Utilize Approve Lease For Free

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

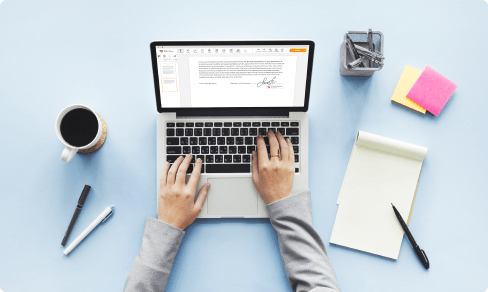

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

Users trust to manage documents on pdfFiller platform

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Andrew M

2018-10-26

Easy to use. Lots of Features. Need to pay a few more dollars to use everything, but great value if you need to combine different documents to create one.

Verified Reviewer

2019-01-29

PDFfiller is da bomb

I like how easy it is to edit a pdf and change what you want or add what you want to it

I find it difficult to see how big or small the font is until I print it

Get a powerful PDF editor for your Mac or Windows PC

Install the desktop app to quickly edit PDFs, create fillable forms, and securely store your documents in the cloud.

Edit and manage PDFs from anywhere using your iOS or Android device

Install our mobile app and edit PDFs using an award-winning toolkit wherever you go.

Get a PDF editor in your Google Chrome browser

Install the pdfFiller extension for Google Chrome to fill out and edit PDFs straight from search results.

pdfFiller scores top ratings in multiple categories on G2

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What kind of credit score do you need to lease a car?

Accredit.org suggests that the typical minimum credit score to be approved for a lease is 620. The best rates are available for lessees with credit scores above 660.

What FICO score do you need to lease a car?

Leasing industry trade groups generally agree that a FICO score of 620 is the average minimum score for approving a lease application. Of course, that's not to say someone with a lower score can't lease a car. It just means they will have a harder time qualifying, and will likely pay more for the lease.

Is it easier to get approved for a car lease?

Depending on whether you can get approved for a lease, there might not even be a choice. But if you can get approved for both a loan and a lease, then the choice becomes harder. Even with the added costs that come with a low credit score, that lease might still be cheaper than the payments on a car loan.

Can you lease a car with a 500 credit score?

It's not impossible to lease a car if you have a bad credit score. Though you may still be able to get a lease, you'll pay a higher down payment and monthly rate than if your score is higher. As a general rule, dealerships look for lessees with credit scores in the good range or above for the best deals.

Does lease a car hurt your credit score?

Leasing a car does affect your credit score, and usually it can help you build credit. However, if you miss payments, it can be detrimental to your credit. Understanding the implications of leasing and preparing your credit will help you get the best rates and manage your finances.

Can you lease a car with a 580 credit score?

You don't need a certain credit score to lease a car. But people with credit scores below 580 have taken out roughly 13% of the auto loans and leases over the past decade, according to data from Equifax. And more than 7% of new leases go to people with credit scores of 300 to 600.

Can I get a car with a 580 credit score?

Credit Score of 580: Car Loans Buying a car with a credit score of 580 is possible, but higher interest rates are always given to people with bad credit. First, let's take the average amount borrowed by car buyers: $27,000 according to Melinda Babinski, Experian's senior director of automotive credit.

Can you lease a car with a credit score of 600?

A Credit Score Below 600 is Considered a Subprime Lease According to most experts in the field of auto financing and leasing, the best lease terms are reserved for those with credit scores above 700. For those with scores lower than this, leasing options still exist in the subprime financing category.

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.