Acquisition Term Sheet Template

What is Acquisition term sheet template?

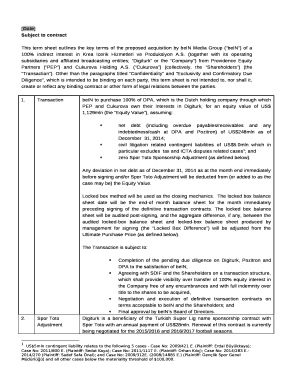

An Acquisition term sheet template is a document that outlines the basic terms and conditions of a proposed acquisition. It typically includes information about the purchase price, payment structure, due diligence process, and any other important details related to the acquisition.

What are the types of Acquisition term sheet template?

There are several types of Acquisition term sheet templates available, each catering to different types of acquisitions. Some common types include:

Asset Purchase Agreement Template

Stock Purchase Agreement Template

Merger Agreement Template

Letter of Intent Template

How to complete Acquisition term sheet template

Completing an Acquisition term sheet template involves the following steps:

01

Fill in the details of the parties involved in the acquisition

02

Specify the purchase price and payment terms

03

Outline any conditions or contingencies of the acquisition

04

Include any deadlines for completing due diligence or finalizing the acquisition

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Acquisition term sheet template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What should be included in a term sheet?

A term sheet used as part of a merger or attempted acquisition would typically contain information regarding the initial purchase price offer, the preferred payment method, and the assets included in the deal.

What is the purpose of a term sheet?

A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made. Term sheets are most often associated with start-ups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

What is an acquisition term sheet?

A term sheet is a mostly non-binding document signed by the target and the prospective buyer that describes the major terms of the proposed acquisition. While most term sheets are non-binding, they often contain binding provisions regarding non-soliciation, exculsivity and confidentiality.

What is the difference between a term sheet and an LOI?

A term sheet is a short document that lays out the basics of the terms of an investment deal. It doesn't include financial details or conditions for closing the deal. The LOI — which stands for a letter of intent — is a slightly longer document that details some of the terms of an investment deal.

Is a letter of intent a term sheet?

A Letter of Intent is, as its name suggests, often prepared in the form of a letter from one party (typically the would-be Buyer) to the other (the Seller or target company). On the other hand, a Term Sheet is generally crafted in a sort-of outline format, sometimes even in bullet points.

How do you write a terms sheet?

6 Tips for Writing a Term Sheet List the terms. Summarize the terms. Explain the dividends. Include liquidation preference. Include voting agreement and closing items. Read, edit and prepare for signatures.