Lay Wage Transcript मुफ़्त में

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

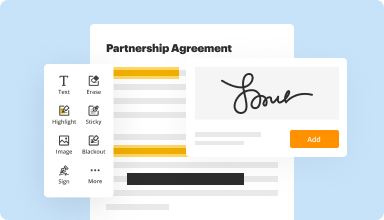

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

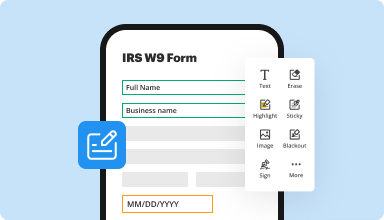

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

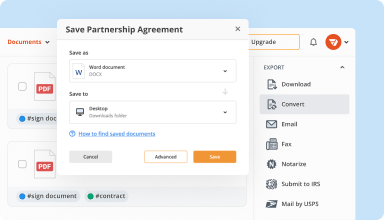

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

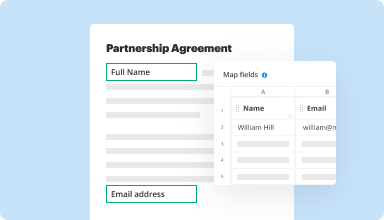

Collect data and approvals

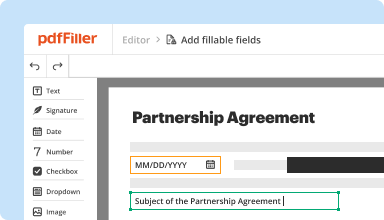

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

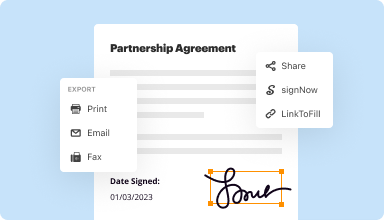

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

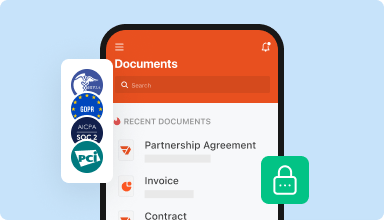

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

kind of difficult to understand..sometimes it would not fill out the form and sometimes it would, then go back to the first signature and had to keep confirming.

2017-01-17

As a new small business operator, this software has helped me with so many tasks without having to leave work. The only draw back is that many times, recipients can't open sent pdf files and another route has to be taken.

2018-02-28

This app has been very helpful in tracking various forms and schedules in one place. I couldn't always access a particular form but generally, this was a great way to do a one-stop-shop for tax forms.

2018-04-06

I was annoyed that I had to enter credit card info for a free trial. It makes me feel as if I'm being tricked into keeping your service. Very pleased with how the product works though.

2019-05-07

Easy to use for 1099 filings

Use for 1099s and other tax filings.

Used this product for 1099 filings.. simple and easy to use except for ability to make edits (address changes etc.) once filed.

Once a 1099 is filed, program does not make it easy to go back and edit a document. Also, any updated filings are charged another filing fee, which seems excessive.

2019-03-12

It's great I had no idea how to get started but the process made simple is the best! This is my first year in business for myself and proving income was scary to think about, but now I can handle my profits and losses monthly with accuracy!!

2023-08-17

Excellent

Worked as expected. When I lost the connection to Wi-Fi dining the filling out of a lengthy form, all of my work was automatically saved to the point connection was disrupted. Whew!

2022-04-04

What do you like best?

It is easy to use across multiple platforms.

What do you dislike?

Some steps feel more complicated than they need to be, such as renaming a file.

Recommendations to others considering the product:

It is easy to access across multiple platforms.

What problems are you solving with the product? What benefits have you realized?

It allows me to sign documents quickly and get them back to whoever requests them.

2022-02-15

It would help to have some sort of tutorial outlining the all the functions. Having been offered a webinar during the 30 day free trial would've been helpful.

2020-07-27

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I get my wage and income transcript?

You can get an IRS wage and income transcript online at www.irs.gov/Individuals/Get-Transcript. When you get wage and income transcript access, it will show you all the informational returns the IRS has received for your tax ID, like: W-2. Form 1099-INT.

What is wage and income transcript?

IRS Definition A wage and income transcript shows data from information returns the IRS receives, such as Forms W-2, 1099, 1098 and Form 5498. Current tax year information may not be complete until July. This transcript is available for up to 10 prior years using Get Transcript Online or Form 4506-T.

How do I get a wage and income transcript?

You can get an IRS wage and income transcript online at www.irs.gov/Individuals/Get-Transcript. When you get wage and income transcript access, it will show you all the informational returns the IRS has received for your tax ID, like: W-2. Form 1099-INT.

Is a tax return transcript the same as a wage and income transcript?

Tax Account Transcript — shows basic data such as return type, marital status, adjusted gross income, taxable income and all payment types. Wage and Income Transcript — shows data from information returns we receive such as Forms W-2, 1099, 1098 and Form 5498, IRA Contribution Information.

Can I file taxes with a wage and income transcript?

Yes, you can use it. You get the wages and income transcript from the IRS, who gets all their info from the SSA. The TurboT ax software might not take it without this, but you can still file.

What is an IRS wage statement?

Form W-2 (officially, the “Wage and Tax Statement”) is an Internal Revenue Service (IRS) tax form used in the United States to report wages paid to employees and the taxes withheld from them. The form is also used to report FICA taxes to the Social Security Administration.

Can I file my taxes with a wage and income transcript?

Yes, you can use it. You get the wages and income transcript from the IRS, who gets all their info from the SSA. The TurboT ax software might not take it without this, but you can still file.

How do I file taxes with a transcript?

The number to call is 800-908-9946. Order by mail. Complete and send either Form 4506-T or Form 4506T-EZ to the IRS to get one by mail. Use Form 4506-T to request other tax records: tax account transcript, record of account, wage and income and verification of non-filing.

#1 usability according to G2

Try the PDF solution that respects your time.