Business Asset Transfer Agreement

What is a Business asset transfer agreement?

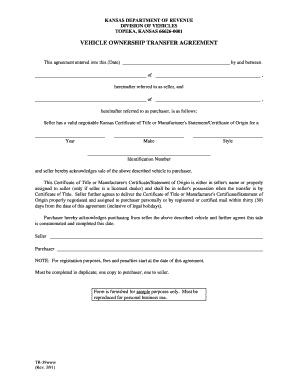

A Business asset transfer agreement is a legal document that outlines the transfer of assets from one business to another. It details the specific assets being transferred, the terms and conditions of the transfer, and the rights and obligations of both parties involved.

What are the types of Business asset transfer agreement?

There are several types of Business asset transfer agreements, including:

Agreement for the transfer of tangible assets such as equipment, machinery, or inventory.

Agreement for the transfer of intangible assets such as intellectual property, patents, or trademarks.

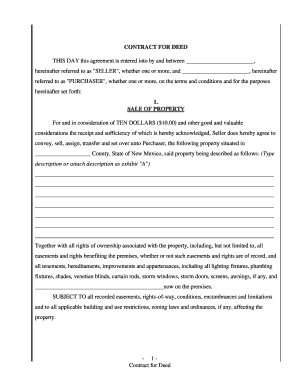

Agreement for the transfer of real estate or property assets.

How to complete Business asset transfer agreement

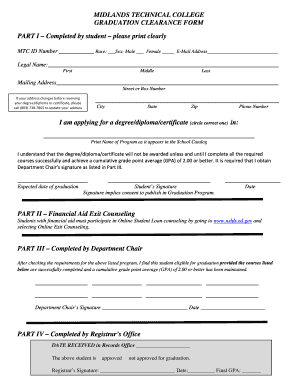

Completing a Business asset transfer agreement is a straightforward process. Here are some steps to follow:

01

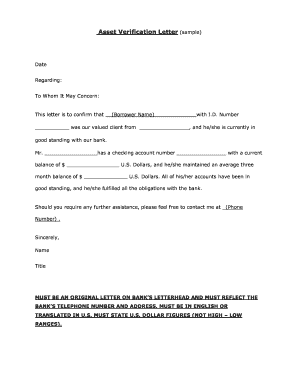

Gather all necessary information about the assets being transferred and the parties involved.

02

Draft the agreement outlining the details of the asset transfer, including the terms and conditions.

03

Review the agreement with all parties involved to ensure accuracy and understanding.

04

Sign the agreement to make it legally binding.

05

Consider using a platform like pdfFiller to create, edit, and share the document online for a seamless process.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What should be included in an asset purchase agreement?

The agreement describes the assets that will be purchased, including important details like price, warranties, and breach of contract provisions. With contract management software, your company is able to manage these complex agreements effectively.

What are examples of transfer of assets?

Asset Title Transfers Ownership transfer can come about due to selling the land, gifting it, willing the title to a beneficiary, following a court order, or foreclosure from bankruptcy. Even the ownership of a phone can be transferred if the mobile carrier permits it.

What is asset transfer in business?

An asset transfer is a movement of an item of plant and equipment from one fund/department to another using the Asset Cost Adjust/Transfers function of the ESP Assets Management System (ESP). The business unit that is receiving the asset is responsible for processing the transfer in ESP.

What is asset transfer agreement?

An asset transfer agreement (ATA) is a contract between two parties that sets forth the terms and conditions for the transfer of ownership of certain assets. The ATA defines the parties to the agreement, the assets to be transferred, and the consideration to be paid for the transfer.

How do you write an asset transfer agreement?

Common Sections in Asset Transfer Agreements Sales of Sold Assets. Representations, Warranties and Covenants of the Seller. Repurchase of Collateral Obligations. Representations, Warranties and Covenants of the Issuer. Closing. Undertaking and Assumption. Notices. GOVERNING LAW.

How do you transfer assets from one entity to another?

The transfer process itself can take the form of a contract for transfer/purchase of business assets. In the case of money transfers, these can be done as a loan or by purchasing shares in the other company, or through dividend payments if shares in the transferor company are owned by the recipient company.