Bookkeeping Service Agreement Template Australia

What is Bookkeeping service agreement template australia?

A Bookkeeping service agreement template australia is a legally binding document that outlines the terms and conditions of the bookkeeping services provided by a bookkeeper to a client in Australia. It ensures that both parties are clear on their responsibilities, expectations, and payment arrangements.

What are the types of Bookkeeping service agreement template australia?

There are several types of Bookkeeping service agreement templates available in Australia, including but not limited to:

Standard Bookkeeping Service Agreement Template

Freelance Bookkeeping Service Agreement Template

Monthly Bookkeeping Service Agreement Template

Customized Bookkeeping Service Agreement Template

How to complete Bookkeeping service agreement template australia

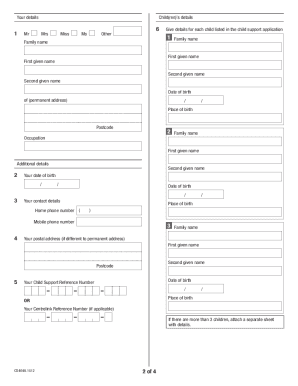

Completing a Bookkeeping service agreement template in Australia is a simple process. Follow these steps:

01

Download a Bookkeeping service agreement template australia from a reputable source.

02

Fill in the necessary details like the names of both parties, services to be provided, payment terms, etc.

03

Review the agreement to ensure all information is accurate and complete.

04

Sign the agreement electronically or print it out for signatures.

05

Share the signed agreement with the other party for their records.

pdfFiller, empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Bookkeeping service agreement template australia

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How much do bookkeepers charge out in Australia?

The hourly rate for a bookkeeper in Australia ranges from $100 to $150 per hour, but can also be more depending on the experience and tasks. Outsourcing to an online bookkeeping service, often a cost-effective option, has a set monthly fee that ranges from $500 to $2,500, depending on business size and task complexity.

How do I become a certified bookkeeper in Australia?

You can complete a Bachelor's Degree of Accounting or similar. However, if you are not interested in committing three years of your life to studying then you can start a Certificate IV in Accounting and Bookkeeping (FNS40217). This is a 6 month full-time commitment and is a nationally recognised qualification.

What is accounting service agreement?

An accounting services agreement is a legal document typically between a company and an accounting services provider. This type of agreement determines how much work needs to be done, the timeframe in which it will be provided, and the compensation and fees involved in the transaction.

Are bookkeepers in demand in Australia?

Bookkeepers are in high demand in Australia, particularly in small and medium-sized businesses.

What is a good rate to charge for bookkeeping?

The average hourly rate for bookkeepers in the U.S. is $20 per hour, ing to Salary.com. The range swings from $18 to $25 per hour, and there's a lot of room for growth beyond the $25/hour figure. You'll see variations of that range across the internet, with Indeed.com reporting a range of $15 to $30 per hour.

What is the rate of a bookkeeper in Sydney?

On average, the salary for a bookkeeper in Australia is around $50,000 to $70,000 per year.