Accounting For Fiscal Sponsorship

What is Accounting for fiscal sponsorship?

Accounting for fiscal sponsorship is the process of keeping track of financial transactions and ensuring accurate reporting for organizations that operate under fiscal sponsorship agreements.

What are the types of Accounting for fiscal sponsorship?

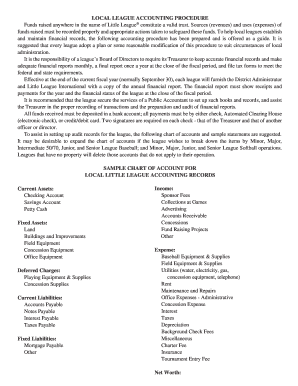

There are two main types of Accounting for fiscal sponsorship: Cash Basis Accounting and Accrual Basis Accounting.

Cash Basis Accounting

Accrual Basis Accounting

How to complete Accounting for fiscal sponsorship?

To complete Accounting for fiscal sponsorship, follow these steps:

01

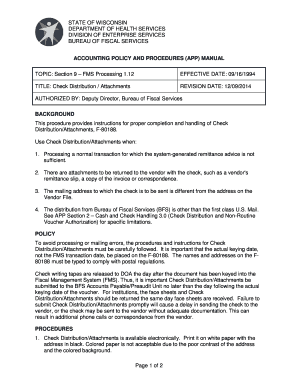

Gather all financial records and documentation related to the fiscal sponsorship agreement.

02

Organize and categorize income and expenses according to the chosen accounting method.

03

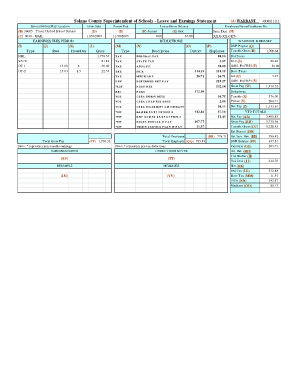

Prepare financial statements, including balance sheets and income statements.

04

Review and reconcile financial data to ensure accuracy.

05

File necessary tax forms and reports as required by law.

06

Consider using a comprehensive online tool like pdfFiller to simplify the process and streamline document management.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Accounting for fiscal sponsorship

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the difference between a nonprofit and a fiscal sponsor?

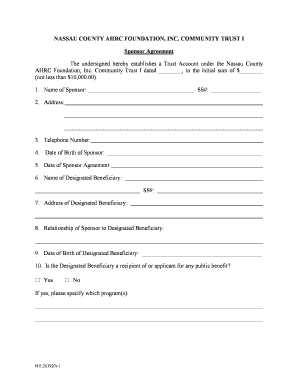

Fiscal sponsorship means you team up with an established nonprofit—your sponsor—to accomplish your charitable goals. Your fiscal sponsor is a tax-exempt entity that provides your project with administrative, accounting, fundraising, and legal services, freeing you from having to spend time on these onerous tasks.

What is the liability of a fiscal sponsor?

CL: Under the Direct Model of fiscal sponsorship, the sponsor is responsible for the project in every way. The sponsoring nonprofit must include the project as though it is a program of the sponsor, as it is liable for everything that the project does.

Is sponsorship considered fundraising?

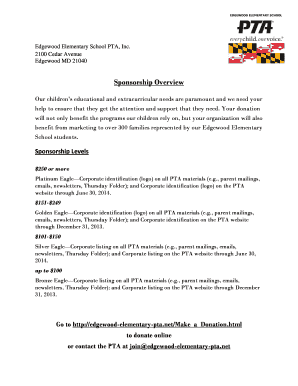

The goal of fundraising is to generate funds to support the organization's mission or goals. Sponsorship, on the other hand, involves partnering with a company or organization that provides financial support in exchange for exposure or promotional benefits.

Is sponsorship advertising or public relations?

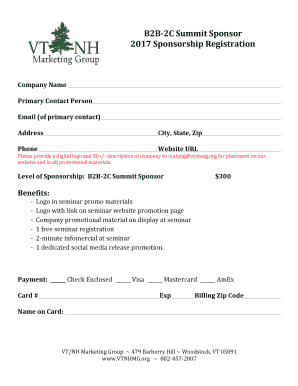

Sponsorship is a specialised kind of public relations and increasingly popular, particularly with larger businesses. A business will sponsor an event, team or individual in order to build brand awareness.

How do you classify sponsorship?

What are the 4 types of event sponsorship? Financial Event Sponsorship. Financial, or sometimes referred to as cash sponsors, continue to be the leading type of event sponsorship. In-Kind Sponsorship. In-kind sponsorship provides goods or services instead of physical currency. Media Event Sponsorship. Promotional Partners.

What is the process of a fiscal sponsor?

The project writes a grant request to the fiscal sponsor, detailing the project and its activities. Once approved, the fiscal sponsor then receives funds on behalf of the project, and disperses them ingly.