Underwrite Electronic Signature Request For Free

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

Users trust to manage documents on pdfFiller platform

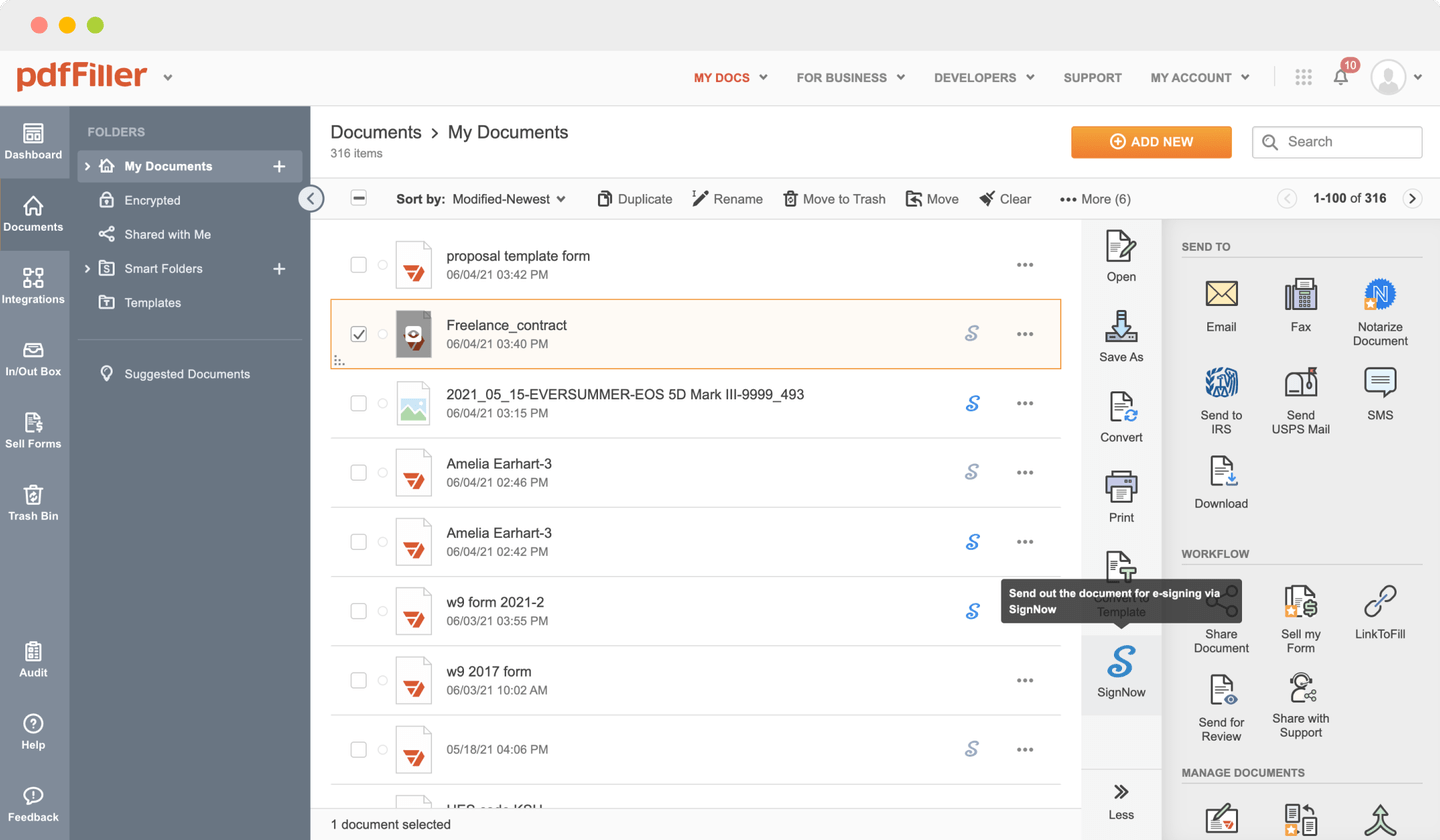

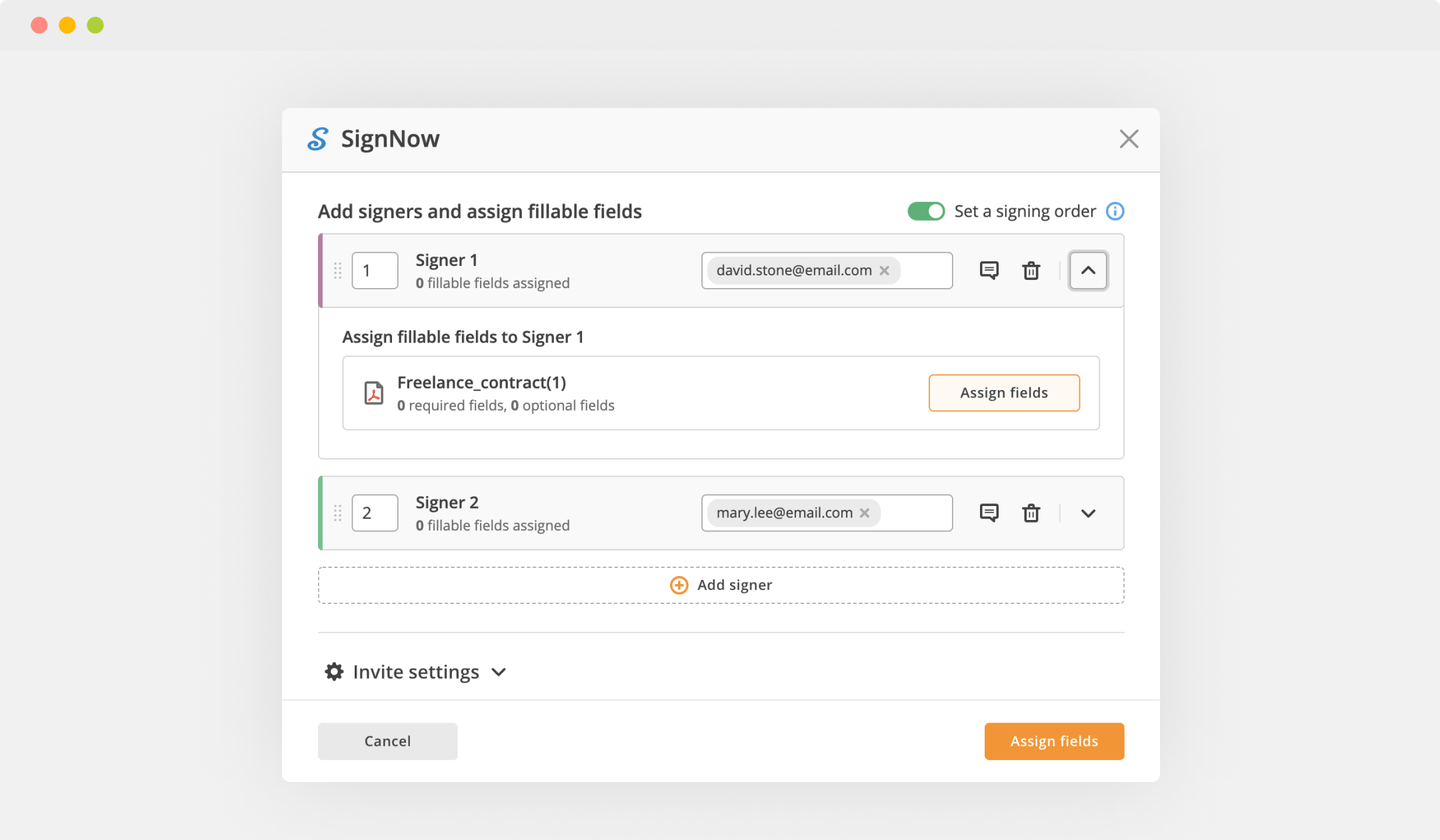

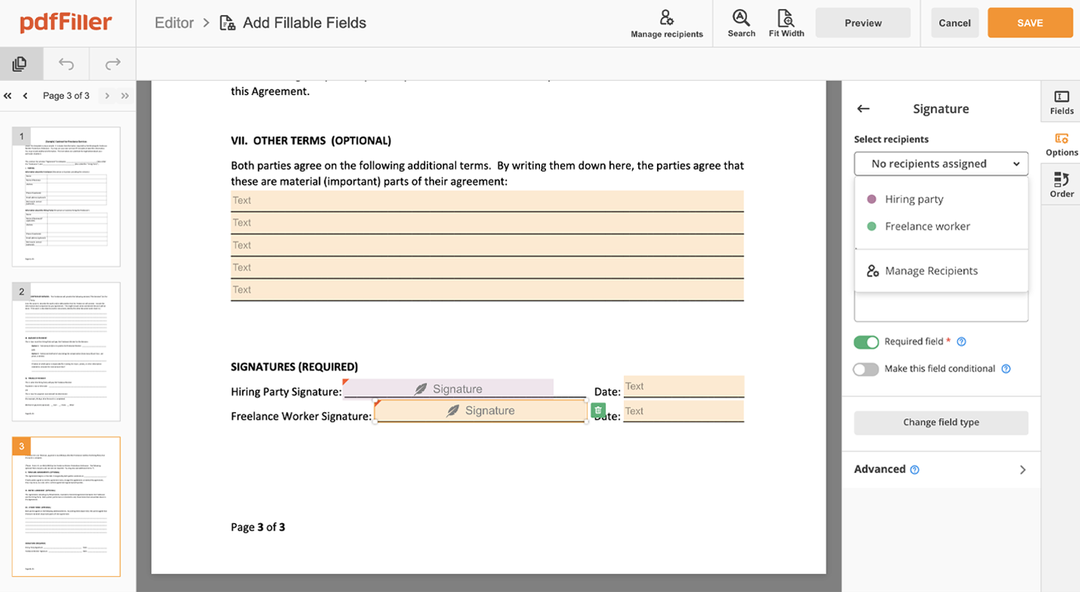

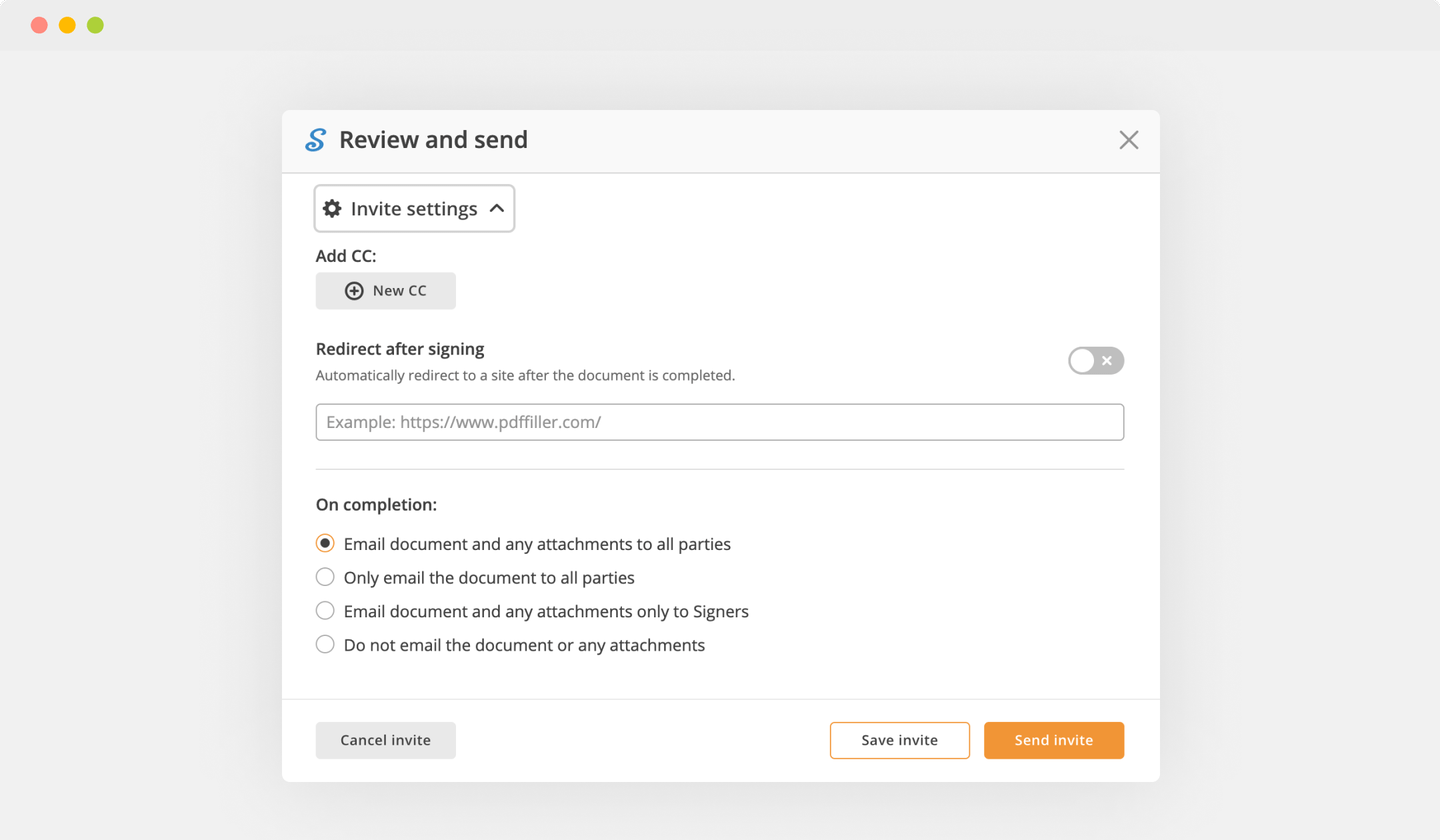

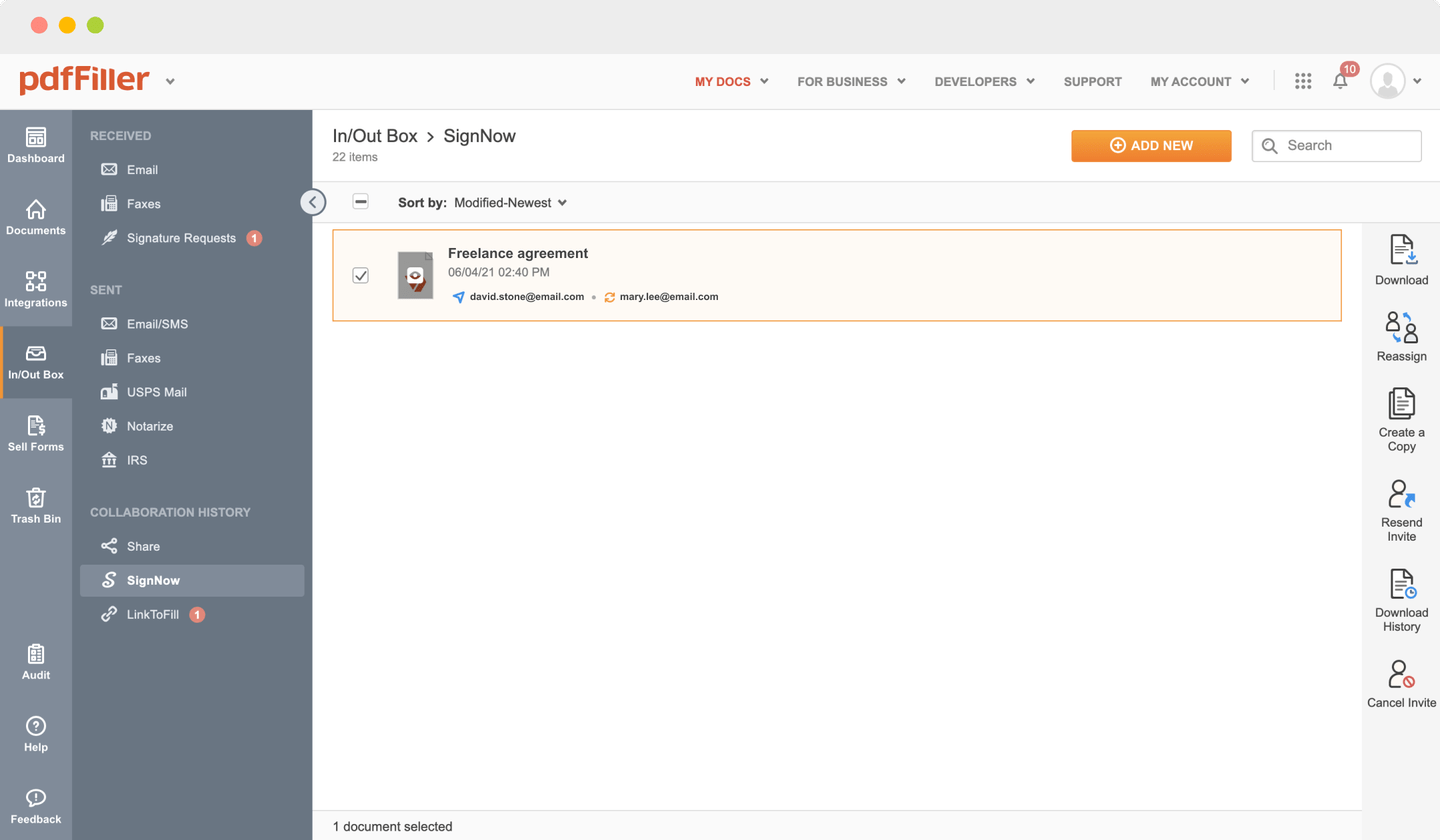

Send documents for eSignature with signNow

Create role-based eSignature workflows without leaving your pdfFiller account — no need to install additional software. Edit your PDF and collect legally-binding signatures anytime and anywhere with signNow’s fully-integrated eSignature solution.

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

pdfFiller scores top ratings in multiple categories on G2

How to Underwrite Electronic Signature Request

Are you stuck working with multiple programs to create and sign documents? Try our all-in-one solution instead. Document management becomes easier, faster and more efficient with our tool. Create forms, contracts, make templates, integrate cloud services and utilize even more useful features within one browser tab. You can Underwrite Electronic Signature Request directly, all features are available instantly. Have the value of full featured program, for the cost of a lightweight basic app. The key is flexibility, usability and customer satisfaction. We deliver on all three.

How-to Guide

How to edit a PDF document using the pdfFiller editor:

01

Upload your form to the uploading pane on the top of the page

02

Find the Underwrite Electronic Signature Request feature in the editor's menu

03

Make the required edits to the file

04

Click the orange “Done" button at the top right corner

05

Rename the template if it's necessary

06

Print, save or share the form to your desktop

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Lydia L

2016-02-23

Well I paid for the year then could not access a file I did the same day. Then I sent my accountant a file via attachment since he says "not technical" & could not open it in pdfiller file, so I sent as attachment so he could complete but he could not so he wrote it in now I have to complete it & paying him the same.

Hannah B.

2020-01-31

Pdffiller

Pdffiller makes it easy to add in information on a copy of something that is used widely throughout company for all employees. It saves the time, hassle and trees not having to print it out, fill it out and send it back in.

There wasn't anything that i disliked about the software

Get a powerful PDF editor for your Mac or Windows PC

Install the desktop app to quickly edit PDFs, create fillable forms, and securely store your documents in the cloud.

Edit and manage PDFs from anywhere using your iOS or Android device

Install our mobile app and edit PDFs using an award-winning toolkit wherever you go.

Get a PDF editor in your Google Chrome browser

Install the pdfFiller extension for Google Chrome to fill out and edit PDFs straight from search results.

List of extra features

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can you sign closing documents electronically?

Your real estate agent may email you a scanned copy of your closing documents, as a PDF attachment. You don't have to print the PDF to sign your refinancing or real estate documents. Make your life easier by electronically signing them even from your phone. Use the same process for electronically signing a Word document.

Does Fannie Mae accept electronic signatures?

Does Fannie Mae accept electronic signatures on mortgage closing documents? Yes. Per the Selling Guide, we accept signatures on most documents used to originate or service a loan.

Does HUD allow electronic signatures?

HUD Real Estate Owned (RED) Documents: Electronic signatures will be accepted on the HUD RED Sales Contract and related addenda.

Can the FHA amendatory clause be signed electronically?

HUD 4000.1 says that if it meets FHA criteria, yes. An electronic signature conducted in accordance with the Electronic Signature Performance Standards (Performance Standards) is accepted on FHA documents requiring signatures to be included in the case binder for mortgage insurance, unless otherwise prohibited by law.

Is a wet signature necessary?

When to Use Wet Signatures There are also certain documents that are required by law to contain a wet signature. For example, there are certain banks that require a wet signature for loan documents. So you're able to sign contracts, agreements, and finance documents electronically as long as all parties agree.

What is Dogmatic?

Welcome to DocMagic A secure digital environment for intuitive signatures, document management and delivery. Borrowers, lenders and closing agents share critical documents and data via our mobile app.

What triggers a revised loan estimate?

A revised loan estimate may only be provided if the original disclosures stated clearly and conspicuously that at any time prior to 60 days before consummation, the lender may issue revised disclosures. If no such statement is provided, the lender may not issue revised disclosures.

What is a revised loan estimate?

As your lender works to verify the information in your loan application, you may receive revised Loan Estimates. These new Loan Estimates indicate that something important has changed about the loan and its costs.

What happens after you sign the closing disclosure?

After choosing a lender and running the gantlet of the mortgage underwriting process, you will receive the Closing Disclosure. It provides the same information as the Loan Estimate but in final form. This means that it contains the locked-in costs of your loan and the specific amount you'll need to pay at closing.

Who is required to receive a closing disclosure?

The creditor is required to provide the consumer Closing Disclosure at least three business days before consummation. The CFPB says that business day for purposes of the Closing Disclosure is the rescission-based business day definition, and means all calendar days except Sundays and legal public holidays.

What happens after the loan estimate?

When you receive a Loan Estimate it does not mean that your loan has been approved or denied. The Loan Estimate shows you what loan terms we can offer you if you decide to move forward. After you receive your Loan Estimate, it is up to you to decide whether to move forward with us or not.

What happens after signing closing disclosure?

After choosing a lender and running the gantlet of the mortgage underwriting process, you will receive the Closing Disclosure. It provides the same information as the Loan Estimate but in final form. This means that it contains the locked-in costs of your loan and the specific amount you'll need to pay at closing.

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.