Tax Donation Form Templates

What are Tax Donation Form Templates?

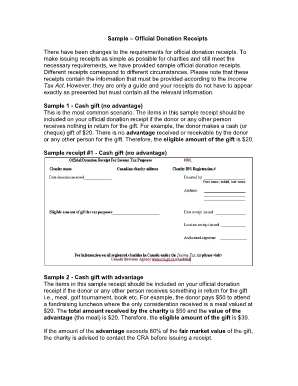

Tax Donation Form Templates are pre-designed documents that individuals and organizations can use to record and report donations made for tax purposes. These templates make it easier for users to accurately document their charitable contributions and claim appropriate deductions on their tax returns.

What are the types of Tax Donation Form Templates?

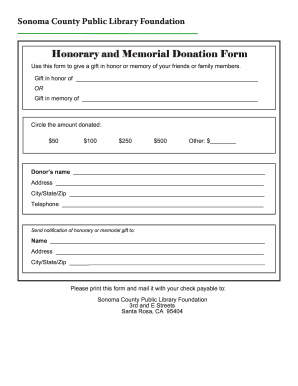

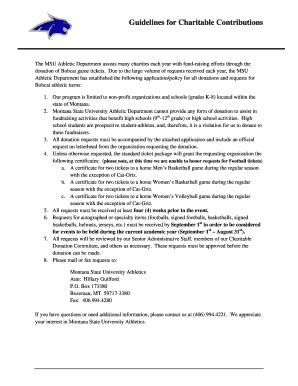

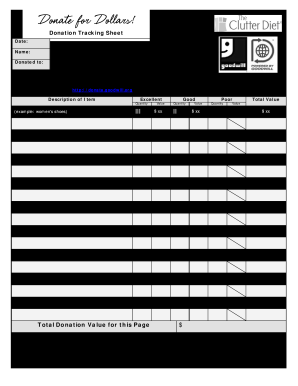

There are several types of Tax Donation Form Templates available, including but not limited to: 1. Blank Donation Form Templates 2. Receipt for Donation Templates 3. Donation Acknowledgement Letter Templates 4. Tax Deductible Donation Receipt Templates

How to complete Tax Donation Form Templates

Completing Tax Donation Form Templates is a straightforward process that involves the following steps: 1. Fill in the donor's information, including name, address, and contact details. 2. Specify the donation amount or value and provide a detailed description of the donated items. 3. Include the recipient organization's information and any acknowledgment details. 4. Sign and date the form to validate the donation.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.