Last updated on

Aug 16, 2021

Convert On Amount Transcript For Free

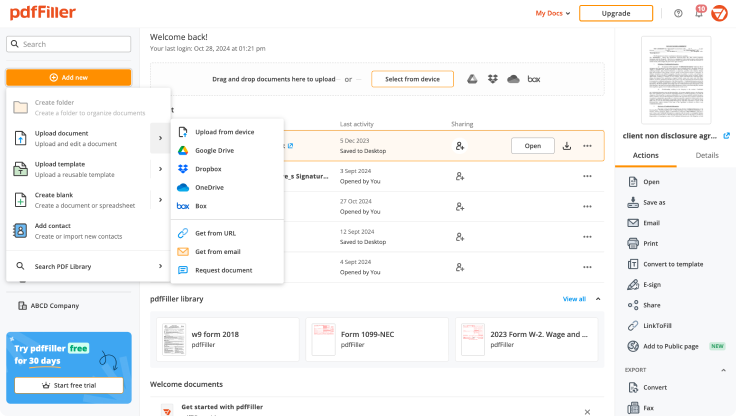

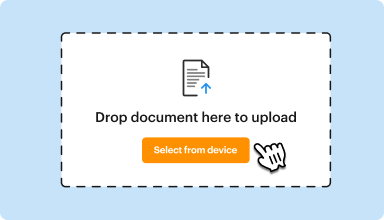

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

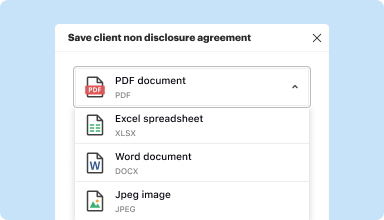

Edit, manage, and save documents in your preferred format

Convert documents with ease

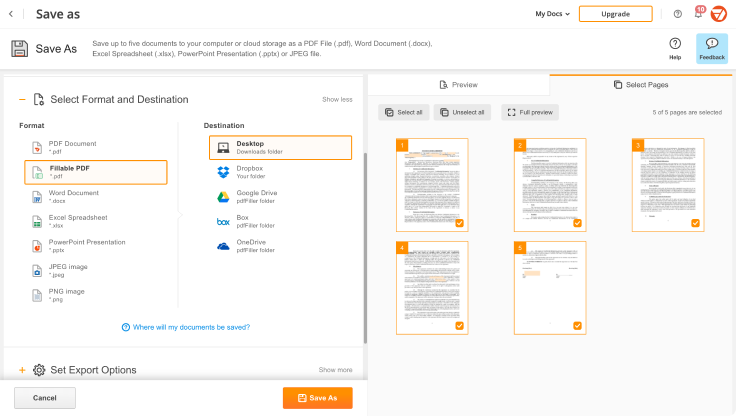

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

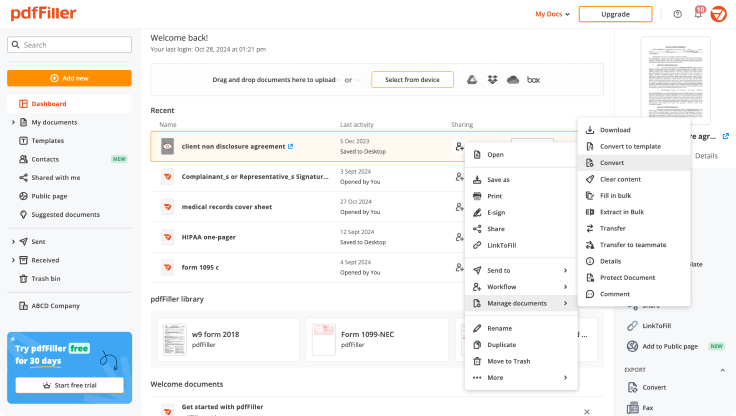

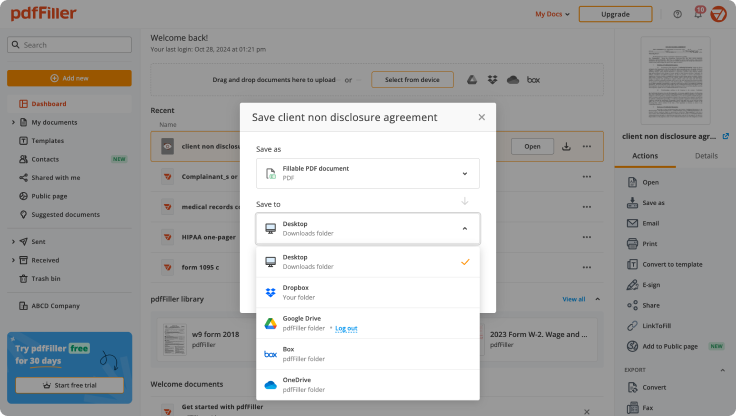

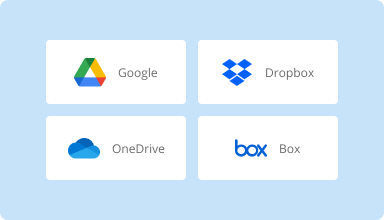

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

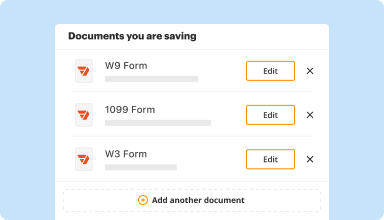

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

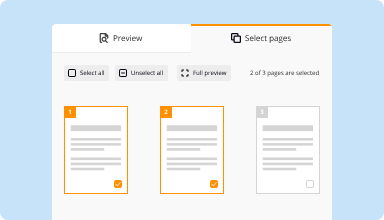

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

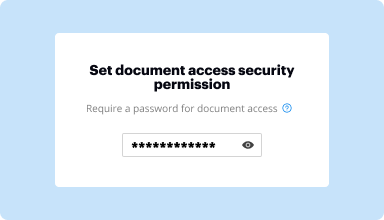

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

The stars did not appear on this survey, so nothing is marked; however, this was and still is a great service, and is very much needed as it is a very helpful tool in filling out forms that do allow computer input. :-)

2014-07-28

I got confused a couple of times when using PDFfiller, but their customer support was outstanding; they immediately responded and were very helpful.

PDFfiller is a solid solution for filling out yearly tax paperwork on my Mac. I'll be using it every year now.

2015-01-20

I needed to use my resources and resourcefulness to do a friend a favor. PDF filler permitted me to get it done-- with my own gratitude and my friend's as well. Nicer going! You're a huge part of my legend now!

2017-06-26

I have been looking for a "filler" and to date have never been satisfied until I came across PDF Filler. So, far it has more than met any expectation I would have had and I look forward to using it in the future.

2018-04-18

I would give it a 5 except that when I go to edit a template, it shows up with over 1/2 or 3/4's of the page covered up! I have to keep closing it & reopening it to maybe finally work! Very frustrating.

2019-11-04

What do you like best?

I like the fact that you have send a document via text or email to have someone electronically sign it. I also like the fact that you can edit PDF documents! It used to be so hard to get anything done at my current job but now I can edit Bill of Laidings, Commerical invoices.... etc.

What do you dislike?

nothing! this software is truly amazing!

Recommendations to others considering the product:

Don't hesitate! You need this in your life! Its awesome for sending my drivers documents to Esign.

What problems are you solving with the product? What benefits have you realized?

over seas documents that were quite difficult to re-create or edit.

I like the fact that you have send a document via text or email to have someone electronically sign it. I also like the fact that you can edit PDF documents! It used to be so hard to get anything done at my current job but now I can edit Bill of Laidings, Commerical invoices.... etc.

What do you dislike?

nothing! this software is truly amazing!

Recommendations to others considering the product:

Don't hesitate! You need this in your life! Its awesome for sending my drivers documents to Esign.

What problems are you solving with the product? What benefits have you realized?

over seas documents that were quite difficult to re-create or edit.

2019-02-01

A good product

A good product. You'll have to sign up for the service if you want to save your doc, but they have a free thirty day trial, so it's not so bad. Allows you to edit documents in a relatively user-friendly and intuitive way. No real complaints, but it also didn't blow my socks off or anything, so 4/5.

2020-02-25

The product works

I was able to fill forms and use powerful tools. They are not Adobe though and they charge nearly as much.

The web sight interface was easy to use.

They charge WANton much especially if you want the option to use it for only a short period of time.

2019-09-05

What do you like best?

The ability to easily upload various documents and manipulate as needed.

What do you dislike?

The difficulty in emailing a document and getting a notification when the die is opened. Could it be less than using a PIN to access the document. Although the security is a nice factor.

Recommendations to others considering the product:

The most valuable tool you can add to your toolbox.

What problems is the product solving and how is that benefiting you?

PdfFiller allows me to send confidential documents to my districts HR keeping my payroll moving forward.

2022-05-27

Convert On Amount Transcript Feature

Discover the Convert On Amount Transcript feature, designed to simplify your data management. This tool allows you to convert financial transcripts based on specific amounts, making it easier to track and analyze your financial data. Whether you manage a small business or oversee personal finances, this feature offers a practical solution to streamline your processes.

Key Features

Convert transcripts based on specific monetary amounts

User-friendly interface for quick navigation

Supports a variety of financial formats

Export data for further analysis

Secure handling of sensitive financial information

Potential Use Cases and Benefits

Small business owners can monitor expenses effortlessly

Accountants can generate accurate financial reports with ease

Personal finance managers can analyze spending habits effectively

Auditors can verify financial transactions without cumbersome processes

Financial analysts can improve data accuracy for better insights

By using the Convert On Amount Transcript feature, you can solve problems related to data organization and accuracy. It helps you focus on important financial details, reduces the time spent on manual conversions, and ensures your financial records are clear and precise. Embrace this tool to enhance your financial management and make informed decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What does account balance mean on tax transcript?

Account Balance. The balance due amount for the tax year. Account Balance Plus Accruals. The total of the Account Balance, Accrued Interest, and Accrued Penalties. This amount may not be the payoff amount.

What does account balance mean on IRS transcript?

Account Balance. The balance due amount for the tax year. Account Balance Plus Accruals. The total of the Account Balance, Accrued Interest, and Accrued Penalties. This amount may not be the payoff amount.

How do I read my IRS transcript?

Request an account transcript by calling the IRS directly at (800) 829-1040, or by filing Form 4506T, Request for Transcript of Tax Return. Check the taxpayer identification numbers below that, as well as the taxpayer name or names, to make sure they are accurate.

What is the difference between an account transcript and a return transcript?

A tax return transcript usually meets the needs of lending institutions offering mortgages and student loans. Tax Account Transcript — shows basic data such as return type, marital status, adjusted gross income, taxable income and all payment types. It also shows changes made after you filed your original return.

What do IRS transcript codes mean?

IRS Transaction Codes and Error Codes. IRS Code 846 Refund of Overpayment is the transcript code that signals the time for a happy dance and that a refund is forthcoming. IRS Code 570 Additional Liability Pending/or Credit Hold is a code that means there is a bump in the road for some tax refunds.

What is the difference between a tax return transcript and a tax account transcript?

Difference Between Tax Return and Transcript A tax transcript is a summary of your tax return provided by the IRS. A tax account transcript contains the same information as the tax return transcript along with additional items such as marital status, taxable income and the type of tax return you filed.

What is the difference between a tax return and a tax transcript?

A tax return is used to pay taxes or request a refund. A tax transcript is a summary of your tax return that is provided by the IRS.

Can I file taxes with a transcript?

Yes, an IRS (or state) account transcript is an acceptable document to process your return.

#1 usability according to G2

Try the PDF solution that respects your time.