Consolidate Logo Title For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

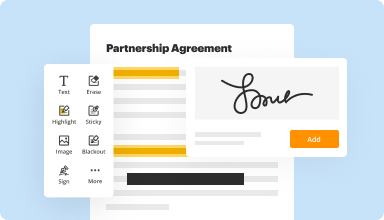

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

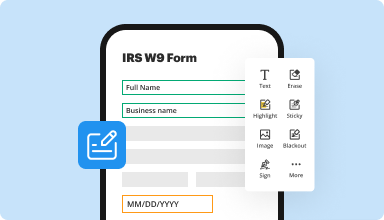

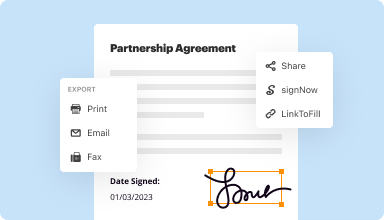

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

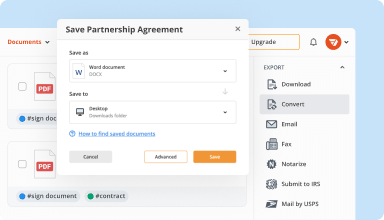

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

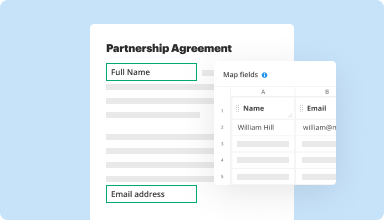

Collect data and approvals

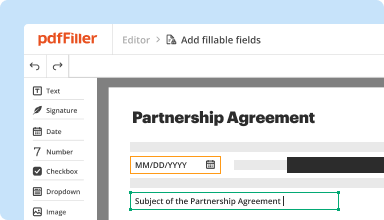

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

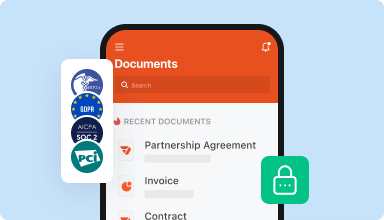

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Just started using PDFfiller and found it really very helpful. It saves me a lot of time in filling up billing forms that are being submitted monthly. Thank You!

2015-11-24

i like how the team at PDFfiller make things happen. The recipient box is useful and suddenly the email is ready to be sent to a certain school. Also how you helped me to create a cover letter relating to the Teacher for Science vacancy Very professional. Thank you Brent Walton 2 June 2019

2019-06-02

Default At Company

I like that I can read-only PDFs straight from Gmail - previewing with PDFfiller is way easier than having to download through Adobe.

I feel like there is nowhere to go if you need assistance or a homepage to see all of the PDFs that you have viewed.

2018-07-30

With this site I can get any and all my paper work done in the manner that I wish to have done.

Typing out my paperwork in the correct format. Always there when I need it done. Able to use it anywhere.

It's ease of use,it's ability to take on tasks that I need done,the customer service is always there with answers to questions that I need answered. All the different jobs this site can achieve. I can not get along with out this site. Thank You for being there for us.

2017-11-14

Kara is awesome.

I had a great experience with Kara at Technical Support. She took control of my screen via Zoom and resolved my problem. I can't say enough good things about her.

2024-02-28

Only ever used Adobe in the past. Found this affordable option. It is fantastic. User friendly and effective app. I applied for a rental with a heap of forms to fill out and now our family are living in it. I accidentally signed the 1year subscription. Advised that I only wanted to use it during the trial period for a purpose and happy to pay for one month. They communication was quick and on point. They summarised and actioned exactly what I requested. Only charged me $30 for the month and cancelled my future subscription. I would happily use this again. Thank you.

2022-03-28

Payment issue dealt with swiftly

After both my cards being declined to register my subscription, I went onto the online support chat. Kara was super helpful and quick to deal with my issue - very professional and friendly. Kara was very generous in giving me three free days and advised within that time to try my payment again after 24 hours. Thank you Kara for taking the stress away and resolving my issue fast. Morven

2021-09-16

What do you like best?

Very great experience with editing pdf files. Helps to create a digital signature, no need to print the documents to sign them. PDFfiller does it all for you. What best is to save the paper save the environment.

Best website during such a pandemic situation, while working at home.

What do you dislike?

There is just one problem that it just provides limited font styles. Please provide more font options and some more features like double spacing etc.

Recommendations to others considering the product:

It is the best website if you are working from home if you are an environment lover and want to save the earth by not printing paper and also save money.

What problems are you solving with the product? What benefits have you realized?

We are in the transportation business, so we have to send the documents for the Border clearance.

Earlier, we used to print the documents and then put a border sticker and write notes with a pen on it.

But, with the help of this, we are saving a lot of paper. Just upload the docs to pdffiller and copy, paste border sticker, and write notes with edit text icon. Everything is easy now.

2021-02-16

Top Notch Customer Service: They were polite and quick to respond.

Large Selection of Templates and a Template/Doc Creator.

Enjoyed the easy of sending Documents for review/signature.

Would highly recommend this service to anyone needing quick and easy documents for all kinds of topics.

2020-07-22

Consolidate Logo Title Feature

Discover the power of the Consolidate Logo Title feature, designed to enhance your branding experience. This feature allows you to streamline your logos and titles into cohesive units, making your presentations look polished and professional.

Key Features

Combine multiple logos and titles into a single, clear display

Customizable options for different branding needs

User-friendly interface for easy adjustments

Responsive design works on all devices

Supports various file formats for versatility

Potential Use Cases and Benefits

Ideal for businesses looking to unify their brand identity across platforms

Perfect for presentations where clarity and professionalism matter

Useful for marketing materials needing consistent branding

Helps in creating memorable visual experiences for your audience

Enhances brand recognition through simplified visuals

The Consolidate Logo Title feature effectively addresses your branding challenges. By combining elements into a single unit, it reduces clutter and confusion. You can easily present your brand in a way that is organized and appealing. This solution not only saves you time but also enhances your brand's visibility, making it an essential tool for any business focused on growth and clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Can I consolidate my title loan?

A debt consolidation loan allows you to combine multiple debt payments (credit card, medical, title loans, etc.) into one monthly payment. A debt consolidation loan ideally will have a lower interest rate than what you are paying on your old debts.

How can I get out of paying my title loan?

Pay off Your Debts Regularly. Simply put, this is the best way to get out of a title loan, albeit not the easiest method since you probably took out the loan because you were in need of money. ...

Take Out another Loan to Pay off Your Title Loan. ...

Sell Your Car. ...

Negotiate with Your Lender. ...

Default.

How can I get out of my car title loan?

Understand Your Rights. Many consumers are aware of the right of rescission related to vehicle financing. ...

Use Cash. ...

Apply for a Long-Term Car Loan. ...

Apply for a Personal Loan. ...

Use a Credit Card Cash Advance. ...

Apply for a Home Refinance Loan. ...

Cash in Your Whole Life Insurance Policy. ...

Borrow Money From a Friend.

What happens if you can't pay your title loan?

The Roll-Over If you can't pay off the loan in the typical 30day period, the lender may offer to roll over the loan into a new loan. ... If you don't pay what you owe, the lender may decide to repossess your vehicle.

How long do you have to pay off a title loan?

Many title loan lenders have incredibly short loan terms. They require that the borrower to pay off the loan in 30 to 90 days. Shorter term loans such as this are extremely stressful for the customer as the payments are so large that they can sometimes be impossible to pay off.

Can you extend a title loan?

In certain states, you can only extend your title loan a limited number of times, or you need to start paying a portion of the loan principal once you reach a specific number of extensions on the loan. Extending a title loan isn't a long-term solution because you'll end up paying quite a bit in interest and fees.

What happens if I can't pay my title loan?

If you can't pay off the loan in the typical 30day period, the lender may offer to roll over the loan into a new loan. But the roll-over process always adds fees and interest to the amount you originally borrowed. ... If you don't pay what you owe, the lender may decide to repossess your vehicle.

How long do you have to pay back a title loan?

The repayment period for a car title loan can be customized to fit your unique needs. The loan can be paid back anytime early without penalty, but the typical loan is written from 1 year to 3 years depending on the circumstances. Our goal is to help you out of financial hardship and difficulties.

Can you get an extension on a title loan?

If neither of these will work for you, most lenders will allow you to extend your title loan. This is also known as rolling over the loan, and it requires you to pay any interest and fees the loan has. You don't need to pay any of the loan principal, and instead, you take that principal into a new term.

Can I get a title loan if my car is not paid off?

If you have a vehicle loan and your car is not yet paid off, there is no need to worry. We can give you a car title loan even if it's still being financed, or you have a few payments left1.

#1 usability according to G2

Try the PDF solution that respects your time.