Filing 1040-ES tax form online

The number of e-filed tax returns is increasing by the day. Today, you have the option of submitting completed forms directly to the IRS online in minutes. This option is especially convenient for self-employed individuals, small business owners, freelancers, and independent contractors required to file IRS Form 1040-ES.

This page is for informative purposes only and does not constitute tax or legal advice

What is IRS Form 1040-ES?

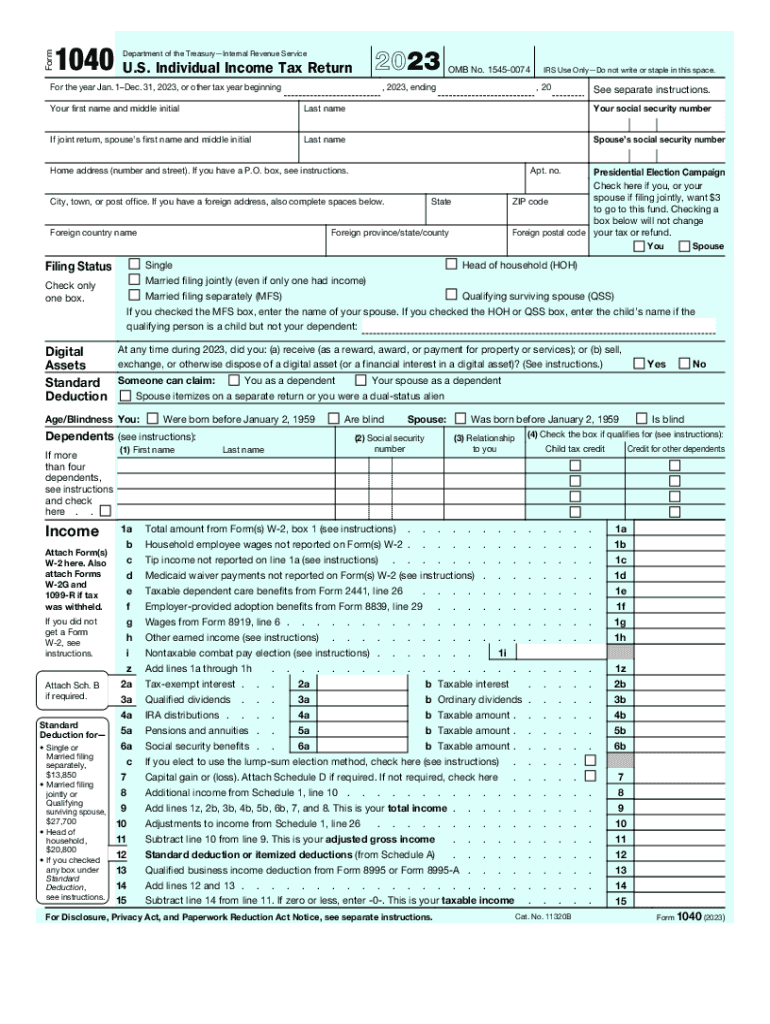

While Form 1040 reports your income tax for the whole year, Form 1040-ES breaks it into four parts. By doing so, the IRS keeps track of how much quarterly income tax you’ve paid over the year. In most cases, you must pay estimated tax if both of the following apply:

You expect to owe at least $1,000 in tax for 2024 after subtracting your withholding and refundable credits.

You expect your withholding and refundable credits to be less than 90% of the tax shown on your 2020 tax return or 100% of the tax shown on your 2019 tax return.

Dates: Both payments should be made by the end of 2024.

Extensions: The coronavirus outbreak has changed the deadline for estimated tax payment. Still, missed payments can be subject to penalty and interest.

How to fill out Form 1040-ES

Filling out a 1040-ES is perhaps the easiest part of filing your quarterly estimated taxes. All you need to do is include your info and the amount of the quarterly payment. Each of the form’s slips has its deadline printed on it.

Here’s how it’s done:

Here’s how it’s done:

01

Fill in the adjusted gross income you expect this year.

02

If you plan to itemize deductions, fill in the estimated total of your itemized deductions, or enter your standard deduction if you don’t.

03

Fill in your estimated taxes for the year.

04

Fill in your self-employment tax, which is usually 15.3% of your gross income.

05

Fill in your total tax for the year, taking into account deductions and credits.

06

Multiply your total tax amount by 0.25 to get your quarterly payment amount.

All of the above data impacts your tax return.

E-file your tax forms directly to the IRS

According to new IRS rules, those that file their tax refund forms online will be the first to receive their refunds.

File your W-2, 1099-MISC, and 941 forms with the IRS online

Fill out your tax forms and submit them directly to the IRS with pdfFiller.

Submit your form to the IRS in a single click and email copies to your employees and independent contractors right from your pdfFiller account.

Experience simple, transparent, and stress-free filing from start to finish.

E-filing with pdfFiller is the absolute fastest and safest way to get your refund. All forms that are generated, completed, and sent using pdfFiller are securely stored in your personal account in the cloud, ensuring only you have access to them.

Pay IRS taxes online

The most convenient way to file a 1040-ES is to fill out a fillable sample online. Get the newest editable PDF sample of Form 1040-ES and fill it out in minutes. There’s no need to download or install anything!

Besides that, paying taxes online has many benefits:

Besides that, paying taxes online has many benefits:

Ability to file from anywhere

Ensured accuracy

Time and money savings

Avoid added interest and penalties

Welcome to the pdfFiller forms catalog

Browse Versions and Schedules for All Relevant Forms

IRS Forms with Versions and Schedules

Edit professional templates, download them in any text format or send via pdfFiller’s advanced sharing tools. See also Top Forms by user votes.

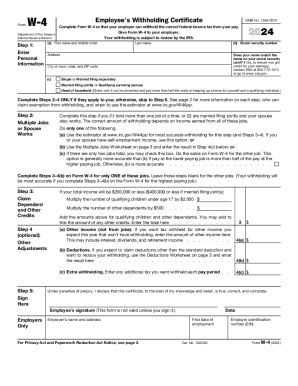

W4 form

Individual tax return information to the IRS

W9 form

If you are providing Form W-9 to an FFI to document a joint account each holder of the account...

1040-ES form

Department of the Treasury Internal Revenue Service Form 1040-ES Estimated Tax for Individuals...

How to fill out other forms

Find the form you need, fill it out, and sign faster than ever before.

California tax form

For residents and part-year residents of the state of California, and also non-residents receivin...

Read guide

New York tax form

New York tax forms for residents, part-year residents and non-residents earning income from sourc...

Read guide

DS-11 form

U.S. Passport Application Form

Read guide

DS-82 form

U.S. Passport Renewal Application for Eligible Individuals

Read guide

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.