Expect Electronically Signed Request For Free

Upload your document

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

Users trust to manage documents on pdfFiller platform

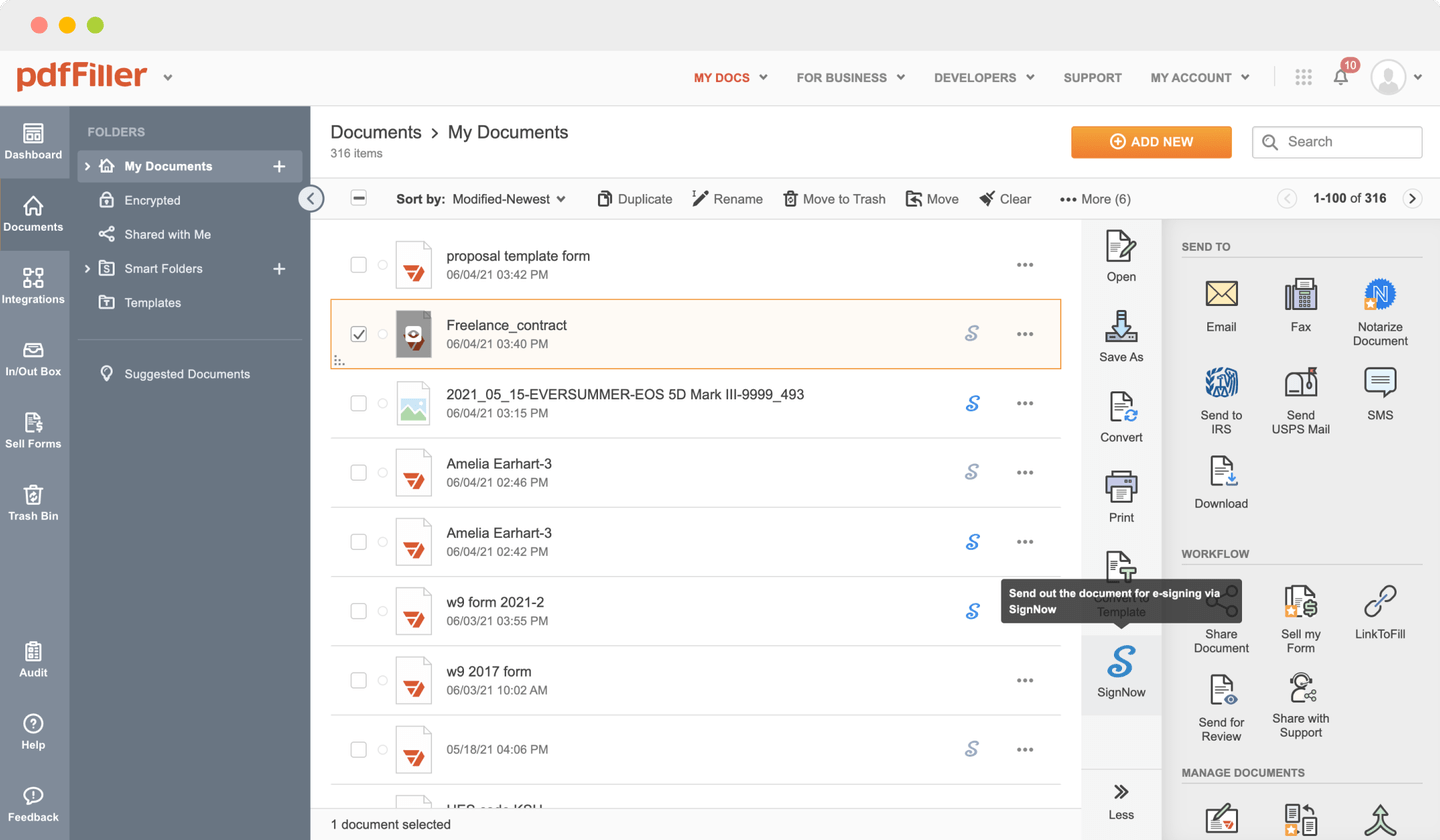

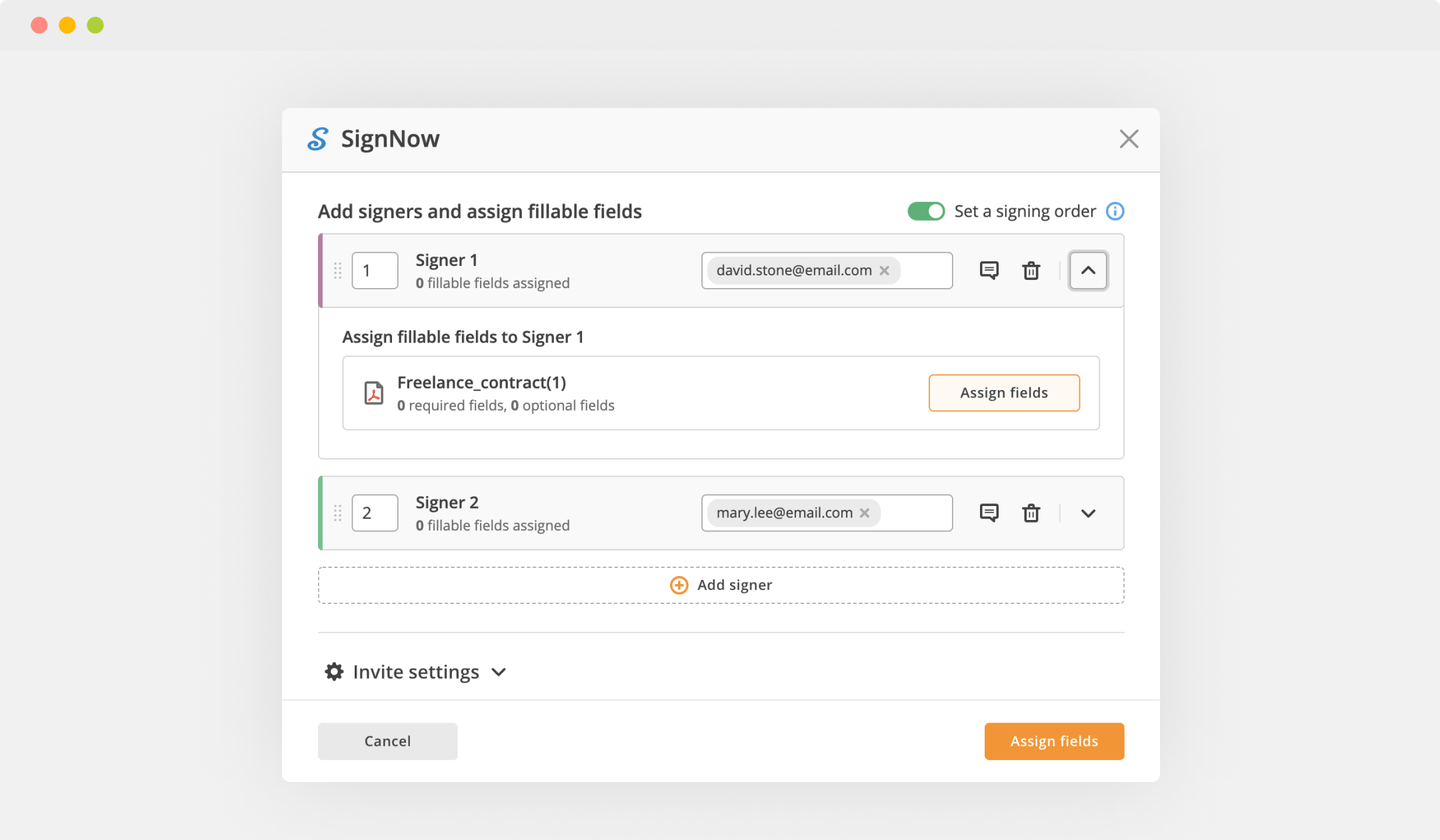

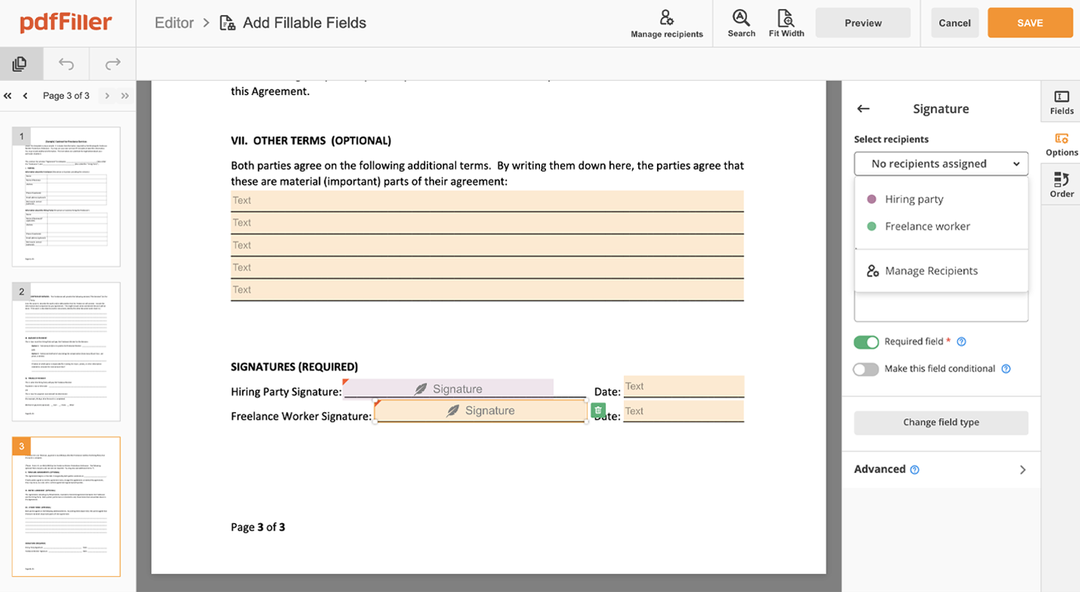

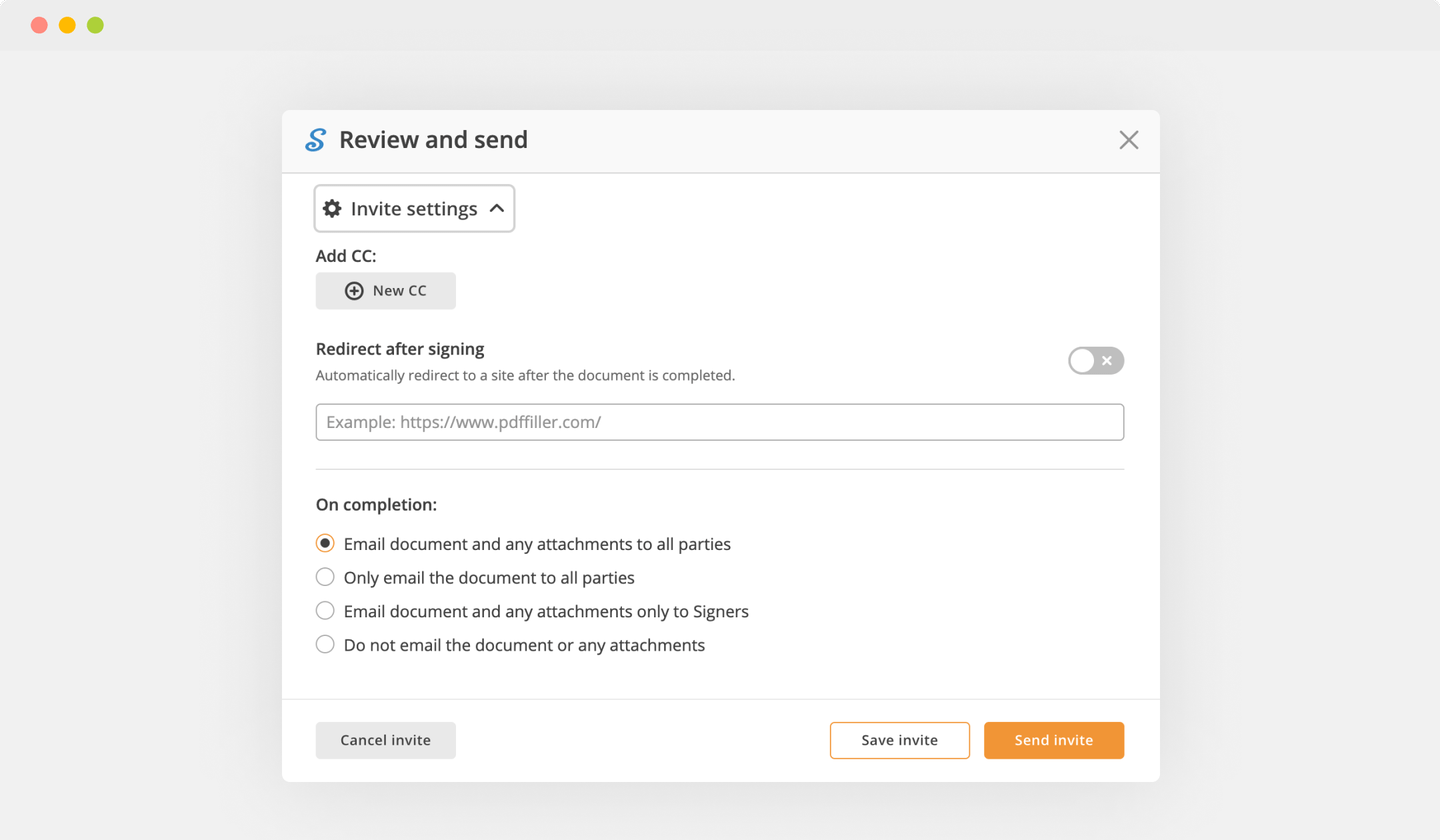

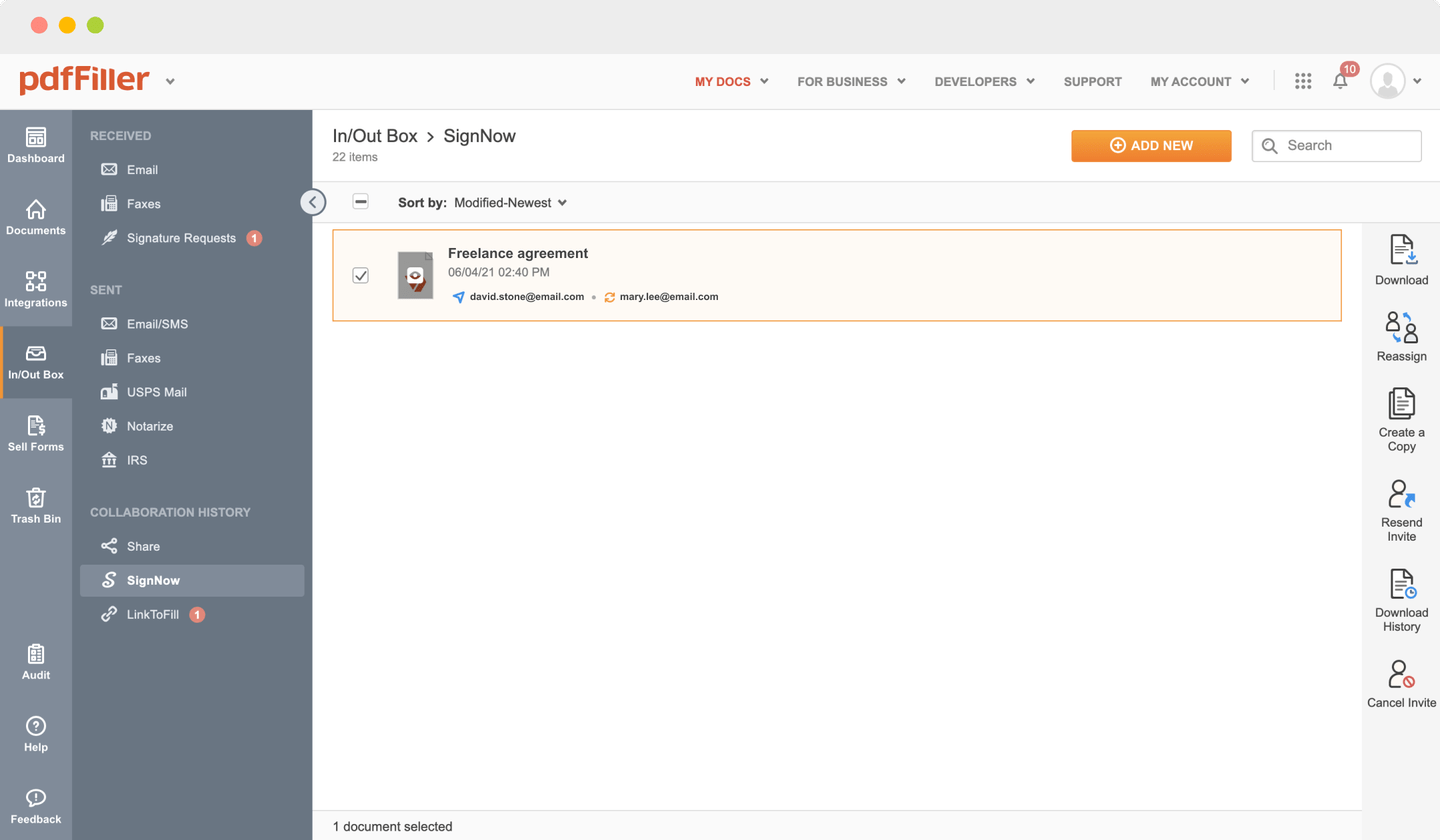

Send documents for eSignature with signNow

Create role-based eSignature workflows without leaving your pdfFiller account — no need to install additional software. Edit your PDF and collect legally-binding signatures anytime and anywhere with signNow’s fully-integrated eSignature solution.

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

pdfFiller scores top ratings in multiple categories on G2

How to Expect Electronically Signed Request

Still using different programs to manage and modify your documents? We have the perfect all-in-one solution for you. Use our platform to make the process efficient. Create forms, contracts, make document templates and other features, without leaving your account. You can Expect Electronically Signed Request with ease; all of our features are available to all users. Have a major advantage over other tools.

How-to Guide

How to edit a PDF document using the pdfFiller editor:

01

Download your form using pdfFiller`s uploader

02

Find the Expect Electronically Signed Request feature in the editor's menu

03

Make all the necessary edits to your document

04

Click the “Done" button in the top right corner

05

Rename the file if needed

06

Print, share or download the document to your desktop

How to Expect Electronically Signed Request - video instructions

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Lisa

2018-08-13

Not the easiest to figure out initially, and detailed instructions are a bit hard to come by, but it seems to do what I need it to do to make signable forms and merged PDF's.

Kevin D. Smith

2020-03-07

Outstanding Online Support

I have used Pdffiller for the past 4 years to file tax returns for an investment group with over 40 members. I made an error when creating my template and when I went to print the 40 documents an erroneous number was appearing, the result of my error in creating the document. Fortunately Pdffiller has an online support staff. So many online companies require you to submit a ticket and then promise a 24 to 48 hour response time. Pdffiller offers that option but they have an outstanding online chat support. I had the benefit of working with Ryan and got access to him immediately upon opening up the online chat support. This was in the evening but Ryan thoroughly researched and tested my issue. Sadly the only option that appeared to be the answer was to create a new set of 40 documents which Ryan was willing to teach me how to create the docs in way that would avoid this error. When I expressed my issue with not having another 6 hours to re-create my work, Ryan persisted in finding a work around that was very creative and saved me from over six hours of new work!!! Needless to say I was ecstatic!!! Thank you Pdffiller for not only a great product but an online support staff that truly cares about helping customers get the results they require!!

Get a powerful PDF editor for your Mac or Windows PC

Install the desktop app to quickly edit PDFs, create fillable forms, and securely store your documents in the cloud.

Edit and manage PDFs from anywhere using your iOS or Android device

Install our mobile app and edit PDFs using an award-winning toolkit wherever you go.

Get a PDF editor in your Google Chrome browser

Install the pdfFiller extension for Google Chrome to fill out and edit PDFs straight from search results.

List of extra features

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can you do signature online?

Use our online signature tool to quickly capture a free electronic signature. You can sign the document yourself, or capture a digital signature from up to 2 persons. Upload a document you would like to sign using your local file storage or one of the cloud services below.

Is an e-signature legally binding?

Electronic Signatures in Global and National Commerce (DESIGN) Act. For an electronic signature to be legally binding under the DESIGN Act, it is recommended that all electronic signature workflows include: Intent to sign. Similar to ink signatures, a signer must show clear intent to sign an agreement electronically.

Can electronically sign tax documents?

You can sign your tax return electronically by using a Self-Select PIN, which serves as your digital signature when using tax preparation software, or a Practitioner PIN when using an Electronic Return Originator (ERO).

Do I need to sign my tax return if IE file?

If you e-file your return: If your return is accepted, and you signed with a PIN, you're done. You don't need to mail anything else. If your return is accepted, and you chose to use an IRS signature form (Form 8453-OL), you need to sign and mail this form.

Can Form 8821 be electronically signed?

If you complete Form 8821 for electronic signature authorization, do not file a Form 8821 with the IRS. Instead, give it to your appointee, who will retain the document. The copy of the tax information authorization must have a current signature and date of the taxpayer under the original signature on line 7.

How do I fill out IRS Form 8821?

Suggested clip

Tips For Filling Out IRS Form 8821, Tax Information Authorization YouTubeStart of suggested clipEnd of suggested clip

Tips For Filling Out IRS Form 8821, Tax Information Authorization

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.