Convert On Company Certificate मुफ़्त में

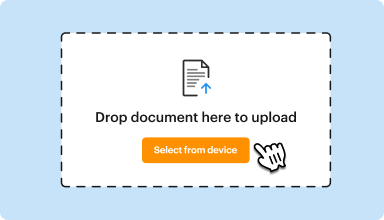

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

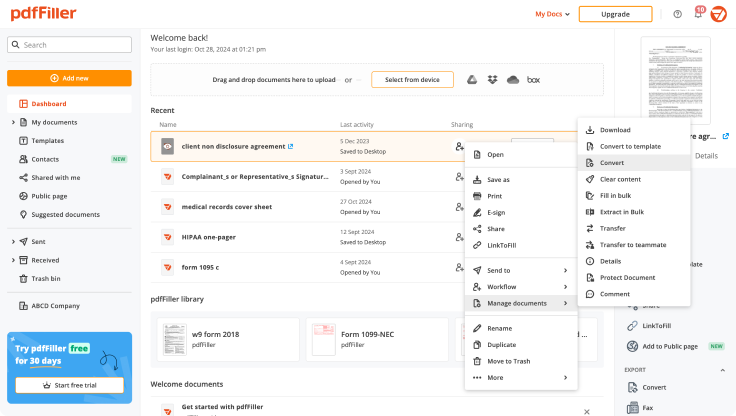

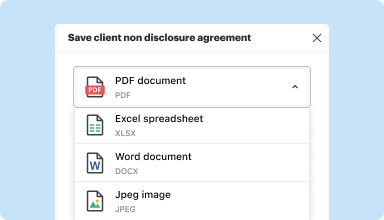

Edit, manage, and save documents in your preferred format

Convert documents with ease

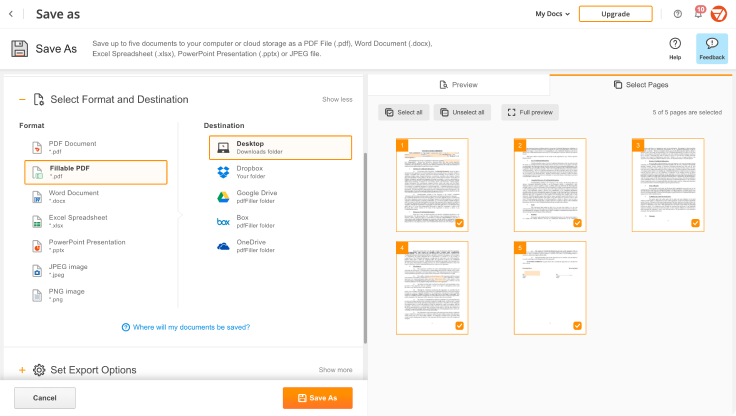

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

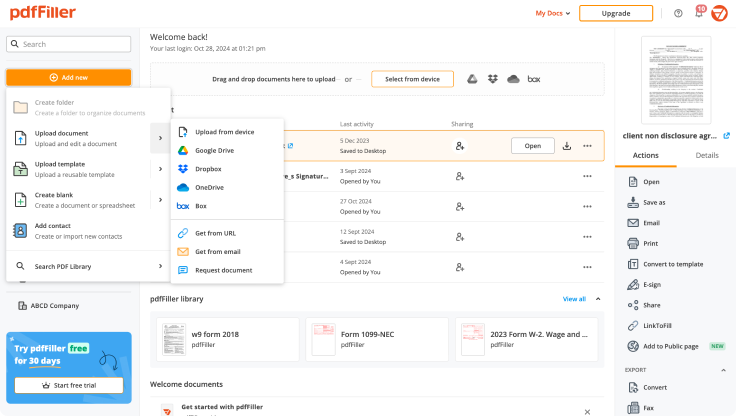

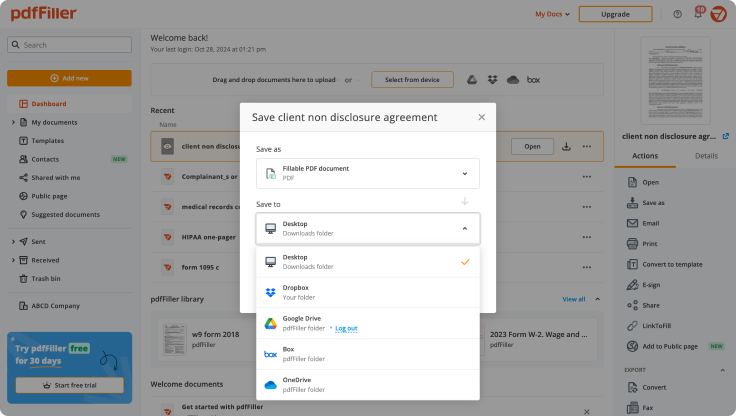

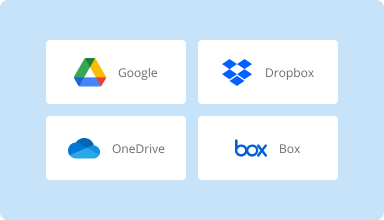

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

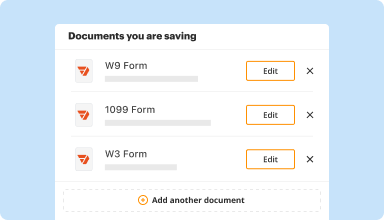

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

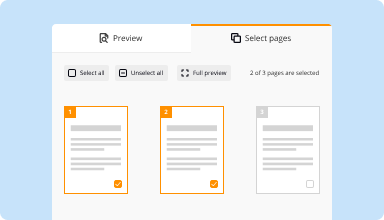

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

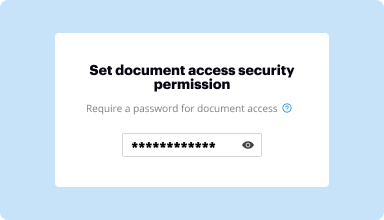

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

it is great. I can mark where I need clients to notice or sign. Would be interested to know how the rest of the programming works so I can use more of it.

2016-02-23

So far so good thou I only used it to print out claims I do like the features it has. I should be upgrading my account in the next couple of months if all goes well.

2016-05-25

I was dealing with California DMV forms and no where did it tell me to send our Florida Statutes showing the towing procedures for a private property tow. They rejected my pkg. & sent letter, delaying processing 2 mths. Very frustrating to say the least.

2017-07-18

PDFfiller has been great to work with! It has made it easier in running my business being able to send documents to clients and have them fill it out online and submit.

2018-11-29

I have used a couple of the other apps and I believe that the PDFfiller is the easiest with very self explained instructions. I love the fact that the mobile app is just as user friendly as the app on my computer. Thanks

2019-05-07

Tree saver

My son has to do virtual school with everything going on at the moment. This is great for filling out worksheets instead of printing and killing trees

2020-04-02

This is a super good program, it helped me all along with my university applications, it's really fast and intuitive. Thanks, team PdfFiller :) Totally worth the money

2021-08-27

I activated to try for the first time and only needed for a single transaction. Very easy to use and should I need a service in the future, would definitely purchase.

2021-01-10

I teach 3rd grade and most of the resources and district...

I teach 3rd grade and most of the resources and district resources are in PDF or Doc Hub format. This does not allow my students to fill these kinds of worksheets out online. That was a problem until now. PdfFiller is saving me time and effort in preparing lessons for my students.

2020-09-06

Convert On Company Certificate Feature

Streamline your documentation process with the Convert On Company Certificate feature. This tool transforms standard certificates into digital formats, making them easy to manage, share, and verify.

Key Features

Seamless conversion to digital formats

User-friendly interface for easy navigation

Secure storage for certificates

Quick sharing options via email or links

Integration with existing systems

Potential Use Cases and Benefits

Businesses looking to digitize their certification process

Educational institutions managing student certificates

Organizations needing to share certificates with stakeholders quickly

Human resource departments verifying employee qualifications

Consultants and trainers providing course completion certificates

This feature addresses the common challenges of paperwork management. By converting certificates to digital formats, you reduce the risk of loss, simplify retrieval, and enhance accessibility. Ultimately, you save time and improve efficiency in your operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I change from an S Corp to an LLC?

Some S Corps want to convert to an LLC but still be taxed as an S Corp. There are two ways to do this. The first way is to create an LLC and subsequently convert the corporation into the LLC. The corporation will then be referred to as an LLC, and the corporation's assets will transfer to the new LLC.

Can I convert my S Corp to an LLC?

Most states have an easy process for changing from an S corporation to an LLC. In some states, you must first form your LLC and then merge the S corporation into the existing LLC. This transaction can be complicated. A shareholders' resolution will need to be passed by the S corporation authorizing the conversion.

Can an S Corp merged with an LLC?

Merger into LLC Process The directors and shareholders can then approve a merger between the existing S corporation and the new LLC. The company's operating agreement must specify that the LLC is the surviving member of the merger. After the merger is complete, the company can then choose to dissolve the S corporation.

Do I need a new EIN If I convert from a corporation to an LLC?

An existing partnership converts to an LLC classified as a partnership. The LLC name or location changes. An LLC that already has an EIN chooses to be taxed as a corporation or as an S corporation. NOTE: You may request an EIN for banking or state tax purposes, but an EIN is not required for federal tax purposes.

How do you terminate an S Corp election and revert to an LLC?

Basic Revocation Requirements Your election to have your LLC taxed as an S corporation was done by filing Election by a Small Business Corporation (Form 2553), most likely when you first formed your corporation. You may revoke your company's S corp. status for the current tax year or for a later date.

How do I change from S Corp to partnership?

For an S corporation to change to a partnership, the owners must first dissolve the company. Owners can do this by filing Articles of Dissolution -- which may be named a Certificate of Dissolution in some jurisdictions -- with their state government agencies.

How do I reverse an S Corp election?

To revoke a Subchapter S election/small business election that was made on Form 2553, submit a statement of revocation to the service center where you file your annual return. The statement should state: The corporation revokes the election made under Section 1362(a)

Can an S Corp transfer assets to an LLC?

One method to convert to a tax partnership tax-free, without undergoing an inversion, is the LLC drop-down, which entails the S corporation forming a wholly-owned LLC, that is initially a disregarded entity for tax purposes, and transferring all the S corporation's assets and business to the new LLC.

#1 usability according to G2

Try the PDF solution that respects your time.