Last updated on

Jan 19, 2026

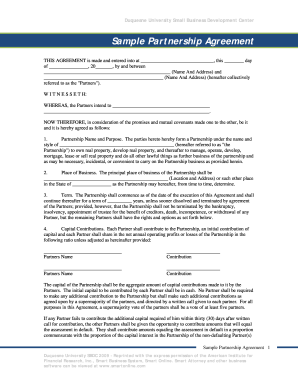

Customize and complete your essential Profit Sharing Agreement template

Prepare to streamline document creation using our fillable Profit Sharing Agreement template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

Customize Your Profit Sharing Agreement Template

Create a tailored Profit Sharing Agreement that meets your needs. Our feature allows you to define terms that reflect your business goals and partnerships.

Key Features

Easy customization for specific terms and conditions

User-friendly interface designed for quick edits

Downloadable formats like PDF and Word

Pre-defined clauses applicable to various industries

Guidance on legal compliance and best practices

Potential Use Cases and Benefits

Small businesses establishing profit-sharing arrangements

Startups preparing for investor agreements

Partnerships outlining revenue distribution

Consultants and freelancers formalizing payment structures

Nonprofits sharing funds among stakeholders

This feature helps you solve the common problem of vague or poorly structured agreements. By customizing your Profit Sharing Agreement, you ensure clarity, minimize disputes, and establish clear expectations. Save time and resources while fostering stronger business relationships.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to create a Profit Sharing Agreement

Creating a Profit Sharing Agreement has never been so easy with pdfFiller. Whether you need a professional forms for business or personal use, pdfFiller offers an instinctive solution to generate, customize, and handle your documents efficiently. Utilize our versatile and fillable templates that align with your specific demands.

Bid farewell to the hassle of formatting and manual customization. Employ pdfFiller to easily craft polished forms with a simple click. your journey by following our detailed guidelines.

How to create and complete your Profit Sharing Agreement:

01

Register your account. Access pdfFiller by signing in to your profile.

02

Search for your template. Browse our comprehensive catalog of document templates.

03

Open the PDF editor. When you have the form you need, open it in the editor and take advantage of the editing instruments at the top of the screen or on the left-hand sidebar.

04

Insert fillable fields. You can choose from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Adjust your form. Add text, highlight areas, add images, and make any required adjustments. The intuitive interface ensures the process remains easy.

06

Save your changes. Once you are happy with your edits, click the “Done” button to save them.

07

Send or store your document. You can deliver it to others to sign, download, or securely store it in the cloud.

To summarize, crafting your documents with pdfFiller templates is a smooth process that saves you time and guarantees accuracy. Start using pdfFiller right now to take advantage of its robust features and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How to structure a profit share agreement?

The five most important considerations when creating a ProfitSharing Agreement Clarify expectations. Define the role. Begin with a fixed-term agreement. Calculate how much and when to share profits. Agree on what happens when the business has losses.

How do you structure a profit share?

How To Set Up A Profit-Sharing Plan Define the purpose and goals. Consult with professionals. Decide on the plan structure. Create a written plan document. Establish a trust for plan assets. Implement record-keeping procedures. Provide information to employees. File the plan with the IRS. How To Set Up A Profit-Sharing Plan: Ultimate Guide People Managing People strategy-operations People Managing People strategy-operations

What is the typical profit sharing structure?

A profit-sharing program is exactly as it sounds: Your company gives employees a percentage of its quarterly or annual earnings. It's typically based on your organization's profit, which is your total revenue minus total expenses.

How to setup a profit sharing plan?

How to create a profit-sharing plan Determine how much you want your PSP amount to be. Profit allocation formula. Write up a plan. Rules. Provide information to eligible employees. File IRS Form 5500 annually. Details your contribution plan and all participants in it. Keep records (e.g., amounts, participants, etc.)

How to create a profit sharing agreement?

The five most important considerations when creating a ProfitSharing Agreement Clarify expectations. Business is as much about strong relationships as it is about making money. Define the role. Begin with a fixed-term agreement. Calculate how much and when to share profits. Agree on what happens when the business has losses. 5 Insights to Help you Draft the Perfect Profit-sharing Agreement 5-insights-to-help-you-draft-t 5-insights-to-help-you-draft-t

How to structure a revenue share agreement?

How to Structure a Revenue-Sharing Agreement Identify the revenue sources and stakeholders. Define each party's responsibilities and define a timeline for payment. Set measurable performance metrics that will be used to assess success. Consider any applicable government regulations. What is Revenue Sharing? | DealHub DealHub glossary revenue-sharing DealHub glossary revenue-sharing

What is an example of a profit sharing plan?

As a basic same-dollar example, suppose a business generated a profit of $100,000 in a year and decided to allocate 5% to the profit sharing plan. If there are 10 eligible employees, each would receive $500 (5% of $100,000). As a pro-rata profit sharing example: Suppose a company gives employees 10% of annual profits.

Who can set up a profit sharing plan?

A profit sharing plan is for employers of any size. are used solely to benefit the participants and their beneficiaries. The trust must have at least one trustee to handle contributions, plan investments, and distributions. Profit Sharing Plans for Small Businesses | US Department of Labor U.S. Department of Labor resource-center publications p U.S. Department of Labor resource-center publications p

How to structure revenue share?

These include: 50/50 split: Revenue sharing puts all parties on equal footing. Royalty: The business pays a percentage of the total amount of revenue to an associated party as royalty based on performance. Retainer with Royalty: Here, the business pays an associated party a flat rate fee and royalties.

What is the formula for revenue sharing?

To calculate a revenue share, multiply the total revenue by the percentage of revenue shared.

What is a typical revenue share percentage?

A typical revenue-sharing percentage is between 2% and 10% of total sales revenue.

How do you structure a profit-sharing agreement?

What are things you should include in a Profit-Sharing Agreement? Clearly define the methodology for calculating and distributing profits. Specify the formula, criteria, or percentage allocation used for profit distribution. Outline the frequency of profit distributions, whether monthly, quarterly, or annually.