Insurance Underpayment Appeal Letter

What is Insurance underpayment appeal letter?

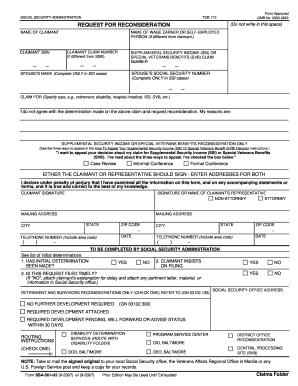

An Insurance underpayment appeal letter is a formal written request submitted by policyholders or healthcare providers to insurance companies to review and reconsider the amount of payment made for a specific claim. It usually includes details of the claim, reasons for appealing, and any supporting documentation to make a strong case for a higher reimbursement.

What are the types of Insurance underpayment appeal letter?

There are several types of Insurance underpayment appeal letters, including:

Medical Insurance Underpayment Appeal Letter

Auto Insurance Underpayment Appeal Letter

Home Insurance Underpayment Appeal Letter

Dental Insurance Underpayment Appeal Letter

Life Insurance Underpayment Appeal Letter

How to complete Insurance underpayment appeal letter

To effectively complete an Insurance underpayment appeal letter, follow these steps:

01

Begin by addressing the letter to the appropriate contact person at the insurance company.

02

Clearly state the reason for the appeal and provide all relevant details of the claim.

03

Attach any supporting documentation such as medical records, bills, or receipts.

04

Clearly state the desired outcome or resolution you are seeking.

05

Close the letter with a polite and professional tone, expressing gratitude for their attention and consideration.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Insurance underpayment appeal letter

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Are insurance companies denying more claims?

One insurer denied 49% of claims in 2021. another's turndowns hit an astonishing 80% in 2020. Despite the potentially dire impact that denials have on patients' health or finances, data shows that people appeal only once in every 500 cases.

How do I write an appeal letter for reimbursement?

Things to Include in Your Appeal Letter Patient name, policy number, and policy holder name. Accurate contact information for patient and policy holder. Date of denial letter, specifics on what was denied, and cited reason for denial. Doctor or medical provider's name and contact information.

How do you write a good appeal letter?

Content and Tone Opening Statement. The first sentence or two should state the purpose of the letter clearly. Be Factual. Include factual detail but avoid dramatizing the situation. Be Specific. Documentation. Stick to the Point. Do Not Try to Manipulate the Reader. How to Talk About Feelings. Be Brief.

What percentage of claims are denied?

We find that, across HealthCare.gov insurers with complete data, nearly 17% of in-network claims were denied in 2021. Insurer denial rates varied widely around this average, ranging from 2% to 49%. CMS requires insurers to report the reasons for claims denials at the plan level.

Why are most insurance claims denied?

Unfortunately, insurance companies can — and do — deny policyholders' claims on occasion. Some of the most common reasons for claim denials are exceeding the policy limit, lacking the needed coverage and breaking the law. Additionally, sometimes claims are incorrectly denied.

How do I write an appeal letter for insurance?

How to write an appeal letter to insurance company appeals departments Step 1: Gather Relevant Information. Step 2: Organize Your Information. Step 3: Write a Polite and Professional Letter. Step 4: Include Supporting Documentation. Step 5: Explain the Error or Omission. Step 6: Request a Review. Step 7: Conclude the Letter.