Sba Loan Closing Process

What is Sba loan closing process?

The SBA loan closing process refers to the procedures and steps involved in finalizing a Small Business Administration (SBA) loan. It is the final stage where all necessary documentation is reviewed, and the loan is officially approved and funded.

What are the types of Sba loan closing process?

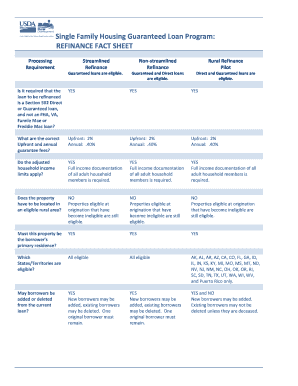

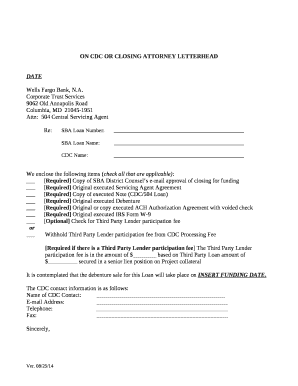

There are several types of SBA loan closing processes based on the specific loan program. Some common types include the 7(a) loan closing process, CDC/504 loan closing process, and microloan closing process.

7(a) loan closing process

CDC/504 loan closing process

Microloan closing process

How to complete Sba loan closing process

To successfully complete the SBA loan closing process, follow these steps:

01

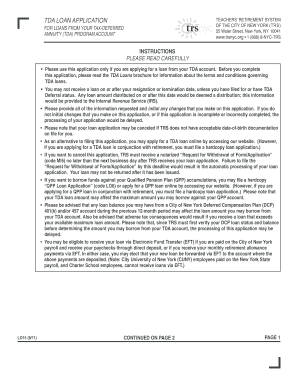

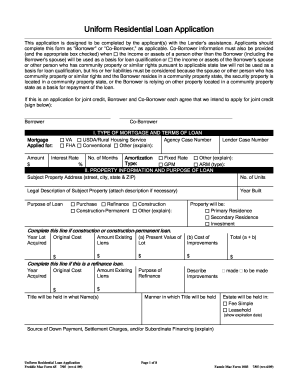

Gather all required documentation, including financial statements and business plans.

02

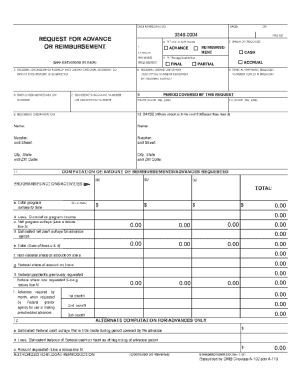

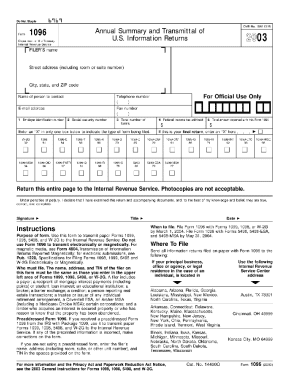

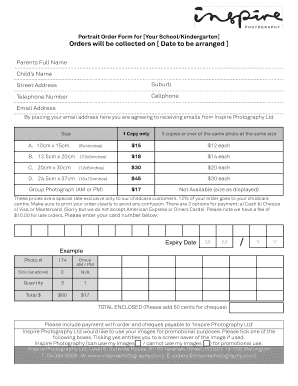

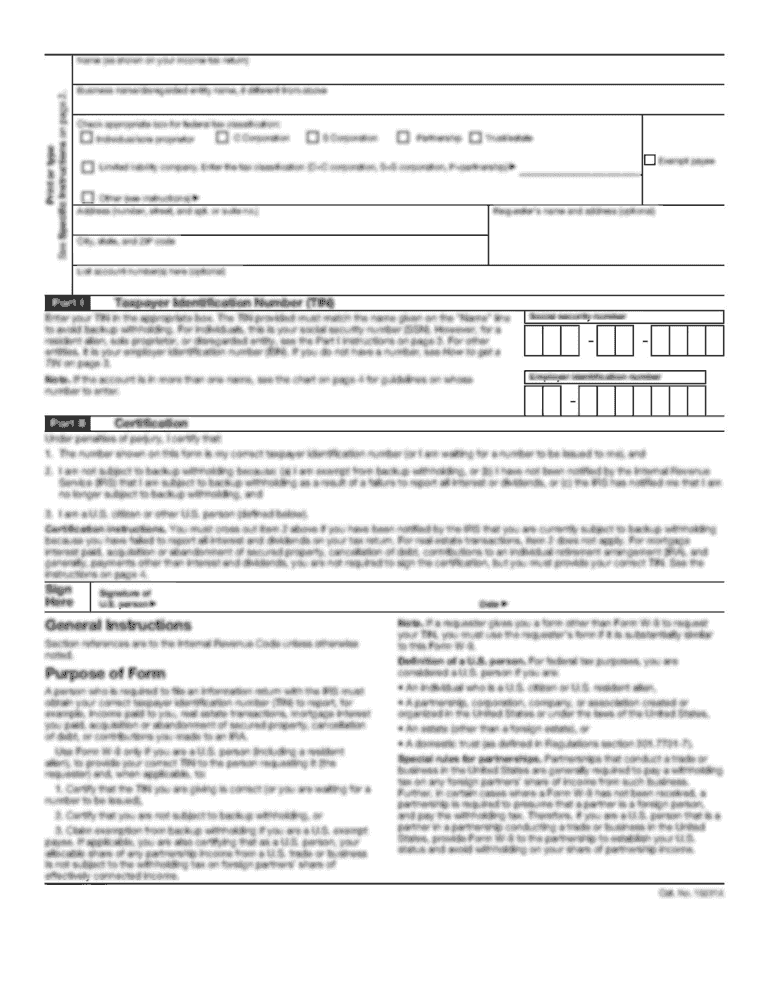

Review and fill out all necessary forms accurately.

03

Attend the closing meeting with a financial advisor or representative.

04

Sign all required documents for loan approval.

05

Wait for the final approval and funding of the SBA loan.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Sba loan closing process

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Are SBA loans automatically forgiven?

While the SBA will not forgive 100% of the debt owed, the goal is to settle on a number that makes sense for both the agency's bottom line and a business's financial ability to pay. If the SBA approves the offer in compromise, a payment will be issued and the loan will be classified as “Compromised/Closed.”

Do I have to pay back an SBA loan if I close my business?

Loans of less than $25,000 were unsecured, which means there were no personal guarantees and no collateral. If you closed your business and have outstanding debt on a loan through the EIDL program of less than $25,000, there is little (if anything) the SBA can do to recover what you owe.

What happens after you pay off SBA loan?

Once you've paid off your SBA loan, you're free of the financial debt from your SBA loan! Free up more cash flow in the future. Paying off your SBA loan means that you no longer need to pay your SBA loan payment on a monthly basis.

What are the closing documents for SBA loan?

Closing documents SBA Form 147: Note - 7(a) Loans (lenders also have the option of using their own note) SBA Form 148: Unconditional Guarantee (as necessary - lenders also have the option of using their own guaranty agreements) SBA Form 1050: Settlement Sheet (Use of Proceeds Certification) or comparable documentation.

How long does it take SBA to release funds?

SBA loans provide entrepreneurs with a low-cost business loan option guaranteed by the government. Generally, receiving funds following an application takes 30 to 90 days. SBA loan approval time differs depending on the lender you use and the type of loan you apply for.

Is it better to pay off SBA loan early?

You may be able to save money by paying off your SBA loan early. But you may also just be increasing your fees and starting over with a new loan term. For most small business owners, the time, energy, and expense of getting a U.S. Small Business Administration (SBA) loan is enough.