Independent Contractor Agreement Templates

What are Independent Contractor Agreement Templates?

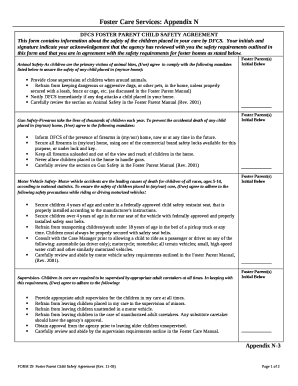

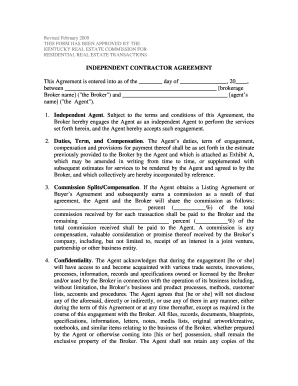

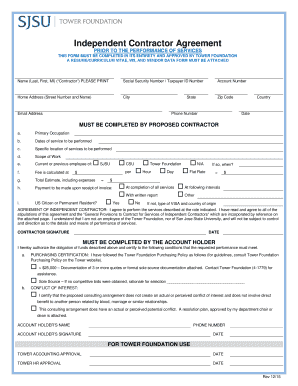

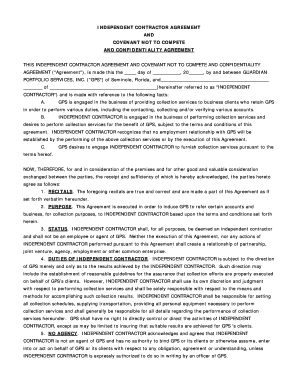

Independent Contractor Agreement Templates are pre-designed contracts that outline the terms and conditions between a company or individual hiring an independent contractor for services. These templates help establish clear expectations and protect the rights of both parties involved.

What are the types of Independent Contractor Agreement Templates?

There are different types of Independent Contractor Agreement Templates based on the specific nature of the work being performed. Some common types include: 1. General Independent Contractor Agreement Template 2. Creative Services Independent Contractor Agreement Template 3. Consulting Independent Contractor Agreement Template 4. Construction Independent Contractor Agreement Template

How to complete Independent Contractor Agreement Templates

Completing Independent Contractor Agreement Templates is a straightforward process. Follow these steps to ensure all necessary information is included:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.