Excise Zip Code Lease For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

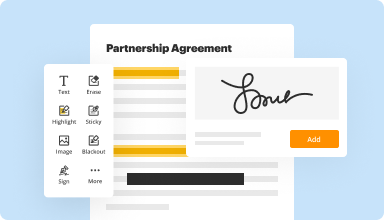

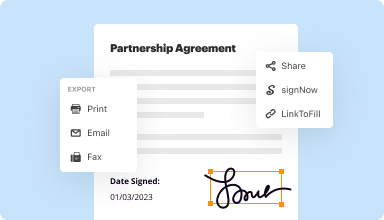

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

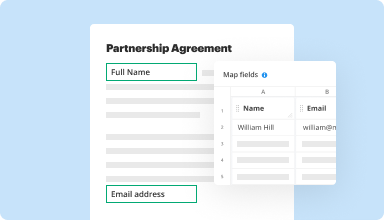

Fill out & sign PDF forms

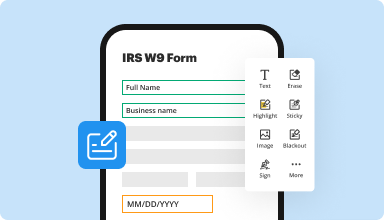

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

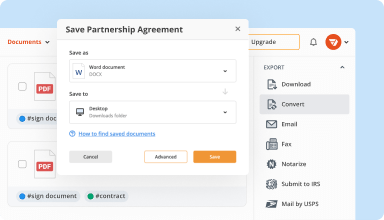

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

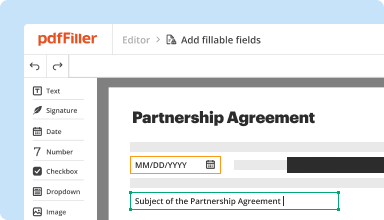

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

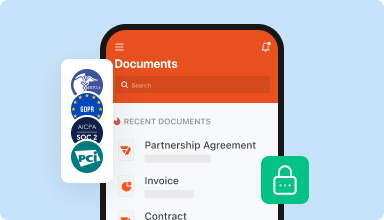

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Very easy to use. I tried several free PDF services for editing PDF documents and I was totally lost. PDFfiller meets all my needs. Is reasonable in cost.

2015-01-09

I wasn't sure what all this would do, but I LOVE it! It's nice to be able to scan a document in and change it without having to re-do the whole thing! YAY!

2015-02-18

I really like it. I have not read all of the instructions, but have used it on several forms. Would like to know how to print a form, without all of the background being printed. I mean, I upload a form. Fill it in and then try to print to the form that I have. It prints everything, when I just want to print what I filled in. For instance, had a problem with my QuickBooks. Wanted to print a check, quickly. Thought I will just upload a check, fill it in and print in on my check. It wanted to print everything. Of course, the bank will not take that, because if it just isn't quite right, it can look altered. Is there a way to do it? Of course, as you know everyone just wants to start working and not read the instructions. Thank you

2018-02-16

I liked the ease of using the pdf filler and being able to save and print my documents. If I needed this service regularly, I probably would purchase the service and explore pdf filler furthe

2019-06-29

PDF filler that will empty your pockets.

The most accurate file editor. The most reliable document converter. The master of alterations.

I can email important documents immediately upon request. I can edit and sign government documents that are lifesaving for important life necessities. I.e. rental arrears. Rent ledgers. W2 forms, etc.

The darn subscription is too expensive just to use for once a month, or only when necessary. They should have like, one time prepaid options instead of monthly or yearly.

2022-06-22

The online help was very kind and was…able to understand the mistake the I was making

The online help was very kind and was able to help me get my problem solved.

2022-03-01

PDF Filler has been a great tool to…

PDF Filler has been a great tool to assist me in the large amount of forms that I have had to edit over the past few months. It is very easy to use. I do think that is for the more tech savvy individuals that deal with PDFs on a daily basis. There were a few things that I had to figure out, but overall I give it 5 stars because it is a lot easier to use and edit documents my way than it is for me to do in Adobe PDF. Thanks PDF Filler.

2022-01-30

It is very easy to operate and fill in and forward or make a copy if needed.

It is very easy to operate and fill in all the information needed in the forms.

2021-08-14

I had to type information into a PDF…

I had to type information into a PDF document and I couldn't do it in Windows 10; I found pdf.filler.com and was able to type in my information easily!

2021-02-28

Excise Zip Code Lease Feature

The Excise Zip Code Lease feature provides a straightforward solution for businesses navigating the complex landscape of excise tax regulations. This tool enables companies to assign specific zip codes to their leases, ensuring compliance while streamlining operations.

Key Features

Assign specific zip codes to leases accurately

Streamline compliance with excise tax regulations

Simplify reporting processes for better visibility

Enhance tracking and auditing capabilities

Integrate seamlessly with existing software systems

Potential Use Cases and Benefits

Perfect for businesses in the alcohol, tobacco, or fuel industries

Ideal for companies with multiple locations requiring precise tax management

Useful for financial departments needing accurate record-keeping

Helps mitigate risks associated with tax compliance

Supports growth by simplifying tax-related processes

By implementing the Excise Zip Code Lease feature, you can eliminate the confusion around excise tax compliance. This tool allows you to manage zip codes relevant to your leases effectively, reducing the risk of costly errors. With this solution, you can focus on running your business without the worry of regulatory challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is the rental tax in Mesa AZ?

You are in the business of renting or leasing real property. If you rent residential property to non-permanent residents, see the Transient Lodging Tax. The tax rate is 2.0% of the gross income. Income is any value received either as funds or bartered services or merchandise.

What is rental tax in Arizona?

The short answer is yes. There is no statewide uniform rent tax in Arizona, but all cities, except Flagstaff and Tucson, impose a local “rent tax” to some degree. What does this mean to you? If you live in Phoenix, for example, you pay a 2 percent tax on your monthly rent bill.

Is rental income taxable in Arizona?

Arizona residential rental properties are subject to state rent tax. Some, but not all, Arizona cities also tax residential rental income. Arizona's transaction privilege tax is a tax on the privilege of doing business in Arizona.

What is the rental tax in Phoenix?

The City's tax rate is 2.3% starting January 1, 2016 (was 2.0%); there is no State or County tax on residential rental. WHO MUST PAY THE TAX? You must be licensed and pay tax if you are in the business of leasing, licensing or renting residential real property located within the city of Phoenix.

Can a landlord charge tax on rent?

Yes, your landlord can make you pay property taxes. In most residential cases, you'll have no idea whether he's using your money for property taxes -- and it doesn't really matter as long as the rent is affordable for you.

Do I have to pay sales tax on rent?

Sales and/or lodging taxes are only due on income owned from “short-term rentals.” Thus, for example, a landlord who rents out a home on an annual basis need not pay these taxes. What constitutes a short-term rental varies from state to state. In many states, any rental less than 30 days is considered short term.

What is the tax rate for Mesa AZ?

The 85204, Mesa, Arizona, general sales tax rate is 8.3%. The combined rate used in this calculator (8.3%) is the result of the Arizona state rate (5.6%), the 85204's county rate (0.7%), the Mesa tax rate (2%).

What is the property tax rate in Mesa AZ?

PROPERTY TAX Rates are per $100 assessed valuation. The assessed valuation for commercial property development is 18% of the actual value determined by the Maricopa County Assessor and 10% for residential.

Does Mesa AZ tax food?

Phoenix, Mesa and Tucson don't tax groceries Neither the state nor its three largest cities Phoenix, Tucson and Mesa tax food. The state eliminated its food tax in the 1980s. Mesa voters repealed the tax in 2000.

What is the Arizona sales tax?

The state general sales tax rate of Arizona is 5.6%. Cities and/or municipalities of Arizona are allowed to collect their own rate that can get up to 4.5% in city sales tax.

#1 usability according to G2

Try the PDF solution that respects your time.