Amend Subsidize Log मुफ़्त में

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

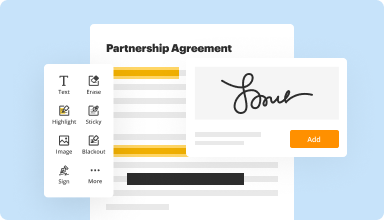

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

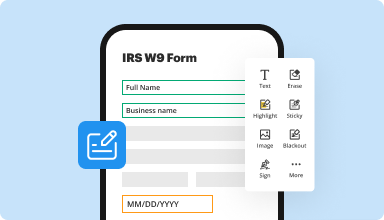

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

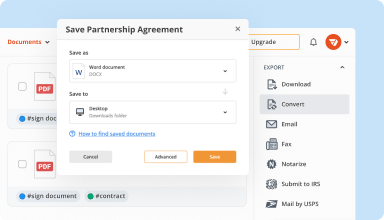

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

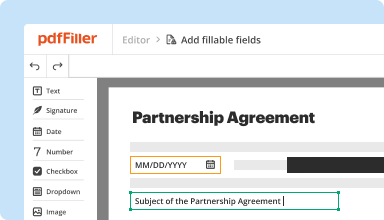

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

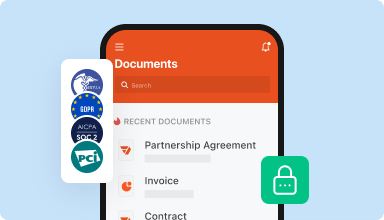

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Up to this point I have navigated easily, however I need to learn more about each command and feature, so that I can be more efficient. a webar would be a great asset.

2016-10-21

Ease of use is great because I am a one-person office, and don't have access to a lot of office machines, so this works good. I just have to figure out how to get it to scan.

2017-11-30

Some of the text sizes seemed to change when editing, and the positioning of the text didn't always seem to be consistent with existing and added text

2019-05-17

Easy to use and enabled me to use a PDF…

Easy to use and enabled me to use a PDF workbook for a course online - without having to print it out.

2019-11-11

This program is SO easy to use and…

This program is SO easy to use and Efficient when you need to fill out forms for work but you cannot physically get to work to turn them in!

2019-05-23

The reason it is a four instead of a five...

The reason it is a four instead of a five is I feel like there is a strong learning curve... at least for me.

So I am still learning.

Check back with me in a month and let's see if we can delete this 4 rating and move it up to a 5!!

2023-02-20

pdfFiller came through for me in a…

pdfFiller came through for me in a business deal that was time sensitive. As a first time user, I was able to navigate this user freindly site and meet my deadline. Recommended!

2022-05-04

It's the best experience on pdf editors, the only thing is that i passed 10 minutes just to find how to change the color of the text, i suggest to modify the icon of the text color for better user experience and as a back-end developer I thank you for the work you are doing, work for your project, believe on it and you will have more success. I hope you share my comment with all your team, this will motivate them to do more effort for pdfFiller. have a nice day, stay positive and good luck.

2022-03-31

I had an issue and emailed the company and not only did 2 different people respond immediately they resolved my issue within a few hours of me sending the email. I’ve never seen that quick of a response before. Very impressive.

2020-10-26

Amend Subsidize Log Feature

The Amend Subsidize Log feature is designed to help you manage and track subsidies effectively. This tool simplifies your workflow and ensures accuracy in financial reporting. By utilizing this feature, you can focus more on your core tasks and less on administrative burdens.

Key Features

Real-time tracking of subsidy entries

User-friendly interface for easy navigation

Automated alerts for missing information

Comprehensive reporting capabilities

Secure access for authorized users

Potential Use Cases and Benefits

Nonprofits tracking funding allocations

Businesses managing government grants

Educational institutions recording student subsidies

Health organizations monitoring aid distribution

This feature helps you solve the problem of oversight in subsidy management. By providing an organized log, you can prevent errors, streamline your processes, and improve overall accountability. With the Amend Subsidize Log, you gain clarity and can make informed decisions with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How can I avoid paying back my premium tax credit?

The easiest way to avoid having to repay a credit is to update the marketplace when you have any life changes. Life changes influence your estimated household income, your family size, and your credit amount. So, the sooner you can update the marketplace, the better. This ensures you receive the correct amount.

Do I have to pay back the advance premium tax credit?

Advance Premium Tax Credit (APC) If at the end of the year you've taken more premium tax credit in advance than you're due based on your final income, you'll have to pay back the excess when you file your federal tax return. If you've taken less than you qualify for, you'll get the difference back.

Do you have to pay back the tax credit for health insurance?

This is officially called the premium tax credit. The amount of the premium assistance is based on your estimated income and the amount of your health insurance premiums. However, at higher income levels, you'll have to pay back the entire amount you received, which could be a lot.

How does the premium tax credit affect my tax return?

The size of your premium tax credit is based on a sliding scale. The credit is refundable because, if the amount of the credit is more than the amount of your tax liability, you will receive the difference as a refund. If you owe no tax, you can get the full amount of the credit as a refund.

What happens if I don't use my premium tax credit?

A tax credit you can use to lower your monthly insurance payment (called your premium) when you enroll in a plan through the Health Insurance Marketplace. If you use less premium tax credit than you qualify for, you'll get the difference as a refundable credit when you file your taxes.

How do I not pay back my premium tax credit?

This amount is added to the other taxes shown on her tax return. The key to avoid having to pay back all the subsidies you received is keeping your MAGI below 400% of the federal poverty level. As long as your MAGI is below this level, you'll only have to pay back a portion of your subsidy.

Do I have to pay back premium tax credit?

A tax credit you can take in advance to lower your monthly health insurance payment (or premium). If at the end of the year you've taken more premium tax credit in advance than you're due based on your final income, you'll have to pay back the excess when you file your federal tax return.

Do you have to pay back Marketplace insurance?

If your income is below 400% of the federal poverty level, there is a cap on the amount you'll have to pay back, even if you received more in assistance than the amount of the cap. However, at higher income levels, you'll have to pay back the entire amount you received, which could be a lot.

#1 usability according to G2

Try the PDF solution that respects your time.