Itemize Radio Settlement मुफ़्त में

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

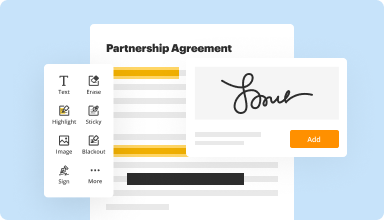

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

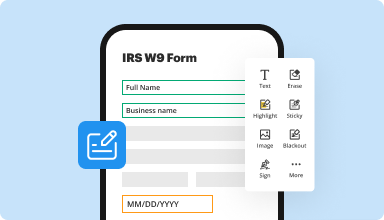

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

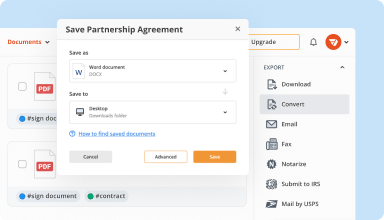

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

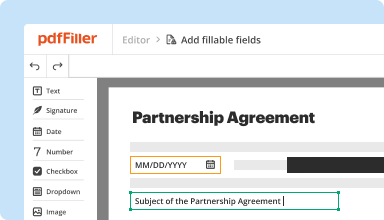

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

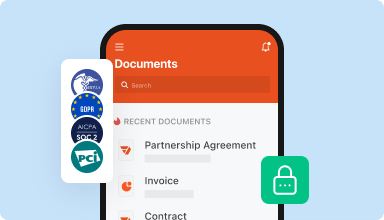

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I was able to do what I needed but I am not sure about future applications. Also, I thought I received a 70% Discount for signing up annually but I did not receive this.

2016-02-25

I am so pleased with the cost and features of PDFfiller. Today, I just learned that it has an online search function as well! Quite enthused about this!

2018-02-15

What do you like best?

The best feature of PDFFiller is its ease of use, whether it's editing documents, signing documents, and then being able to access your documents anywhere by logging onto the site, as opposed to being constrained if you don't have your computer files with you.

What do you dislike?

Some of the option menus should be improved upon, especially as far as layout and ease of finding what you need, it's a bit counterintuitive though with experience that becomes less of an issue.

What problems are you solving with the product? What benefits have you realized?

Signing PDFs with ease. Being able to access and edit a pdf no matter where I am as long as I have internet access, even if I don't have my computer with me and/or don't have access to my cloud storage.

The best feature of PDFFiller is its ease of use, whether it's editing documents, signing documents, and then being able to access your documents anywhere by logging onto the site, as opposed to being constrained if you don't have your computer files with you.

What do you dislike?

Some of the option menus should be improved upon, especially as far as layout and ease of finding what you need, it's a bit counterintuitive though with experience that becomes less of an issue.

What problems are you solving with the product? What benefits have you realized?

Signing PDFs with ease. Being able to access and edit a pdf no matter where I am as long as I have internet access, even if I don't have my computer with me and/or don't have access to my cloud storage.

2019-05-28

Support has been helpful several times.

Support has been helpful several times.

It takes a bit of patience, but whenever I need help, they have been able to solve my problem succesfully!

2024-09-18

What do you like best?

GREAT to use, has lots of options and you can upload almost anything!

What do you dislike?

I wish that there were more options, like adding icons, or company stamps. I also have found sometimes when I download it there are lines that run through it, very frustrating when it took like an hour to manipulate a document, and it won't upload without random lines.

What problems is the product solving and how is that benefiting you?

Specifically AIA forms for commercial contracting, such a great tool!

2022-11-03

Tolles Programm für das Bearbeiten von PDF.

Diese Software ist durch seine leichte Funktionsweise, ein tolles und hilfreiches Programm, um PDF-Dateien zu bearbeiten. Es hat alle Funktionen, die ich dafür benötige.

Die Zeit der Gratisversion ist etwas zu kurz.

2022-06-14

Fast! We love the way it transfers previous, redundant info...

Very Accurate...woo hoo! Thank you, worth every bit the price, especially if everything submits electronically.

2021-01-29

Thomas from PDFFILLER did an AMAZING…

Thomas from PDFFILLER did an AMAZING job helping me resolve my matter. He was professional and helped me as a consumer. I will definitely keep doing business with you guys!!

2021-01-12

I'm still learning! It's been really helpful working from home. It could be a little bit more user friendly, I had to start using it suddenly due to being quarantined,

2020-07-22

Itemize Radio Settlement Feature

The Itemize Radio Settlement feature simplifies the process of managing and reconciling financial settlements for your organization. It helps you track incoming and outgoing transactions efficiently.

Key Features

Real-time transaction tracking

Automated reconciliation processes

Customizable report generation

User-friendly interface

Integration with existing accounting systems

Potential Use Cases and Benefits

Streamlining financial reporting for businesses of all sizes

Enhancing accuracy in transaction matching and tracking

Reducing time spent on manual reconciliation tasks

Improving decision-making through detailed insights

Facilitating better communication among finance teams

By implementing the Itemize Radio Settlement feature, you can reduce the hassle of managing financial transactions. This feature addresses common problems such as errors in manual entry and the time-consuming nature of reconciliation. You can regain valuable time and focus on growing your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is itemized deduction recovery?

Itemized Deduction Recoveries. If you recover any amount that you deducted in an earlier year on Schedule A (Form 1040), you generally must include the full amount of the recovery in your income in the year you receive it.

How do I know if I itemized my deductions?

If you filed Form 1040-A or 1040-EZ last year, you took the standard deduction.

If the amount on Line 40 of last year's Form 1040 ends with a number other than 0, you itemized. ...

If your return included Schedule A, you itemized.

Is it better to take the standard deduction or itemized?

Generally speaking, itemizing is a good idea if the value of your itemized expenses is more than the value of the standard deduction. Because the new tax plan nearly doubled the standard deduction for the 2018 tax year, some people who itemized their 2017 taxes will not benefit from itemizing their 2018 taxes.

How should a recovery of an item previously deducted be reported?

The tax benefit rule states that: If a taxpayer recovers an amount that was deducted or credited against tax in a previous year, the recovery must be included as income to the extent that the deduction or credit reduced the tax liability in the earlier year.

What is an itemized deduction recovery?

A recovery is a refund of an amount you used as an itemized deduction in an earlier year. If you used the standard deduction that year, your refund is not taxable.

What is recovery exclusion?

The term recovery exclusion as used in this section means an amount equal to the portion of the bad debts, prior taxes, and delinquency amounts (the items specifically referred to in section 111), and of all other items subject to the rule of exclusion which, when deducted or credited for a prior taxable year, did ...

What is the tax benefit rule?

Tax Benefit Rule. A rule that provides that the amount of an expense recovered must be included in income in the year of the recovery to the extent the original expense resulted in a tax benefit. The most common example is a state income tax refund of tax deducted in the prior year.

Are federal tax refunds taxable?

First, federal income tax refunds are not taxable as income. Second, interest from both the federal and state governments is considered taxable income and should be reported. Finally, state income tax refunds may be taxable, depending on what you deducted on your prior-year tax returns.

Is workers compensation reported to IRS?

If you received your workers compensation “under a workers' compensation act or a statute in the nature of a workers' compensation act” it is not taxable, and they should not have issued you a 1099-MISC. ... In the meantime, the IRS expects to see that income on your tax return.

Do I have to report workers compensation on my taxes?

You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers' compensation act or statute for an occupational injury or sickness. However, retirement plan benefits are taxable if either of these apply: You retire due to your occupational sickness or injury.

#1 usability according to G2

Try the PDF solution that respects your time.