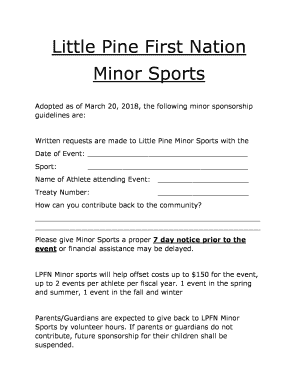

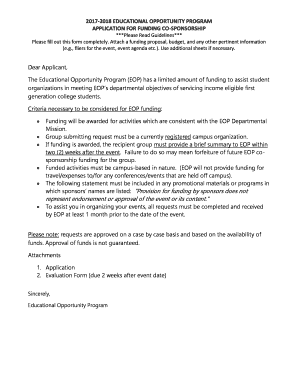

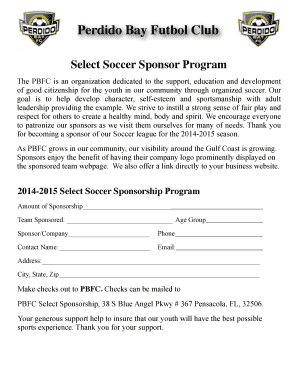

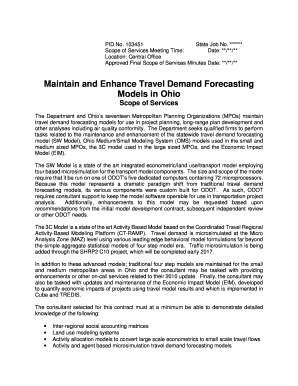

Fiscal Sponsorship Guidelines

What is Fiscal sponsorship guidelines?

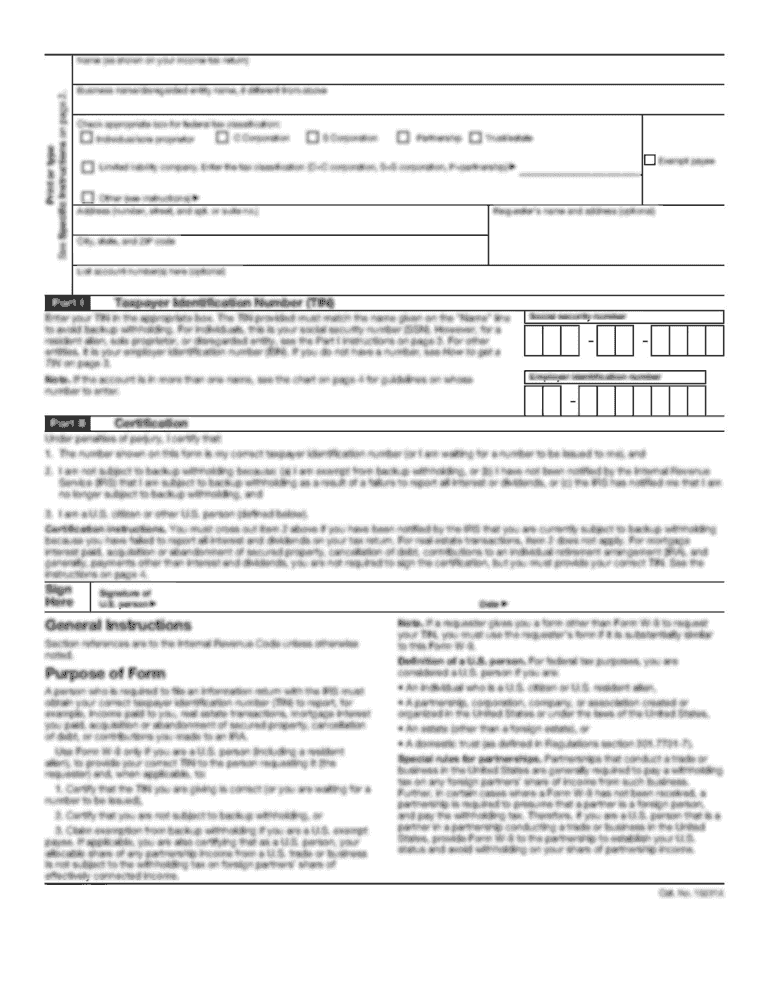

Fiscal sponsorship guidelines are a set of rules and regulations that outline the responsibilities and requirements for organizations looking to establish a fiscal sponsorship relationship. These guidelines help ensure transparency, accountability, and compliance with legal and financial standards.

What are the types of Fiscal sponsorship guidelines?

There are several types of fiscal sponsorship guidelines that organizations can choose from based on their specific needs and goals. Some common types include:

How to complete Fiscal sponsorship guidelines

Completing fiscal sponsorship guidelines involves several key steps to ensure compliance and successful partnership. Here are some tips to help you navigate the process:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.