ESigning Recapitalization Agreement For Free

Users trust to manage documents on pdfFiller platform

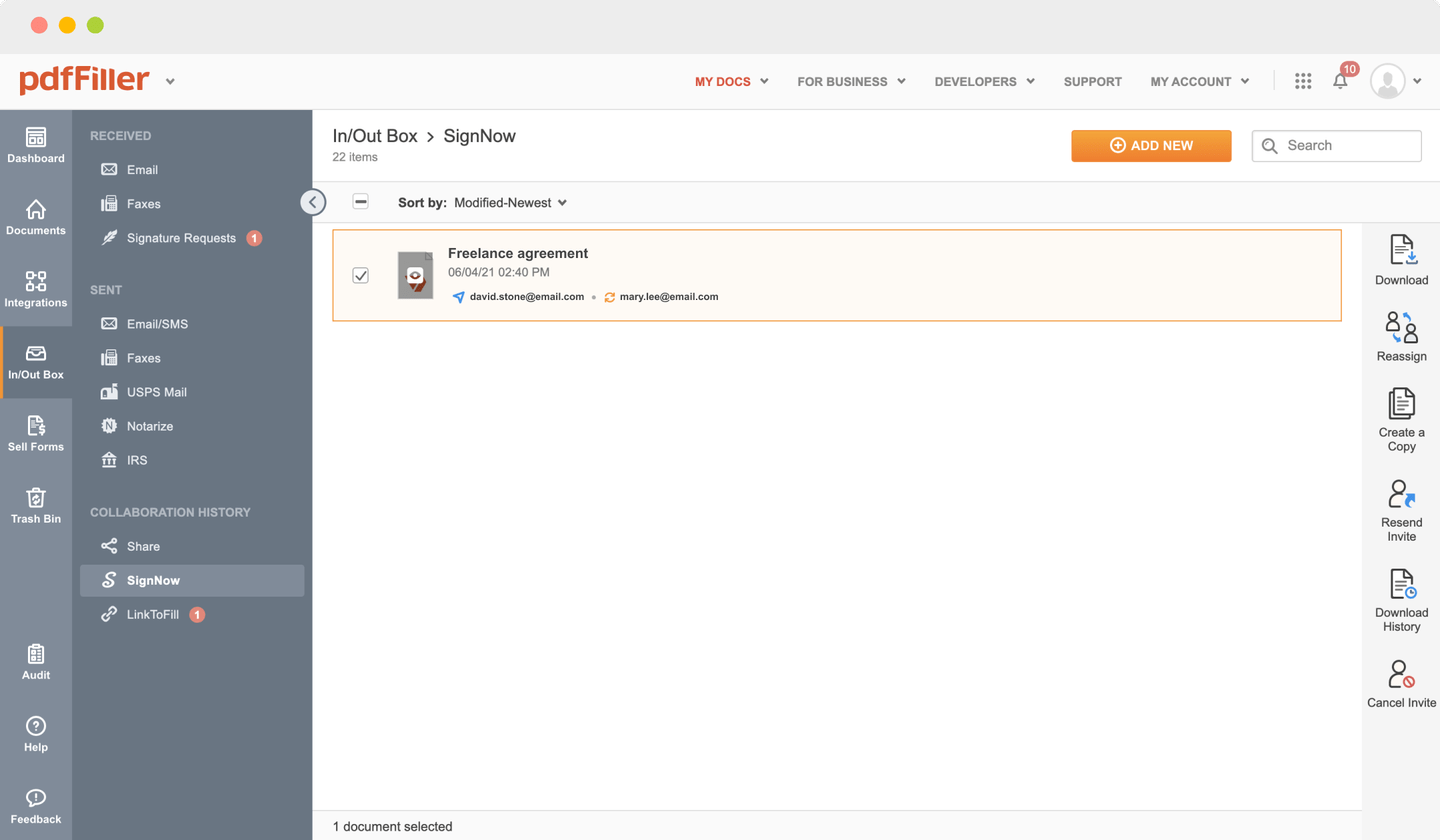

Send documents for eSignature with signNow

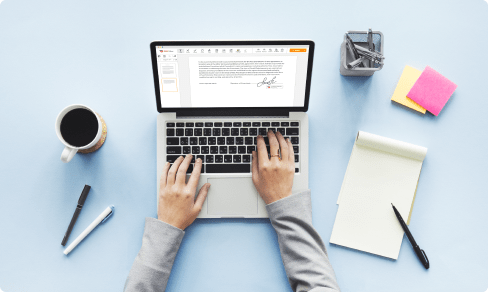

Watch a short video walkthrough on how to add an ESigning Recapitalization Agreement

pdfFiller scores top ratings in multiple categories on G2

Create a legally-binding ESigning Recapitalization Agreement with no hassle

pdfFiller enables you to manage ESigning Recapitalization Agreement like a pro. Regardless of the platform or device you use our solution on, you'll enjoy an easy-to-use and stress-free method of executing documents.

The whole pexecution flow is carefully safeguarded: from importing a document to storing it.

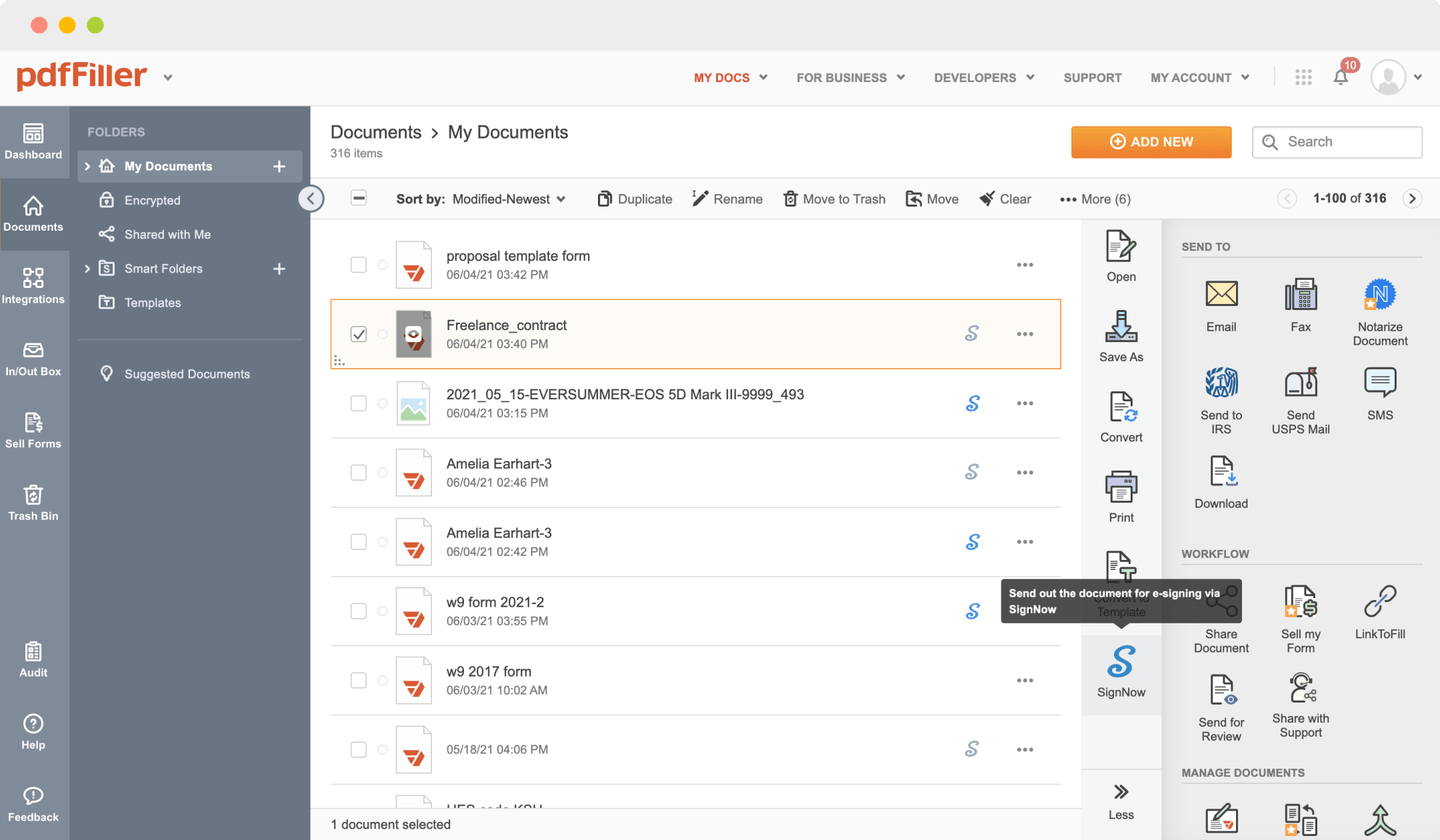

Here's how you can generate ESigning Recapitalization Agreement with pdfFiller:

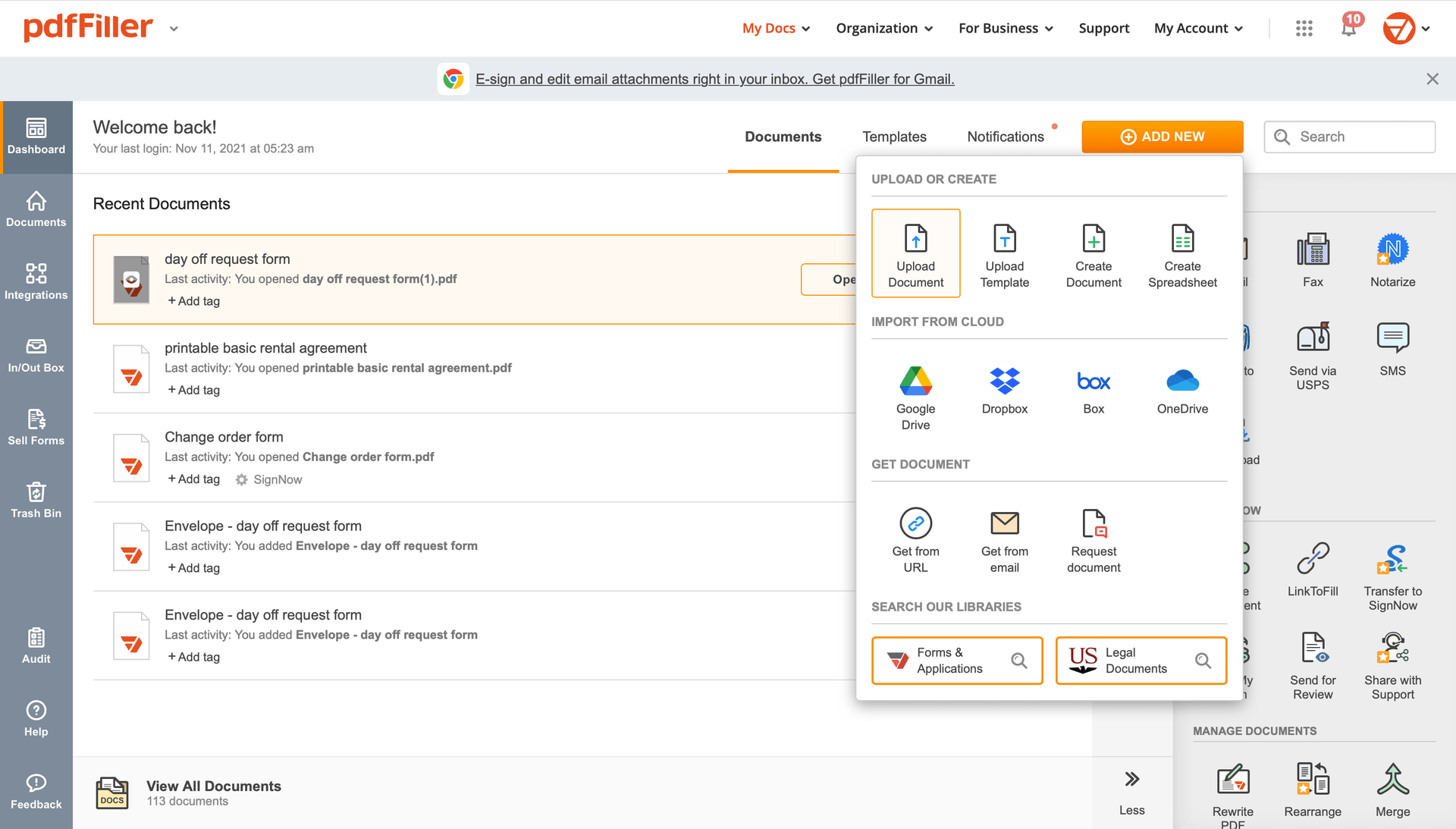

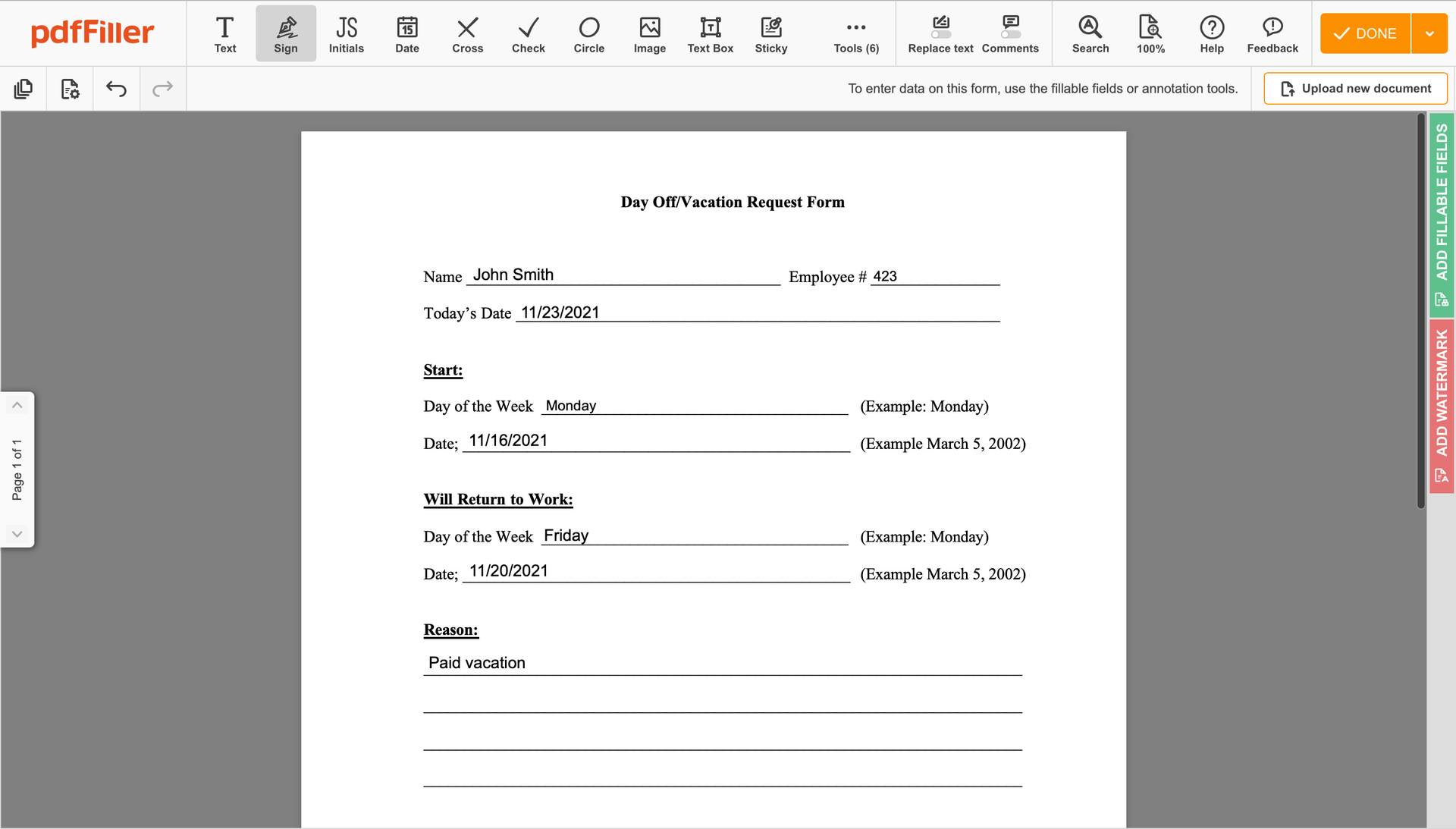

Choose any available way to add a PDF file for completion.

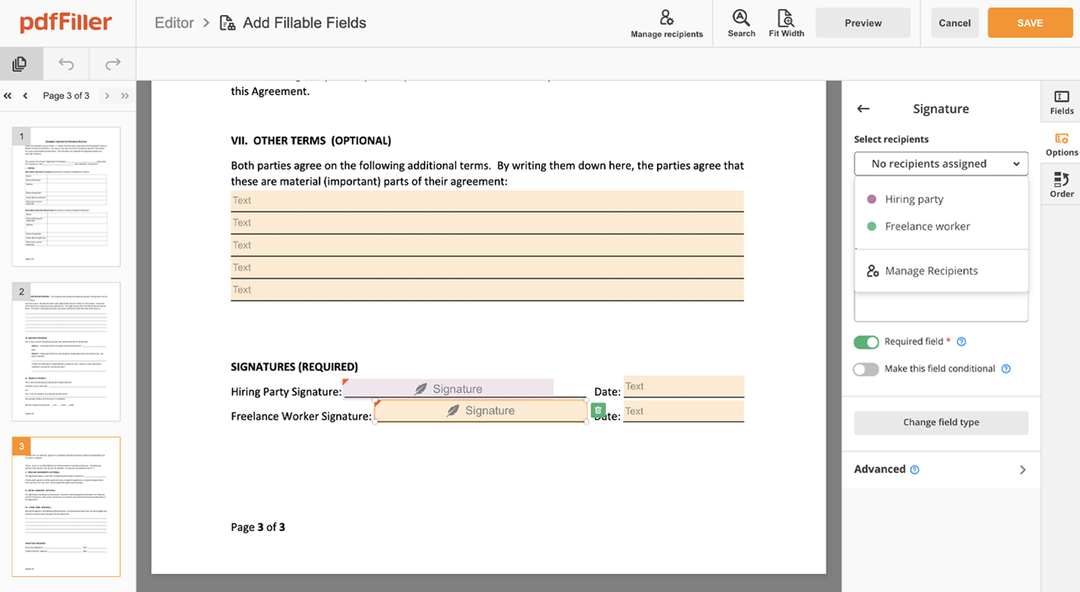

Utilize the toolbar at the top of the page and select the Sign option.

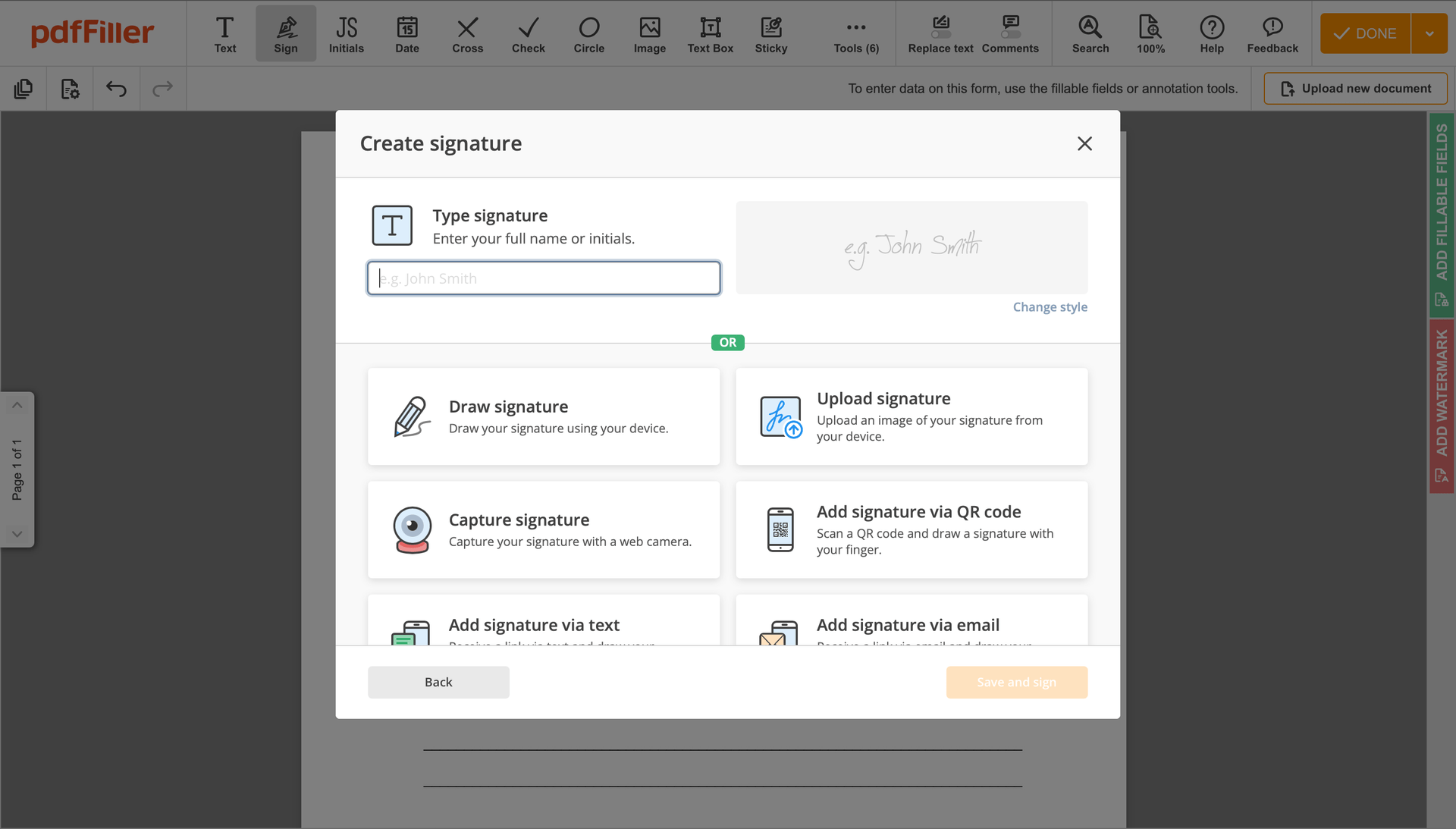

You can mouse-draw your signature, type it or upload a photo of it - our tool will digitize it automatically. As soon as your signature is set up, click Save and sign.

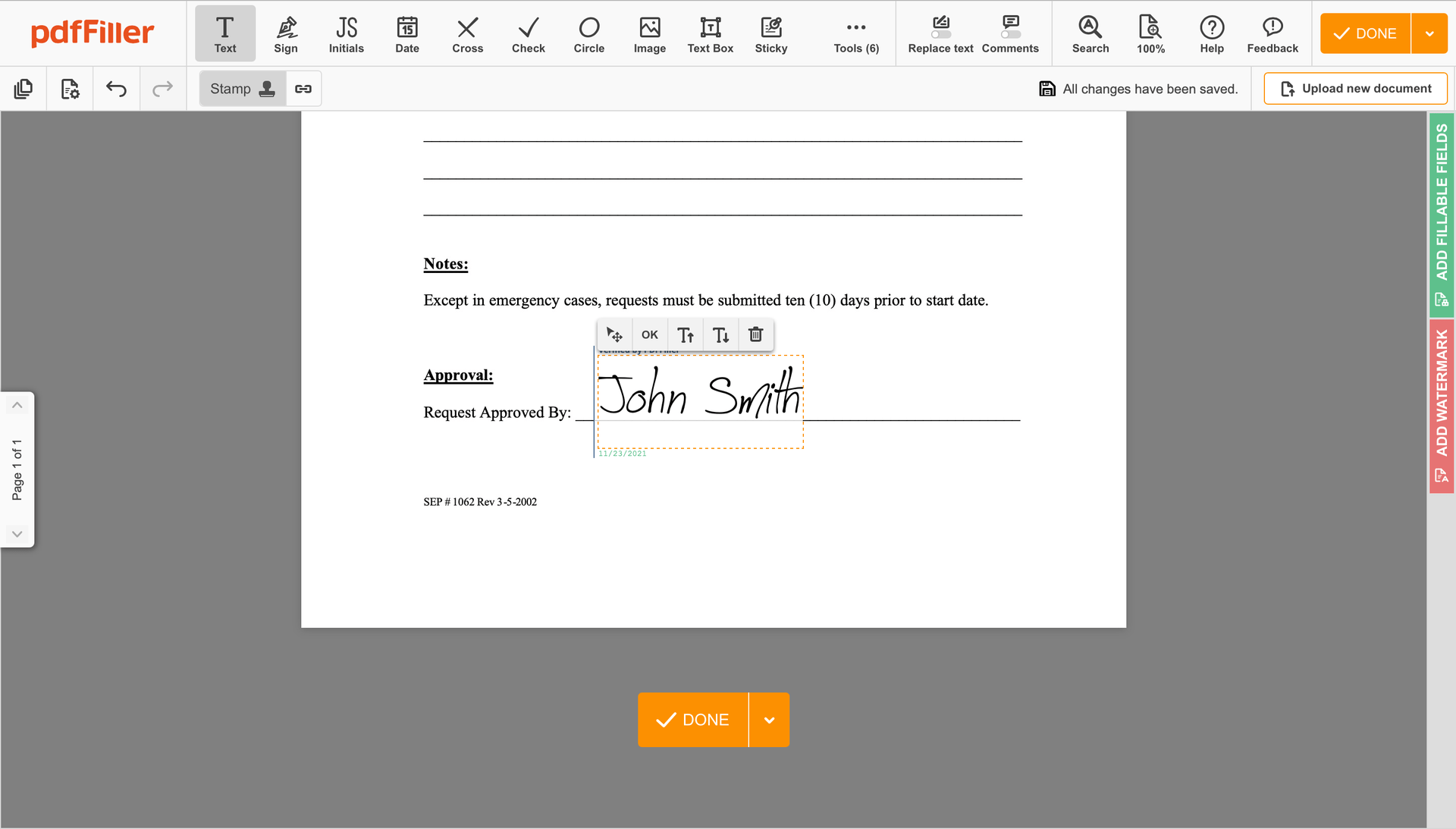

Click on the form area where you want to put an ESigning Recapitalization Agreement. You can drag the newly generated signature anywhere on the page you want or change its settings. Click OK to save the changes.

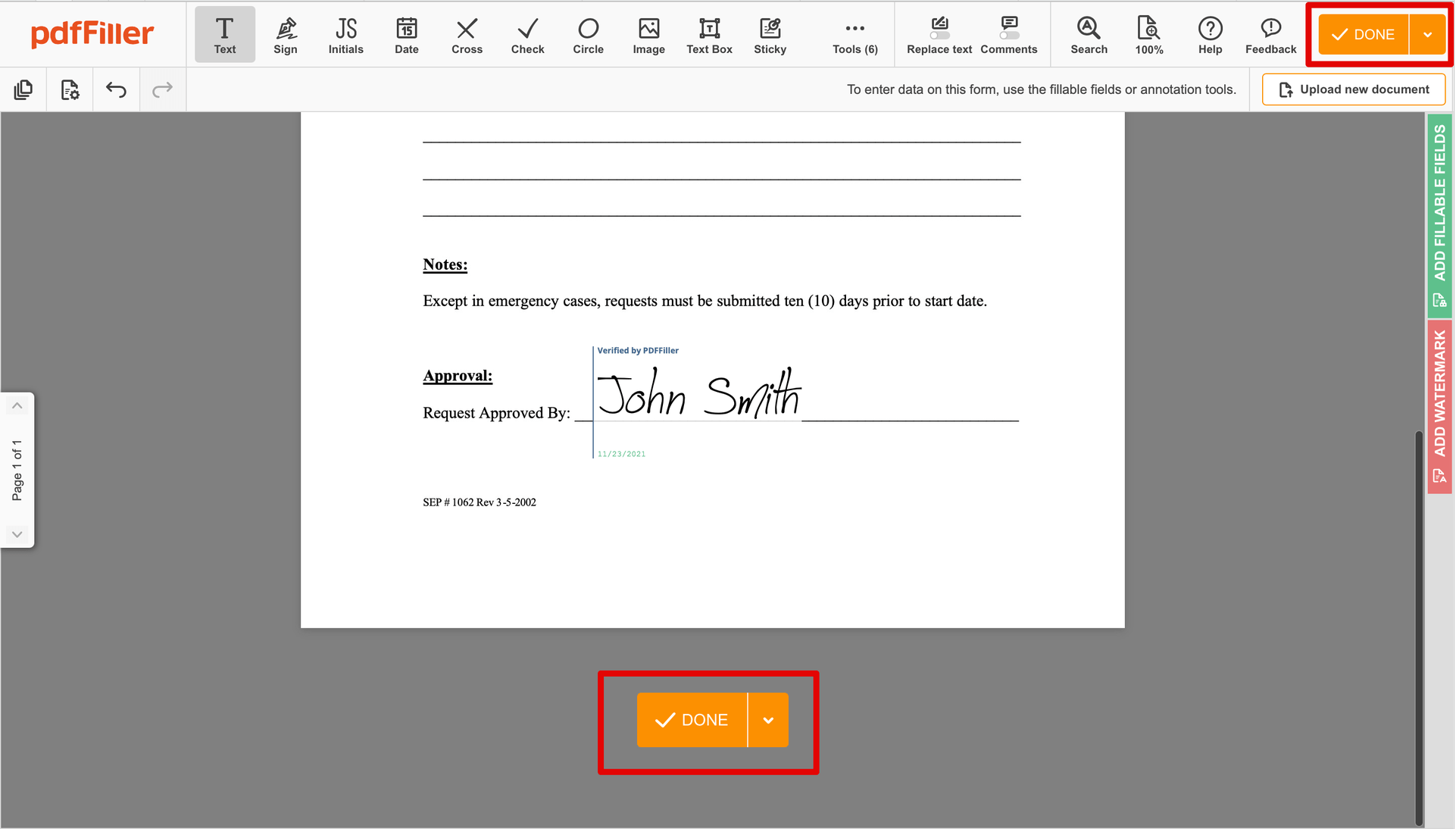

Once your document is good to go, hit the DONE button in the top right area.

As soon as you're done with signing, you will be taken back to the Dashboard.

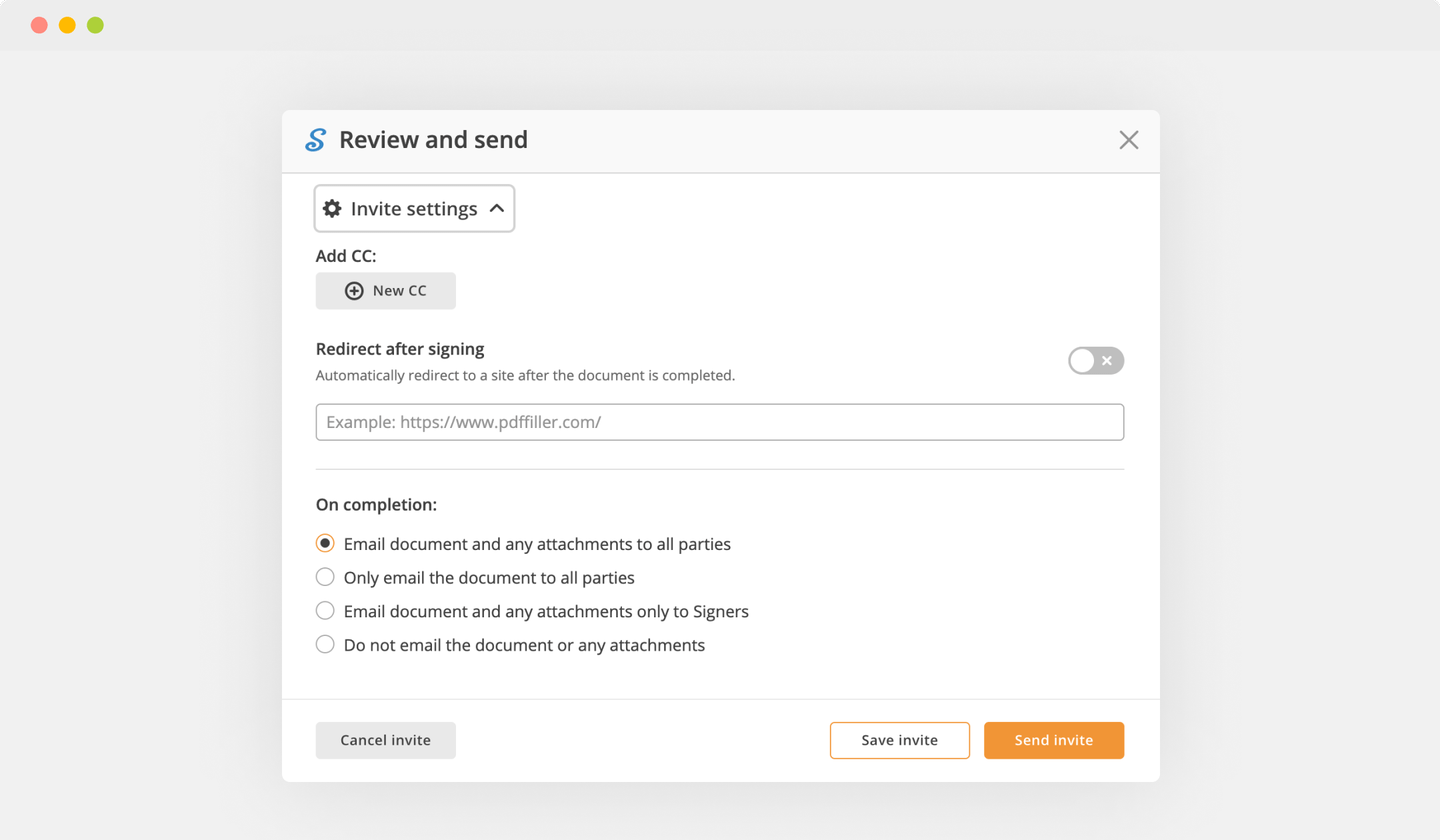

Utilize the Dashboard settings to get the completed copy, send it for further review, or print it out.

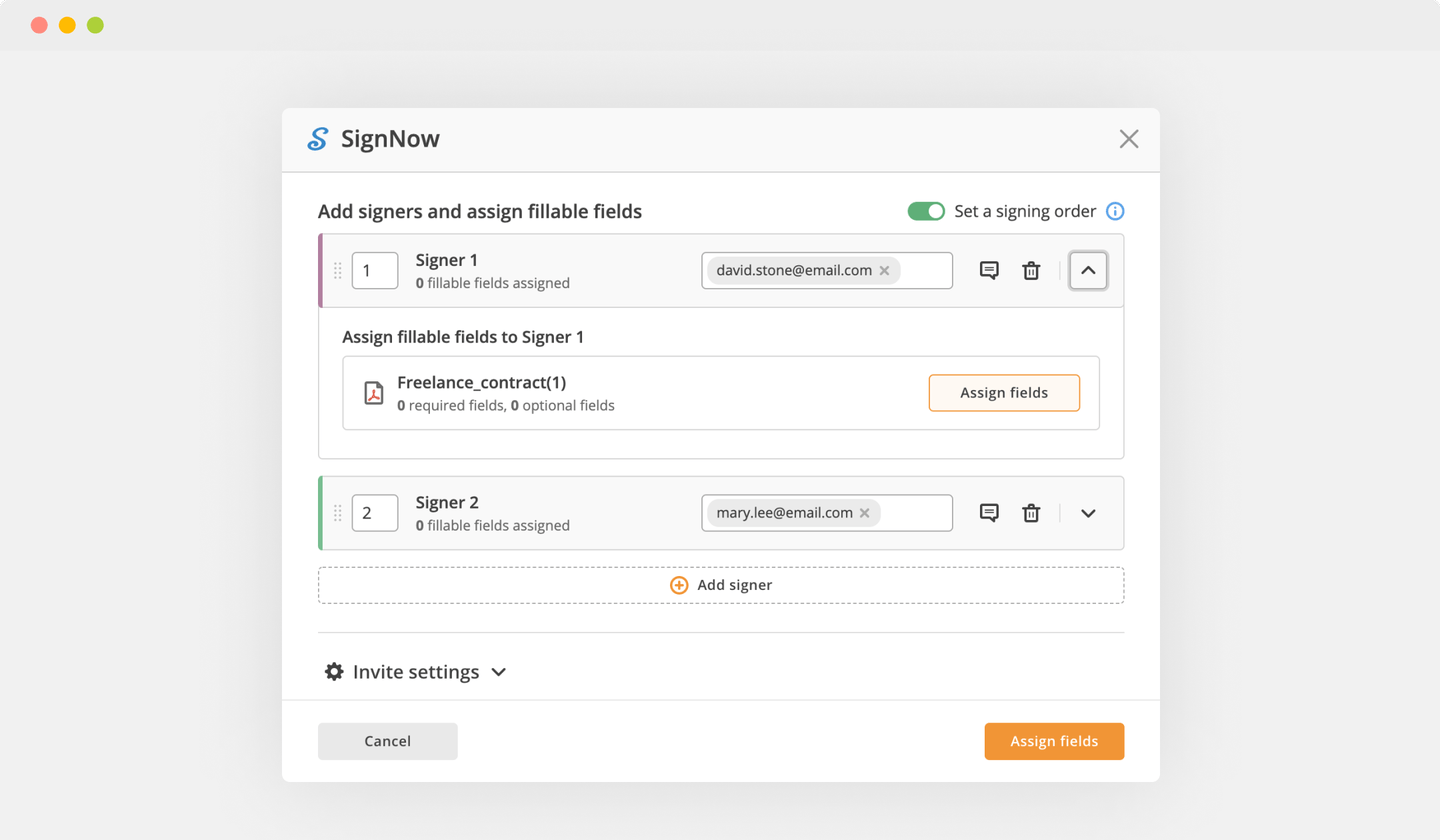

Are you stuck working with numerous applications for managing documents? Use our all-in-one solution instead. Document management is notably easier, faster and much smoother using our editing tool. Create fillable forms, contracts, make document templates, integrate cloud services and utilize more useful features within one browser tab. You can use signing Recapitalization Agreement with ease; all of our features, like signing orders, reminders, requests , are available instantly to all users. Get the value of full featured tool, for the cost of a lightweight basic app. The key is flexibility, usability and customer satisfaction. We deliver on all three.

How to edit a PDF document using the pdfFiller editor:

How to Send a PDF for eSignature

What our customers say about pdfFiller

I can send as many documents out for signature as I want. No restrictions. I used to use Adobe, but they had a cap on the amount of documents you can send for signature. When I tried to get that upgraded, they had outlandish prices for this same service. With PDFfiller, I can send all the documents I want and I'm also able to save all of them securely.

What do you dislike?

I wish the PDF conversions didn't come out like pictures. When I convert a PDF to Word, it always comes into Word as a picture instead of being able to edit the document. As a recruiter, I receive a lot of resumes that need some work before we can submit them to clients. I still have to use Adobe for this function, so now I'm paying for two PDF programs. I can't just stay with Adobe though because of the above mentioned issues.

Recommendations to others considering the product:

If you need eSignatures, this is the program to go with.

What problems are you solving with the product? What benefits have you realized?

Remote onboarding is a breeze with PDFfiller. I am able to send HR documents to people across the country and still get them to work on time. I'm in VA and have to get employees to work in all states across the country, as well as oversees. We have to get documents to them for signature and faxing doesn't always work. With PDFfiller, we can send anyone any document and get it back fully signed by them. It's truly wonderful.