Excise Dropdown Lease मुफ़्त में

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

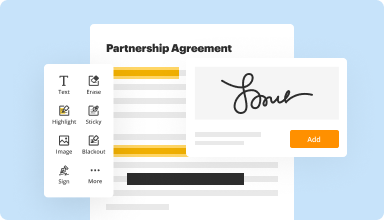

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

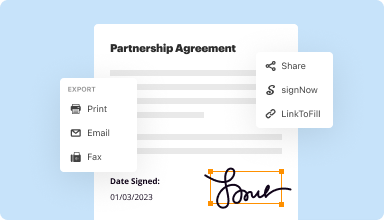

Fill out & sign PDF forms

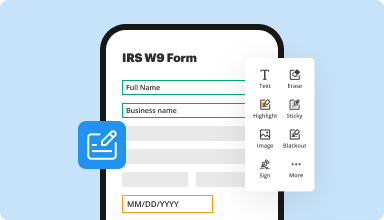

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

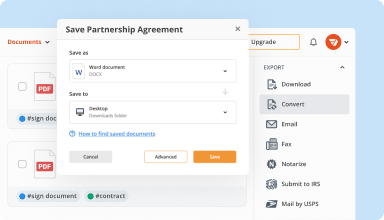

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

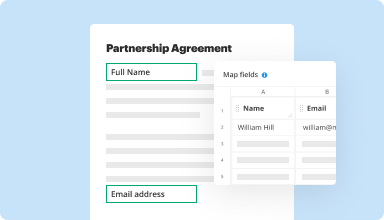

Collect data and approvals

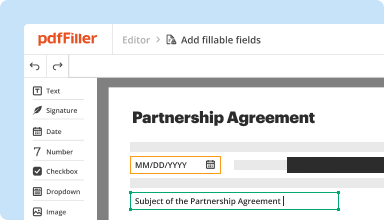

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

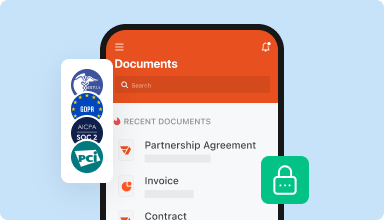

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

PDFFiller responded to my concerns and moved me from inexperienced to competent user status. They promote a feature that pulls PDF files from your email to your account - looking forward to learning how that works.

2016-01-10

Absolutely love it. Never heard of it before. Googled a sample form for disciplinary action...low and behold, when I clicked on your program, It was more than I expected. Will tell my colleagues about it.

2017-03-01

What do you like best?

The program is very quick and easy to use. Uploads your documents very fast. You can type or alternate any pdf or word file. It saves it in no time. You can go back and look at any file you have uploaded. Everything is saved. I also love the fact I can use it on my phone as well through the app. It is extremely convenient. I can fill out new vendors forms very quick which saves me time.

What do you dislike?

I haven't come up with any problems for as long as I have used it...over 2 years now.

What problems are you solving with the product? What benefits have you realized?

It saves me a lot of time. It is a very convenient and fast way to fill out forms or alternate them. Adding a signature on any form is so easy to do through pdffiller. I don't have to print the form, chase my husband to sign, scan it and then email it. Imagine just uploading your form, adding the signature which is already saved and you're DONE :D

The program is very quick and easy to use. Uploads your documents very fast. You can type or alternate any pdf or word file. It saves it in no time. You can go back and look at any file you have uploaded. Everything is saved. I also love the fact I can use it on my phone as well through the app. It is extremely convenient. I can fill out new vendors forms very quick which saves me time.

What do you dislike?

I haven't come up with any problems for as long as I have used it...over 2 years now.

What problems are you solving with the product? What benefits have you realized?

It saves me a lot of time. It is a very convenient and fast way to fill out forms or alternate them. Adding a signature on any form is so easy to do through pdffiller. I don't have to print the form, chase my husband to sign, scan it and then email it. Imagine just uploading your form, adding the signature which is already saved and you're DONE :D

2019-05-21

tough start, but Sam saved the day!

SAM/ JULZ WAS WONDERFUL! SUCH A GREAT SUPPORT! After spending hours trying to fix the problem earlier and having no luck with the calling from billing dept. One agent hung up on me! He came to the rescue, worked to TEACH ME how to walk through the issue and solve the problem. I am so grateful! I will always ask for him in the future! perfect 10 for his effort and going out of his way to help really solve the issue and teach me how to handle it in the future!

2019-05-07

What do you like best?

I can upload any document. I can fill out forms sent to me by others and resend them on the quickness.

What do you dislike?

I have not found anything that I dislike about it.

What problems are you solving with the product? What benefits have you realized?

I save time by not having to print and scan forms and also saves paper.

2022-02-14

I love everything about pdf filler my only problem is i wished i would've knew about this long time ago because this would have saved a lot of time ,gas , money, headache & much more with my business .THIS IS A GAME CHANGER!!!

2021-11-01

Fantastic

i adore this. Used it for my son for distant learning for many of his projects and class work. Also now helping with work from home. Making my job easier. Not needed to scan as much.

2020-10-26

I am a relatively new user to pdffiller, but have found the platform user friendly and does exactly what I need it to. Helping me modernise a lot of statutory requirements for e-signatures and template creations.

When I experienced issues loading documents due to permissions through my work network, the support team at pdffiller responded quickly and continued assisting myself and co-ordinated with my employers IT support function to resolve it within 24 hours, allowing me to get on with my job.

2020-09-25

Well I am finding this to be quite convenient and plus...

Well I am finding this to be quite convenient and plus having all types of forms, but since most things come in PDF I am loving it for my small business, I can duplicate the state tax for for each company and only fill in the "seller" info and that is so time saving! I think I am going to absolutely love this, its my first day here and already feel super pleased!

2020-08-21

Excise Dropdown Lease Feature

Discover the Excise Dropdown Lease feature, designed to simplify your lease management process. This tool provides an intelligent way to handle excise taxes within your leasing agreements, enabling you to focus on what truly matters—your business.

Key Features of Excise Dropdown Lease

User-friendly interface for easy navigation

Automated tax calculations for accurate lease management

Customizable options to tailor leases to your needs

Integrated reporting for clear insights on expenses

Potential Use Cases and Benefits

Ideal for businesses managing multiple leasing agreements

Useful for accountants and finance teams handling excise taxes

Enhances compliance by ensuring accurate tax reporting

Saves time by automating manual processes

The Excise Dropdown Lease feature addresses common challenges in lease management, such as miscalculating taxes or spending too much time on paperwork. With its automated tools and clear customization options, you can ensure accuracy and efficiency in your leasing processes. This feature enables you to streamline operations, improve accuracy, and reduce the risk of non-compliance—ultimately allowing you to concentrate on growing your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Do you pay sales tax on a private car sale in Arizona?

Sales tax on an out-of-state private sale vehicle. I understand that in AZ, if you buy a vehicle from a private party, you don't pay sales tax when you register the car under your name.

Do you pay sales tax on a used car from private seller in Arizona?

State lawmakers are weighing a proposal by the Arizona Automobile Dealers Association to require anyone who sells a used car or truck to collect the state's 5.6 percent sales tax, the same as dealers have to.

Do you have to pay taxes when you buy a car from a private party?

If you buy from a private seller and not from a dealer, you do not pay sales tax to the seller since the private transaction is considered a casual sale. You pay the taxes when you register your car and title it in your name at the DMV.

What is the sales tax on used cars in Arizona?

In Arizona, the sales tax for cars is 5.6%, but some counties charge an additional 0.7%. Some cities can charge up to 2.5% on top of that. The other taxes specific to Arizona are the Title tax of $4, the Plate Transfer tax of $12 and the Registration tax of between $8 and $120.

How do you buy a used car from a private seller in Arizona?

Buying from Private Sellers The seller must provide the vehicle title signed and notarized. The buyer must complete an Arizona Title and Registration Application and pay the necessary fees and vehicle license tax. If there is a lien recorded on the vehicle title, the seller must provide a lien release form.

Do you have to pay sales tax on a private car sale?

Tax obligation with you buy a car through a private sale When you purchase a vehicle through a private sale you must pay the associated local and state taxes. ... However, if you do not bring sufficient documentation, they may ask you to pay sales tax in your state, too.

Can you avoid paying sales tax on a car?

Sales taxes on cars are often hefty, so you may try to avoid paying them. The easiest way to do so is to buy a car in a state with no sales taxes and register the car there. There are five states without sales taxes: Montana, Alaska, Delaware, Oregon and New Hampshire.

Do you have to pay sales tax on private car sale in AZ?

The law requires anyone in the business of selling vehicles to pay the transaction privilege tax, but since 1986, it exempts those who are not automobile dealers. Sparrow said Arizona is the only state where the question of the tax turns on whom the seller is.

Why do I have to pay sales tax on a used car?

It's actually on the sale itself. That's why it's called a sales tax. That car might keep getting traded in, and every time a dealer sells it, it's subject to sales tax. ... If you purchase something and do not pay sales tax, you are supposed to report it to your state and pay use tax.

When buying a car privately How do you tax it?

Tax obligation with you buy a car through a private sale In most states, you'll need to bring your Bill of Sale and or signed title to the Department of Motor Vehicles (DMV) or motor vehicle registry agency to pay your taxes and obtain your registration, new title and plates.

#1 usability according to G2

Try the PDF solution that respects your time.