E-Signature 1040EZ Form मुफ़्त में

Join the world’s largest companies

How to Send a PDF for eSignature

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

E-Signature 1040EZ Form Feature

The E-Signature 1040EZ Form feature helps you file your taxes easily and securely. With this tool, you can sign your tax forms electronically, saving you time and effort. No more printing, signing, and scanning documents. You can complete your filing process from the comfort of your home.

Key Features

Use Cases and Benefits

This E-Signature feature resolves the common problem of cumbersome paperwork. By allowing you to sign your 1040EZ Form quickly and electronically, it streamlines your tax filing process. You can avoid the delays often caused by mailing paper forms. Instead, enjoy a fast, efficient way to handle your tax obligations.

Create a legally-binding E-Signature 1040EZ Form with no hassle

pdfFiller enables you to manage E-Signature 1040EZ Form like a pro. Regardless of the system or device you run our solution on, you'll enjoy an intuitive and stress-free method of executing paperwork.

The whole signing flow is carefully safeguarded: from importing a document to storing it.

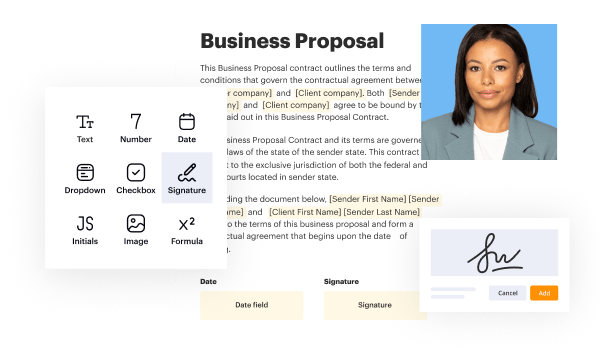

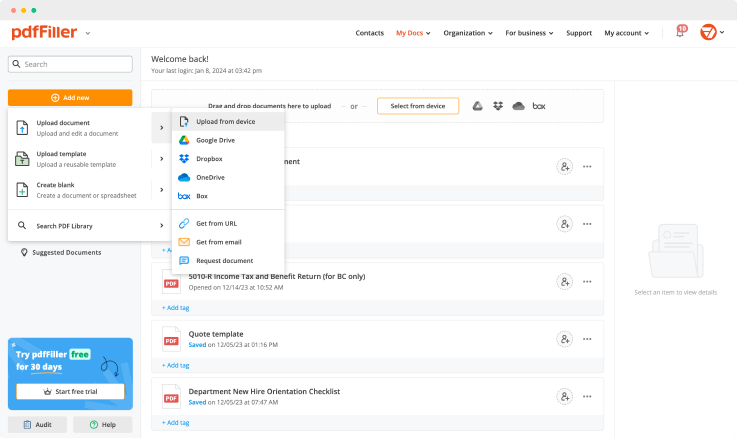

Here's the best way to create E-Signature 1040EZ Form with pdfFiller:

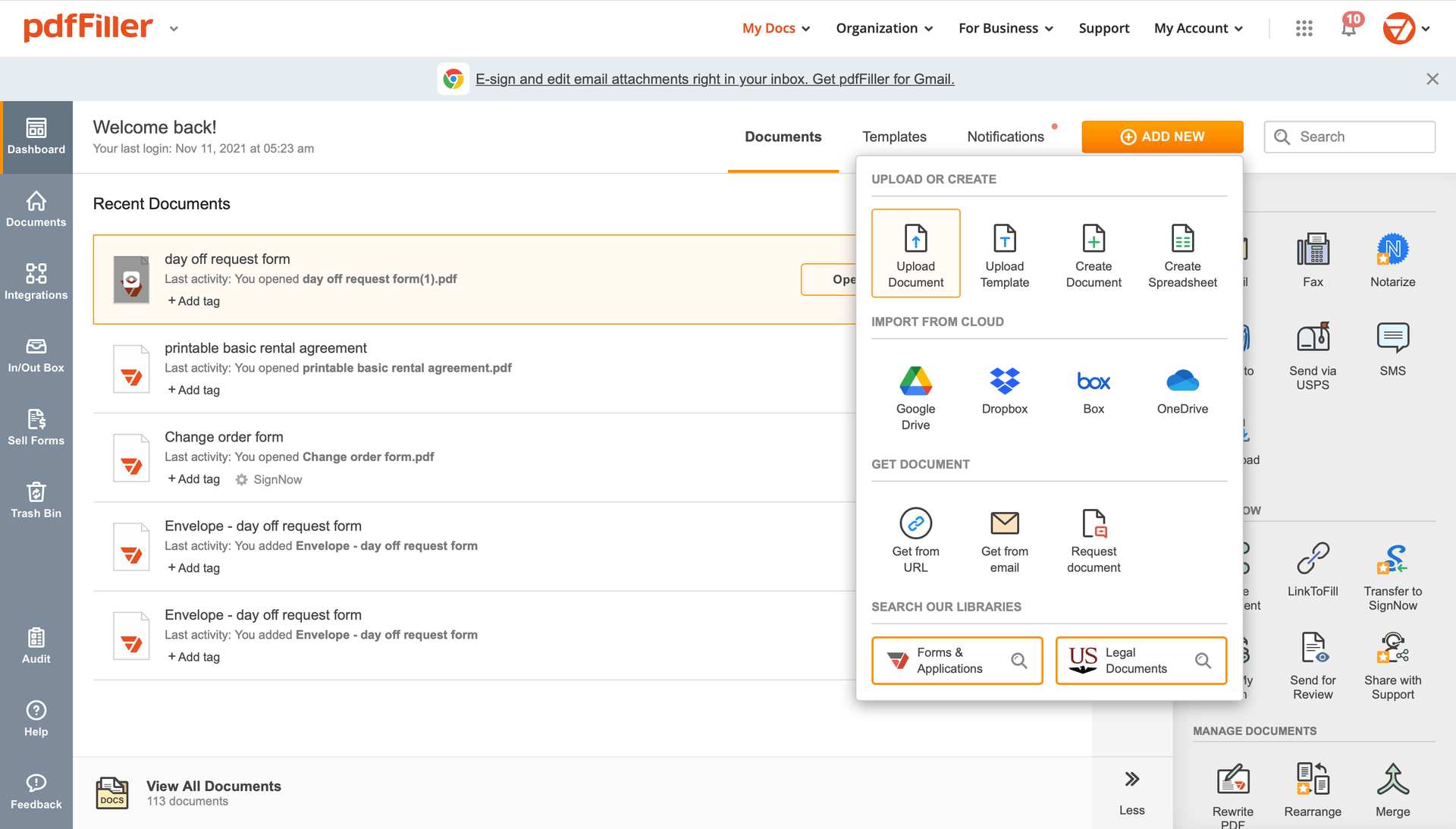

Choose any readily available way to add a PDF file for signing.

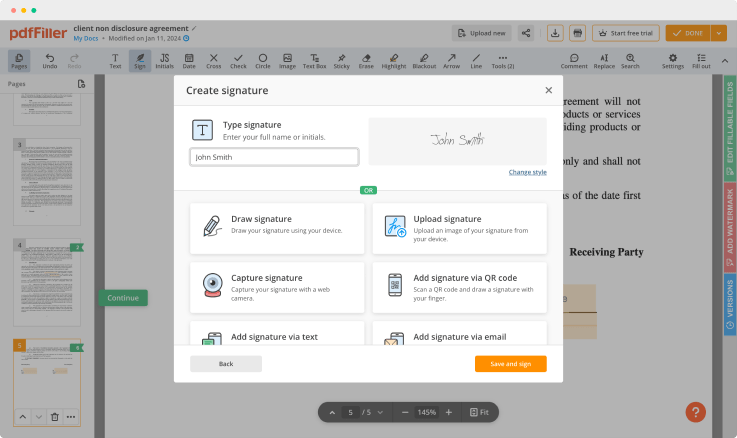

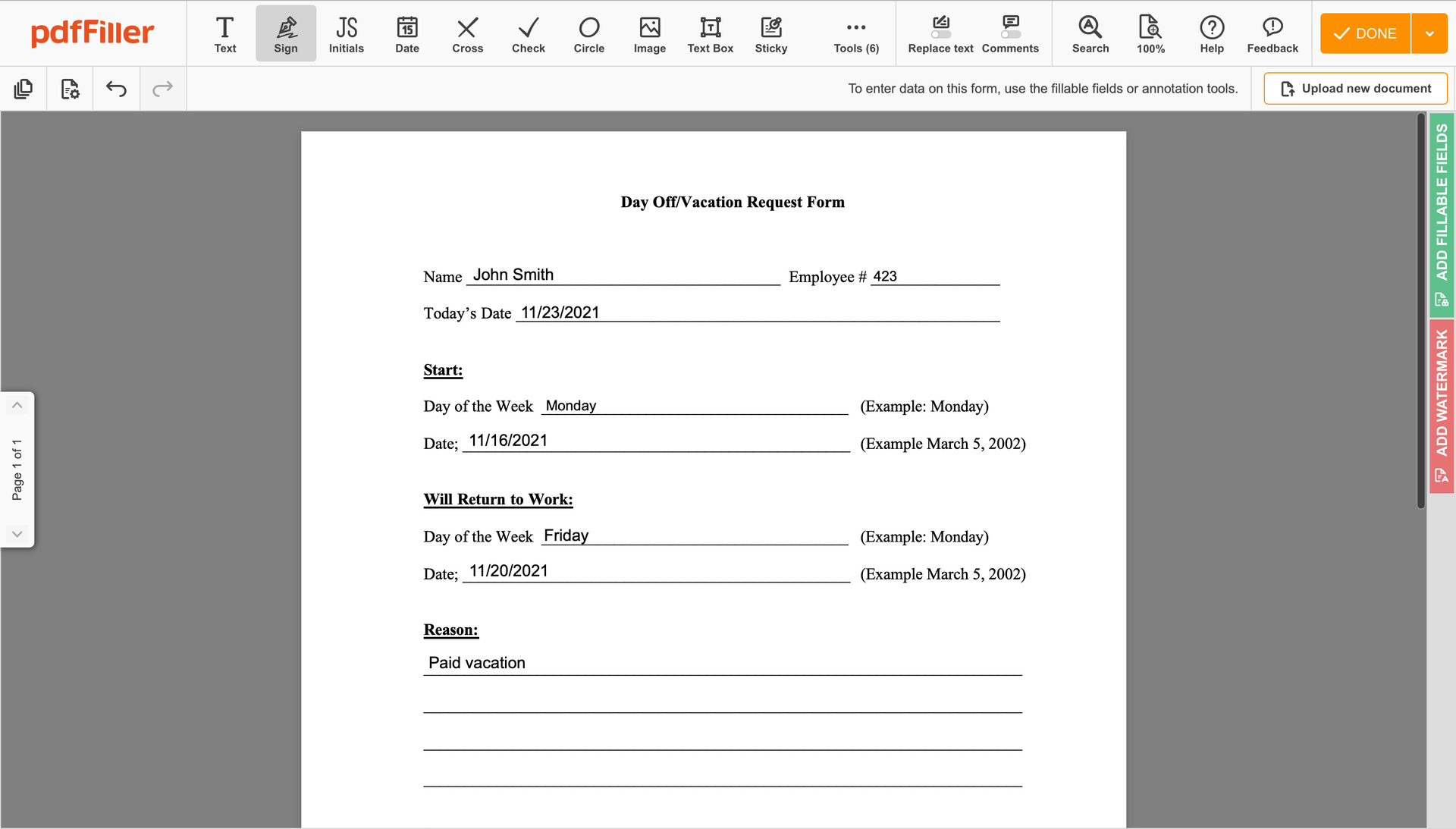

Utilize the toolbar at the top of the page and select the Sign option.

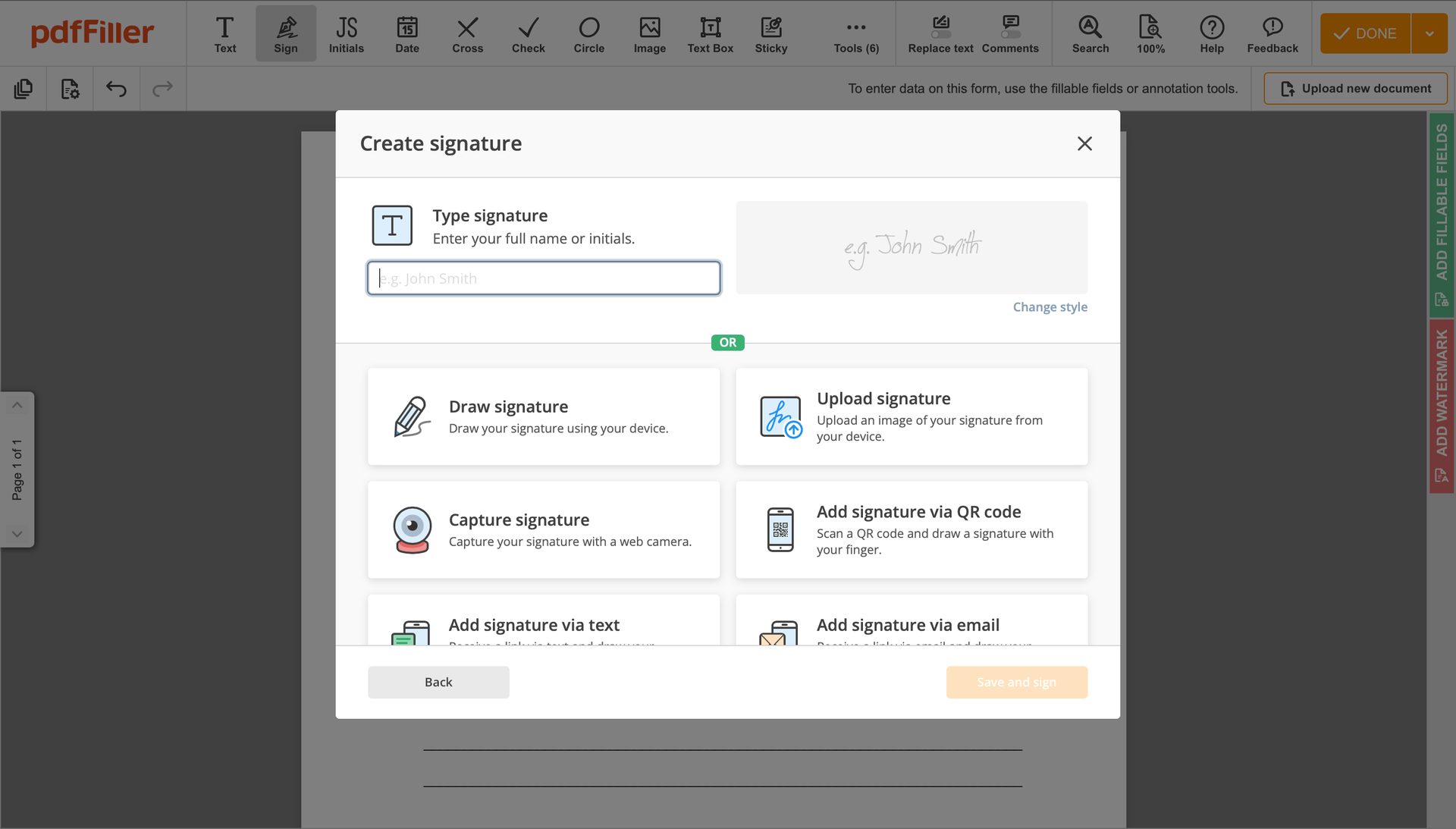

You can mouse-draw your signature, type it or upload a photo of it - our solution will digitize it automatically. As soon as your signature is created, hit Save and sign.

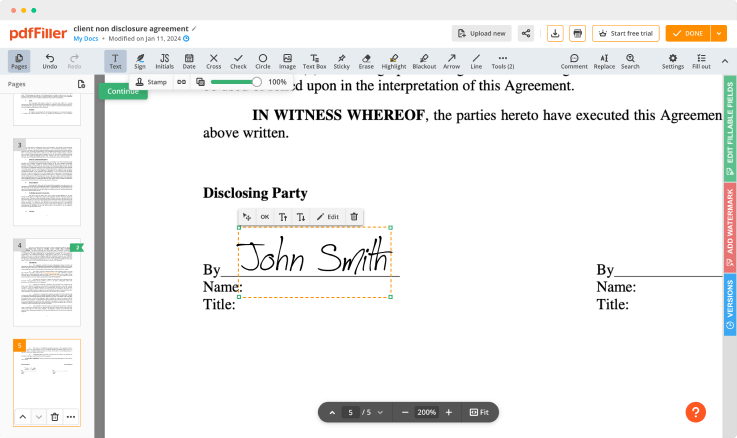

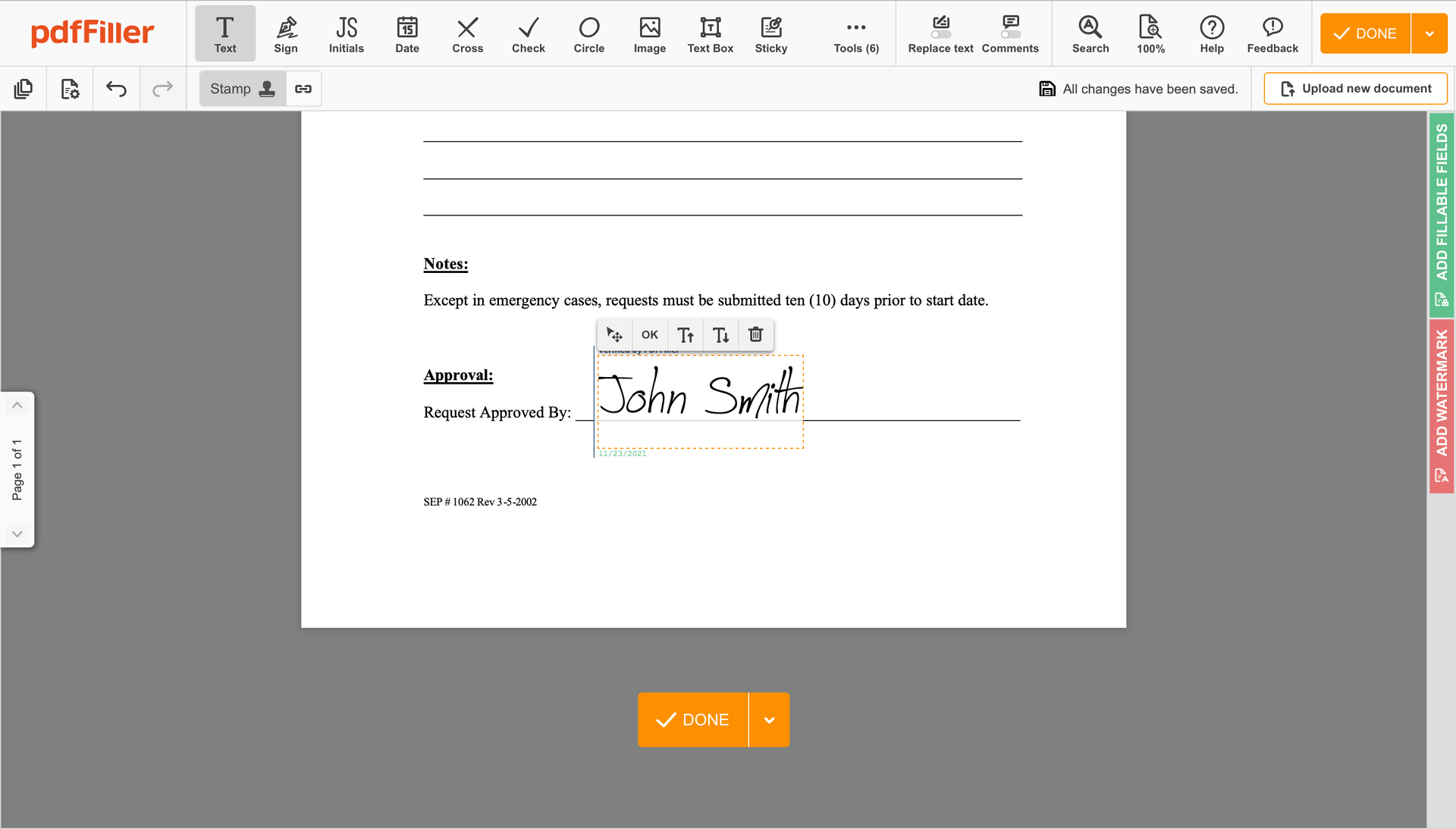

Click on the document area where you want to add an E-Signature 1040EZ Form. You can move the newly generated signature anywhere on the page you want or change its configurations. Click OK to save the adjustments.

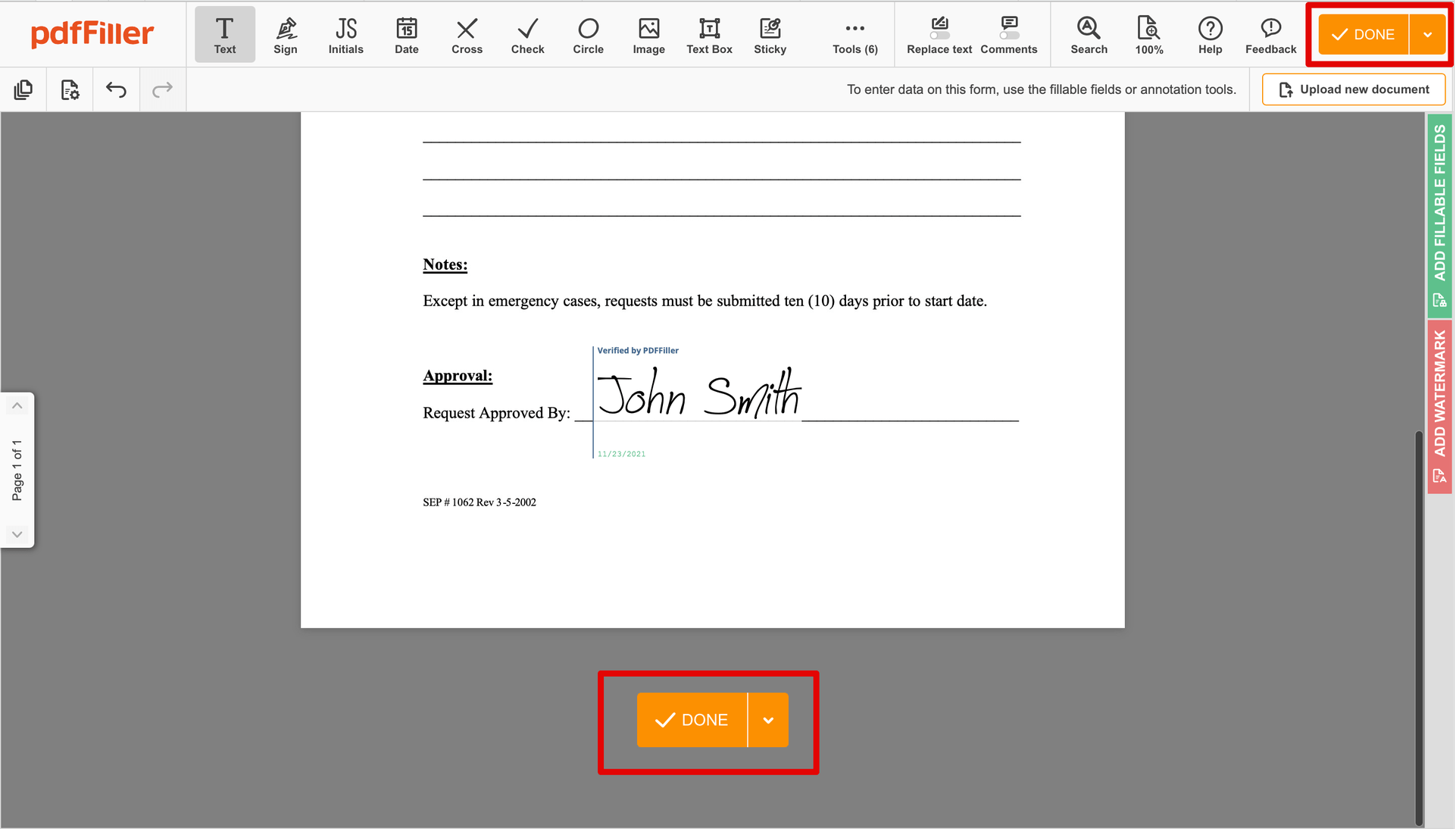

Once your document is all set, hit the DONE button in the top right corner.

As soon as you're through with certifying your paperwork, you will be taken back to the Dashboard.

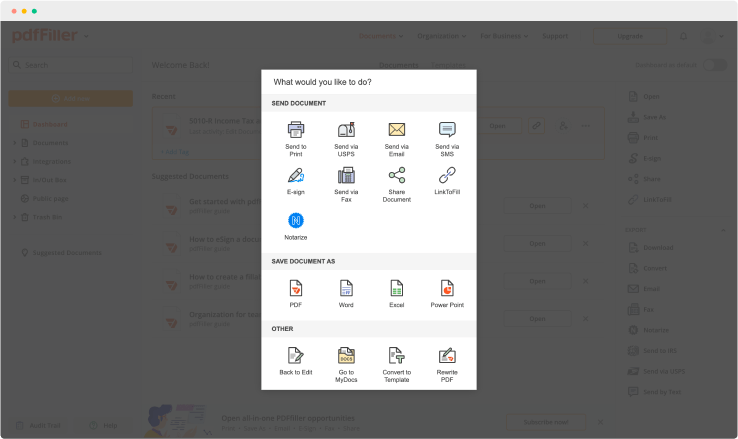

Utilize the Dashboard settings to get the executed form, send it for further review, or print it out.

Stuck with multiple applications for creating and signing documents? We have an all-in-one solution for you. Use our document management tool for the fast and efficient process. Create document templates from scratch, modify existing forms, integrate cloud services and even more features without leaving your browser. Plus, you can use e-Signature 1040EZ Form and add major features like signing orders, reminders, requests, easier than ever. Get the value of full featured platform, for the cost of a lightweight basic app. The key is flexibility, usability and customer satisfaction. We deliver on all three.

How to edit a PDF document using the pdfFiller editor:

For pdfFiller’s FAQs

Ready to try pdfFiller's? E-Signature 1040EZ Form मुफ़्त में