Cobra Insurance Rules

What is Cobra insurance rules?

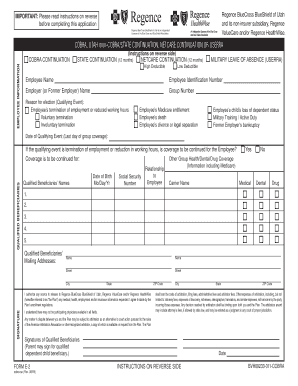

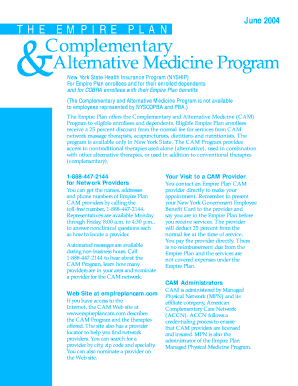

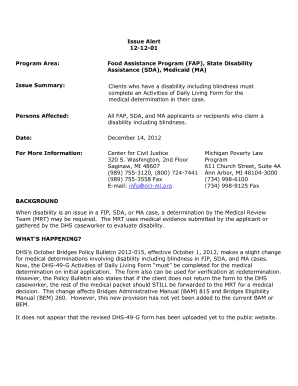

Cobra insurance rules refer to the regulations that ensure individuals have the option to continue their health insurance coverage when they would otherwise lose it due to specific qualifying events.

What are the types of Cobra insurance rules?

There are two main types of Cobra insurance rules: Federal COBRA and State Continuation. Federal COBRA applies to employers with 20 or more employees, while State Continuation applies to smaller companies that are not subject to Federal COBRA.

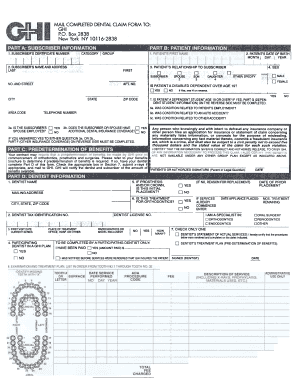

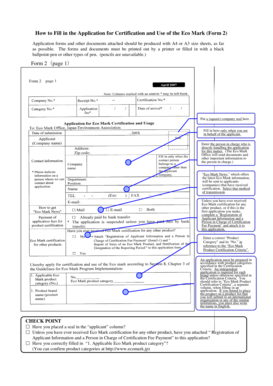

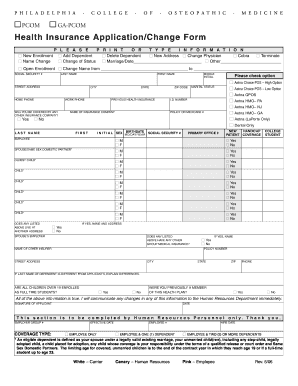

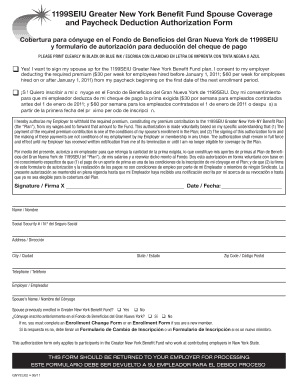

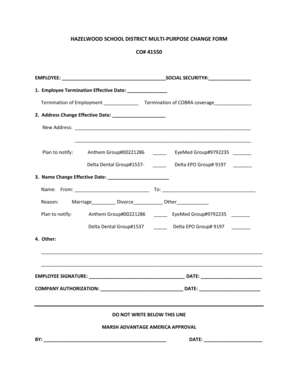

How to complete Cobra insurance rules

Completing Cobra insurance rules is essential to ensuring uninterrupted healthcare coverage. Here are the steps to successfully complete Cobra insurance rules:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.