Sign Bankruptcy Agreement For Free

Users trust to manage documents on pdfFiller platform

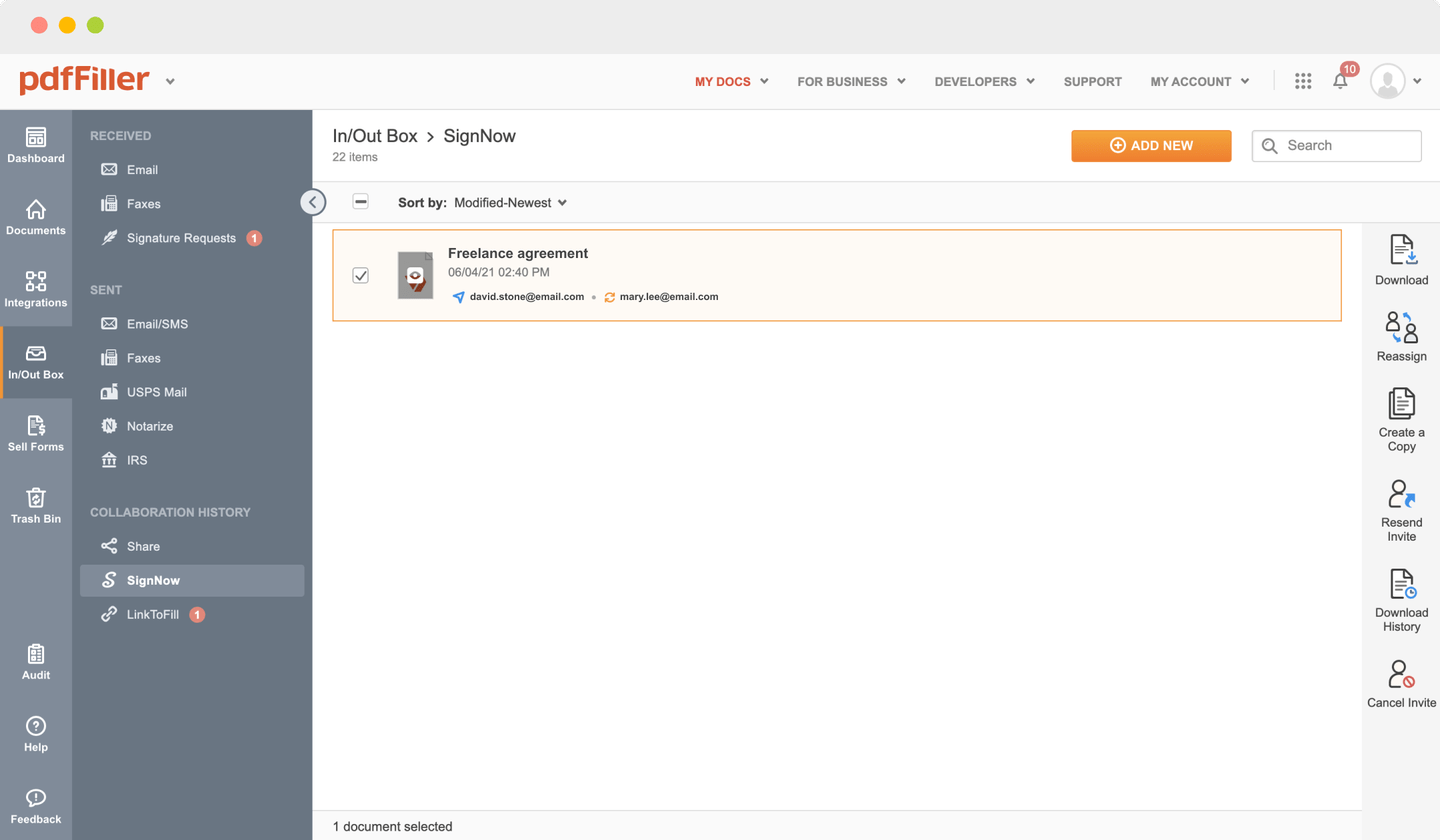

Send documents for eSignature with signNow

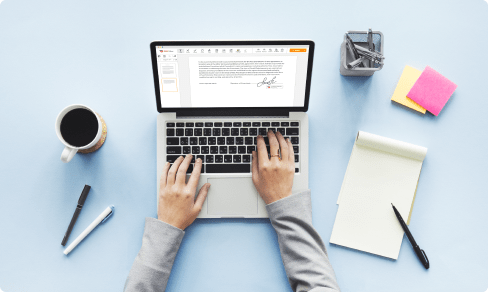

Watch a quick video tutorial on how to Sign Bankruptcy Agreement

pdfFiller scores top ratings in multiple categories on G2

Sign Bankruptcy Agreement with the swift ease

pdfFiller allows you to Sign Bankruptcy Agreement in no time. The editor's hassle-free drag and drop interface ensures quick and intuitive signing on any device.

Ceritfying PDFs electronically is a fast and safe method to validate papers anytime and anywhere, even while on the fly.

See the detailed instructions on how to Sign Bankruptcy Agreement electronically with pdfFiller:

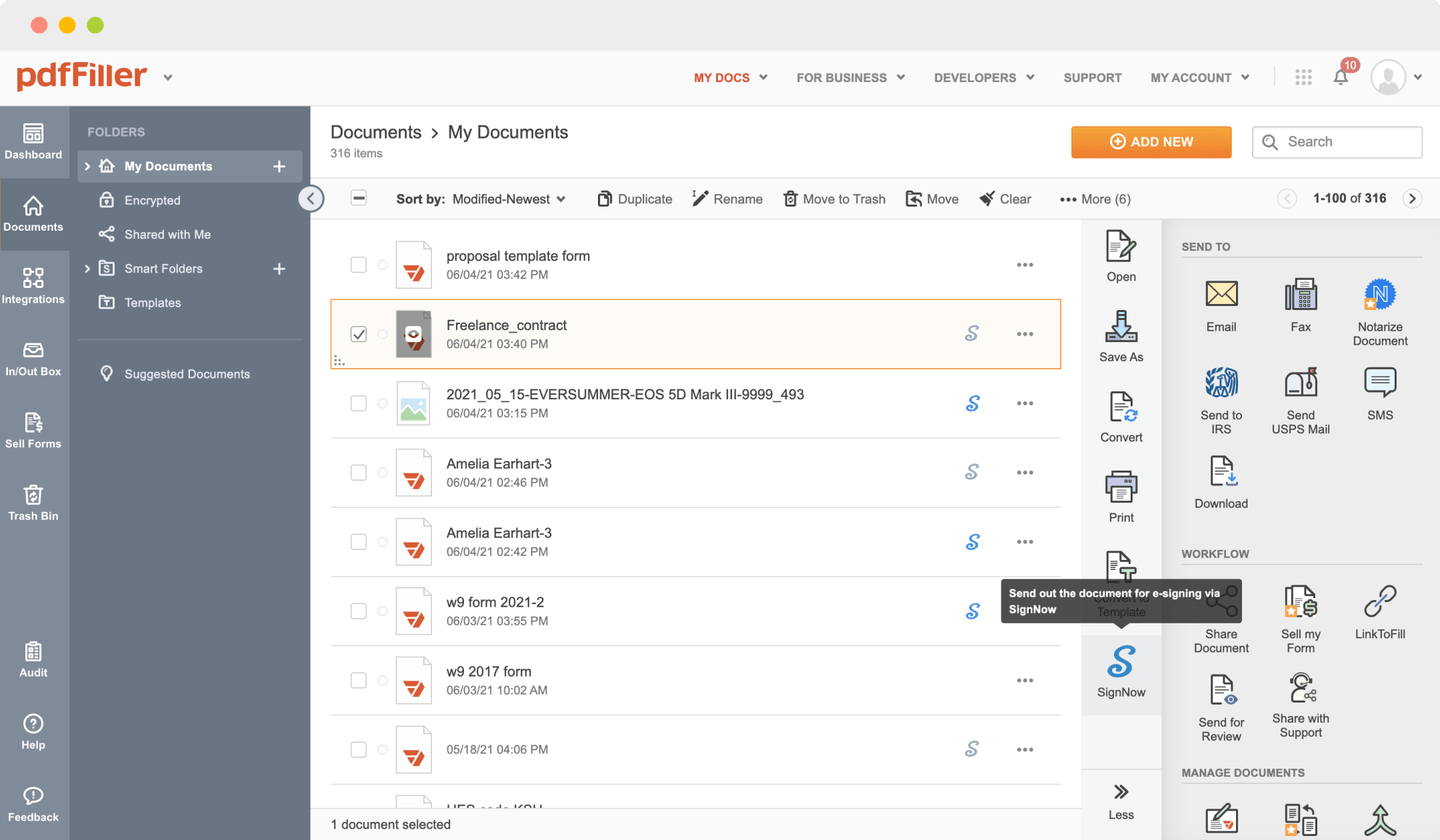

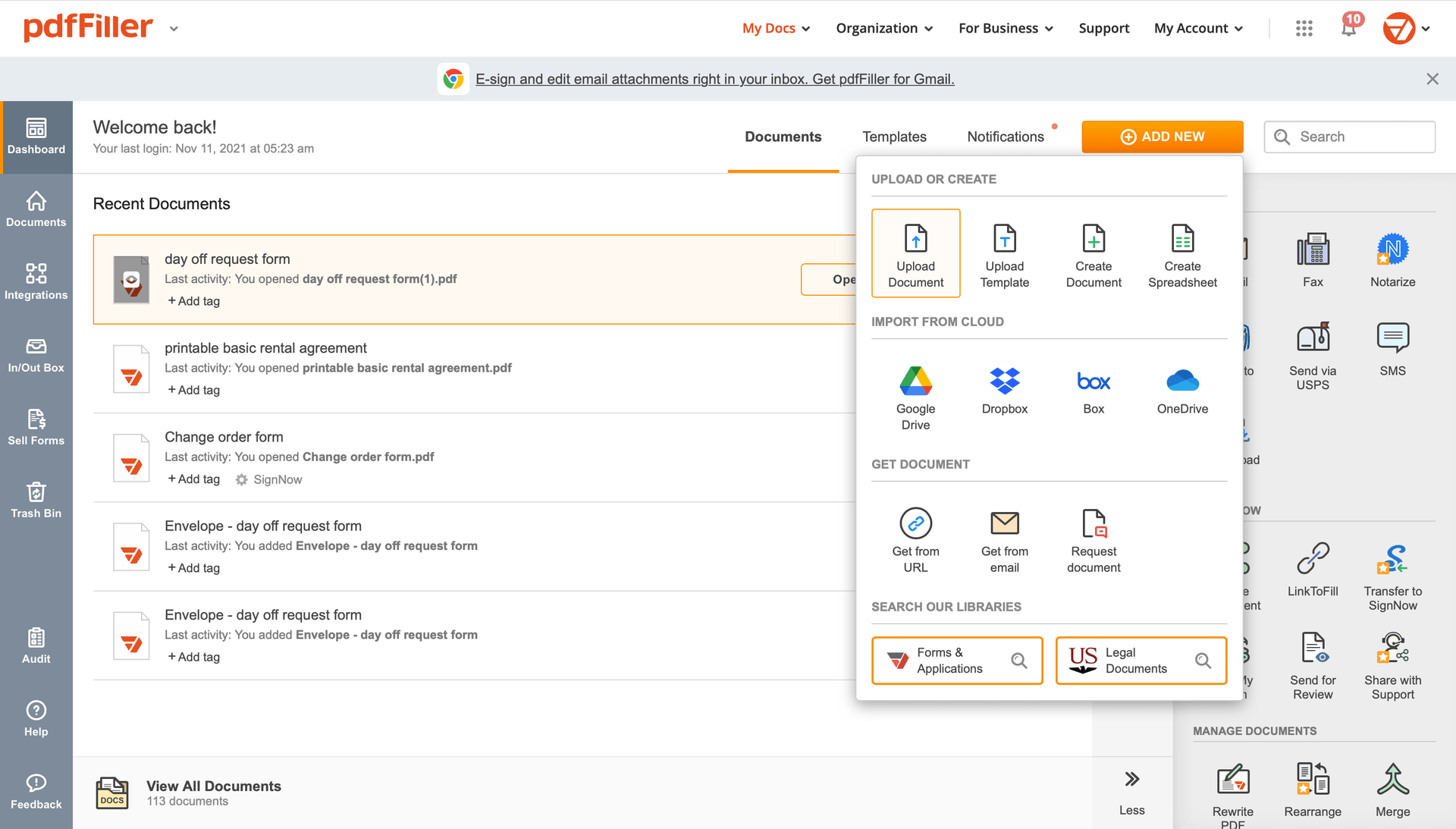

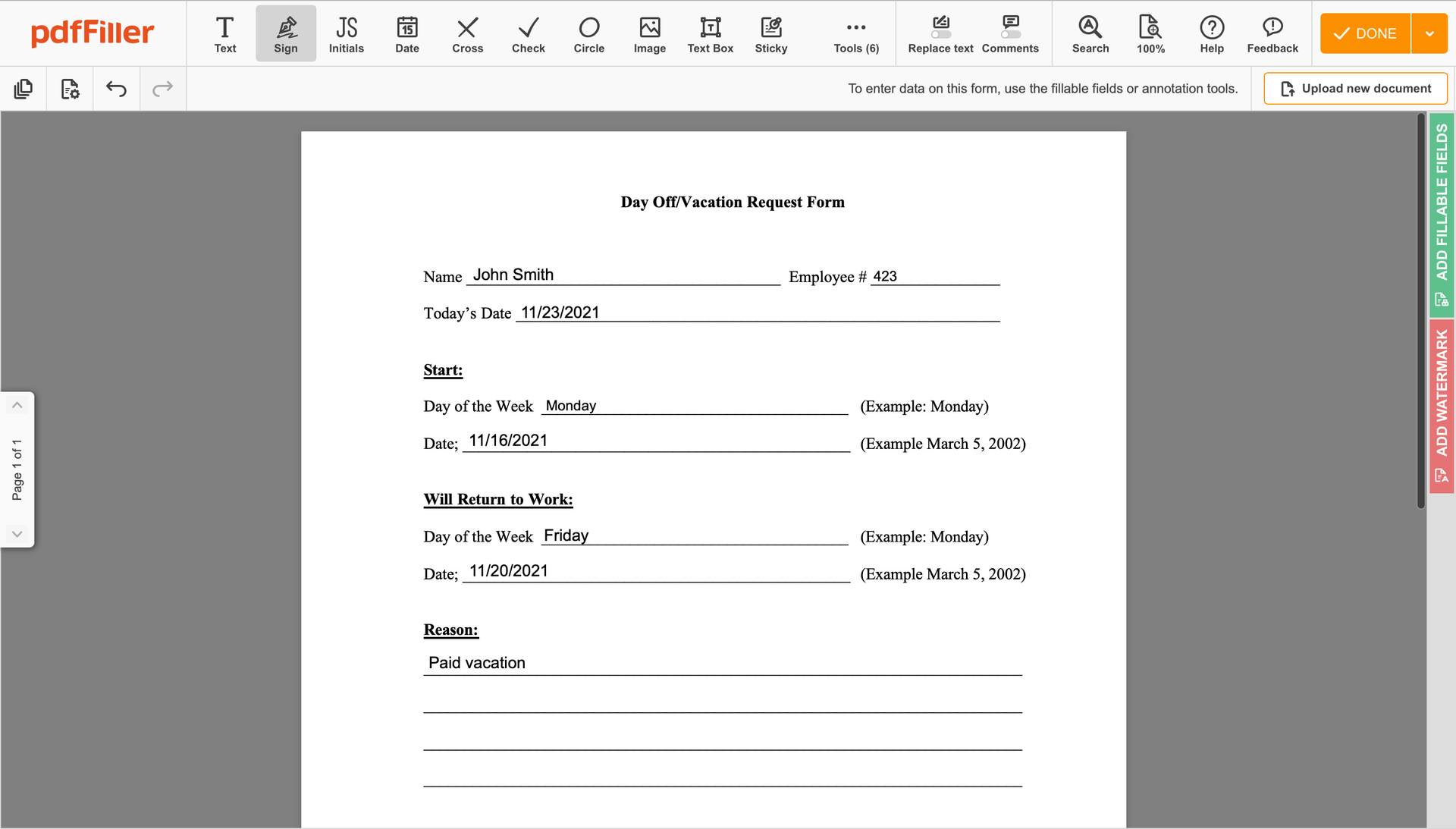

Upload the form for eSignature to pdfFiller from your device or cloud storage.

Once the file opens in the editor, hit Sign in the top toolbar.

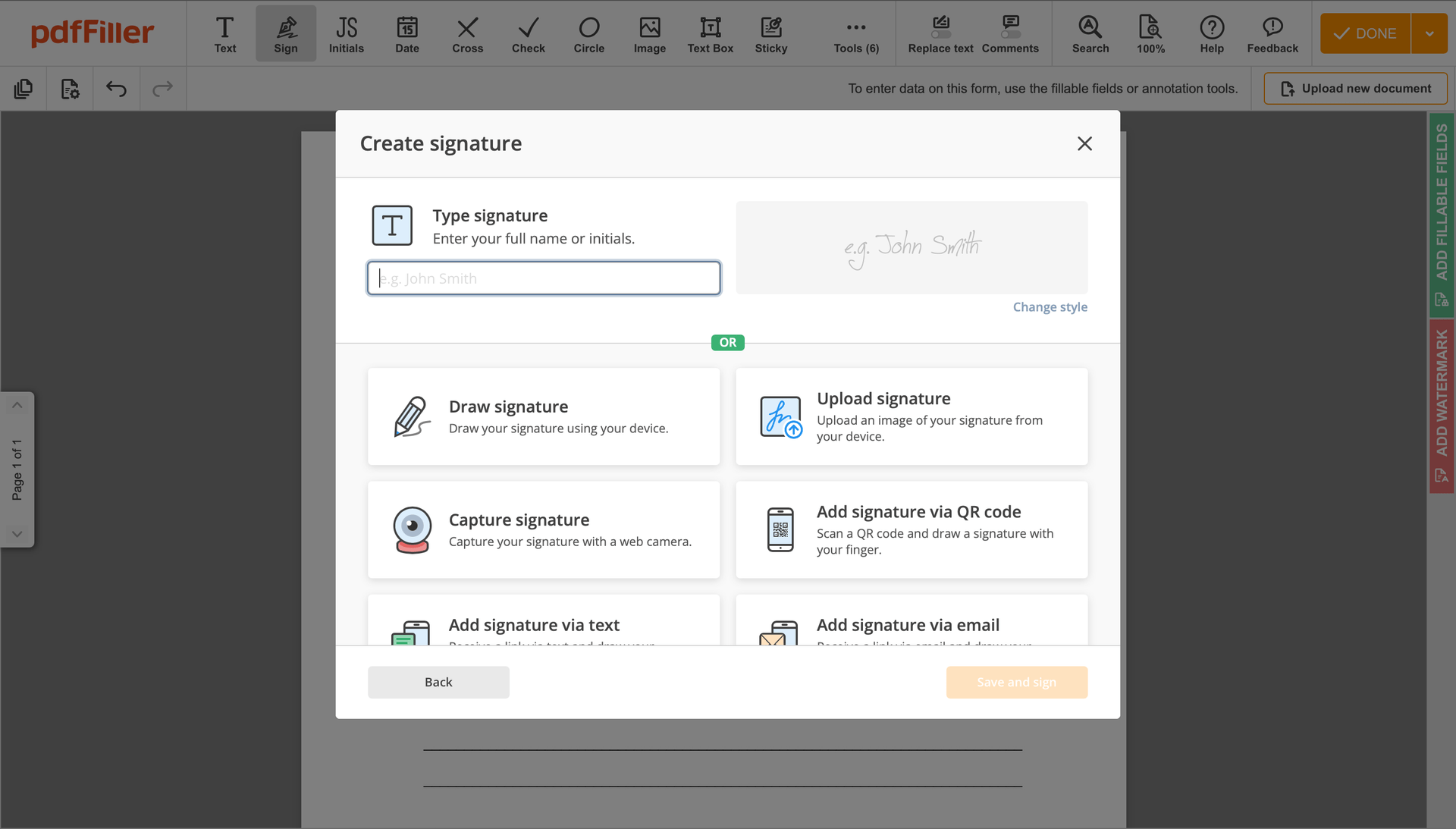

Generate your electronic signature by typing, drawing, or adding your handwritten signature's photo from your laptop. Then, click Save and sign.

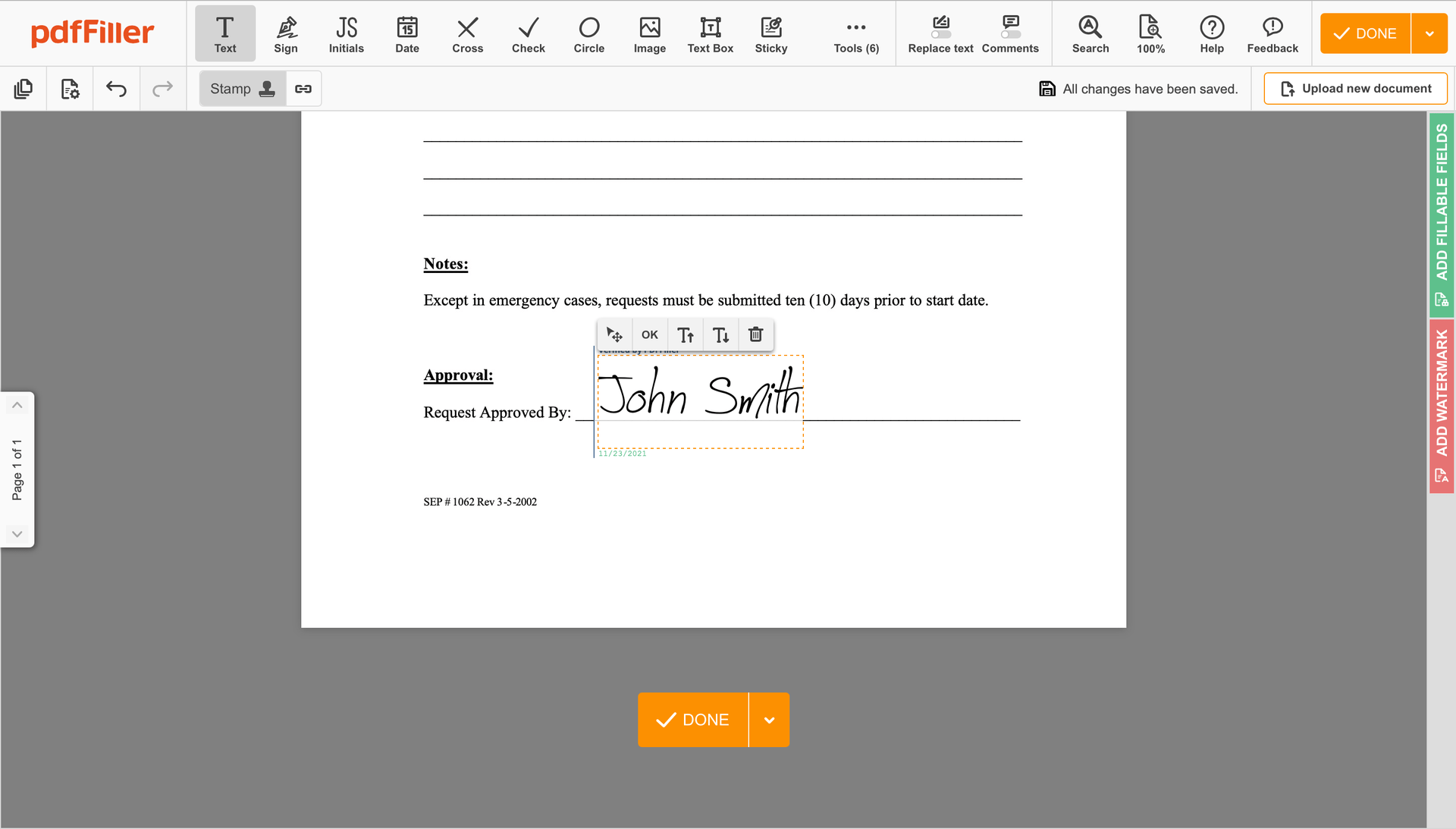

Click anywhere on a form to Sign Bankruptcy Agreement. You can drag it around or resize it utilizing the controls in the hovering panel. To use your signature, click OK.

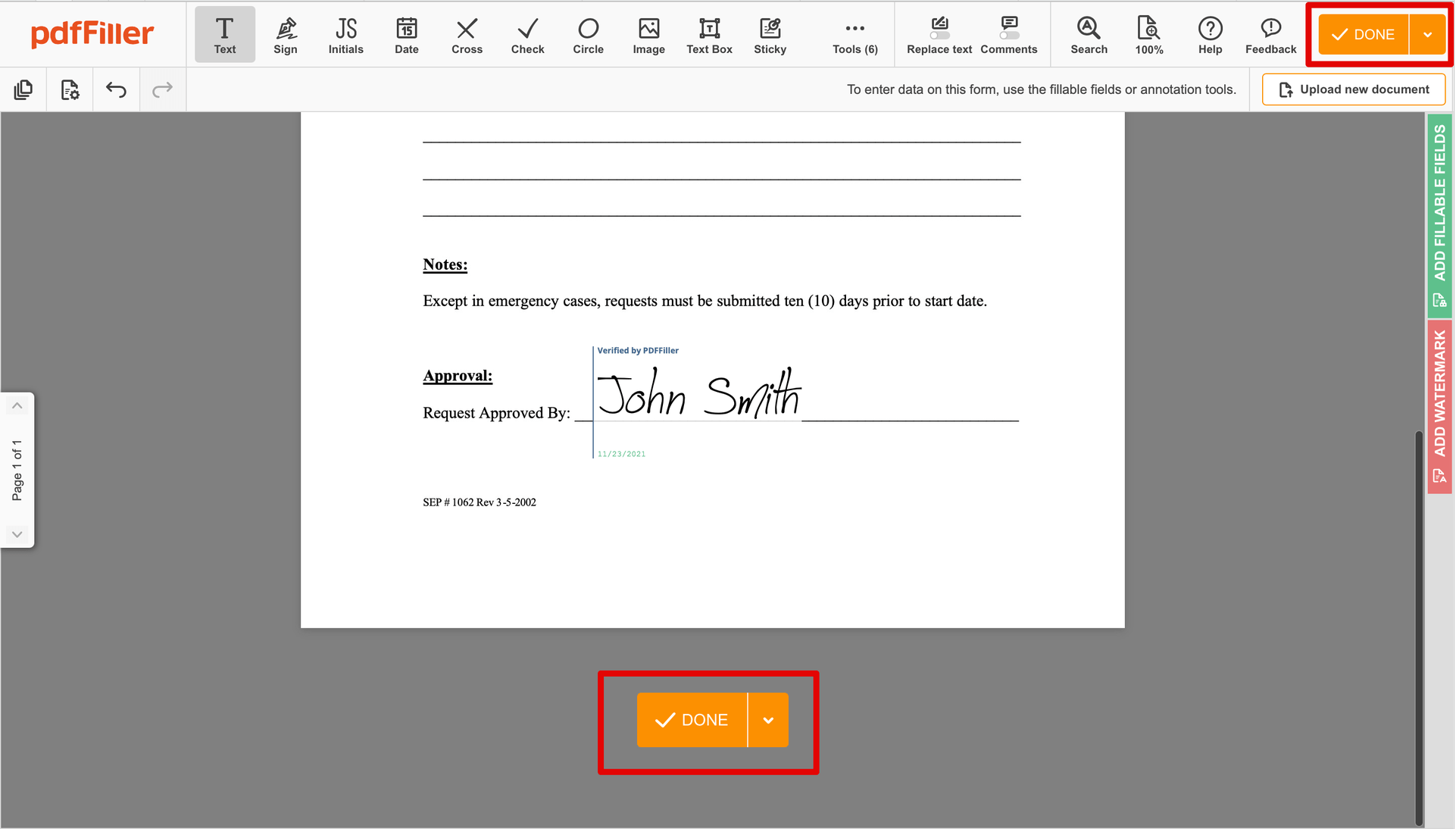

Finish up the signing session by hitting DONE below your form or in the top right corner.

After that, you'll go back to the pdfFiller dashboard. From there, you can download a completed copy, print the document, or send it to other people for review or approval.

Are you stuck working with multiple programs for creating and managing documents? Use our solution instead. Document management is notably easier, faster and smoother with our document editor. Create document templates from scratch, edit existing form sand even more useful features, without leaving your account. You can use Sign Bankruptcy Agreement with ease; all of our features, like signing orders, reminders, requests, are available instantly to all users. Pay as for a basic app, get the features as of pro document management tools. The key is flexibility, usability and customer satisfaction. We deliver on all three.

How to edit a PDF document using the pdfFiller editor:

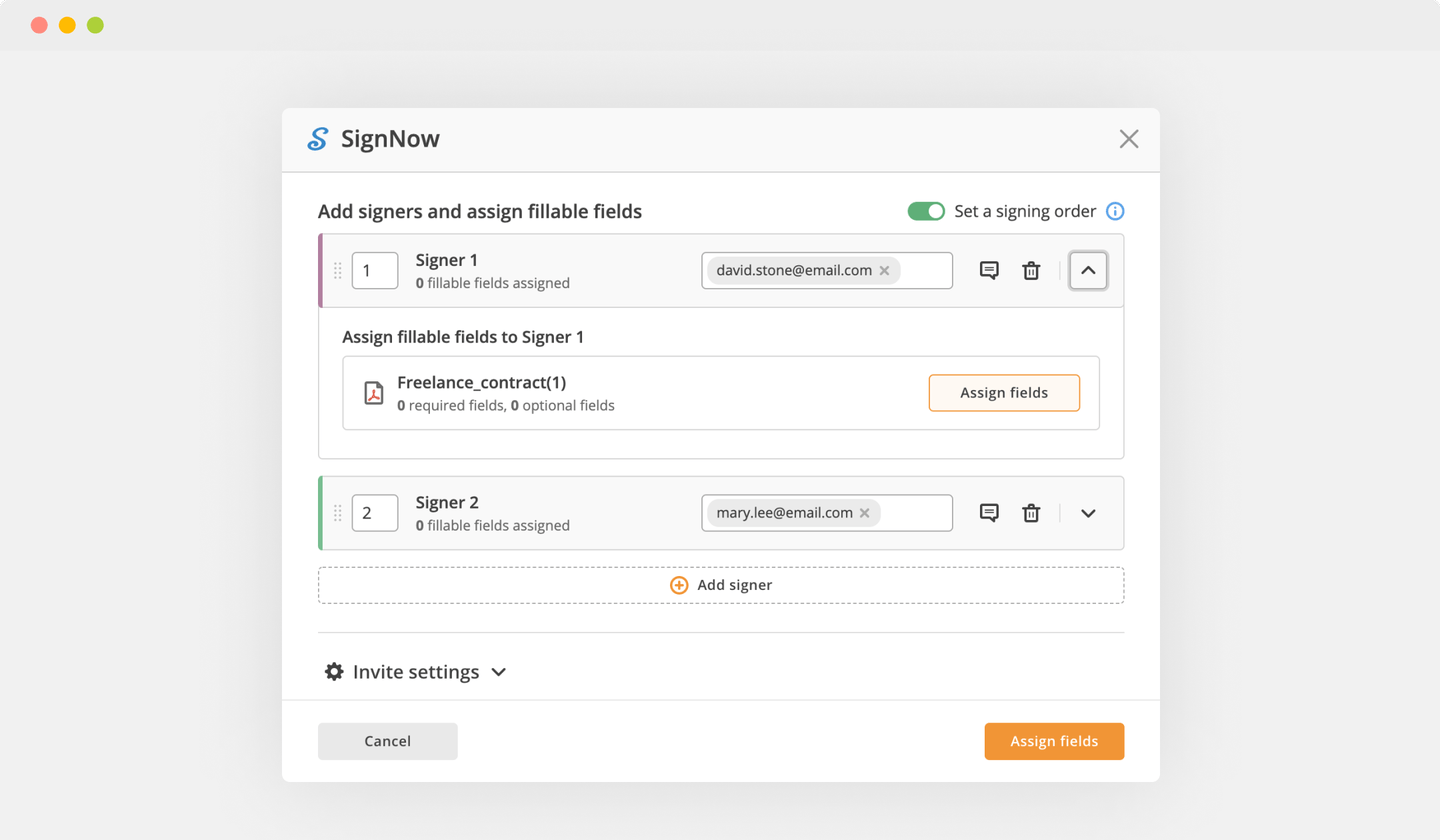

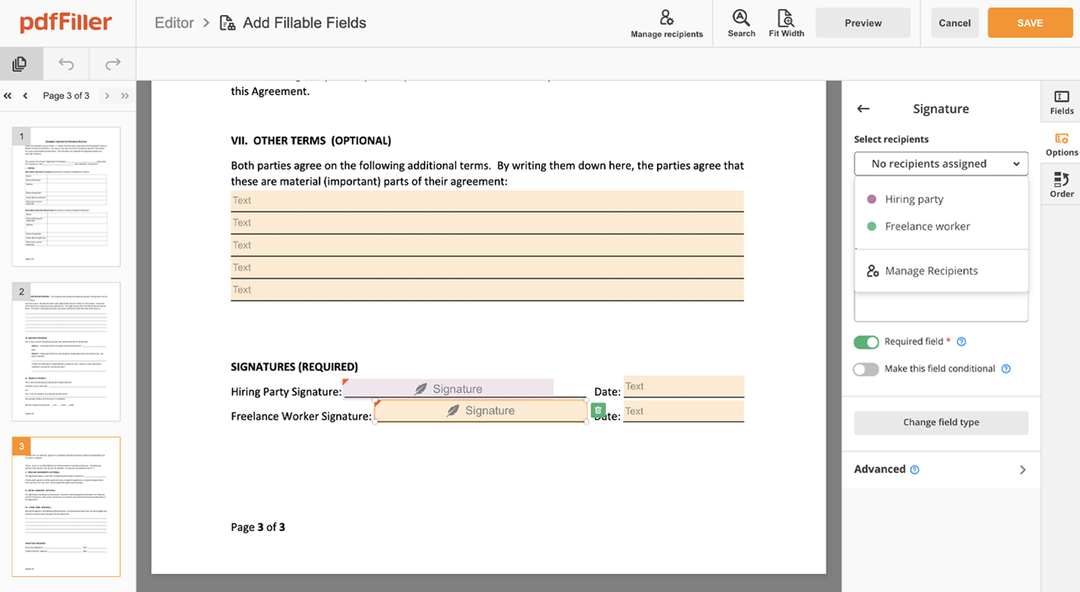

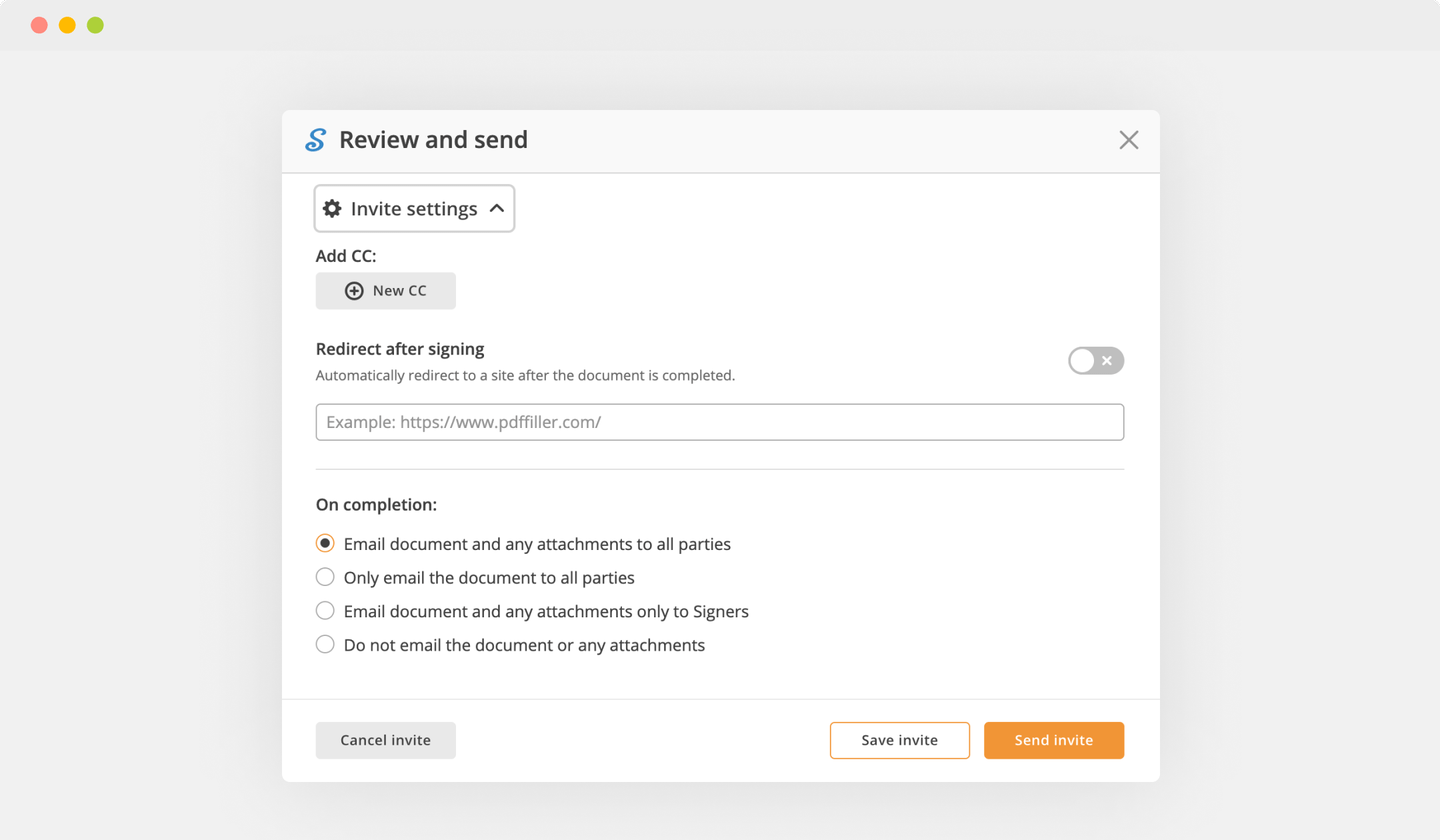

How to Send a PDF for eSignature

What our customers say about pdfFiller

Very easy to use. Not complicated at all. Compatible with every file I needed so far. I don't know how we got by before this program. I haven't come across anything I haven't liked yet. A great value for the price.

What do you dislike?

Wow. I dislike this question! I really love your product and haven't had anything I dislike.

Recommendations to others considering the product:

Great Value Easy to use all around wonderful company

What problems are you solving with the product? What benefits have you realized?

We are able to send files in real time as simply as sending an Email. You can have each person input their own data as well as sign documents all without having to print anything out. Of course that is huge in helping the environment.