Security Agreement Template - Page 2

What is Security agreement template?

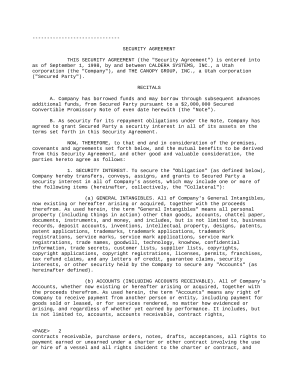

A Security agreement template is a legal document that outlines the relationship between a borrower and a lender regarding the collateral used to secure a loan. It specifies the rights and responsibilities of both parties in case of default or non-payment.

What are the types of Security agreement template?

There are several types of Security agreement templates based on the type of collateral involved, some common types include:

Real Estate Security Agreement

Personal Property Security Agreement

Intellectual Property Security Agreement

Financial Security Agreement

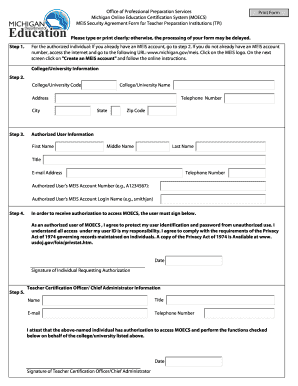

How to complete Security agreement template

Completing a Security agreement template is crucial for ensuring the clarity and enforceability of the agreement. Here are the steps to follow:

01

Fill in the borrower and lender details

02

Describe the collateral being used to secure the loan

03

Specify the terms and conditions of the agreement, including repayment terms and default consequences

04

Review the document carefully and make any necessary edits or corrections

05

Sign and date the agreement to make it legally binding

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Security agreement template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

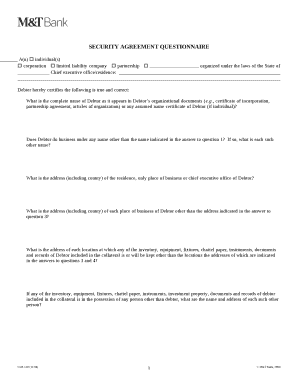

What are the 3 requirements for a creditor to have an enforceable security interest?

Three steps are required for attachment of a security interest: value has been given, the debtor has rights in the collateral or the power to transfer rights in the collateral to the secured party, and the debtor has signed or authenticated a security agreement that provides a description of the collateral.

Does a security agreement need to be in writing?

A statute of frauds within UCC Article 9 requires the security agreement be in writing. An exception to this requirement is when a security interest is pledged.

What must be included in a security agreement?

At a minimum, a valid security agreement consists of a description of the collateral, a statement of the intention of providing security interest, and signatures from all parties involved. Most security agreements, however, go beyond these basic requirements.

How do I make a security agreement?

Creating a security agreement Some key provisions in a security agreement include: Describing the collateral as accurately and as detailed as possible, so both the borrower and the lender agree upon the secured property. How to determine whether and when the borrower is in default under the loan.

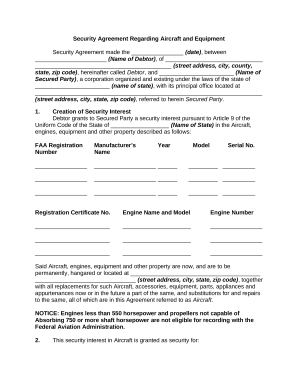

What is a feature of a general security agreement?

What is a General Security Agreement? A GSA is a contract signed between two parties, a borrower and a lender. The GSA protects the lender by creating a security interest in all or some of the assets of the borrower. In sum, the GSA outlines the terms and conditions of the loan, and lists the assets used for security.

What is a general security agreement?

What is a General Security Agreement? A GSA is a contract signed between two parties, a borrower and a lender. The GSA protects the lender by creating a security interest in all or some of the assets of the borrower. In sum, the GSA outlines the terms and conditions of the loan, and lists the assets used for security.