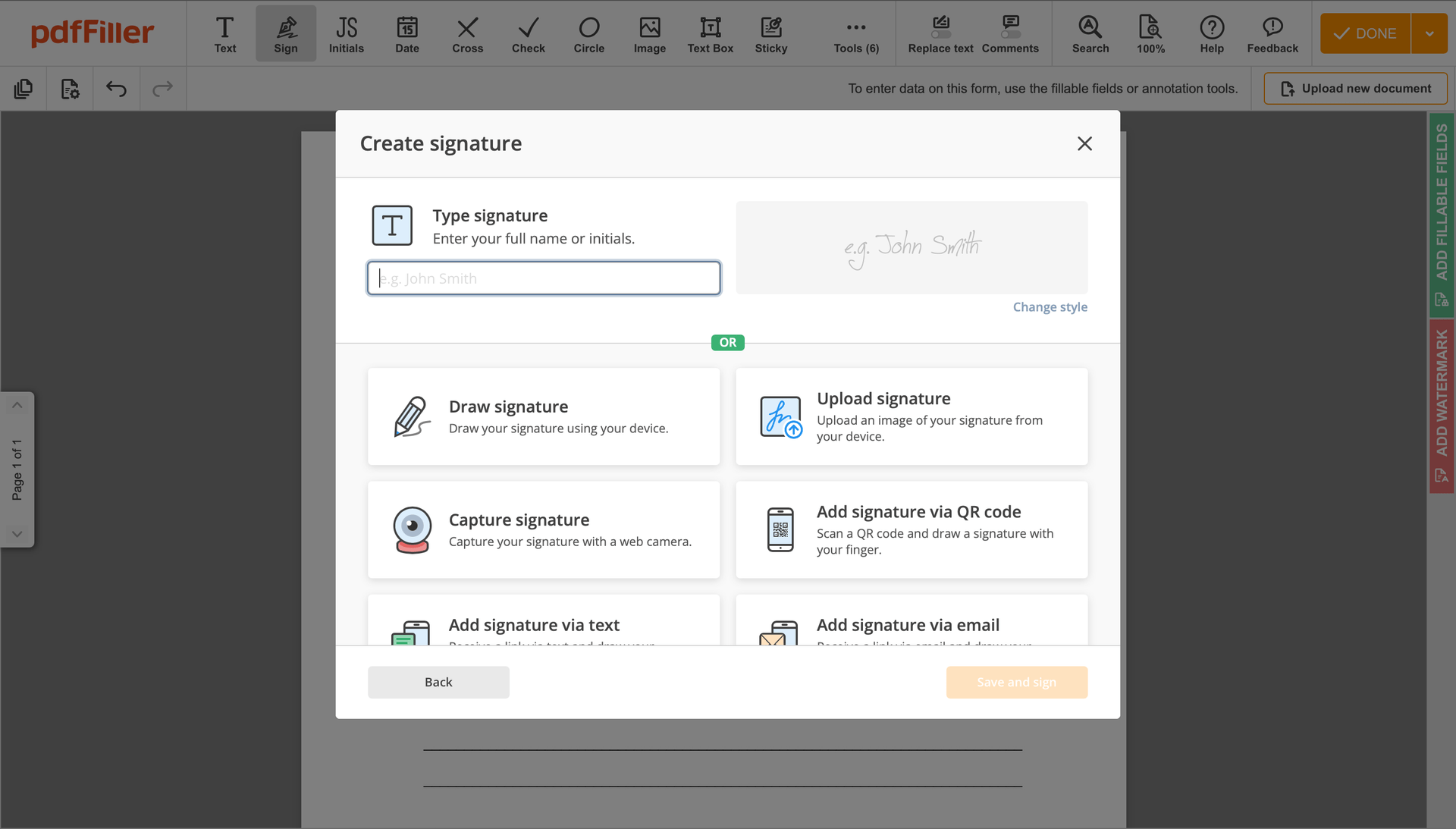

You can mouse-draw your signature, type it or add a photo of it - our solution will digitize it in a blink of an eye. Once your signature is created, hit Save and sign.

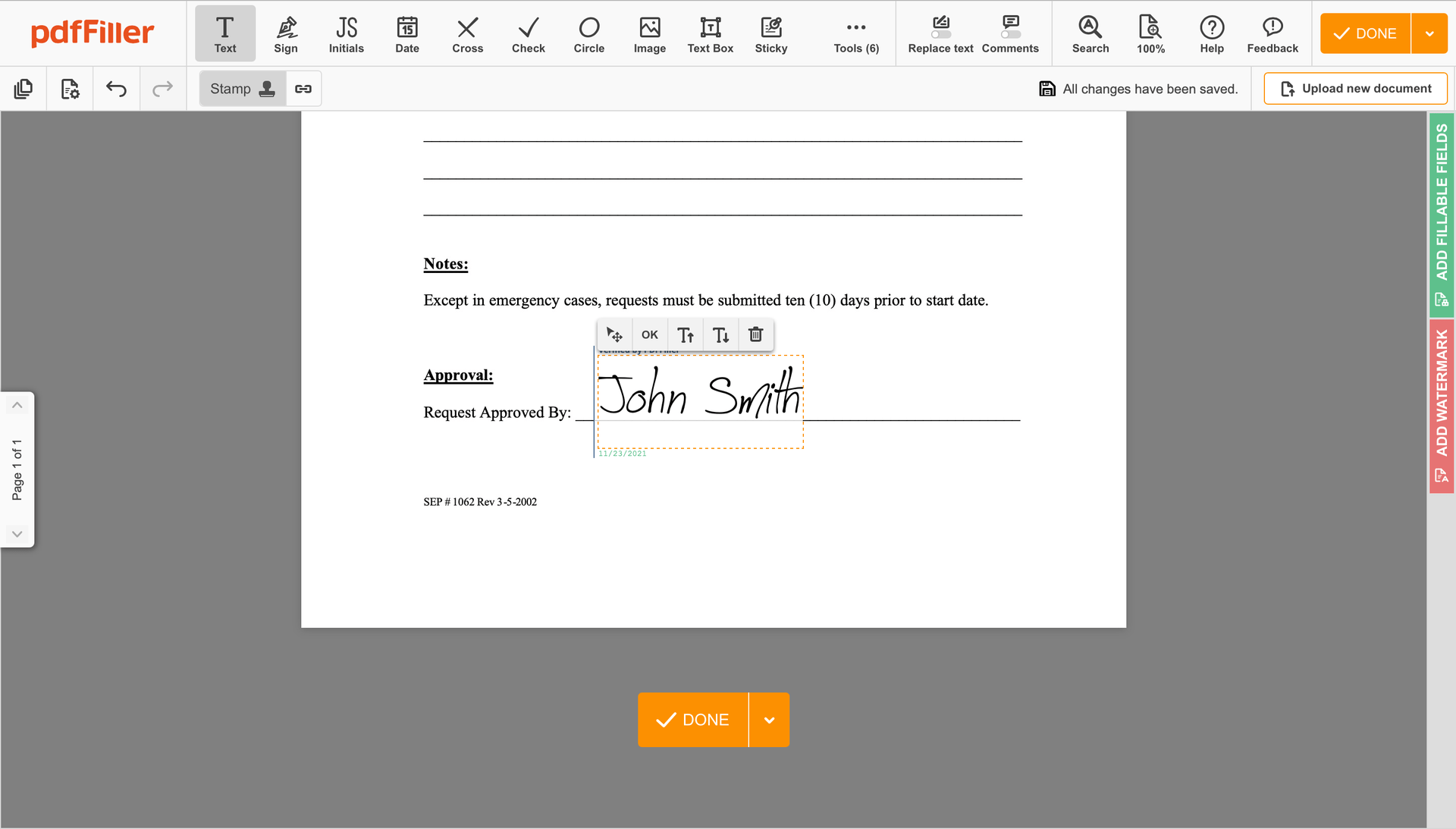

Click on the form area where you want to put an Electronically Signing Revocable Living Trust. You can drag the newly generated signature anywhere on the page you want or change its configurations. Click OK to save the adjustments.

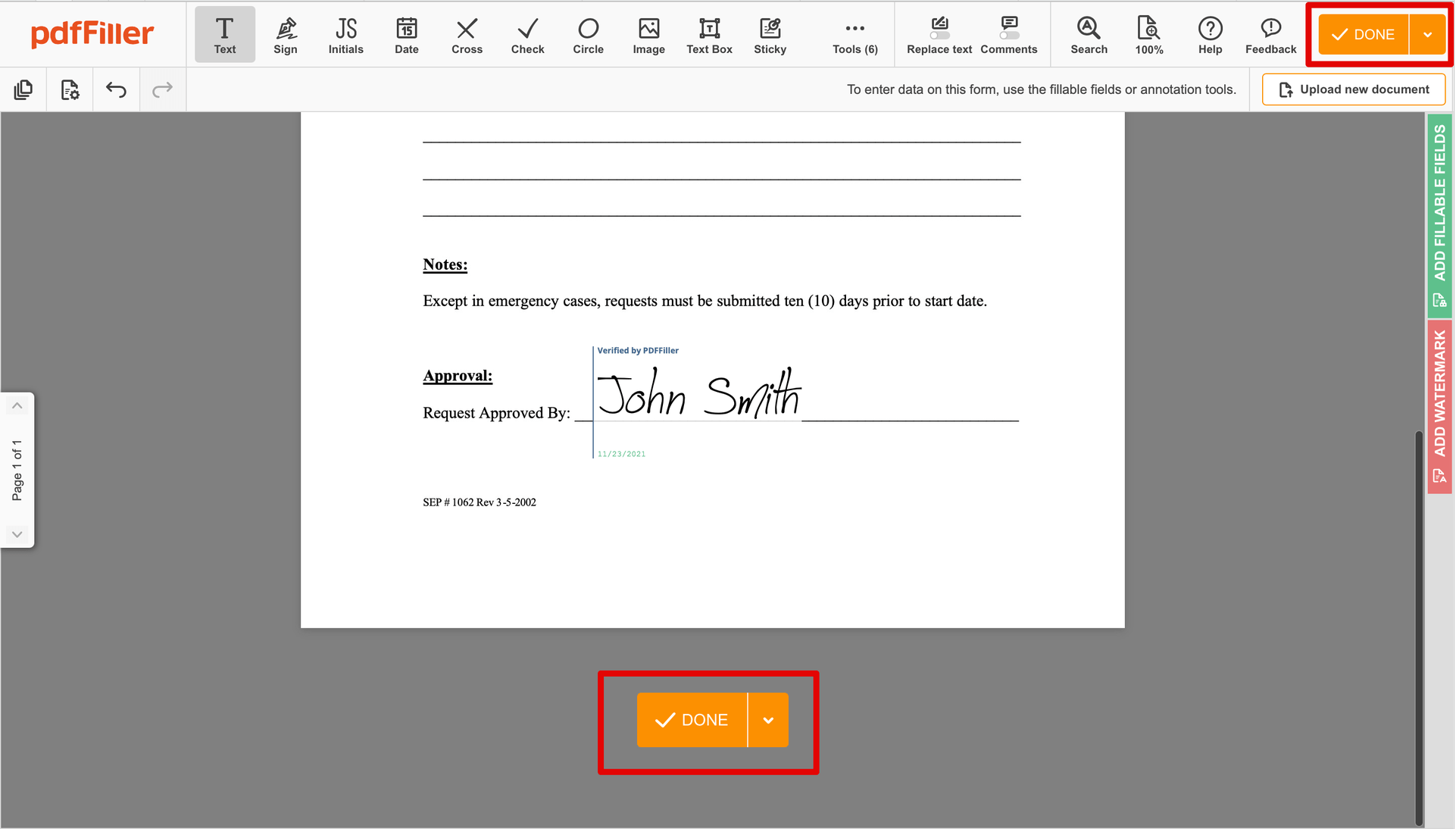

Once your form is good to go, hit the DONE button in the top right area.

As soon as you're done with signing, you will be taken back to the Dashboard.

Utilize the Dashboard settings to get the executed copy, send it for further review, or print it out.

Are you stuck working with numerous applications for managing documents? We have a solution for you. Use our editor to make the process simple. Create document templates from scratch, edit existing form sand even more useful features, without leaving your account. Plus, you can use Electronically Signing Revocable Living Trust and add high-quality features like signing orders, reminders, attachment and payment requests, easier than ever. Pay as for a lightweight basic app, get the features as of a pro document management tools.

How to edit a PDF document using the pdfFiller editor:

How to Send a PDF for eSignature

What our customers say about pdfFiller

Allows unlimited potential to edit virtually any document and send it electronically or conventionally. This software is a time saver/life saver.

What do you dislike?

The drawback. The Eraser tool. This tool could use some work as far as the shape of the tool. The option to be circular as well as the normal shape would be of great assistance when editing. A competitor of yours, sorry to mention uses an eraser too that is amazing and I have thought of switching simply for access to the editing qualities of that software. It allows for the one time purchase of their software and I would not pay monthly fees to maintain it either.

Recommendations to others considering the product:

Try out the product and use it!! See what you are missing!!

What problems are you solving with the product? What benefits have you realized?

The editor allows our office to clean up and mark up documents received in our office such as lease agreements or forms attached to a policy which either enhance or negatively impact the clients coverage from year to year. We directly not on those forms in our proposals during renewal negotiations so the client has specifically seen and reviewed how the coverage impacts their insurance needs.

The Link To Fill Option is great for our company

What do you dislike?

Trying to get around paying extra fees when I know that the service is included

What problems are you solving with the product? What benefits have you realized?

I am solving my clients having to print off important documents