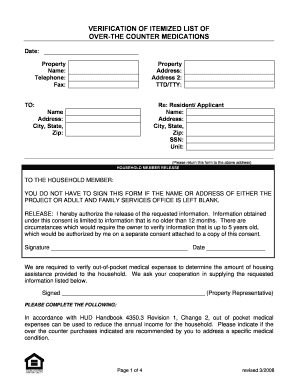

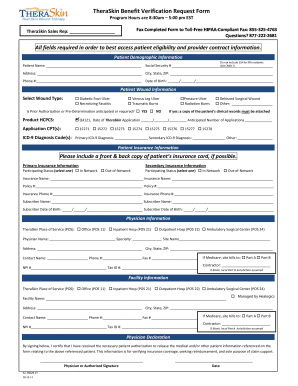

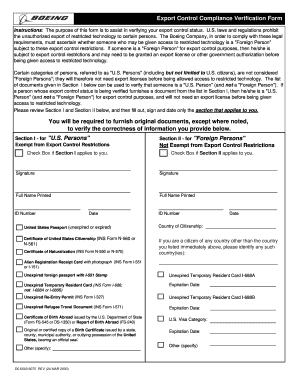

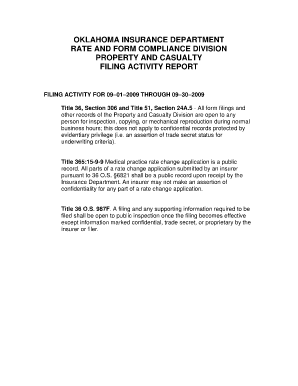

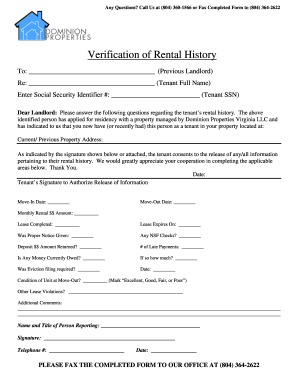

Sample Insurance Verification Form

What is Sample insurance verification form?

The Sample insurance verification form is a document used by insurance companies to confirm the coverage details of an individual or entity. It includes important information such as policy number, coverage start and end dates, and types of insurance included in the policy.

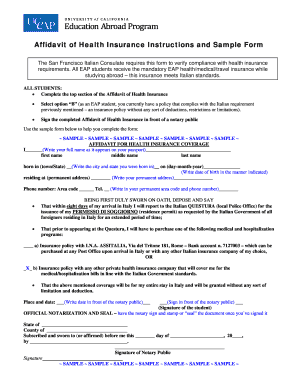

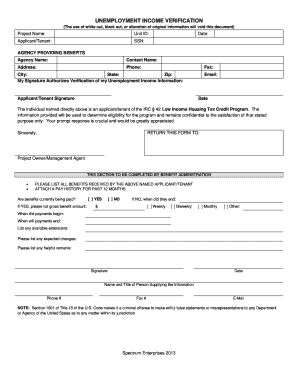

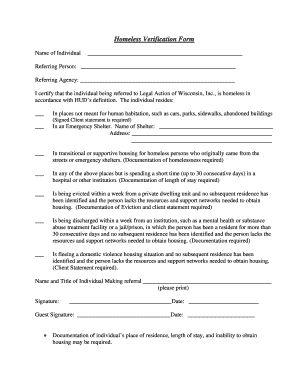

What are the types of Sample insurance verification form?

There are several types of Sample insurance verification forms that insurance companies may use. Some common types include: 1. Health insurance verification form 2. Auto insurance verification form 3. Home insurance verification form 4. Business insurance verification form

How to complete Sample insurance verification form

Completing a Sample insurance verification form is a straightforward process. Follow these steps to ensure accurate and timely submission:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.