Signature Service Money Loan Contract For Free

Users trust to manage documents on pdfFiller platform

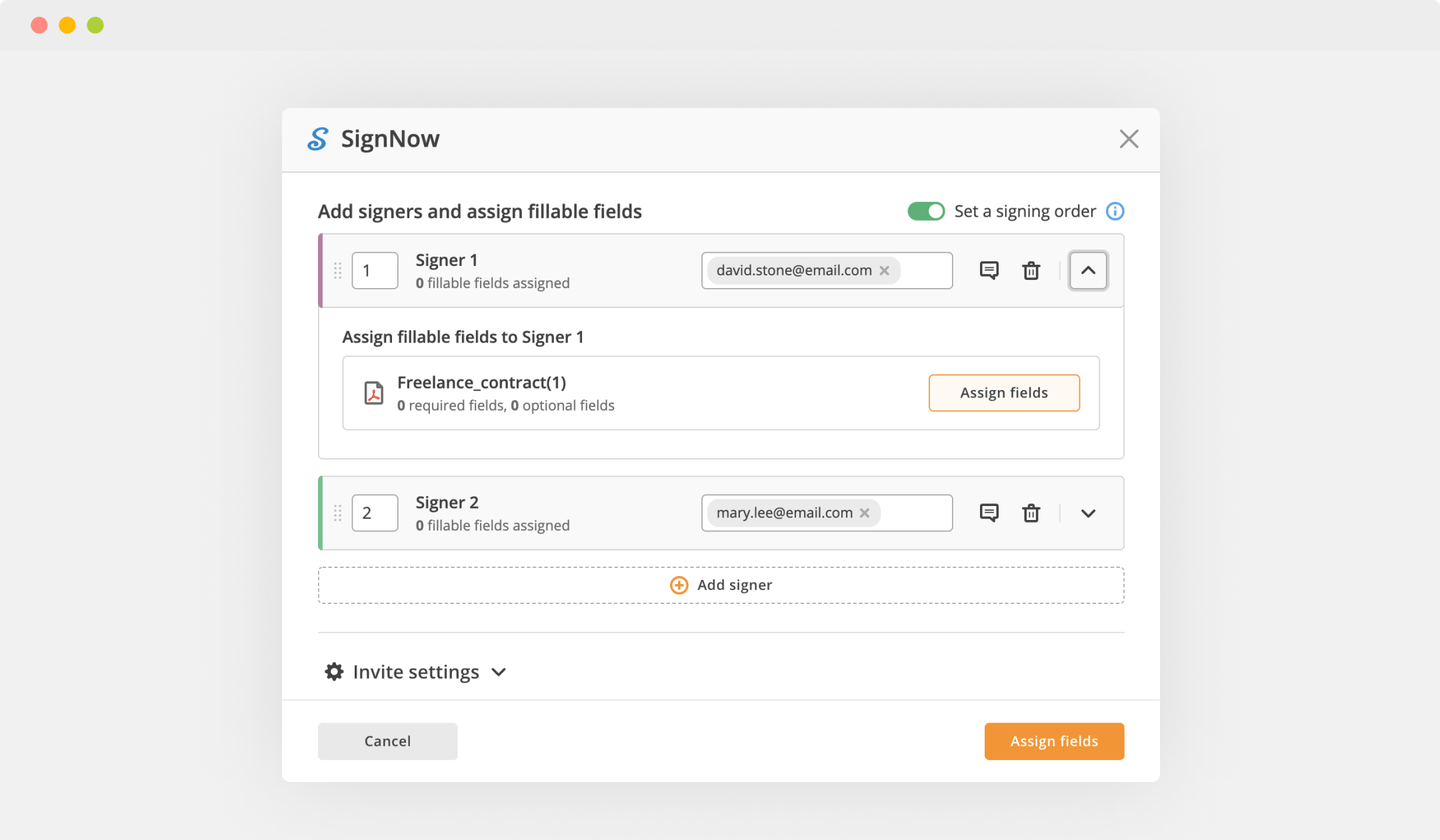

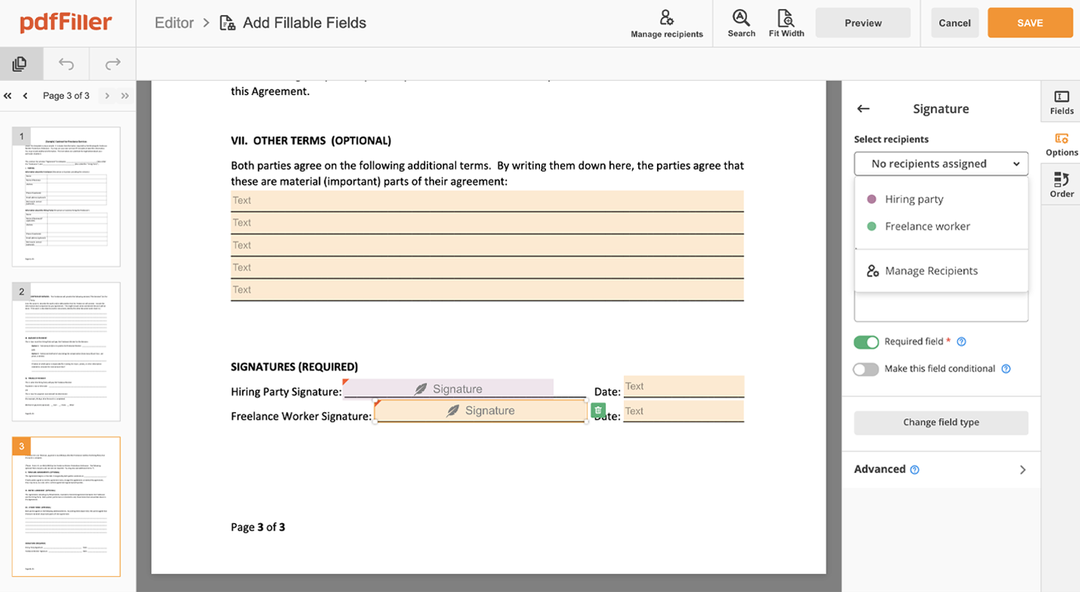

Send documents for eSignature with signNow

Watch a short video walkthrough on how to add an Signature Service Money Loan Contract

pdfFiller scores top ratings in multiple categories on G2

Create a legally-binding Signature Service Money Loan Contract with no hassle

pdfFiller enables you to handle Signature Service Money Loan Contract like a pro. No matter the system or device you run our solution on, you'll enjoy an intuitive and stress-free method of completing documents.

The entire signing process is carefully protected: from adding a document to storing it.

Here's how you can create Signature Service Money Loan Contract with pdfFiller:

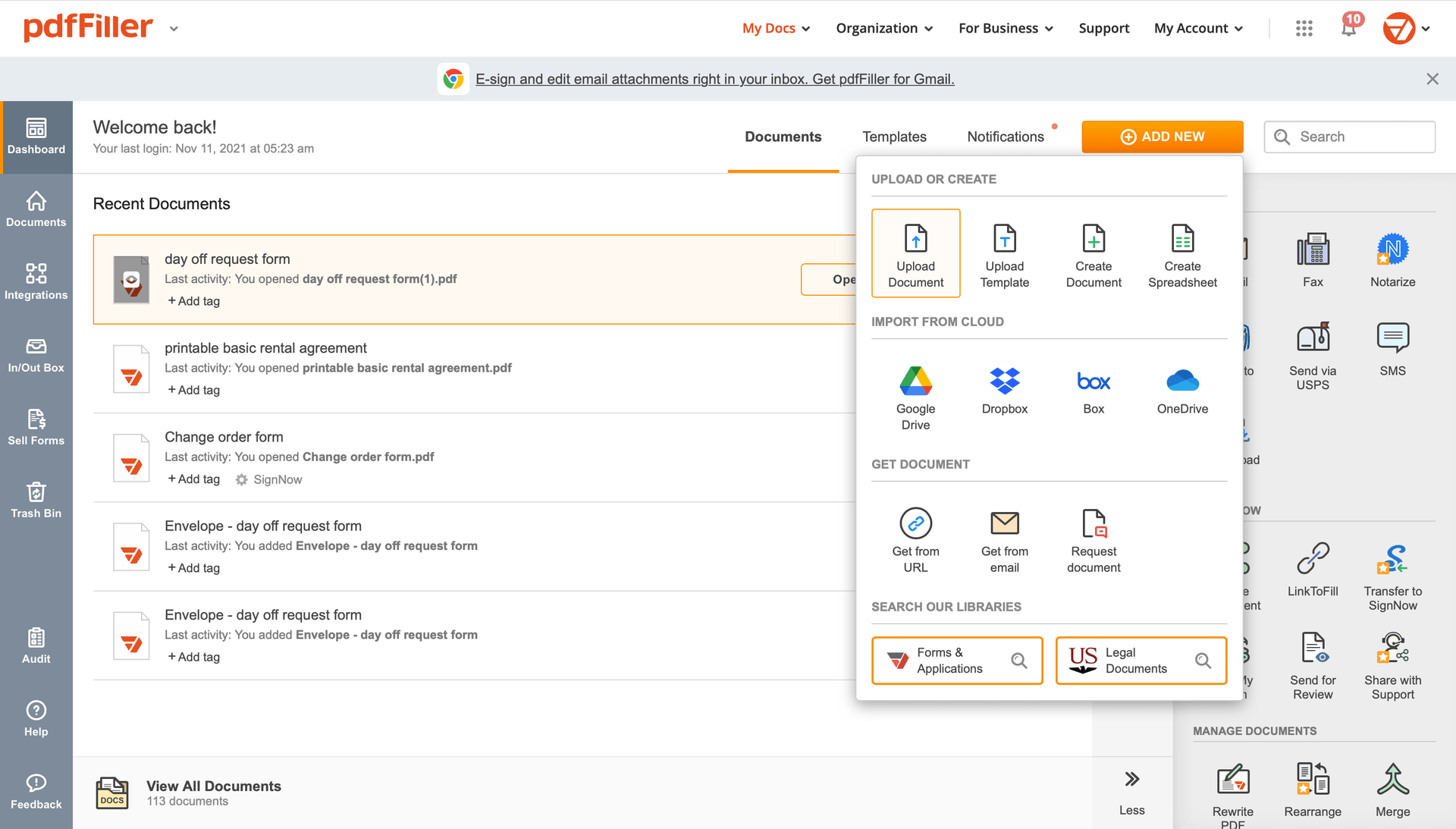

Choose any readily available option to add a PDF file for signing.

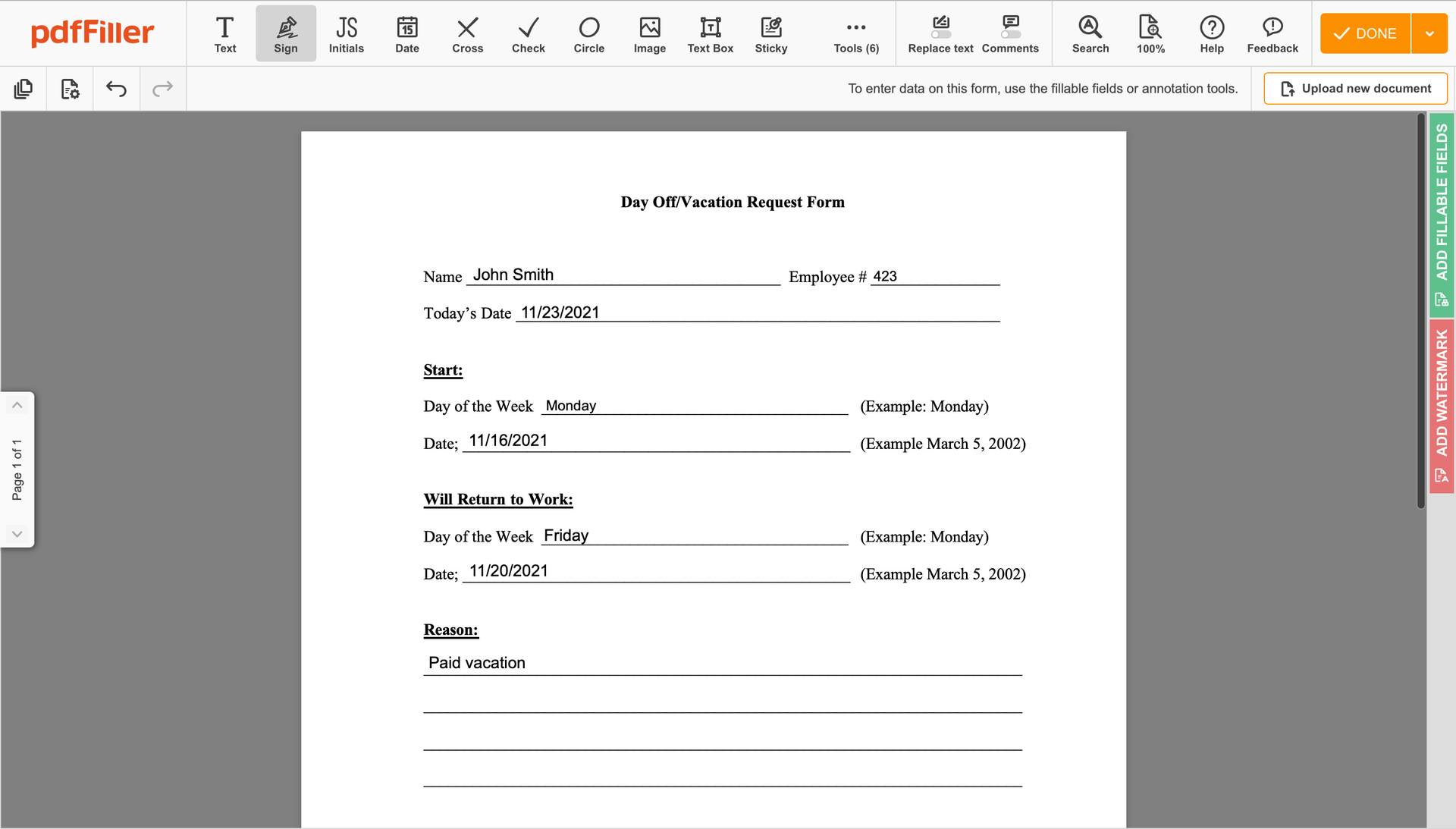

Use the toolbar at the top of the interface and select the Sign option.

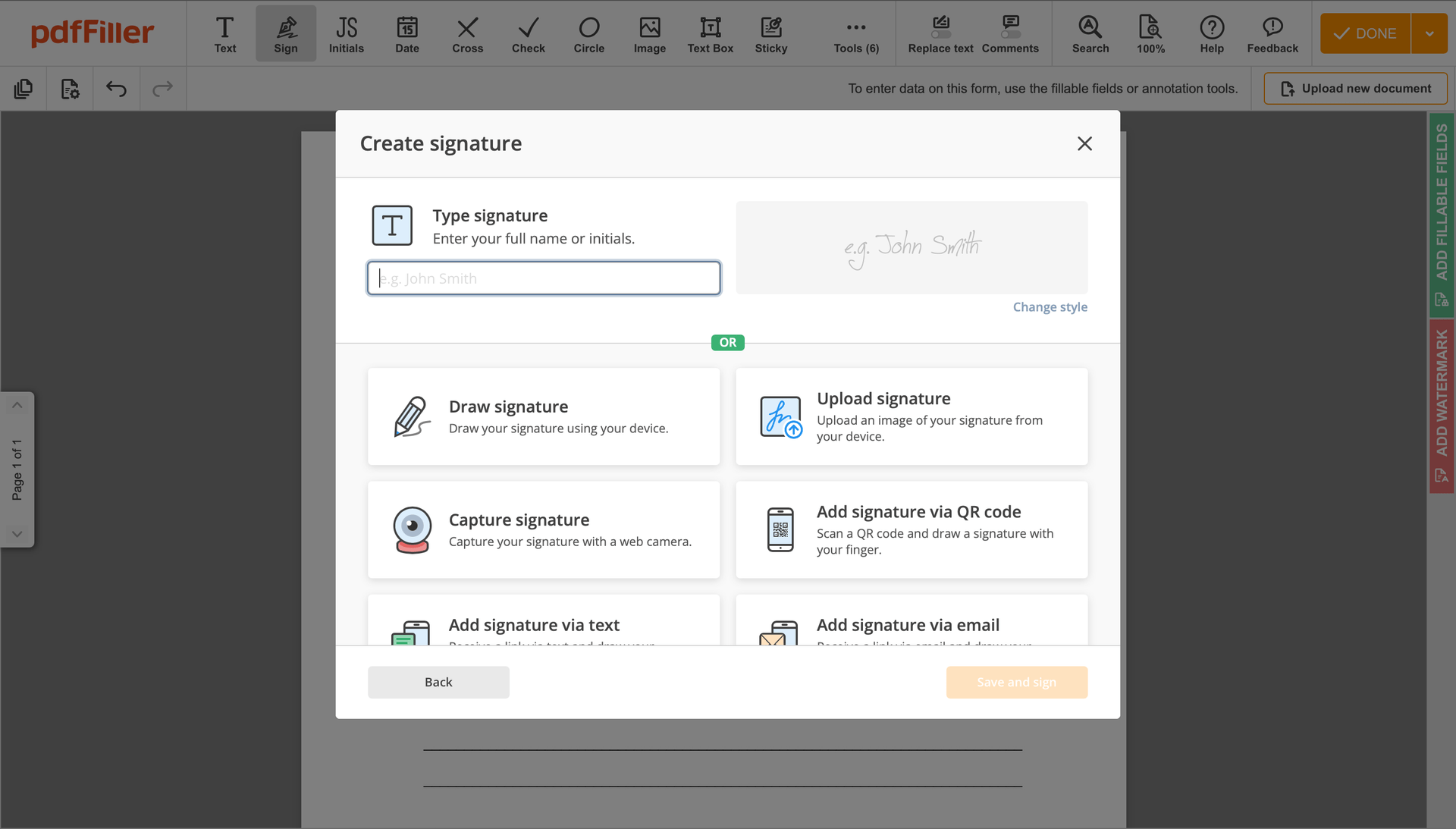

You can mouse-draw your signature, type it or upload a photo of it - our solution will digitize it automatically. Once your signature is set up, click Save and sign.

Click on the form place where you want to add an Signature Service Money Loan Contract. You can drag the newly created signature anywhere on the page you want or change its configurations. Click OK to save the adjustments.

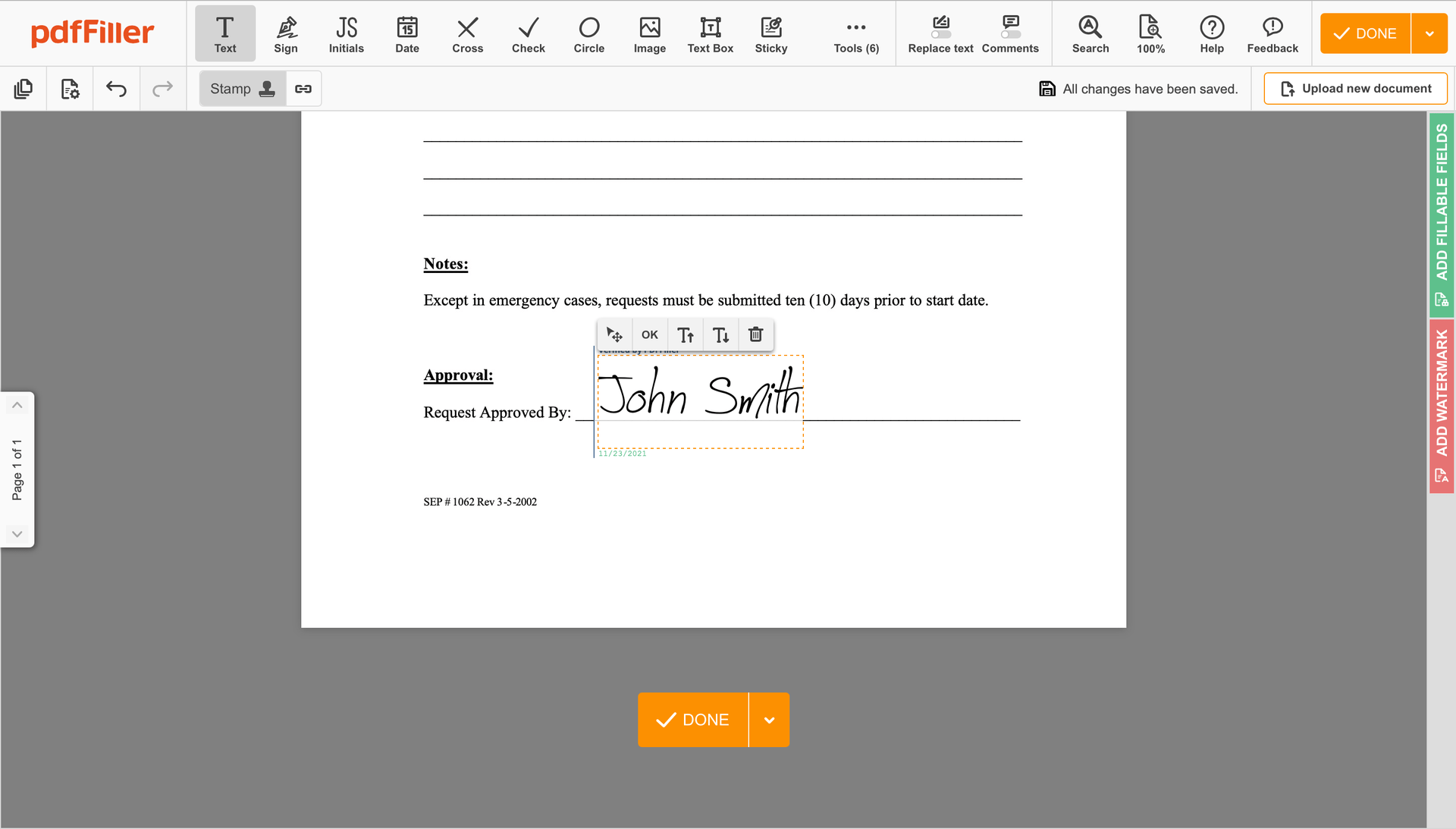

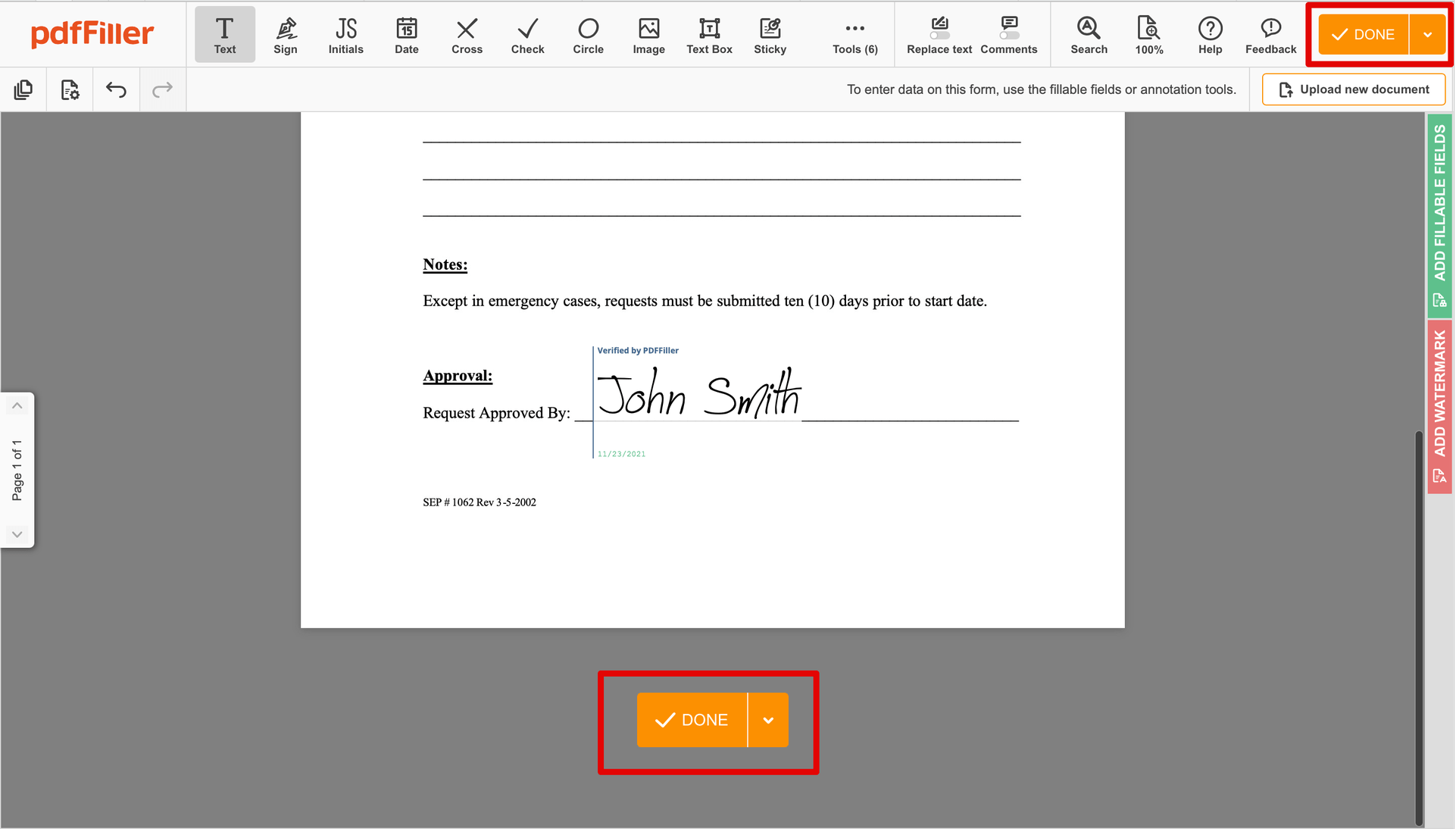

As soon as your form is ready to go, click on the DONE button in the top right corner.

As soon as you're through with certifying your paperwork, you will be redirected to the Dashboard.

Utilize the Dashboard settings to download the executed copy, send it for further review, or print it out.

Still using multiple applications to sign and manage your documents? Use this all-in-one solution instead. Use our document management tool for the fast and efficient process. Create forms, contracts, make template sand many more useful features, within one browser tab. Plus, you can use Signature Service Money Loan Contract and add major features like orders signing, reminders, attachment and payment requests, easier than ever. Pay as for a lightweight basic app, get the features as of a pro document management tools. The key is flexibility, usability and customer satisfaction. We deliver on all three.

How to edit a PDF document using the pdfFiller editor:

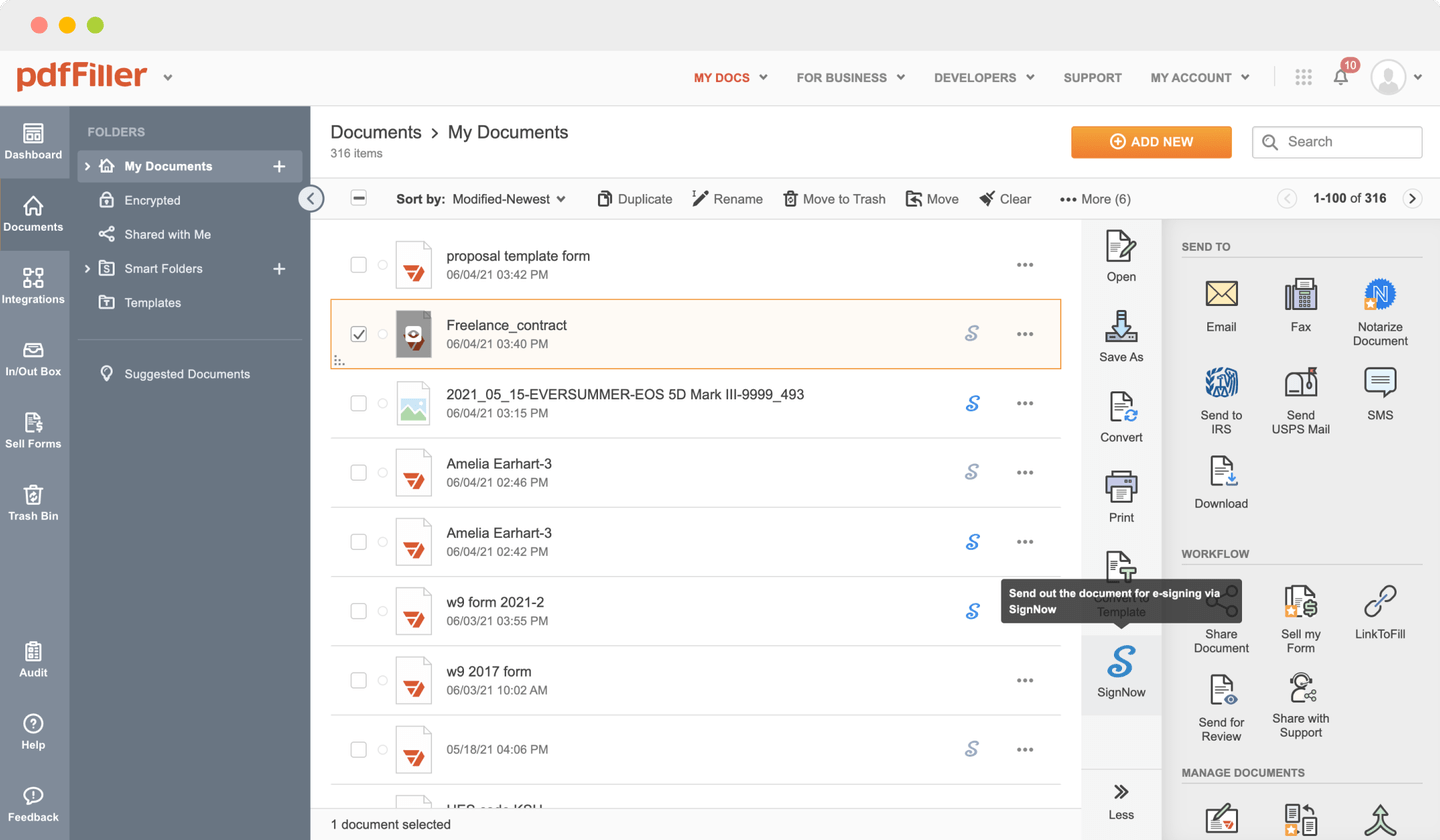

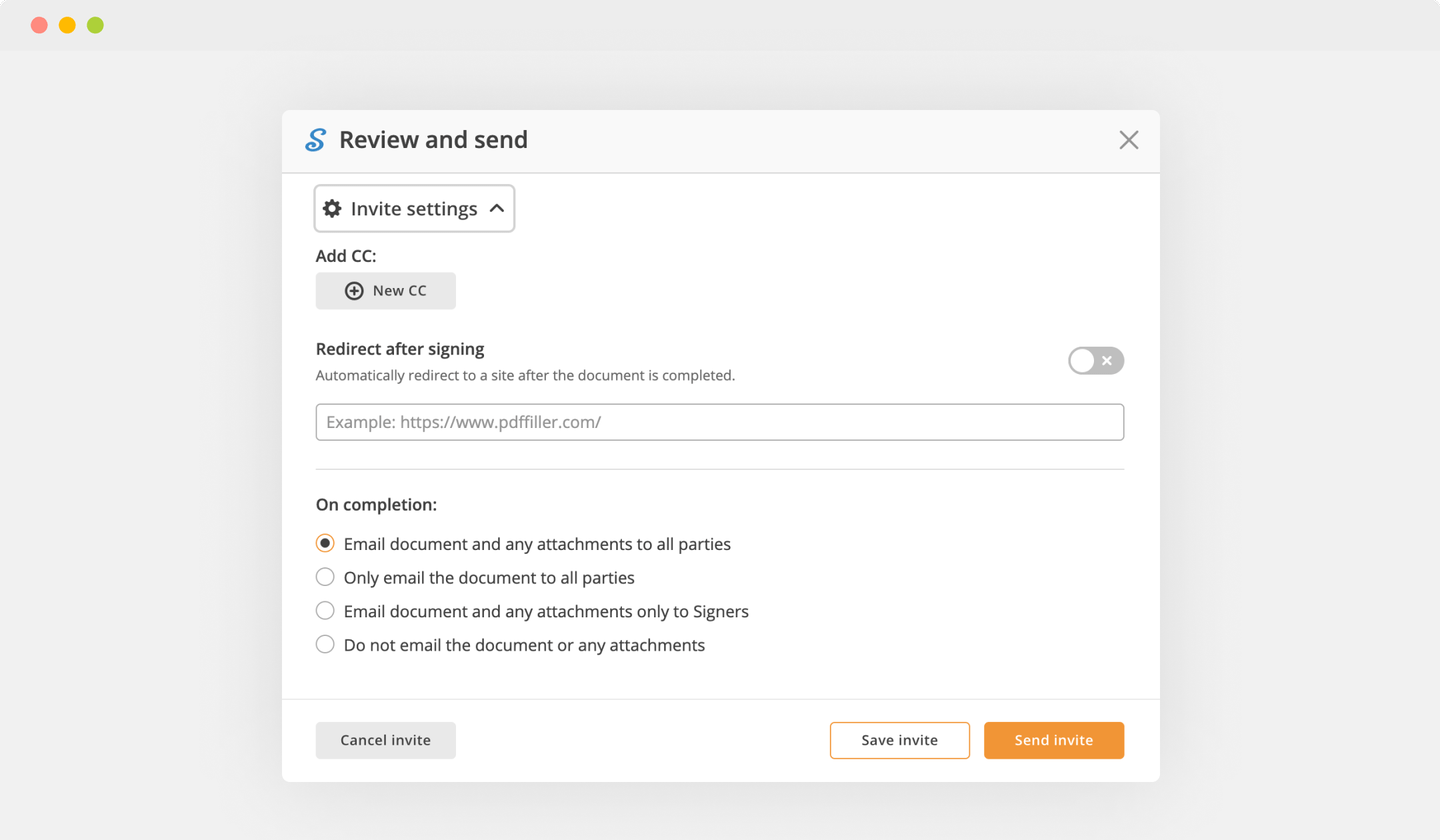

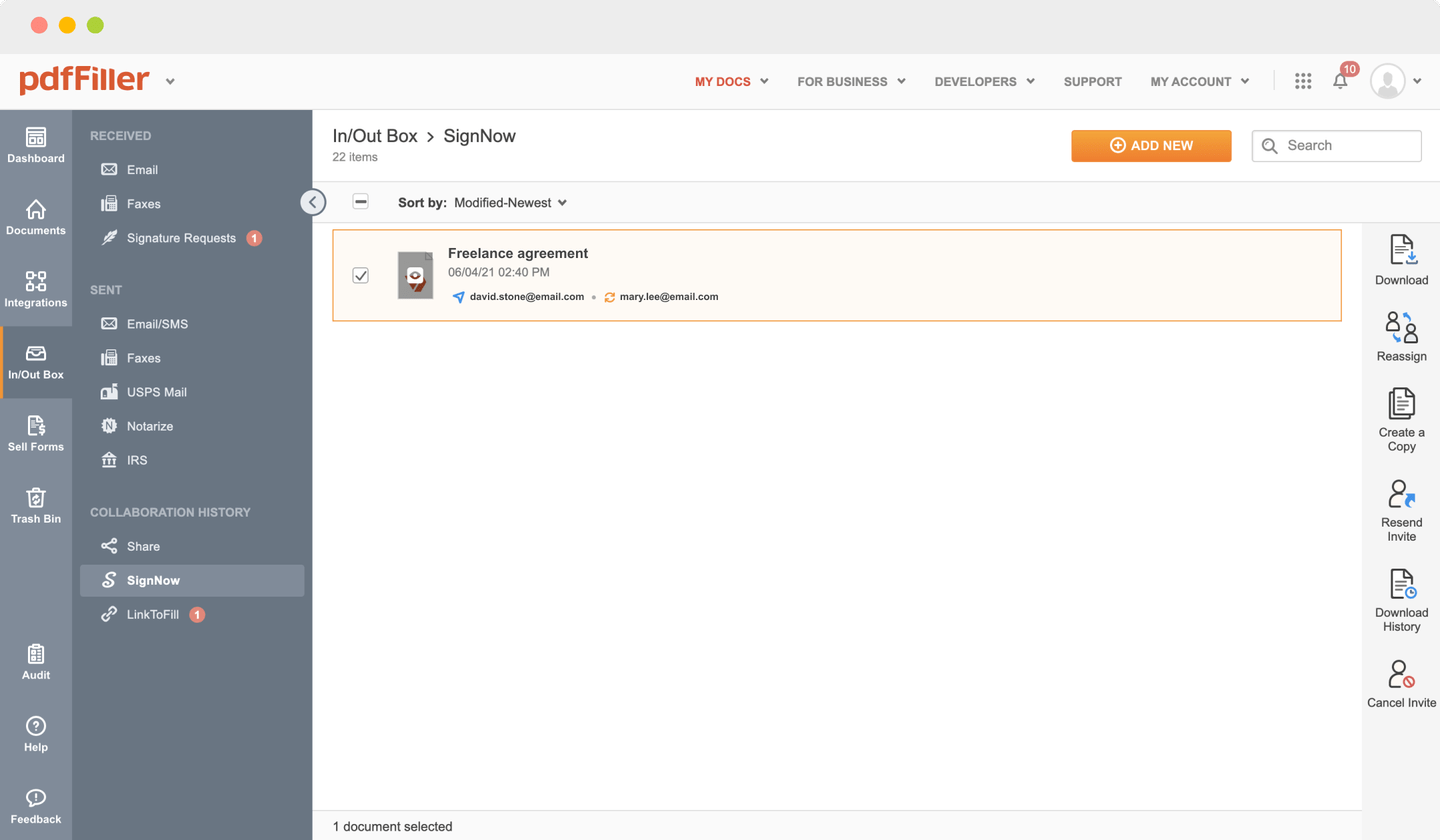

How to Send a PDF for eSignature

What our customers say about pdfFiller

PDFfiller is a great way for me to pre-fill documents that I use on a regular basis for my clients. By having as many fields clearly completed as possible, transactions that may have been held up due to illegible or missing information can be processed much more quickly. Clients also appreciate not having to do as much work! I also like the fact that I can use a social media signin for PDFfiller instead of having to create a separate user ID and password. It's one less thing that I have to remember.

What do you dislike?

Sometimes, I get frustrated by the "auto-detect" feature that highlights an entire line of a form. I'd rather use the text insertion feature and place text where I want it rather than have to edit the whole line. The other frustrating thing is having to make sure you're logged out on one computer before using it on another device in the office!

Recommendations to others considering the product:

I recommend PDFfiller without hesitation, with one caveat: only one sign-in is allowed at a time per user. If you use multiple computers at your place of employment, make sure you're signed out of PDFfiller on one computer before trying to sign on with the other. It will save you some aggravation. This is especially frustrating if you use the program on a desktop and a laptop and forget to sign out of the desktop computer before bringing the laptop home to work remotely. I did do a lot of research before deciding to invest in PDFfiller, and after my due diligence was hard-pressed to find an option with all of the features that I needed and at a price point that I felt was affordable. For the money, PDFfiller is a great investment for offices looking for ease and convenience with pre-filling forms. The learning curve is not very steep, and there is a lot of functionality for adding features besides text: check/"x" in specific boxes, highlighting, erasing, etc. I have used all of those features with little to no difficulty. Erasing is a bit of a science, with some trial and error involved in determining the exact size of the eraser needed for the job. Being able to move inserted text around easily and increase or decrease the font size as needed is a very helpful feature, especially if you want to call attention to certain pieces of information or make them stand out from the rest of the document. While I have not used the signature feature very often, I have found it to be useful in the rare instances that I have needed it. I have a copy of my signature saved in PDFfiller, which makes it very easy to insert a signature field into documents. Clients also appreciate this feature as well.

What problems are you solving with the product? What benefits have you realized?

PDFfiller is making it a lot easier for me to personalize and email forms to my clients, improving their service experience and saving me time and trouble. It's a huge convenience for me and much appreciated by clients whose handwriting is less than clear! The biggest benefit to me is having a library of frequently used documents that I can pull up on the fly, make adjustments and edits to a few fields, and have a new document ready to go in a matter of minutes. I've also been able to add information in the "white spaces" of forms I have created in the past, to include client-specific text, contact information and other items.

The ablitiy to be able to edit documents in PDF format is great. Saving time. When we are bidding on a job i can use the form provided to us from the client. Very easy to use and has worked well ever time I have neede it. Another great feature is that the PDF filler is auto saved in your online profile... so you can take the documents with you.

What do you dislike?

some times when you go to open the PDF from my email directly... it does not up load... so then I have to down load the pdf on to my computure, open PDF fill web app then upload file..... not sure why it does this but it has happened more often lately than it did before.

Recommendations to others considering the product:

It would be great if the filler could be able to authenticate docuements, a big one for us is Bonding, When we submit a bond they require an e-bonding ( look it up) the ebond authenicates the signatures from 3 different parties and leave a digital paper trail that can be confrimed by the client. We recently had to do this and the one website mobile bonds.com has an interface that is not user freindly for set up... and we had to spend countless time with the tech on the phone for the first few bonds. If the filler is able to do this that would be great.

What problems are you solving with the product? What benefits have you realized?

Allowing us to make our bid proposals look great, avoid hand writing in documents, setting us apart from the rest. we also can share the file with my staff making it even better