Fill out your W-2 tax form online

137,866,000 million tax returns were e-filed for the 2018 tax year. The number of e-filed tax returns is increasing every year. The IRS — like most businesses and organizations — prefers dealing with digitized records. So whether you’re filing an individual tax return, miscellaneous income or government payments, you have the option to pay online. This option extends to those filing a W-2 form.

This page is for informative purposes only and does not constitute tax or legal advice

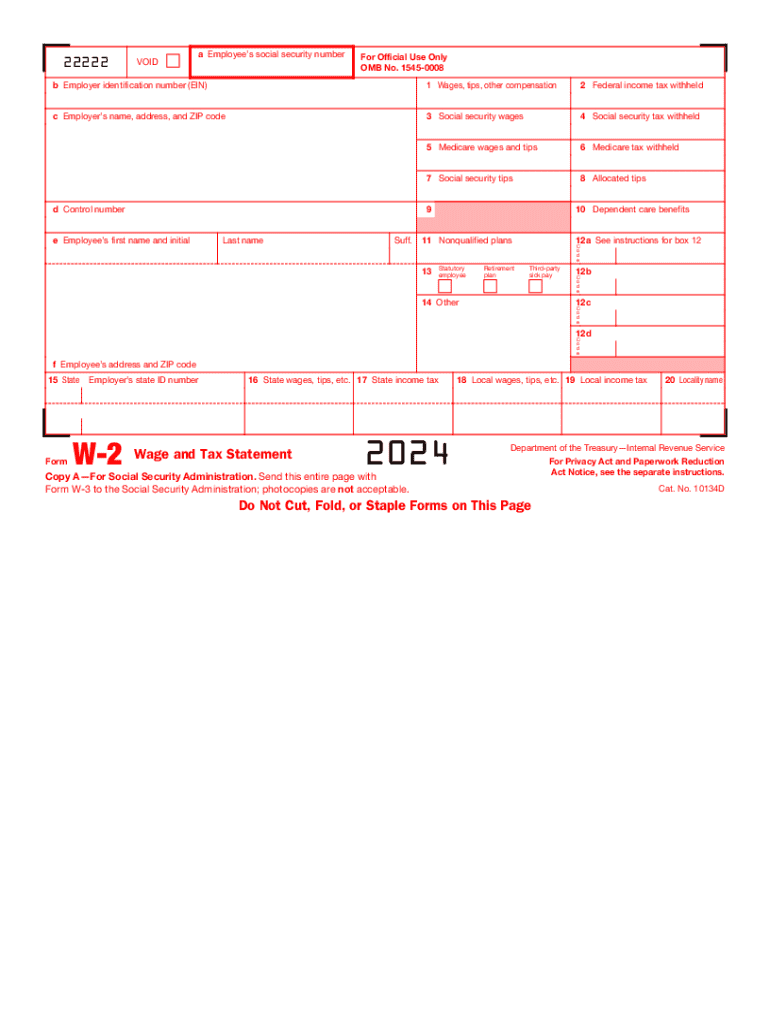

What is a W-2 form?

The W-2 form is the "Wage and Tax Statement". This form reports an employee’s income from the prior year and how much tax the employer withheld from that income.

Any employer that has paid an employee at least $600 during the year has to send them a W-2.

The employee must include tips (if received).

The information on the employee’s W-2 determines whether they’re getting a refund or writing a check in April.

The W-2 form supplies the employee with information that they will need to include in their 1040 form.

An employee completes the W-2 form only if they are a regular employee. If they are a contractor or freelancer, they’ll receive the 1099 form. Don’t confuse the W-2 with the W-4, which is an input document that is filled by an employee only once.

Dates: Employers must send employees a Form W-2 by January 31. They must also send a copy to the IRS.

Extensions: If you encounter unforeseen circumstances, you may request one 30-day extension by submitting an 8809 form.

How to fill out your W-2 form

The W-2 form includes more than just your salary information, but details on whether you have paid for a retirement plan, or whether you’ve received certain types of sick pay. Be sure to include the following information:

01

Any employer that has paid an employee at least $600 during the year has to send them a W-2.

02

The employee must include tips (if received).

03

The information on the employee’s W-2 determines whether they’re getting a refund or writing a check in April.

04

The W-2 form supplies the employee with information that they will need to include in their 1040 form.

05

An employee completes the W-2 form only if they are a regular employee. If they are a contractor or freelancer, they’ll receive the 1099 form. Don’t confuse the W-2 with the W-4, which is an input document that is filled by an employee only once.

All of the above data impacts your tax return.

E-file your tax forms directly to the IRS

According to new IRS rules, those that file their tax refund forms online will be the first to receive their refunds.

File your W-2, 1099-MISC, and 941 forms with the IRS online.

Fill out your tax forms and submit them directly to the IRS with pdfFiller.

Submit your form to the IRS in a single click and email copies to your employees and independent contractors right from your pdfFiller account.

Experience simple, transparent, and stress-free filing from start to finish.

E-filing with pdfFiller is the absolute fastest and safest way to get your refund. All forms that are generated, completed, and sent using pdfFiller are securely stored in your personal account in the cloud, ensuring only you have access to them.

Pay IRS taxes online

So why is e-filing your W-2 Form the preferred method for making your tax payments?

Here are some reasons:

Here are some reasons:

You don’t have to manually enter your taxpayer information for every form included in your tax return.

You eliminate higher chances of error.

By moving away from paper payments you avoid envelope stuffing and postage.

Your return is transmitted directly to the IRS system, making it more secure than physically mailing it.

It’s faster because the IRS service center doesn’t have to waste time on sorting or re-transcribing.

You don’t miss your deadline so you don’t pay penalties or interest.

Welcome to the pdfFiller forms catalog

Browse Versions and Schedules for All Relevant Forms

IRS Forms with Versions and Schedules

Edit professional templates, download them in any text format or send via pdfFiller’s advanced sharing tools. See also Top Forms by user votes.

1099-MISC form

Miscellaneous Income

W2 form

Wage and Tax Statement is used to report wages paid to employees and the taxes withheld from them

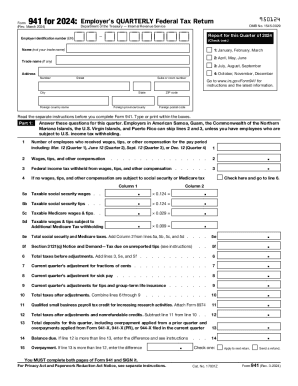

941 form

Don't use Form 941-V to make federal tax deposits. Use Form 941-V when making any payment with...

How to fill out other forms

Find the form you need, fill it out, and sign faster than ever before.

California tax form

For residents and part-year residents of the state of California, and also non-residents receivin...

Read guide

New York tax form

New York tax forms for residents, part-year residents and non-residents earning income from sourc...

Read guide

DS-11 form

U.S. Passport Application Form

Read guide

DS-82 form

U.S. Passport Renewal Application for Eligible Individuals

Read guide

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.