Split Period Certificate मुफ़्त में

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

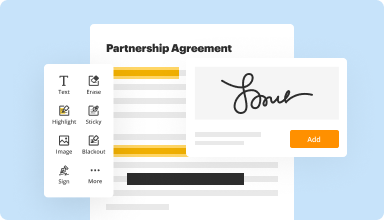

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

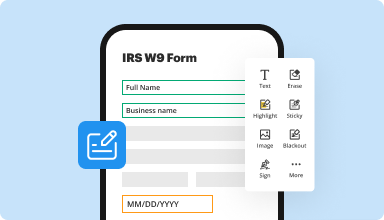

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

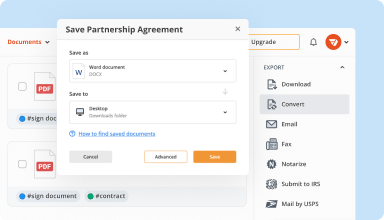

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

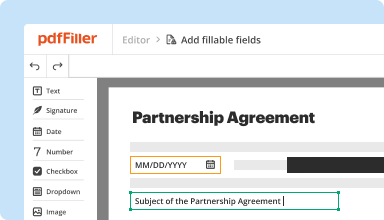

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

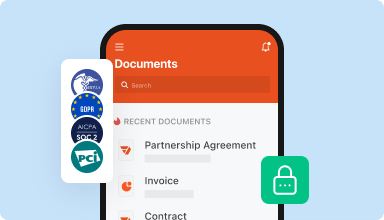

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Everything has worked great and while I honestly don't know what there are companies that still use Fax, they do exist and I need to work with them. Love PDFfiller and everything it provides.

2016-01-04

I like the ease of use. I do think the help system needs and upgrade. Should have a searchable index. It is hard to find topics. I am an experienced software guy and just want to find out how to do thinks.

2017-06-04

I have enjoyed my experience with PDFFiller, the price was reasonable, and I have gotten every feature that I need and expected. It's truly a great service.

2017-06-15

The price is kind of crazy, I am a single mother of 3 and I am on a limited budget. The program itself is fantastic, but the price is hard for me to justify buying. :(

2018-06-13

Experiencia en pdfFiller

Mi experiencia con pdfFiller ha sido bastante positiva. Lo que más me ha gustado del software es su capacidad para crear y diseñar formularios de manera rápida y sencilla. Esto me ha ahorrado mucho tiempo al momento de completar trabajos y tareas para mis clases. Además, la automatización del proceso/flujo de trabajo también ha sido muy útil, ya que me permite organizar y enviar mis documentos de manera eficiente.

Lo que más me ha gustado del software pdfFiller es la facilidad de creación y diseño de formularios, ya que me permite personalizar los formularios según mis necesidades y hacerlos más atractivos visualmente. Además, la automatización de procesos y flujos de trabajo me ha ayudado a ahorrar tiempo y aumentar mi productividad.

Lo que menos me ha gustado del software pdfFiller es que a veces puede ser un poco difícil de usar para algunas personas menos familiarizadas con la tecnología. Aunque la interfaz es intuitiva, puede requerir un poco de tiempo para acostumbrarse a todas las funciones y opciones disponibles.

2023-01-26

used a handful of other pdf programs, and while there have been a decent one here or there, most have been quite irresponsible, irresponsive, and irritable! pdfFiller is by far the most user-friendly, quick, and manageable one there is, notes this observer! am definitely glad i went for the platinum membership - has not only calmed my disdain towards pdfs, but i am actually having fun with them now! ^_^

salamat poh, y arrigato, mi llamato ~

2022-11-14

Eliminating so much wasted paper

Very good! Would highly recommend to any fast paced office

We have cut out paper usage in half since we started using this product! And by refusing our waste we also reduced our shredding fees

I haven't found anything to dislike yet. So far it's been a very positive experience and no complaints.

2021-01-08

I am using this program for school…

I am using this program for school applications and I love the ease of downloading and making all my tests and worksheets fillable the only issue so far is that when students fill out worksheets and send to me they all come ananomously so if a student forgets name on paper I have no way to track it, it is definately the students problem but it is just a bit of a hassle.

2020-11-25

PDFfiller was an easy and convenient…

PDFfiller was an easy and convenient service to use. I filled out my PDF no problem and saved my documents. The customer support team was extremely helpful and accommodating when I needed to change my plan. Highly recommend!

2020-06-10

Split Period Certificate Feature

The Split Period Certificate is designed to offer flexibility and convenience for your investment needs. It allows you to divide your investment period, giving you control over your funds and the potential for higher returns. This feature is perfect for individuals who want to manage their finances more effectively.

Key Features

Flexibility in choosing different investment periods

Option to split investment into multiple certificates

Competitive interest rates

Easy tracking of your investment performance

User-friendly interface for managing certificates

Potential Use Cases and Benefits

Ideal for individuals looking to invest for short and long-term goals

Useful for creating a diversified investment strategy

Helpful for those who want to take advantage of changing market conditions

Supports better cash flow management

Enables gradual investment without locking up funds for long durations

With the Split Period Certificate, you can easily tailor your investment strategy to meet your unique financial goals. By splitting your investment periods, you can access funds when needed, reducing stress during unforeseen financial situations. This feature is ideal for anyone looking to enhance their investment experience while maximizing returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is a 2 for 1 stock split?

A stock split is a decision by a company's board of directors to increase the number of shares that are outstanding by issuing more shares to current shareholders. For example, in a 2-for-1 stock split, an additional share is given for each share held by a shareholder. A stock's price is also affected by a stock split.

How do you calculate a 2 for 1 stock split?

To calculate the number of new shares you will have after a stock split, multiply the number of shares you currently own by the number of new shares being issued for each existing share. For example, say a company that you own 150 shares of is doing a 2-for-1 stock split.

Is a 2 for 1 stock split good?

For example, in a 2-for-1 split (the most common type), the underlying firm doubles its total number of shares outstanding, but its stock price is subsequently halved. The end result to current shareholders is that they now hold twice as many shares of stock, but the stock's price is half of what it was previously.

What happens with a 2 for 1 stock split?

A stock split is a decision by a company's board of directors to increase the number of shares that are outstanding by issuing more shares to current shareholders. For example, in a 2-for-1 stock split, an additional share is given for each share held by a shareholder. A stock's price is also affected by a stock split.

How do you calculate a 3 for 2 stock splits?

You calculate the number of new shares that you have after the split by multiplying the ratio of the stock split. With a 3-for-2 split, multiply your old share total by 3/2, or 1.5. For example, if you had 100 shares before the 3-for-2 split, multiply 100 by 1.5 to find you now have 150 new shares.

How do you calculate a 5 for 2 stock splits?

Divide your per-share basis by the number of new shares you received for each old share in the first stock split. For example, if your stock split five new shares for every old share, divide $25 by 5 to get a new basis of $5 per share. Repeat Step 2 for each stock split to calculate your new stock basis.

What is a 1 1 stock split?

1/1 stock split means, For issuing company: each share splits into two parts. By this they get double the number of shares for trading activity in market at half the price due to split. For stockholders: issuing companies termed it as 1:1 split.

What is a 1 for 2 stock splits?

A stock split is a decision by a company's board of directors to increase the number of shares that are outstanding by issuing more shares to current shareholders. For example, in a 2-for-1 stock split, an additional share is given for each share held by a shareholder.

#1 usability according to G2

Try the PDF solution that respects your time.