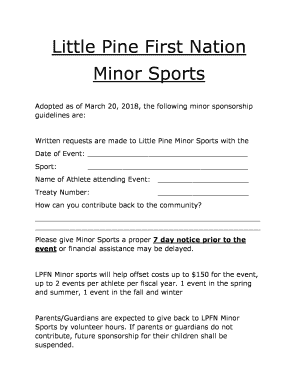

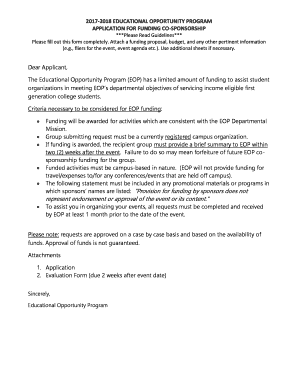

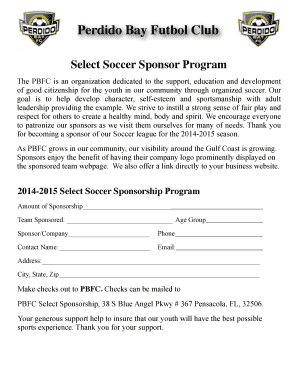

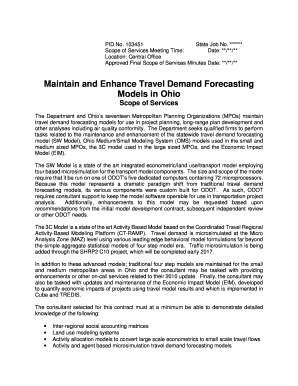

Fiscal Sponsorship Guidelines

What is Fiscal sponsorship guidelines?

Fiscal sponsorship guidelines are a set of rules and requirements that nonprofit organizations must adhere to when partnering with a fiscal sponsor. These guidelines ensure that the relationship between the nonprofit and the fiscal sponsor is structured properly and that all financial transactions are conducted in compliance with legal regulations.

What are the types of Fiscal sponsorship guidelines?

There are several types of fiscal sponsorship guidelines, including:

How to complete Fiscal sponsorship guidelines

Completing fiscal sponsorship guidelines can seem daunting, but with the right tools and resources, it can be a seamless process. Here are some steps to help you complete fiscal sponsorship guidelines:

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. It is the only PDF editor users need to get their documents done.