Itemize Accreditation मुफ़्त में

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

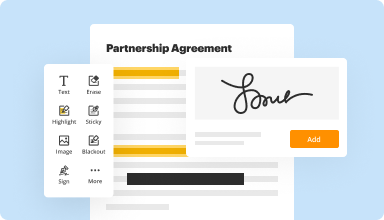

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

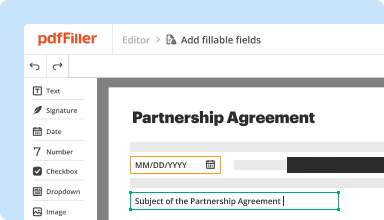

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

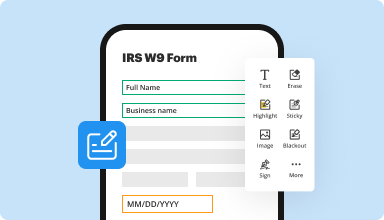

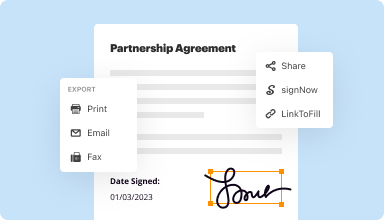

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

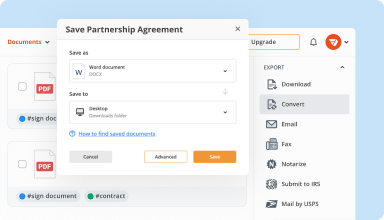

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

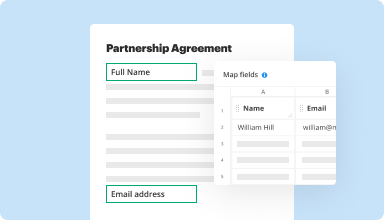

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

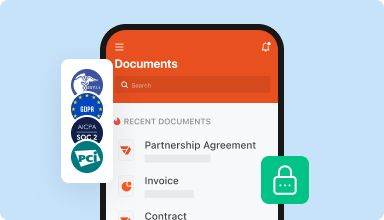

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I used PDF filler to complete a URLA form because the one I was sent by a loan officer was so small I couldn't fit the information in it. PDFfiller made it very easy for me to see and complete the form. I feel that this service would be good for a small business owner because there are many documents available as well as documents that explain the documents you are completing.

2016-09-12

The program did not function as I anticipated, but after I played around with it, I realized it was still a useful tool. I am a Licensed Counselor and this is a great tool used to communicate and transmit sensitive information online. I highly recommend to others!

2018-01-15

What do you like best?

Great support team with quick responses.

What do you dislike?

Don't dislike anything at this time. It is user friendly for what I need to complete.

What problems are you solving with the product? What benefits have you realized?

Great tool to add and delete from forms.

Great support team with quick responses.

What do you dislike?

Don't dislike anything at this time. It is user friendly for what I need to complete.

What problems are you solving with the product? What benefits have you realized?

Great tool to add and delete from forms.

2018-01-02

Good less expensive alternative to some of the competition

Overall, I have been satisfied with PDFfiller

The software works just like advertised. I love that it is super reliable to work when I need it.

The user interface was slightly challenging to get used to but after that, it has been nice.

2019-08-21

Very easy to use. Able to locate any forms that I needed

Not having to use type text of IRS forms.

Ease of Use. Ability to locate any forms that I needed. Ease of transferring to file and in printing the forms.

The T appearing for typing text when I do not want it. I have not other cons. I have enjoyed working with this software and have not run into problems.

2017-11-14

Nice experience

Nice experience, easy to understand my only dislike is the .45 cents fees that are deducted from your banking account during the free trial.

2023-07-26

What do you like best?

The tools are easy to find in PDF filler.

What do you dislike?

It is sometimes difficult to execute certain tasks when the pre-highlighted boxes appear.

What problems are you solving with the product? What benefits have you realized?

I have learned how to use it better, which has negated some of the issues. It is a helpful tool for a job that requires me to fill out many PDF documents.

2021-04-13

I love the product just don't have the need to justify a full subscription. I enjoyed the trial period and had great Customer Service when needed. Very prompt with replies. I would recommend this product.

2020-10-02

Easily Add and Delete Pages From PDFs

PDFfiller has saved me a lot of time combining PDFs and adding/deleting pages. Definitely a must have software.

I like that I can easily add and delete pages from PDFs. They also make it super easy to combine PDFs together.

Overall, very happy with the platform. Might be nice if there was an option to upload and download to Google Drive.

2020-06-12

Itemize Accreditation Feature

The Itemize Accreditation feature empowers organizations by providing a streamlined and efficient way to validate and manage accreditations. With this feature, you can ensure that your certifications are up to date and properly recognized in your industry.

Key Features

Automated tracking of certification expirations

Customizable alerts for renewal reminders

User-friendly dashboard for easy management

Integration with existing systems for seamless workflow

Secure storage of documentation and compliance records

Potential Use Cases and Benefits

Ideal for educational institutions needing to manage instructor accreditations,

Helpful for professionals aiming to keep their certifications current,

Useful for organizations required to comply with industry standards,

Supports HR teams in tracking employee qualifications and training,

Enhances operational efficiency by reducing manual tracking efforts

By implementing the Itemize Accreditation feature, you can solve the challenges of managing multiple certifications and the stress of ensuring compliance. This feature saves you time and helps you focus on what matters most: growing your skills and advancing your career.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Are professional certifications tax-deductible?

If the certification is to maintain or improve your skills for a job you are already working in, or is required to keep your current job, you can deduct the cost as job-related expenses. ... In addition, the deduction will not have any tax benefit unless your total itemized deductions are more than your standard deduction.

Are professional education courses tax-deductible?

You may be able to deduct work-related education expenses paid during the year. To be deductible, your expenses must be for education that (1) maintains or improves your job skills or (2) a law requires to keep your status or occupation. ... Other educational expenses, such as the cost of research and typing.

Can I deduct professional membership fees?

The Internal Revenue Service allows you to deduct any dues that are required by your profession, such as bar dues or membership fees to a professional or trade organization, from your taxes. ... You can also deduct the costs of other organizations you join to help your business, such as the Chamber of Commerce.

Are professional dues deductible in 2018?

The 2017 Tax Cuts and Jobs Act no longer allows employees to deduct club dues as a professional expense on their individual tax returns, effective for 2018 through 2025 tax returns). This expense used to be deductible as a Miscellaneous Expense on Schedule A.

Are professional dues tax-deductible in 2018?

The 2017 Tax Cuts and Jobs Act no longer allows employees to deduct club dues as a professional expense on their individual tax returns, effective for 2018 through 2025 tax returns). This expense used to be deductible as a Miscellaneous Expense on Schedule A.

Are professional dues tax-deductible?

The Internal Revenue Service allows you to deduct any dues that are required by your profession, such as bar dues or membership fees to a professional or trade organization, from your taxes. ... Dues are reported on Schedule A of Form 1040, so if you don't itemize, you won't be able to claim the deduction.

Can I deduct union dues in 2018?

For tax years 2018 through 2025, union dues and all employee expenses are no longer deductible, even if the employee can itemize deductions. However, if the taxpayer is self-employed and pays union dues, those dues are deductible as a business expense.

What is included in miscellaneous itemized deductions?

Miscellaneous itemized deductions are certain nonbusiness expenses that individuals as taxpayers who otherwise itemize deductions may take against their taxable income. Such miscellaneous expenses are allowed only to the extent that they exceed 2-percent of a taxpayer's adjusted gross income.

Are all miscellaneous itemized deductions gone?

No miscellaneous itemized deductions allowed. You can no longer claim any miscellaneous itemized deductions. Miscellaneous itemized deductions are those deductions that would have been subject to the 2% of adjusted gross income limitation.

Are miscellaneous deductions allowed in 2018?

Tax reform eliminates most miscellaneous itemized deductions. ... Starting in 2018 and continuing through 2025, taxpayers will not be able to deduct expenses such as union dues, investment fees, or hobby expenses. However, gambling losses remain deductible.

#1 usability according to G2

Try the PDF solution that respects your time.