Sign IRS Form 1040-ES For Free

Users trust to manage documents on pdfFiller platform

Send documents for eSignature with signNow

Watch a quick video tutorial on how to Sign IRS Form 1040-ES

pdfFiller scores top ratings in multiple categories on G2

Sign IRS Form 1040-ES with the swift ease

pdfFiller enables you to Sign IRS Form 1040-ES in no time. The editor's handy drag and drop interface ensures quick and user-friendly signing on any device.

Signing PDFs online is a quick and safe way to validate paperwork at any time and anywhere, even while on the go.

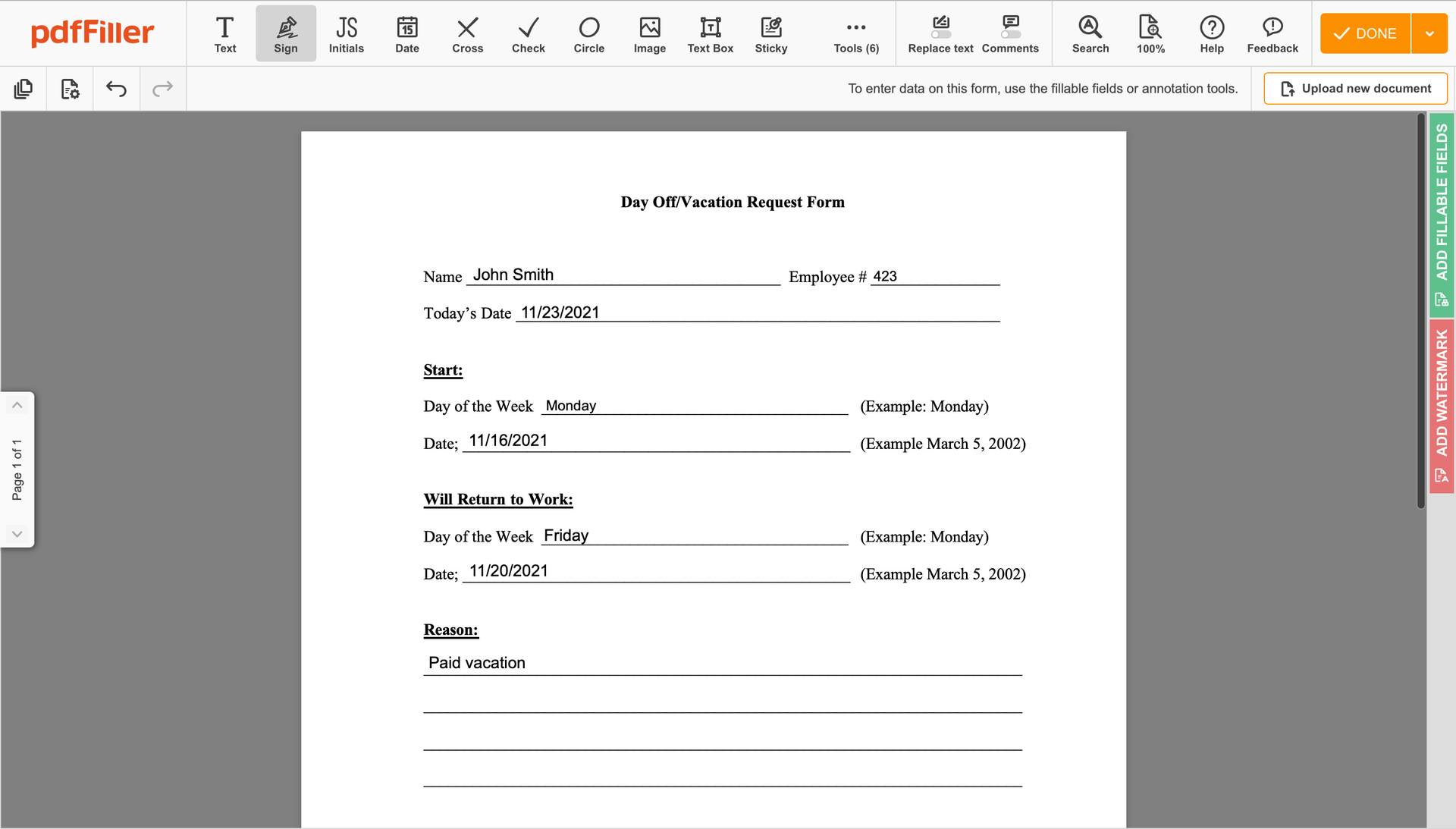

Go through the detailed guide on how to Sign IRS Form 1040-ES electronically with pdfFiller:

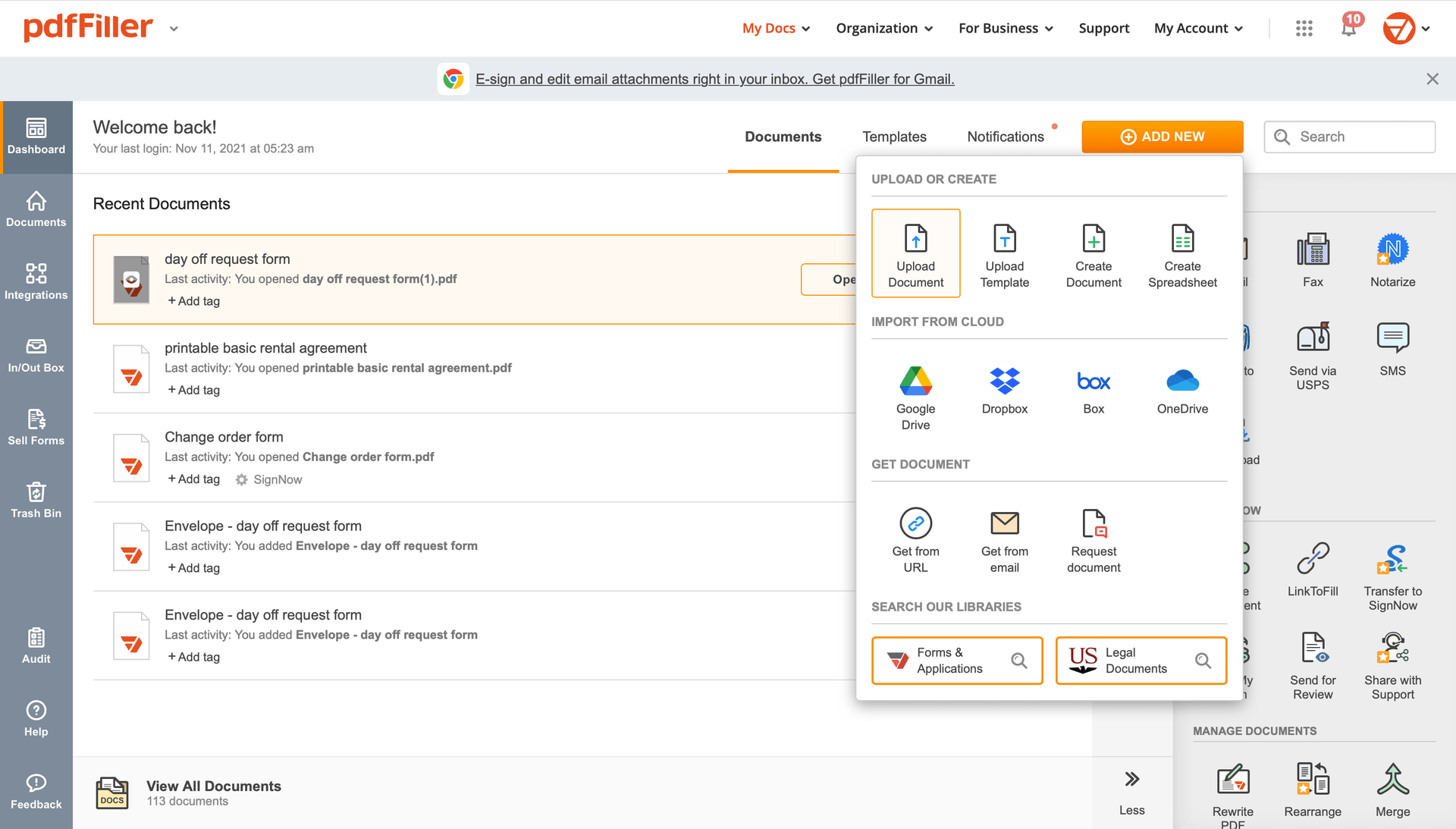

Upload the form you need to sign to pdfFiller from your device or cloud storage.

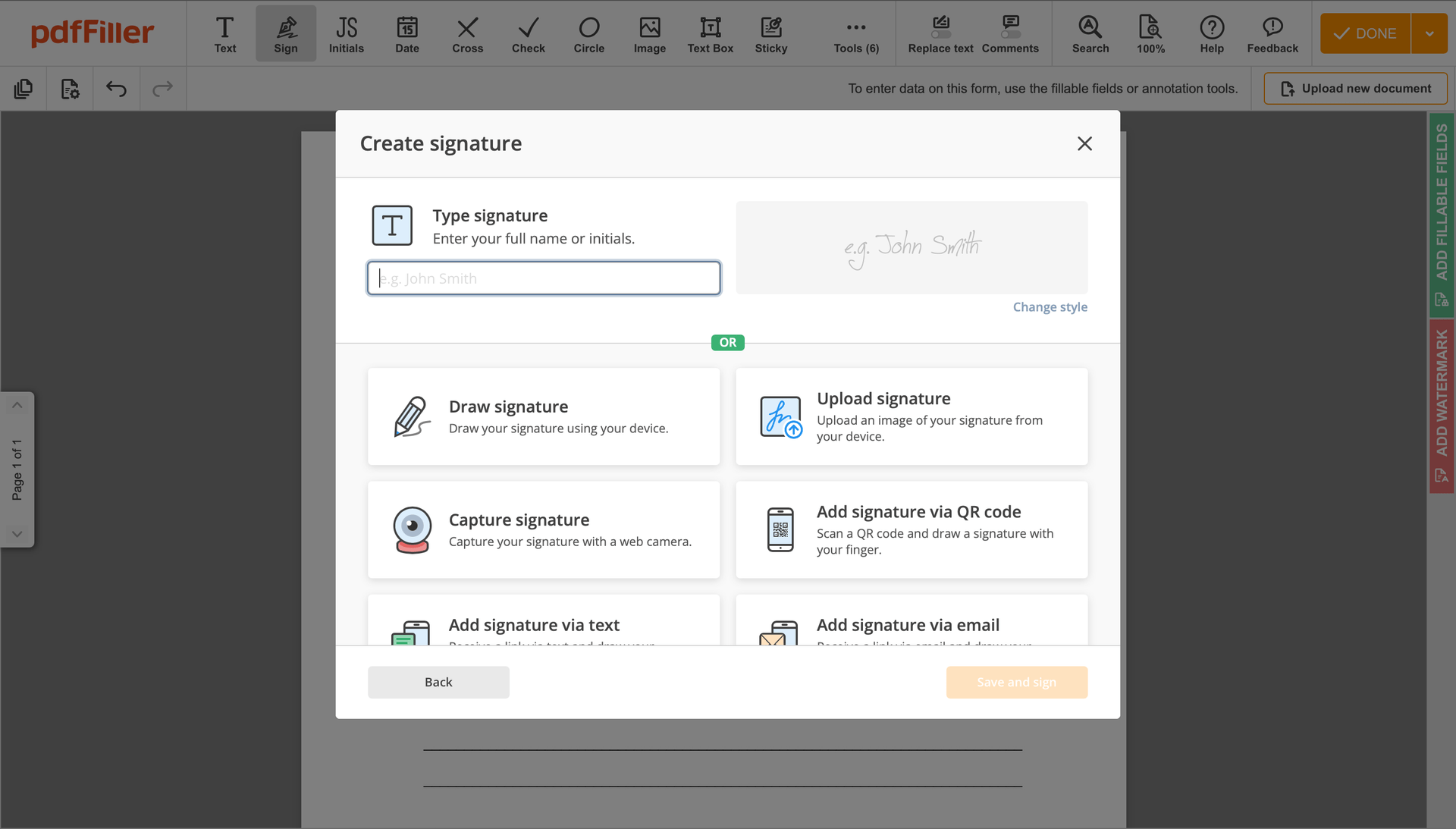

As soon as the file opens in the editor, hit Sign in the top toolbar.

Generate your electronic signature by typing, drawing, or uploading your handwritten signature's photo from your laptop. Then, click Save and sign.

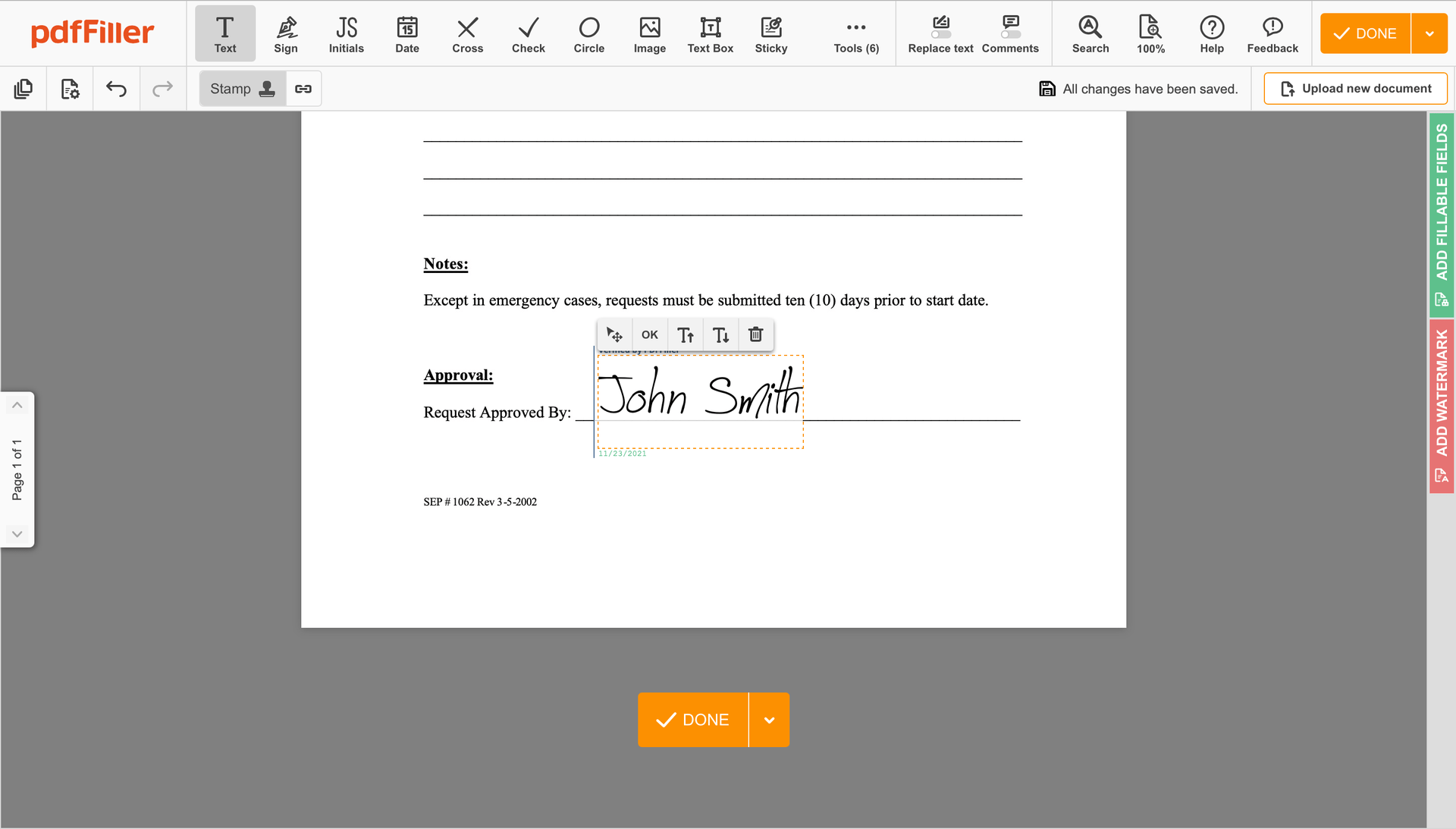

Click anywhere on a form to Sign IRS Form 1040-ES. You can drag it around or resize it utilizing the controls in the floating panel. To use your signature, click OK.

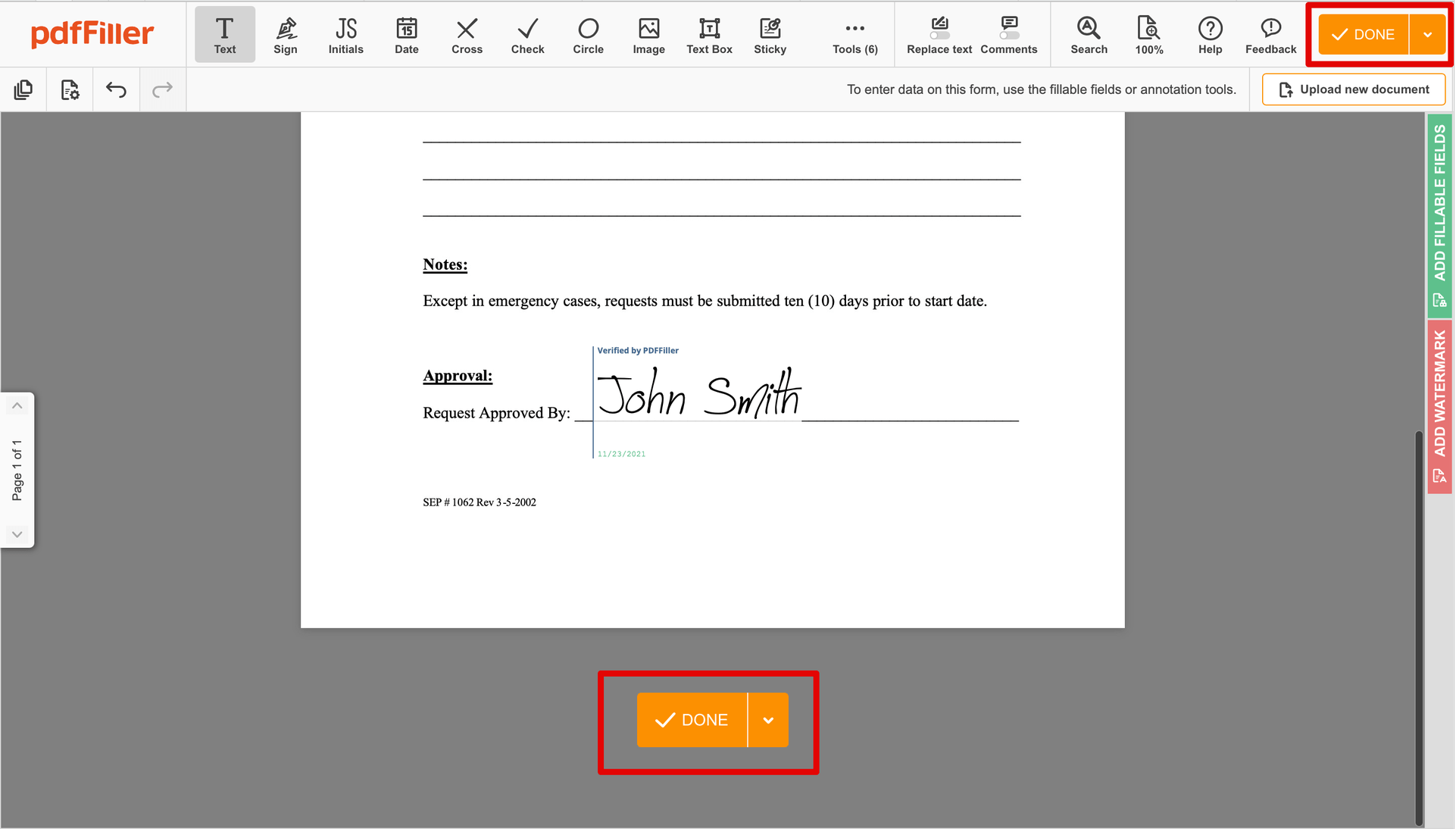

Complete the signing process by hitting DONE below your form or in the top right corner.

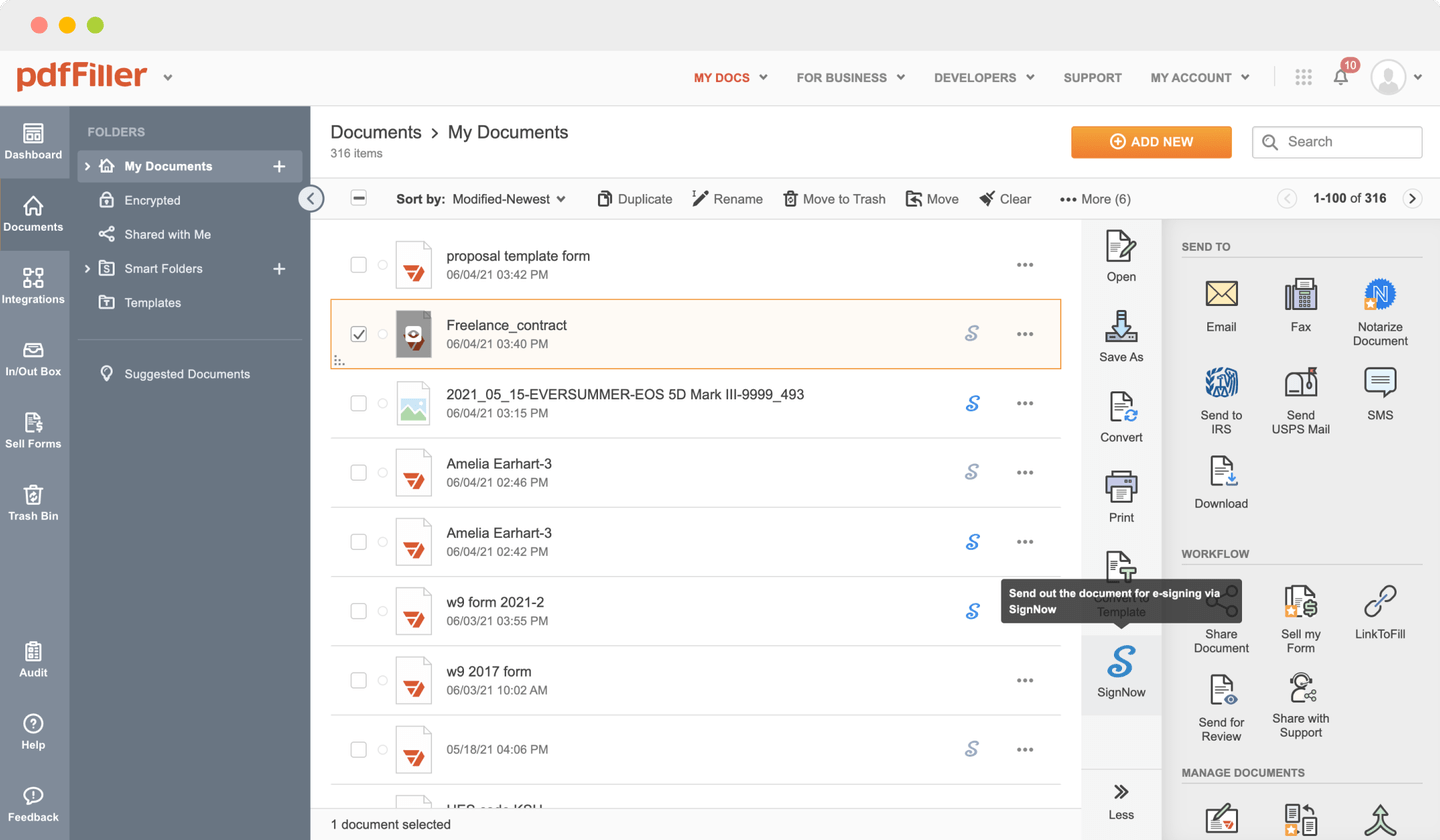

Next, you'll go back to the pdfFiller dashboard. From there, you can get a completed copy, print the document, or send it to other parties for review or approval.

Are you stuck with different applications for creating and managing documents? Use this all-in-one solution instead. Use our platform to make the process efficient. Create document templates on your own, modify existing formsand more useful features, without leaving your account. You can use Sign IRS Form 1040-ES right away, all features, like signing orders, alerts, requests , are available instantly. Get the value of full featured platform, for the cost of a lightweight basic app. The key is flexibility, usability and customer satisfaction. We deliver on all three.

How to edit a PDF document using the pdfFiller editor:

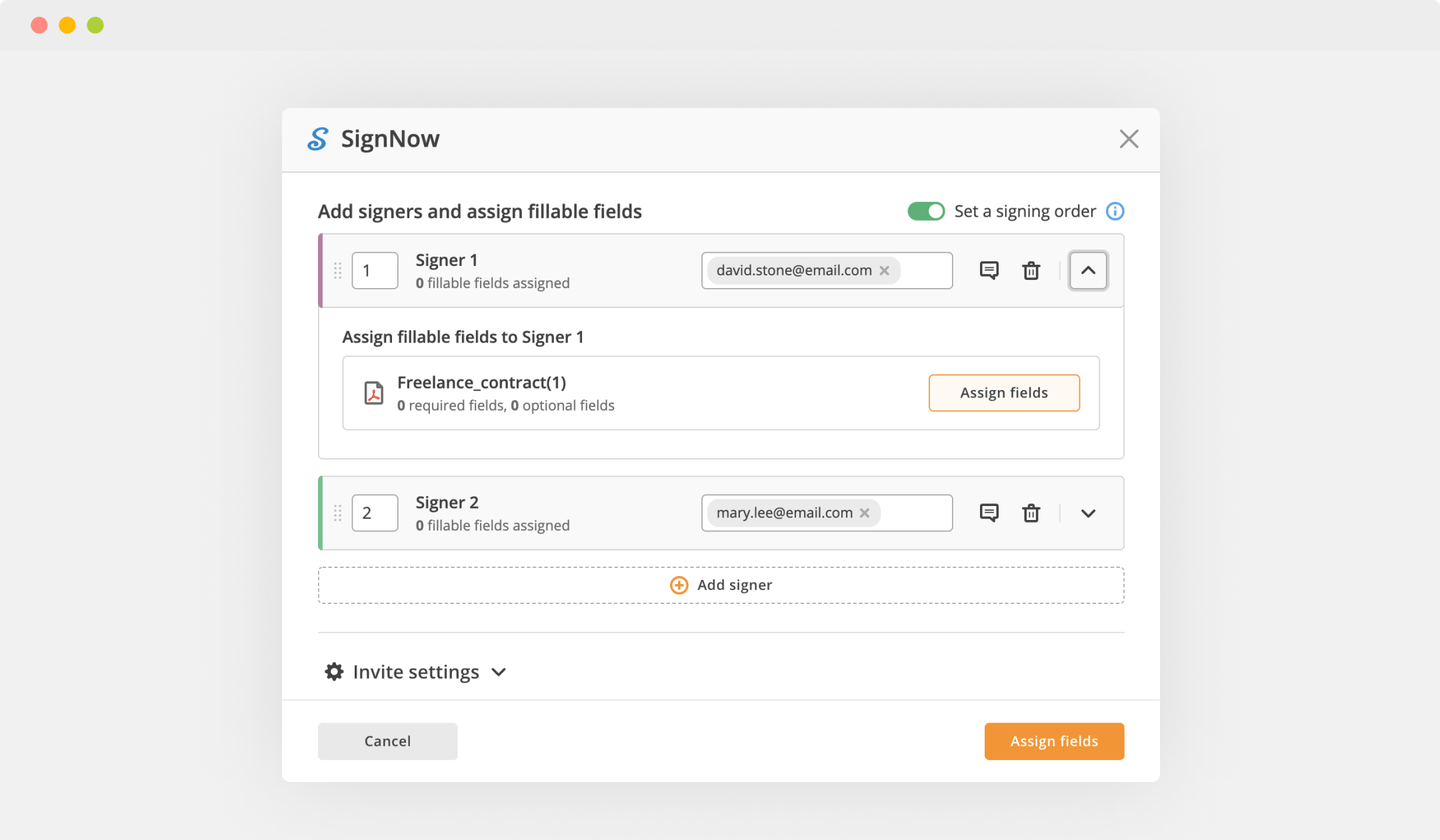

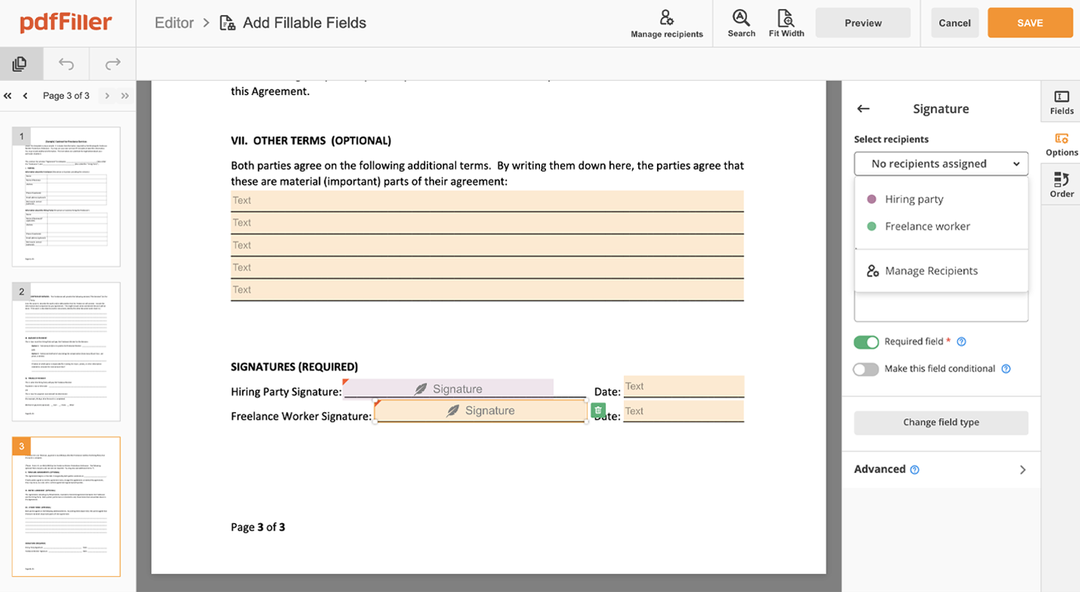

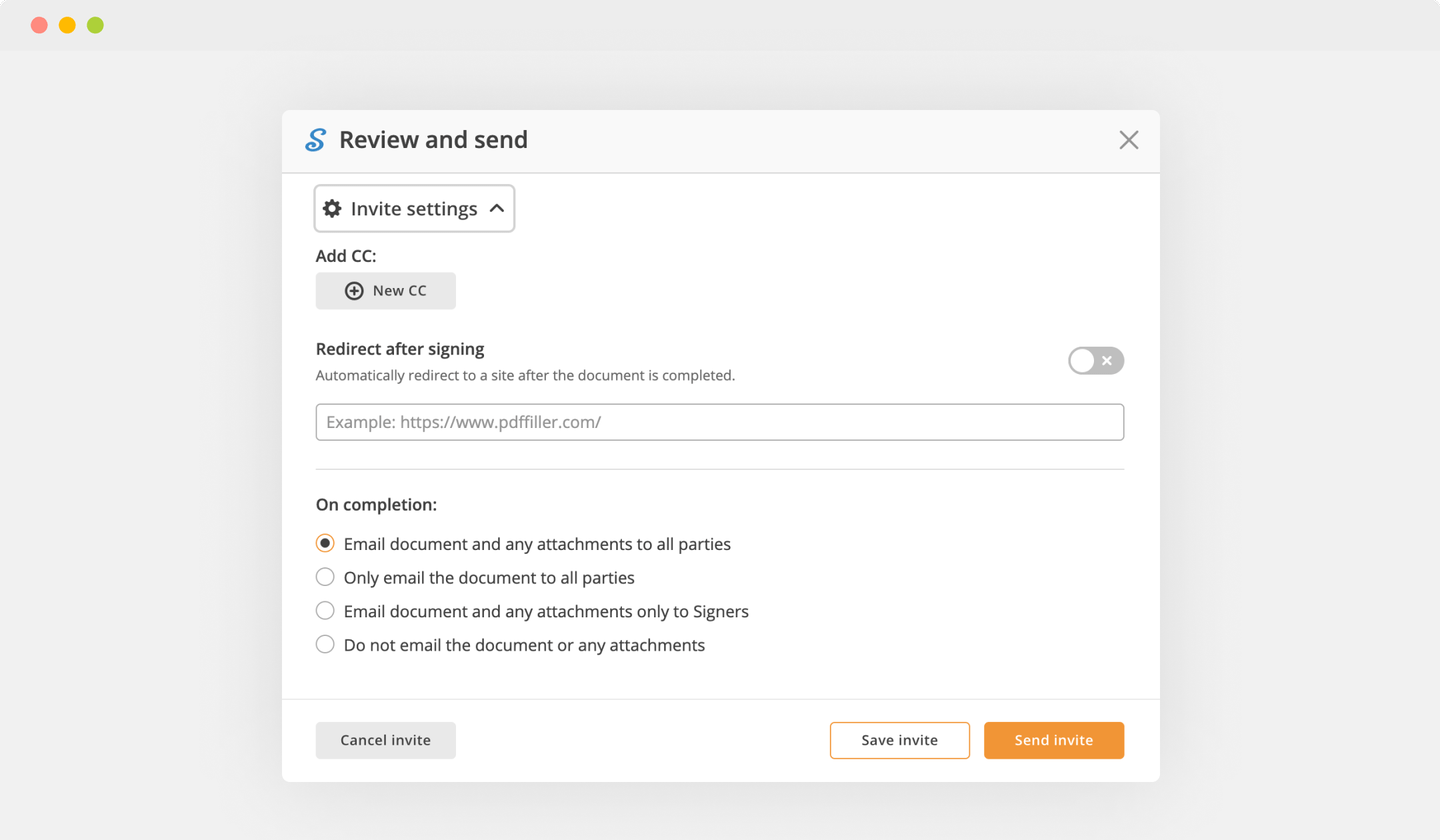

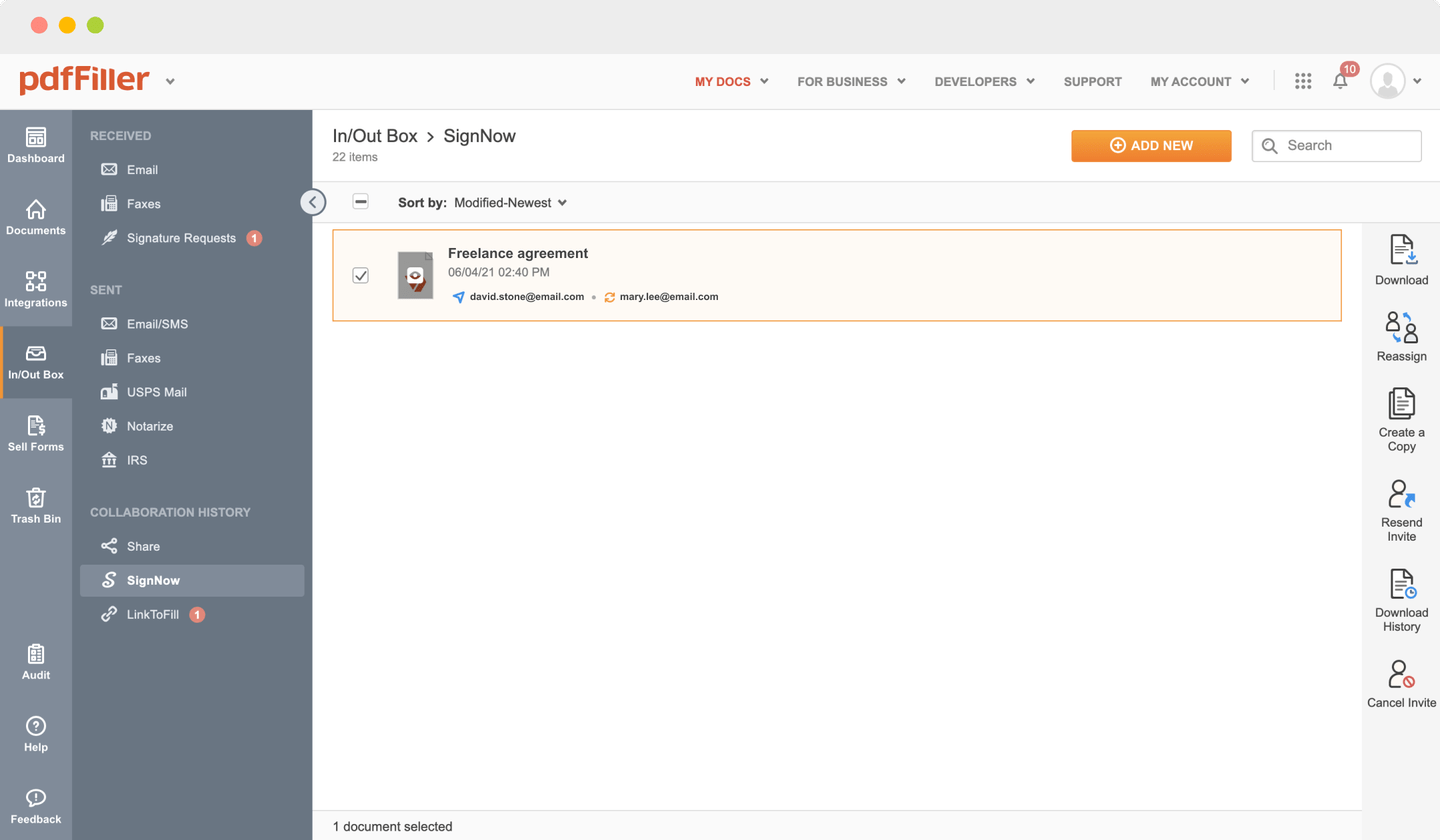

How to Send a PDF for eSignature

What our customers say about pdfFiller

Simple and easy way I can get things done

What do you dislike?

Wish phone app was just as easy to manuever

What problems are you solving with the product? What benefits have you realized?

Signature and cleaning up Documents

I like the fact that PDF filler is very user friendly. I use it often in my insurance business

What do you dislike?

Not always easy to find specific forms for my business

What problems are you solving with the product? What benefits have you realized?

It has made the use of filling out pre-set forms much more convenient.