Form Line Certificate मुफ़्त में

Join the world’s largest companies

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Form Line Certificate Feature

The Form Line Certificate feature offers you a streamlined solution for creating and managing certificates. Whether you run a school, business, or a workshop, this feature can make certification easy and efficient. With its user-friendly interface, you can focus on celebrating achievements without the hassle of complicated processes.

Key Features

Potential Use Cases and Benefits

With the Form Line Certificate feature, you can solve the problem of delayed and cumbersome certification processes. This feature simplifies the entire workflow, allowing you to issue certificates quickly and effectively. Make honoring achievements a seamless part of your operations, and enhance the satisfaction of your recipients.

Instructions and Help about Form Line Certificate मुफ़्त में

Form Line Certificate: make editing documents online a breeze

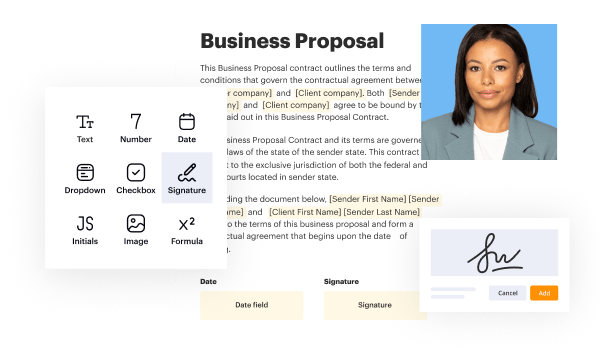

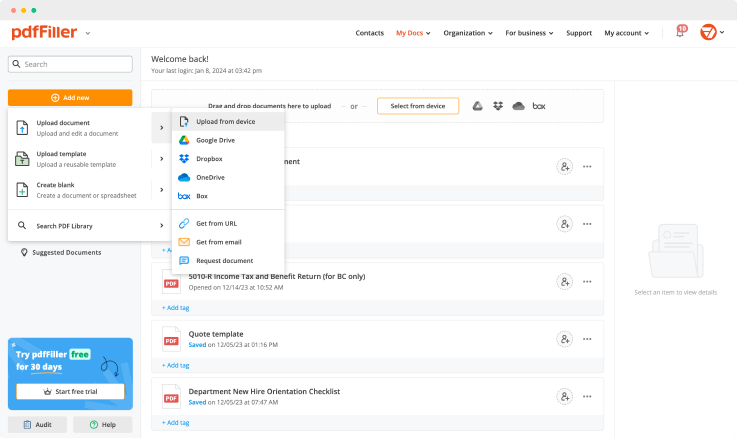

Filing documents online in PDF is the most convenient way to get any type of paper-related work done fast. An application form, affidavit or other document — you're just several clicks away from completion. If you share PDFs with others, and if you want to ensure the accuracy of the information you are sharing, try using PDF editing tools. Having access to a PDF editor gives you the opportunity to edit text, add images, fill out forms and convert PDFs to other formats.

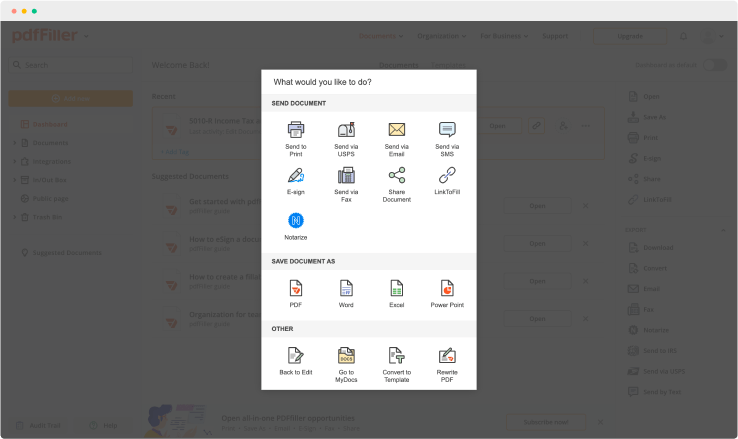

Using pdfFiller, you can create new fillable template from scratch, or upload an existing one to change text, add sheets, images and checkboxes. Export your templates to preferred software solutions to continue where you left off. With pdfFiller, any document can be converted into Word, PowerPoint, image or spreadsheet.

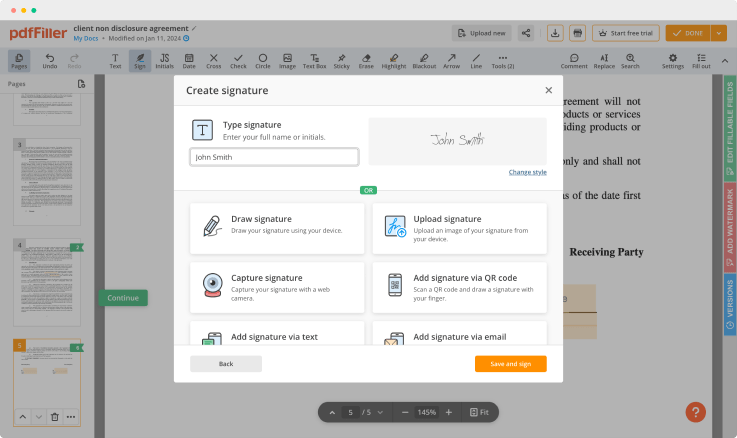

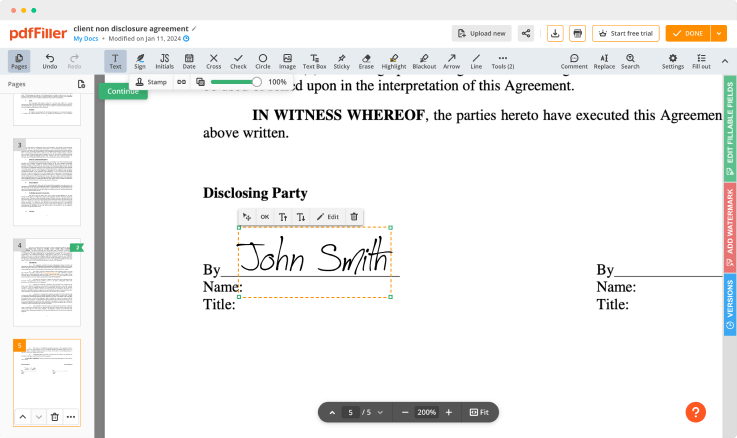

Another useful feature is e-signing, create legally binding signatures with a photograph. Access this from all your devices, your signature will be verified all across the United States according to the DESIGN Act. Upload an existing digital signature from your computer, or use QR codes for verifying documents.

Discover powerful editing features to make your documents look professional. Save documents to the cloud storage to access them across all your devices and secure them from unauthorized use.

Edit. Make changes to your documents with a straightforward interface. Add scanned images, watermarks and checkmarks. Highlight or blackout the particular text

Fill out fillable forms. Browse the template library to pick the ready-made document for you

Create documents from scratch. Add as many fillable fields as you want. Add and erase text. Type anywhere on your template

Change the format. Convert PDF files to any format including Word or Excel

Provide safety. Encrypt your files with two-factor authentication

For pdfFiller’s FAQs

Ready to try pdfFiller's? Form Line Certificate मुफ़्त में