Proposal Management System for Property Tax Protest Companies that propels your deals forward

What makes pdfFiller an excellent Proposal Management System for Property Tax Protest Companies?

Trusted RFP management software

pdfFiller’s Proposal Management System for Property Tax Protest Companies: Generate and handle, and keep an eye on your proposals hassle-free

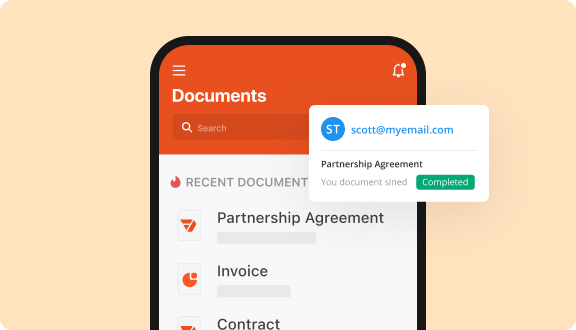

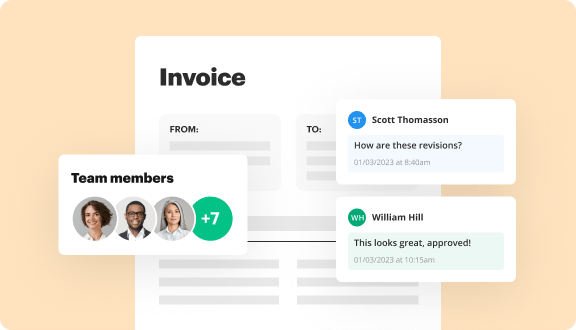

Whether you’re assembling a Request for Proposal (RFP) or find yourself on the other side of a review and negotiation process, pdfFiller’s Proposal Management System for Property Tax Protest Companies is here to facilitate and improve the process of finalizing your deal.

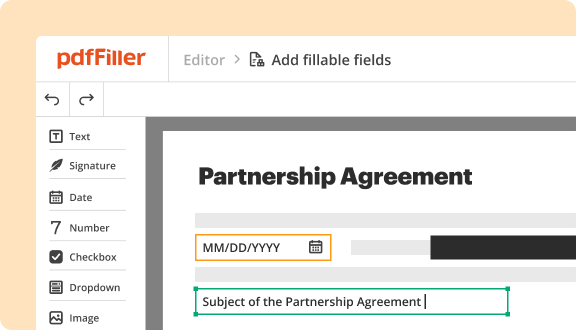

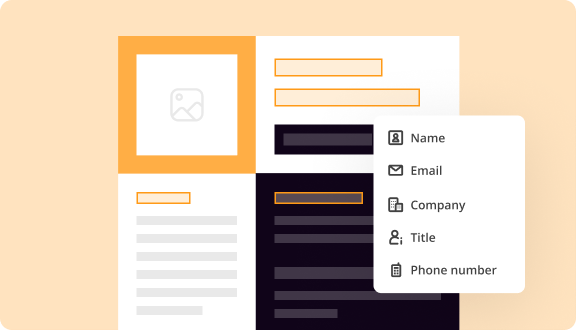

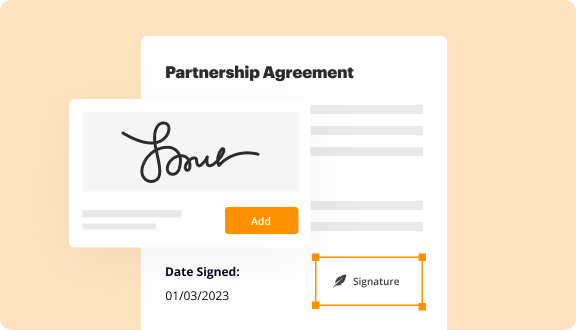

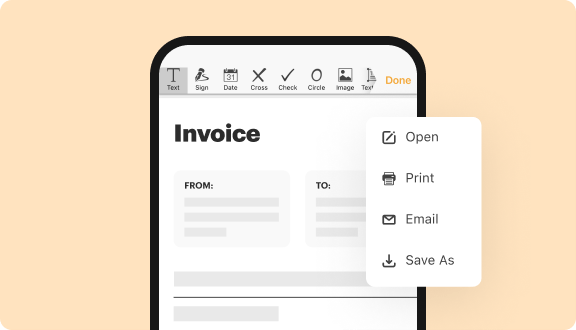

Though "pdfFiller" might hint otherwise, our platform works with a number of file formats and features various proposal management tools that allow you to edit existing documents or set up ones from the ground up. You can also turn them into straightforward-to-share and -embed fillable documents for smooth data requests. Transform any document into a reusable template, leaving less room for error and operational inefficiencies. Follow the steps below to start benefiting from pdfFiller.

Getting started with Property Tax Protest Companies Proposal Management System to create and work together on your first proposal

You don’t need expensive RFP tools when you have pdfFiller, a trusted Proposal Management System for Property Tax Protest Companies, at hand. It strikes an equilibrium between power and performance, providing a powerful toolkit and intuitive interface for streamlined proposal management.

Sign up for your free trial and redefine your document-centric operations today!

Video guide about Proposal Management System for Property Tax Protest Companies

Every proposal management tool you need to close deals fast

Why pdfFiller wins

Cloud-native PDF editor

Top-rated for ease of use

Unlimited document storage

Unmatched cost-to-value

Industry-leading customer service

Security & compliance

Proposal Management System for Property Tax Protest Companies

Discover how our Proposal Management System can streamline your processes and secure your deals effectively. This innovative tool empowers property tax protest companies to manage proposals efficiently and enhance client engagement.

Key Features

Potential Use Cases and Benefits

By adopting our Proposal Management System, you address the common challenge of disorganization in proposal processes. You can move your deals forward confidently with streamlined operations and improved clarity, positioning your company for greater success in property tax protests.