Catalog Numbers Settlement For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

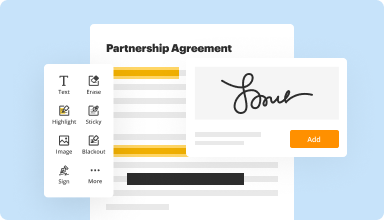

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

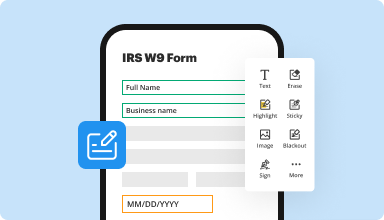

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

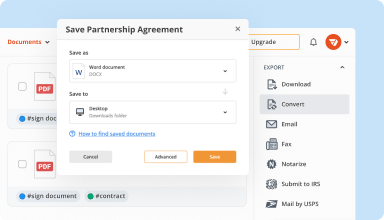

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

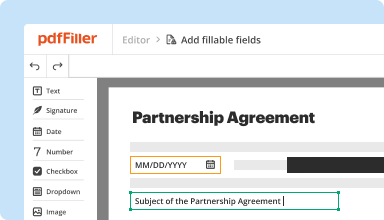

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

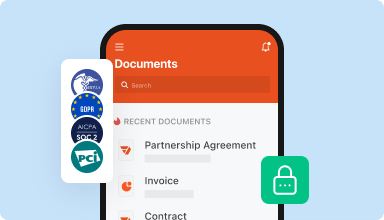

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I purchased the product. It was because I needed to complete a form for an important Employment opportunity. After I spent 4 hours on the form. I was ready to print then was asked to make payment. after I subscribed; I then tried to print the form. Long story short; I could not print the document and then when I accessed it later to try and correct the issue, the information I had put in was all over the place. (in the wrong places). I have then canceled my subscription and have just wasted my $72 US Dollars. I know I will not be refunded, even if I was only Subscribed to the product for less then 6 hours or so. I would never recommend this product to anyone ever.

I immediately got a response and refund... which tells me that this company is serious about its reputation and customers service. Thank you so much for the upright service. Because of that I will recommend this to anyone and everyone

2018-03-22

Slick tool. Nice editing capabilities. Some of the menus are confusing - for example: finding where to update an existing link to fill document is challenging.

2019-02-27

Its save me a little time on the road

Its save me a little time on the road. I was traveling and it will help me keep a safe copy of things too. Most gracious for the options to port to different formats. Well Thought out product..Thank You.

2023-11-20

The service was great and really…

The service was great and really useful! I've used it for the past year- I just didnt need it and couldn't afford it this year- the reason I'm giving 5 stars is because when I went to cancel it within a month of by mistake letting it renew- they (Jerome in the chatbox) were SOOOO AMAZING and helpful! With so many companies they completely dehumanize you and fight for ages when you try to cancel. It has given me immense respect for this company that they were kind and helpful!

2023-06-01

I was perplexed when my money was…

I was perplexed when my money was deducted without prior notice. I didn't know what to do at first because I thought that refund couldn't be possible but I decided to reach out to them despite the uncertainty.

I was happy with the services rendered, the customer relationship and grateful for the refund. The service is customer friendly and has quick response to issues.

2021-12-10

Excellent Customer Service

I contacted the customer service team of pdfFiller when I had a problem and it was dealt with straight away. I spoke to someone called Harmhon and they were really kind and understanding. They replied to me very quickly and the problem was resolved in less than a few minutes. Overall, I am very happy with the service and would definitely recommend to a friend.

2021-07-24

This has everything I need plus more…

This has everything I need plus more and it's not hard to use. No training involved - thank goodness! Can just jump right in and get going. So far, I'm loving pdfFiller. Thank you developers!

2020-08-10

LOVE THIS AND LOVE CUSTOMER SERVICE

PDF.Filler is definitely a MUST in todays world especially with more and more companies working from home, I don't see how anyone could live without this. It makes forms and fillable documents, signature request documents, so very convenient, easy. It's super user friendly as well, I love it. Also the staff super helpful. Simon and Rachel were super great and on it, they both got right back to me within seconds and assisted me with knowledgeable kind and quick service and I appreciate that a lot as well in a company. Thanks again guys and PDF.Filler you Rock!

2020-08-03

pdffiller.com site is very useful & very helpful to do my studies , Specially PDF TO WORD convert best & fast, om site is very useful &…

pdffiller.com site is very useful & very helpful to do my studies , Specially PDF TO WORD convert best & fast,

So I Would like to thanks for pdffiller.com website , Such a accurate & fast results for me, Any one who do your higher studies , This website very helpful to do your Microsoft office package converting jobs.

Thank you

S.H.Y Fernando

2025-06-15

Catalog Numbers Settlement Feature

The Catalog Numbers Settlement feature streamlines your product management process. Designed with you in mind, it grants easy access to organize, track, and manage catalog numbers efficiently. Say goodbye to confusion and chaos in handling product identifiers.

Key Features

Simplified organization of catalog numbers

Real-time tracking of product IDs

User-friendly interface for quick navigation

Automated reporting for better insights

Seamless integration with existing systems

Potential Use Cases and Benefits

Easily manage large inventories across multiple locations

Reduce errors in product identification and tracking

Enhance collaboration among teams with shared access

Improve reporting tasks with automated tools

Facilitate new product launches with organized tracking

By implementing the Catalog Numbers Settlement feature, you can solve the common challenges of catalog number mismanagement. This tool empowers you to keep track of your products effortlessly, ensuring that you maintain accurate records. With enhanced efficiency, you can focus more on growing your business and less on administrative tasks.

Did you know?

Online fashion retailer Fashion Nova will pay $9.3 million to settle Federal Trade Commission charges. Fashion Nova violated the agency's Mail, Internet, Or Telephone Order Merchandise Rule. The settlement also prohibits Fashion Nova from any further violations of the Mail Order Rule.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Are lawsuit settlements taxable income?

If you receive money from a lawsuit judgment or settlement, you may have to pay taxes on that money. ... After you collect a settlement, the IRS typically regards that money as income, and taxes it accordingly. However, every rule has exceptions. The IRS does not tax award settlements for personal injury cases.

How much tax do I pay on a settlement?

It's Usually Ordinary Income The tax rate depends on your tax bracket. As of 2018, you're taxed at the rate of 24 percent on income over $82,500 if you're single. If you have taxable income of $82,499, and you receive $100,000 in lawsuit money, all that lawsuit money would be taxed at 24 percent.

How much tax do you pay on settlement money?

It's Usually Ordinary Income The tax rate depends on your tax bracket. As of 2018, you're taxed at the rate of 24 percent on income over $82,500 if you're single. If you have taxable income of $82,499, and you receive $100,000 in lawsuit money, all that lawsuit money would be taxed at 24 percent.

Do you pay tax on a settlement agreement?

Settlement Agreements are legally binding agreements between an employer and an employee, formerly known as a Compromise Agreement. ... Generally speaking, employers can pay the first £30,000 compensation for the Settlement Agreement tax-free, but this will not apply to all payments.

Do you have to pay taxes on a settlement from a personal injury lawsuit?

Neither the federal government (the IRS), nor your state, can tax you on the settlement or verdict proceeds in most personal injury claims. Federal tax law, for one, excludes damages received as a result of personal physical injuries or physical sickness from a taxpayer's gross income.

Do you pay taxes on a malpractice settlement?

In a negligence case involving personal injury, the settlement for your personal injuries is not taxable unless you deducted your medical expenses on your federal income tax return in a previous year.

Are property damage settlements taxable?

Property settlements for loss in value of property that are less than the adjusted basis of your property are not taxable and generally do not need to be reported on your tax return. ... For additional information, see Publication 525, Taxable and Nontaxable Income, visit our website at www.irs.

Do I have to claim a lawsuit settlement on my taxes?

If you receive money from a lawsuit judgment or settlement, you may have to pay taxes on that money. ... After you collect a settlement, the IRS typically regards that money as income, and taxes it accordingly. However, every rule has exceptions. The IRS does not tax award settlements for personal injury cases.

Do you have to pay taxes on a discrimination lawsuit settlement?

Under Section 104(a)(2) of the Tax Code, only settlement funds that compensate a plaintiff for damages arising from physical injuries or physical sickness are not considered taxable income. ... Like emotional damages, the portion of a settlement dedicated to punitive damages is taxable, exempt only from payroll taxes.

#1 usability according to G2

Try the PDF solution that respects your time.