Travel Claim Form Format

What is Travel claim form format?

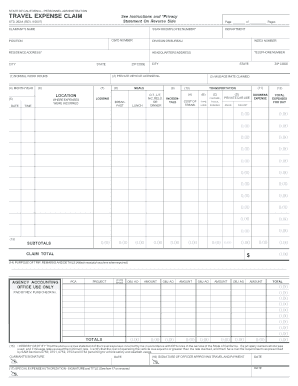

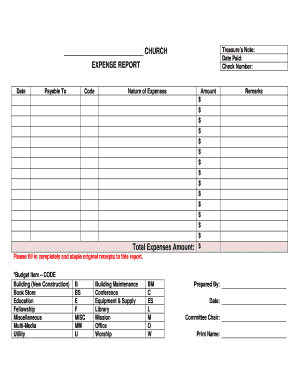

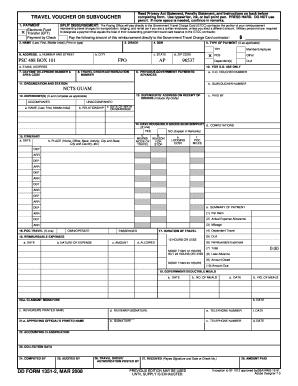

The Travel claim form format is a standardized document used to report expenses incurred during business trips or other travel-related activities. It typically includes fields for entering details such as travel dates, transportation costs, accommodation expenses, meals, and other related expenses.

What are the types of Travel claim form format?

There are several types of Travel claim form formats tailored to specific needs. Some common types include:

Mileage reimbursement form

Meal expense form

Lodging expense form

Incidentals expense form

How to complete Travel claim form format

Completing a Travel claim form format can be a straightforward process if you follow these steps:

01

Gather all necessary receipts and documentation for expenses incurred during the trip.

02

Fill in the required fields accurately, including dates, amounts, and descriptions of expenses.

03

Review the form carefully to ensure all information is accurate and complete before submitting it for reimbursement.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Travel claim form format

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I prove travel expenses for taxes?

The best way to prove business travel expenses (including hotels, flights, rental cars, meals, and entertainment) is to use a credit card slip (using your business card, of course) with additional notes on the business purpose. Make the note at the time you incur the expense.

How do I claim travel expenses?

Claiming your travel expenses To make your claim for travel expenses you will need to complete a P87 form and possibly a self assessment tax return depending on the value of your travel claim.

Can you claim reimbursed travel expenses?

Most reimbursements for ordinary and necessary travel expenses for temporary travel are not taxable. However, if the work at the temporary location is expected to last longer than a year or for an indefinite period of time, the reimbursement is taxable.

How to write a letter for reimbursement of travel expenses?

I recently incurred some travel expenses while working and am submitting my expenses claim here. I've kept all receipts and attached them to this message. The expenses all relate to a trip I had to take for (insert reasons why). My manager approved the trip (insert manager's name and copy them into the email).

What is a travel allowance expense?

Transportation expenses for additional travel outside employees' regular commute. This can encompass airfares, taxi or local transportation costs, car hire, motorway tolls, parking fees, and standard mileage rates when staff use their personal vehicles. A meal allowance for food and drink consumed on the business trip.

Can I claim transportation on my taxes?

If your home is your main place of business, you can deduct transportation expenses you incur. The expenses must be for going from your home to another work location in the same trade or business.