Fiscal Sponsorship Grant Agreement

What is Fiscal sponsorship grant agreement?

A Fiscal sponsorship grant agreement is a legally binding contract between a fiscal sponsor organization and a grantee organization. It outlines the terms and conditions of the fiscal sponsorship relationship, including the responsibilities of both parties and the scope of the project being sponsored.

What are the types of Fiscal sponsorship grant agreement?

There are generally two types of Fiscal sponsorship grant agreements:

Pre-approved grant relationship - where the fiscal sponsor has already approved the grant and the grantee organization is applying for funds under the fiscal sponsor's umbrella.

Comprehensive fiscal sponsorship - where the fiscal sponsor takes on more responsibilities, including financial oversight and management of the project.

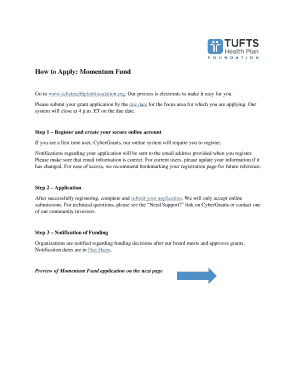

How to complete Fiscal sponsorship grant agreement

Completing a Fiscal sponsorship grant agreement is a straightforward process. Here are the steps to follow:

01

Review the agreement carefully to understand the terms and conditions.

02

Fill in all the required information accurately.

03

Ensure all parties involved sign the agreement.

04

Keep a copy of the signed agreement for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Fiscal sponsorship grant agreement

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the difference between a nonprofit and a fiscal sponsor?

Fiscal sponsorship means you team up with an established nonprofit—your sponsor—to accomplish your charitable goals. Your fiscal sponsor is a tax-exempt entity that provides your project with administrative, accounting, fundraising, and legal services, freeing you from having to spend time on these onerous tasks.

What is a fiscal sponsor agreement?

A fiscal sponsorship relationship confers the sponsor's 501(c)(3) tax-exempt status and certain administrative benefits onto a charitable project so that it can receive grants and tax-deductible contributions that it would otherwise be unable to receive.

What is the fiscal sponsor responsible for?

A fiscal sponsor is a nonprofit organization that provides fiduciary oversight, financial management, and other administrative services to help build the capacity of charitable projects. Fiscal Sponsorship: a 360 Degree Perspective, Trust for Conservation Innovation.

What is the difference between a fiscal sponsorship and a 501 C 3?

A fiscal sponsor is a 501(c)(3) organization that takes nonexempt projects or causes under its umbrella and 'sponsors' them in an arrangement called Fiscal Sponsorship. This provides the sponsored group 501(c)(3) 'status' so that they can start tax-deductible fundraising activities quickly.

What are the two types of fiscal sponsorship?

The most common forms of fiscal sponsorship are the Direct Model and the Grant Model. The Direct Model is the most common form of fiscal sponsorship. In the Direct Model, the project becomes an integrated part of the fiscal sponsor, with no legal identity separate from the fiscal sponsor.

What does being a fiscal sponsor mean?

A fiscal sponsor is a nonprofit organization that provides fiduciary oversight, financial management, and other administrative services to help build the capacity of charitable projects. Fiscal Sponsorship: a 360 Degree Perspective, Trust for Conservation Innovation.