Convert On Wage Transcript For Free

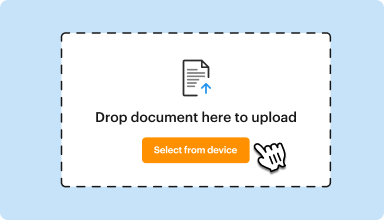

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

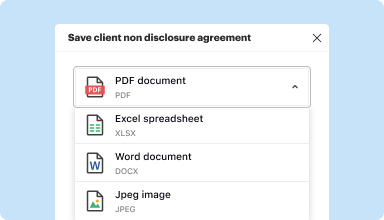

Edit, manage, and save documents in your preferred format

Convert documents with ease

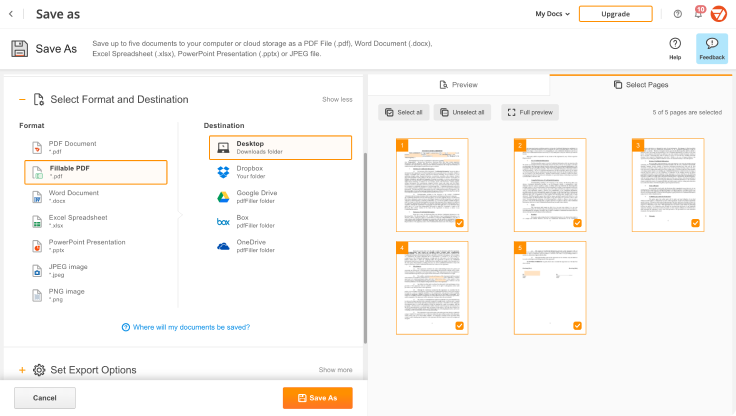

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

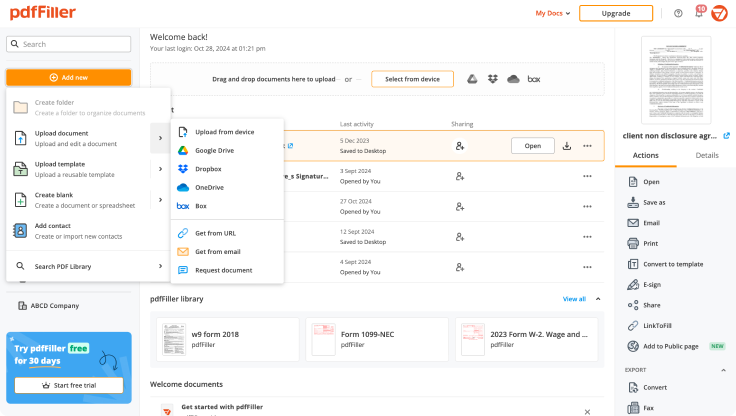

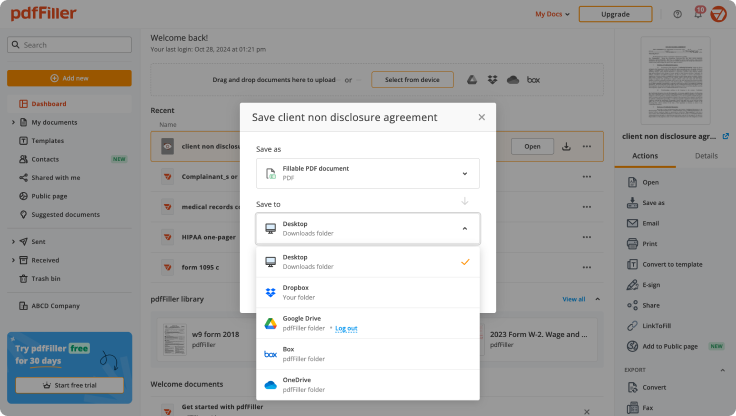

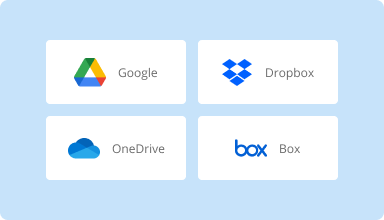

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

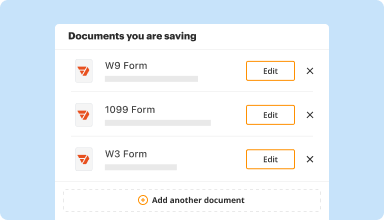

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

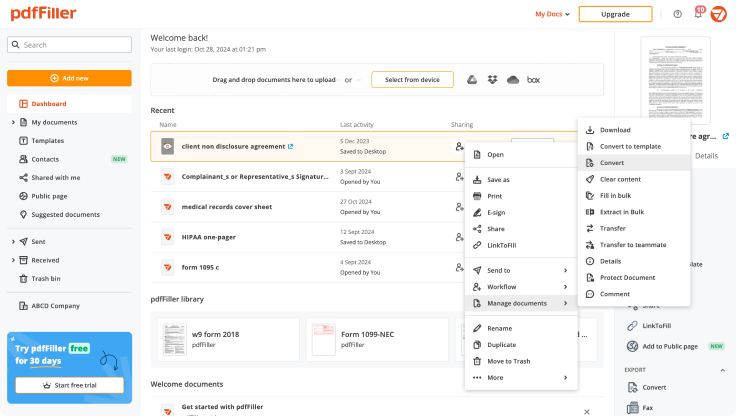

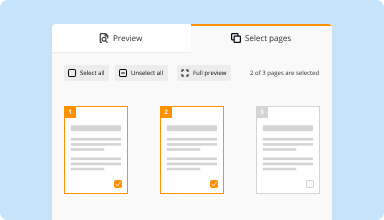

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

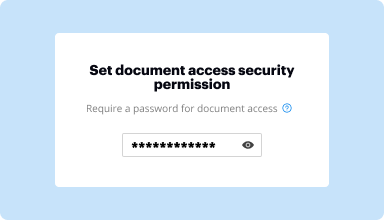

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Before I got PDFfiller, I couldn't figure out how to add text to PDFs. I work for myself and am required to add information to certain PDFs. I am no longer struggling and frustrated. It is very easy to use and well worth the year's subscription.

2017-02-23

PDF filler has been fantastic for me as a small business owner. It truly is the one stop shop for all my business document needs. They handle everything expertly. Totally takes out the stress of filling out documents and sending them to the IRS. I can just fill them out and click my way through the process with ease.

2018-02-06

Hello: I am a tax preparer and this year the 1099 misc forms fromm the IRS had changed and my software had not. PDF Filler really helped me out so thanks.

2018-02-07

Easy to use once I figured it out - with 3 jobs it has become mandatory to use/edit pdf which I have been trying to avoid. Thanks!

Update: Still liking this program!

2019-04-04

It was great to know that I can fill in…

It was great to know that I can fill in and sign documents without needing to print and scan. This is amazing!

2020-02-06

So far seems great and 30 day trial is…

So far seems great and 30 day trial is much better than competitions so I would recomend it for some basic PDF editing

2020-01-23

PDF Filler Descriotion

It has been wonderful from the online accessibility to the ease of computer use. The screen font was adjustable, so I like that it is non-discriminatory.

This software is affordable, and saved me some job hunting in person. It allowed me to sign some paper stuff online.

I o not like that this software left out the name of the company whose creator devoted it to. In addition, it leaves out some colors like blue and black from a police department.

2020-03-24

Effortless Document Filling with pdfFiller!

Overall, pdfFiller has been a great tool for me. It's saved me so much time and hassle, and I'm really happy with the results. Highly recommend!

I've been using pdfFiller to fill out documents for a while and I have to say that I'm very impressed with its ease of use! It's incredibly straightforward and makes it so easy to fill in the blanks on forms. Plus, they have a wide selection of templates that make my job even easier!

The only downside to pdfFiller is that the free version has some limited features. If you need more robust features, you'll have to upgrade to the premium version.

2023-02-01

it's been satisfactory so far how ever with the limitations i can't justify the cost especially the requiired annual payment in which i can't afford at this time and the use of the product will be limited and not on a consistent basis therefore i can't pay the annual fee at one time

2021-10-19

Convert On Wage Transcript Feature

The Convert On Wage Transcript feature streamlines the process of transforming your wage-related documents into easily digestible formats. This tool simplifies data management, ensuring you spend less time on paperwork and more time on your core tasks.

Key Features

Instant conversion of wage transcripts into sought-after formats

User-friendly interface that requires no technical expertise

Secure handling of sensitive wage data with advanced encryption

Compatibility with various payroll systems and formats

Options for bulk conversions to save time

Potential Use Cases and Benefits

Employers can provide wage transcripts to employees quickly and efficiently

Payroll departments can streamline their reporting processes

Financial consultants can analyze wage data without hassle

Employees can easily access and share their wage information for loans or rental applications

Accountants can prepare accurate financial statements with ease

This feature addresses your need for efficient data handling and reduces the risks associated with data loss or misinterpretation. By simplifying the conversion process, you can focus on more pressing business objectives and improve overall productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I get my wage and income transcript?

You can get an IRS wage and income transcript online at www.irs.gov/Individuals/Get-Transcript. When you get wage and income transcript access, it will show you all the informational returns the IRS has received for your tax ID, like: W-2. Form 1099-INT.

What is wage and income transcript?

IRS Definition A wage and income transcript shows data from information returns the IRS receives, such as Forms W-2, 1099, 1098 and Form 5498. Current tax year information may not be complete until July. This transcript is available for up to 10 prior years using Get Transcript Online or Form 4506-T.

How do I get a wage and income transcript?

You can get an IRS wage and income transcript online at www.irs.gov/Individuals/Get-Transcript. When you get wage and income transcript access, it will show you all the informational returns the IRS has received for your tax ID, like: W-2. Form 1099-INT.

Is a tax return transcript the same as a wage and income transcript?

Tax Account Transcript — shows basic data such as return type, marital status, adjusted gross income, taxable income and all payment types. Wage and Income Transcript — shows data from information returns we receive such as Forms W-2, 1099, 1098 and Form 5498, IRA Contribution Information.

Can I file taxes with a wage and income transcript?

Yes, you can use it. You get the wages and income transcript from the IRS, who gets all their info from the SSA. The TurboT ax software might not take it without this, but you can still file.

What is an IRS wage statement?

Form W-2 (officially, the “Wage and Tax Statement”) is an Internal Revenue Service (IRS) tax form used in the United States to report wages paid to employees and the taxes withheld from them. The form is also used to report FICA taxes to the Social Security Administration.

Can I file my taxes with a wage and income transcript?

Yes, you can use it. You get the wages and income transcript from the IRS, who gets all their info from the SSA. The TurboT ax software might not take it without this, but you can still file.

How do I file taxes with a transcript?

The number to call is 800-908-9946. Order by mail. Complete and send either Form 4506-T or Form 4506T-EZ to the IRS to get one by mail. Use Form 4506-T to request other tax records: tax account transcript, record of account, wage and income and verification of non-filing.

#1 usability according to G2

Try the PDF solution that respects your time.