Accounting For Fiscal Sponsorship

What is Accounting for fiscal sponsorship?

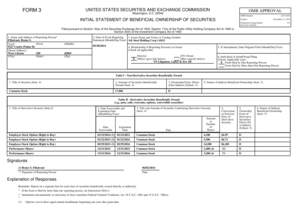

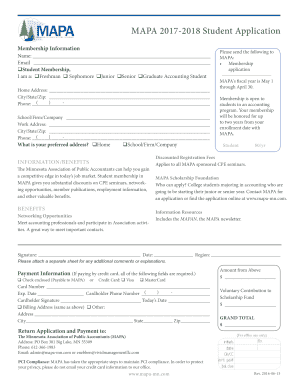

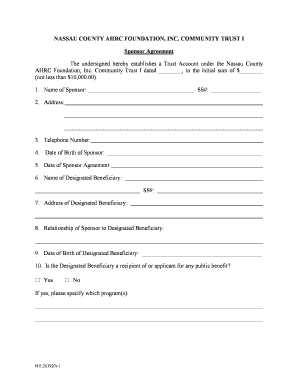

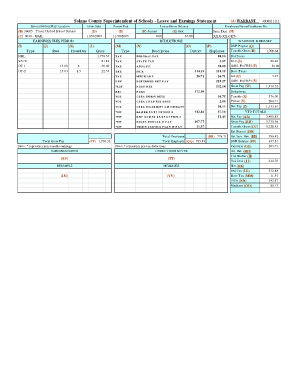

Accounting for fiscal sponsorship is the process of managing and recording the financial transactions and activities of a fiscal sponsor. It involves tracking donations, grants, expenses, and revenues related to the sponsored projects.

What are the types of Accounting for fiscal sponsorship?

There are three main types of Accounting for fiscal sponsorship:

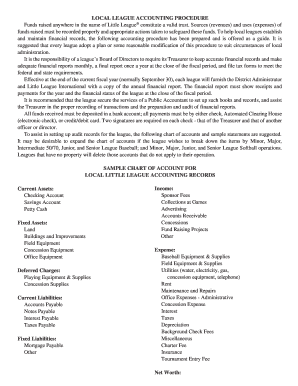

Cash Basis Accounting - Records transactions when cash is received or paid out.

Accrual Basis Accounting - Records transactions when they occur, regardless of when cash is is exchanged.

Fund Accounting - Segregates funds for different projects or purposes, ensuring that each fund's resources are tracked separately.

How to complete Accounting for fiscal sponsorship

To complete Accounting for fiscal sponsorship effectively, follow these steps:

01

Maintain detailed records of all financial transactions related to sponsored projects.

02

Reconcile bank statements regularly to ensure accuracy and identify any discrepancies.

03

Generate financial reports to provide updates on the financial status of sponsored projects.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Accounting for fiscal sponsorship

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is sponsorship a donation or advertising?

Sponsorships are more of a marketing tactic, putting a company's name on an event or ad to boost revenue. Donations are charitable in nature and purely benefit the organization at hand. You might be contemplating whether you're looking for sponsorships, donations, or both.

What does being a fiscal sponsor mean?

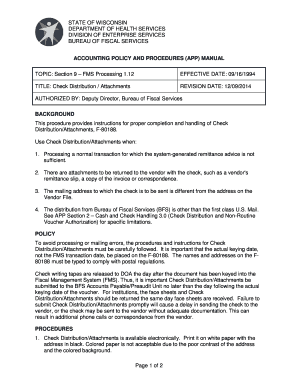

A fiscal sponsor is a nonprofit organization that provides fiduciary oversight, financial management, and other administrative services to help build the capacity of charitable projects. Fiscal Sponsorship: a 360 Degree Perspective, Trust for Conservation Innovation.

What is the process of a fiscal sponsor?

The project writes a grant request to the fiscal sponsor, detailing the project and its activities. Once approved, the fiscal sponsor then receives funds on behalf of the project, and disperses them ingly.

What are the two types of fiscal sponsorship?

The most common forms of fiscal sponsorship are the Direct Model and the Grant Model. The Direct Model is the most common form of fiscal sponsorship. In the Direct Model, the project becomes an integrated part of the fiscal sponsor, with no legal identity separate from the fiscal sponsor.

What is the role of a fiscal sponsor for a nonprofit?

A fiscal sponsor is a 501(c)(3) nonprofit organization that agrees to provide fiduciary oversight, financial management, and other administrative services to support the activities of groups or individuals engaged in work that furthers the fiscal sponsor's mission.

What is the difference between a nonprofit and a fiscal sponsor?

Fiscal sponsorship means you team up with an established nonprofit—your sponsor—to accomplish your charitable goals. Your fiscal sponsor is a tax-exempt entity that provides your project with administrative, accounting, fundraising, and legal services, freeing you from having to spend time on these onerous tasks.