Affirmative Action Plan Software

What is Affirmative action plan software?

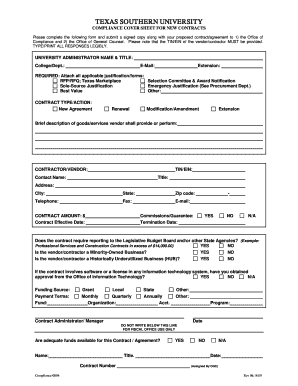

Affirmative action plan software is a specialized tool designed to help businesses create and implement policies that promote diversity and equal opportunity in the workplace. This software facilitates the process of developing, tracking, and reporting on affirmative action initiatives, ensuring compliance with legal requirements and promoting a fair and inclusive work environment.

What are the types of Affirmative action plan software?

There are several types of Affirmative action plan software available, each offering unique features and functionalities to support businesses in their diversity and inclusion efforts. Some common types of Affirmative action plan software include:

How to complete Affirmative action plan software

Completing an Affirmative action plan using software can be a straightforward process if you follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.